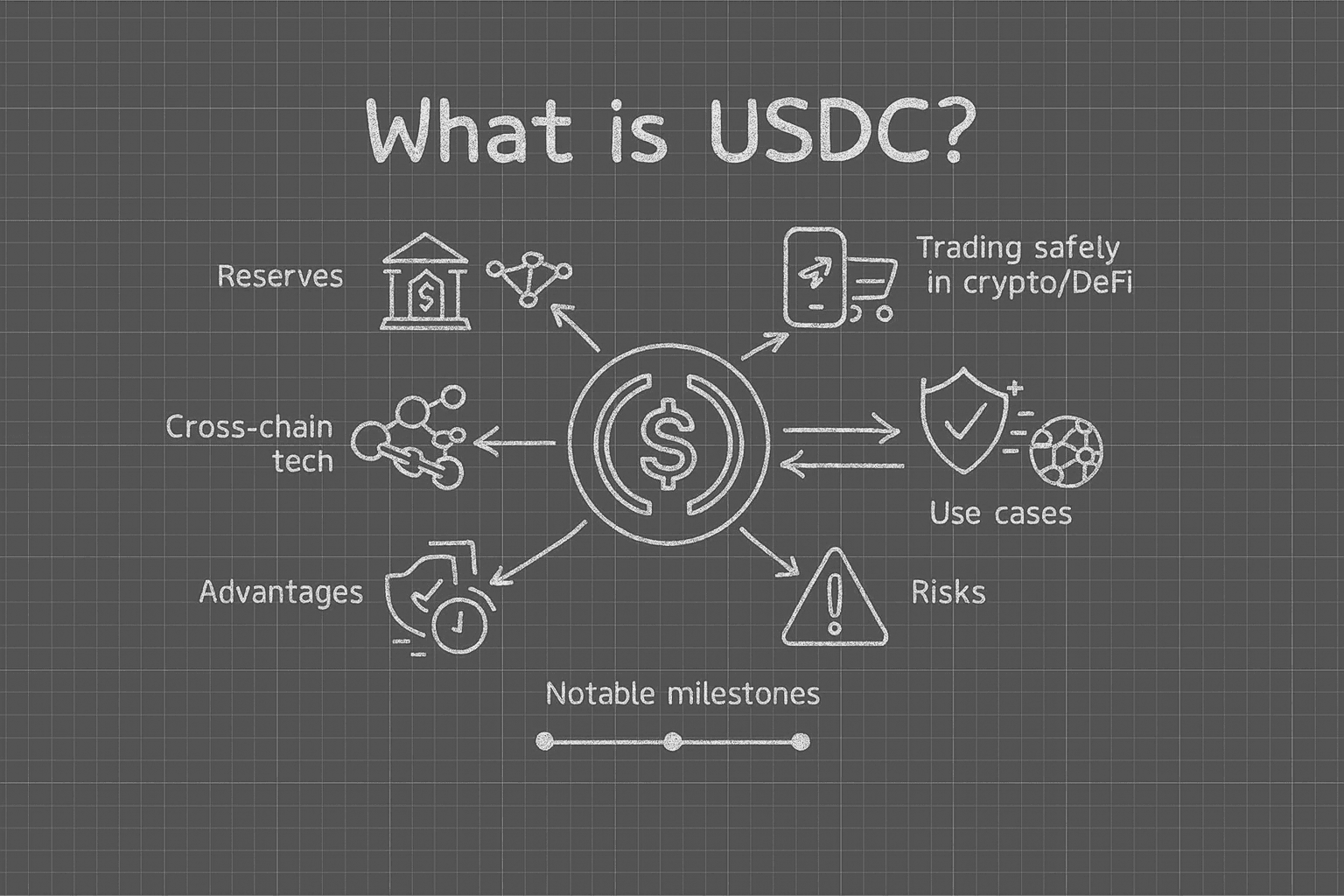

For remote teams and global businesses, paying employees across borders has always been a challenge. From slow wire transfers to unpredictable exchange rates and hefty bank fees, traditional payroll methods often create friction for both employers and workers. Enter USDC payroll: a modern solution that leverages the stability of USD Coin (USDC), a leading stablecoin currently priced at $0.0327 on Fantom, to deliver fast, cost-effective, and compliant payments worldwide.

Why USDC Payroll is a Game-Changer for Cross-Border Teams

The rise of remote work has made cross-border payments more important than ever. But legacy banking systems can’t keep up with the pace or flexibility that today’s distributed teams demand. Here’s where USDC payroll steps in, transforming how companies compensate international staff:

Top Benefits of USDC Payroll for Remote Teams

-

Faster Global Payments: USDC transactions settle on the blockchain within minutes, giving remote workers rapid access to their earnings—much faster than traditional international wire transfers.

-

Lower Transaction Costs: Sending payroll in USDC eliminates expensive wire fees and currency exchange markups, allowing companies to save money on each cross-border payment.

-

Protection Against Currency Volatility: USDC is a stablecoin pegged to the US dollar, offering employees in countries with unstable currencies a reliable way to preserve the value of their earnings.

-

Greater Financial Flexibility: Recipients can choose to hold, spend, or convert their USDC earnings, giving them more control over how and when they use their funds.

Rapid transactions are one of the biggest draws. Unlike international bank wires that can take several days, USDC payments settle within minutes on the blockchain. That means your developers in Brazil, designers in India, or marketers in Eastern Europe can access their earnings almost instantly, no more waiting for banks to clear funds.

The Cost Efficiency Revolution

Let’s talk about fees. Traditional cross-border salary payments often involve expensive intermediaries and unfavorable currency conversions, eating into your team’s take-home pay and your company’s bottom line. With USDC payroll, transaction costs are slashed dramatically. There are no hidden charges or surprise markups, just transparent, near-instant transfers at a fixed value.

This efficiency isn’t just theoretical: global tech firms have reported cutting their payroll costs by up to 60% by switching to stablecoin-based solutions like USDC. Discover how USDC compares with traditional wire transfers here.

Financial Stability and Flexibility for Global Talent

In many emerging markets, local currencies can be volatile, sometimes losing value between invoice and payment day. By paying remote workers and contractors in USDC, companies provide a digital dollar salary that holds its value regardless of local economic swings. This peace of mind is invaluable for workers who want predictable earnings and flexible financial options.

Plus, employees aren’t locked into one system: they can hold their USDC as savings, convert it to local currency when rates are favorable, or spend it directly online, all without involving multiple banks or payment platforms.

How Remote Workers Use USDC Salaries Worldwide

-

Shop online or pay bills directly with USDC through payment gateways like Coinbase Card or Crypto.com Visa Card, letting workers spend their salary at millions of merchants worldwide.

-

Send remittances to family and friends by transferring USDC instantly across borders using wallets like MetaMask or Trust Wallet, avoiding high remittance fees.

Simplified Compliance and Seamless Integration

Worried about regulations? Modern crypto payroll platforms like Rise and Remote have partnered with compliance leaders to ensure that paying in stablecoins like USDC is not just fast but also meets local legal requirements in dozens of countries. Learn how compliance works with crypto payroll here.

This frictionless experience is why more startups, tech firms, and even large enterprises are adopting USDC payroll solutions for their global teams. In the next section, we’ll break down exactly how companies can implement these systems, and what real-world results look like when you empower talent with borderless pay.

How Companies Are Implementing USDC Payroll Today

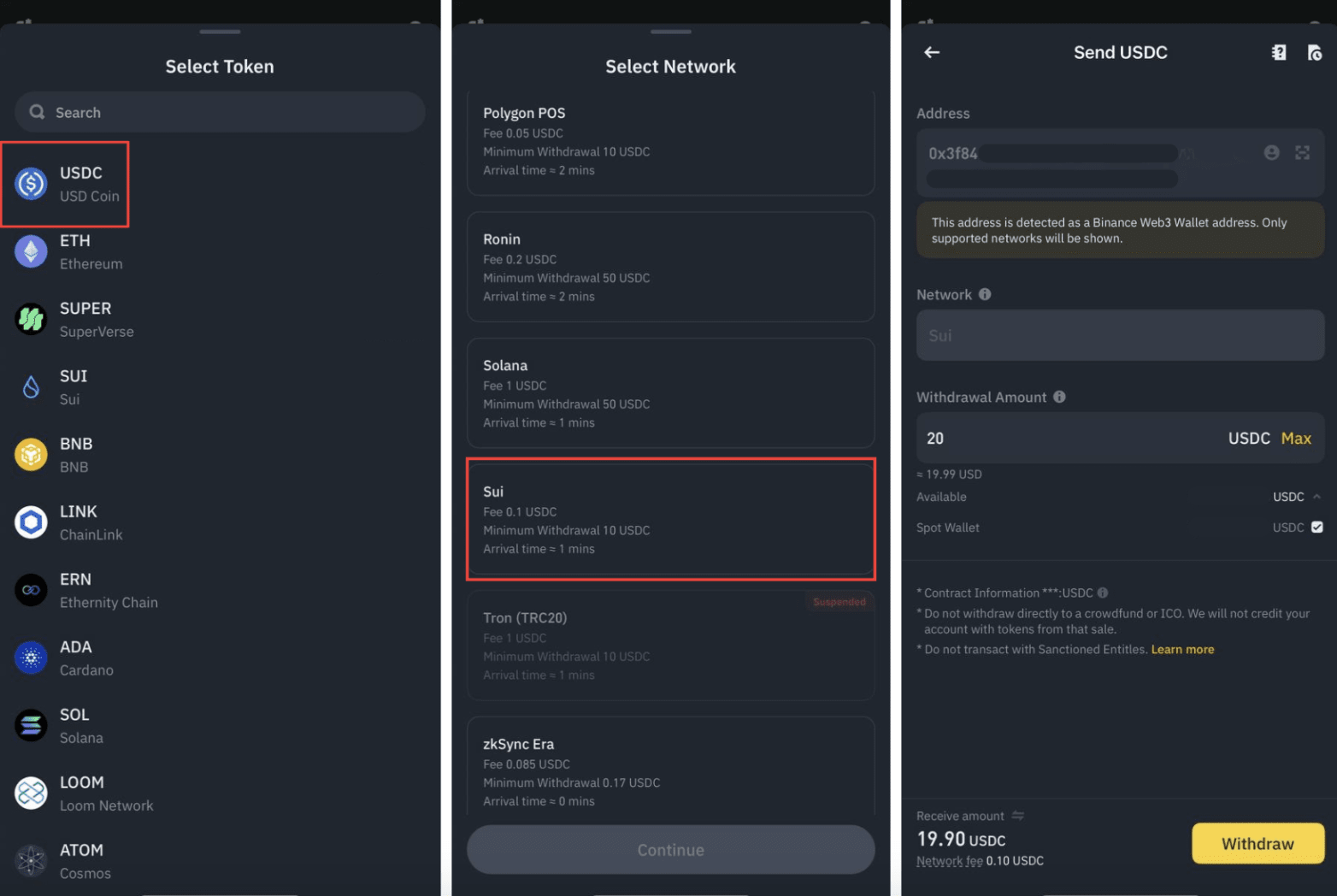

So, what does it look like when a business actually makes the switch to USDC payroll? The process is refreshingly straightforward. Leading platforms let you fund payroll in either fiat or USDC, handle all the conversions, and automate tax documentation. This means companies can focus on growth while the payroll engine runs smoothly in the background.

Take the example of a remote-first SaaS startup: instead of juggling multiple bank accounts and wrestling with wire delays, they set up a USDC wallet for their payroll. Each pay cycle, funds are sent out on-chain at the current stablecoin price of $0.0327 (Fantom), reaching team members in dozens of countries within minutes. No more nail-biting over exchange rates or lost transfers. The result? Happier employees, streamlined operations, and a CFO who can finally sleep at night.

But the benefits don’t stop at speed and cost. By using platforms built for compliance, companies are able to generate local tax reports, meet KYC/AML standards, and ensure every payment is logged transparently on the blockchain. This is a game-changer for audits and regulatory peace of mind.

Real-World Impact: What Teams Are Saying

Feedback from remote workers and contractors paid in USDC is overwhelmingly positive. Many cite the relief of no longer waiting days for funds to clear, while others appreciate the ability to avoid local currency devaluation. For digital nomads, the flexibility to spend or swap their earnings globally is a huge win.

Top Reasons Remote Teams Choose USDC Salaries

-

Faster Access to Earnings: USDC payroll enables near-instant payments via blockchain, letting remote workers receive salaries in minutes instead of days—unlike traditional wire transfers.

-

Lower Fees & More Savings: USDC transactions eliminate expensive wire transfer fees and avoid costly currency exchange markups, helping both companies and employees keep more of their money.

-

Stability in Volatile Markets: Receiving salaries in USDC—a stablecoin pegged to the US dollar at $0.0327 (Fantom bridged version)—protects remote workers from local currency fluctuations and inflation.

-

Greater Financial Control: Remote employees can hold, convert, or spend their USDC as they choose, providing flexibility to manage funds or access global digital services.

It’s also worth noting that as more platforms and payment rails support stablecoin payroll, the ecosystem is getting richer and easier to navigate. Now, even non-crypto-native teams can access the benefits with minimal onboarding friction. The days of payroll anxiety and cross-border payment headaches are numbered.

The Future of Cross-Border Payroll Is Here

With USDC payroll solutions, remote teams are no longer at the mercy of slow banks or volatile exchange rates. Instead, they’re empowered with instant, transparent, and borderless pay, backed by the stability of a digital dollar pegged at $0.0327 on Fantom. As businesses continue to expand globally, the ability to pay and retain world-class talent without friction will set the leaders apart from the laggards.

Ready to take the next step? Dive deeper into step-by-step implementation, compliance best practices, and real-world case studies in our guides: How to Pay Remote Teams with USDC: A Step-by-Step Guide for Crypto Payroll and How USDC Payroll Simplifies Global Payments for Remote Tech Teams.