Paying remote teams in USDC (USD Coin) is rapidly becoming the preferred method for global startups, tech companies, and digital nomad collectives seeking speed, transparency, and cost efficiency. With the current price of Multichain Bridged USDC (Fantom) at $0.0564, stablecoin payroll offers a practical alternative to traditional banking rails, especially for cross-border payroll scenarios where wire fees and delays can erode team morale and company margins.

Why USDC Payroll is Gaining Momentum

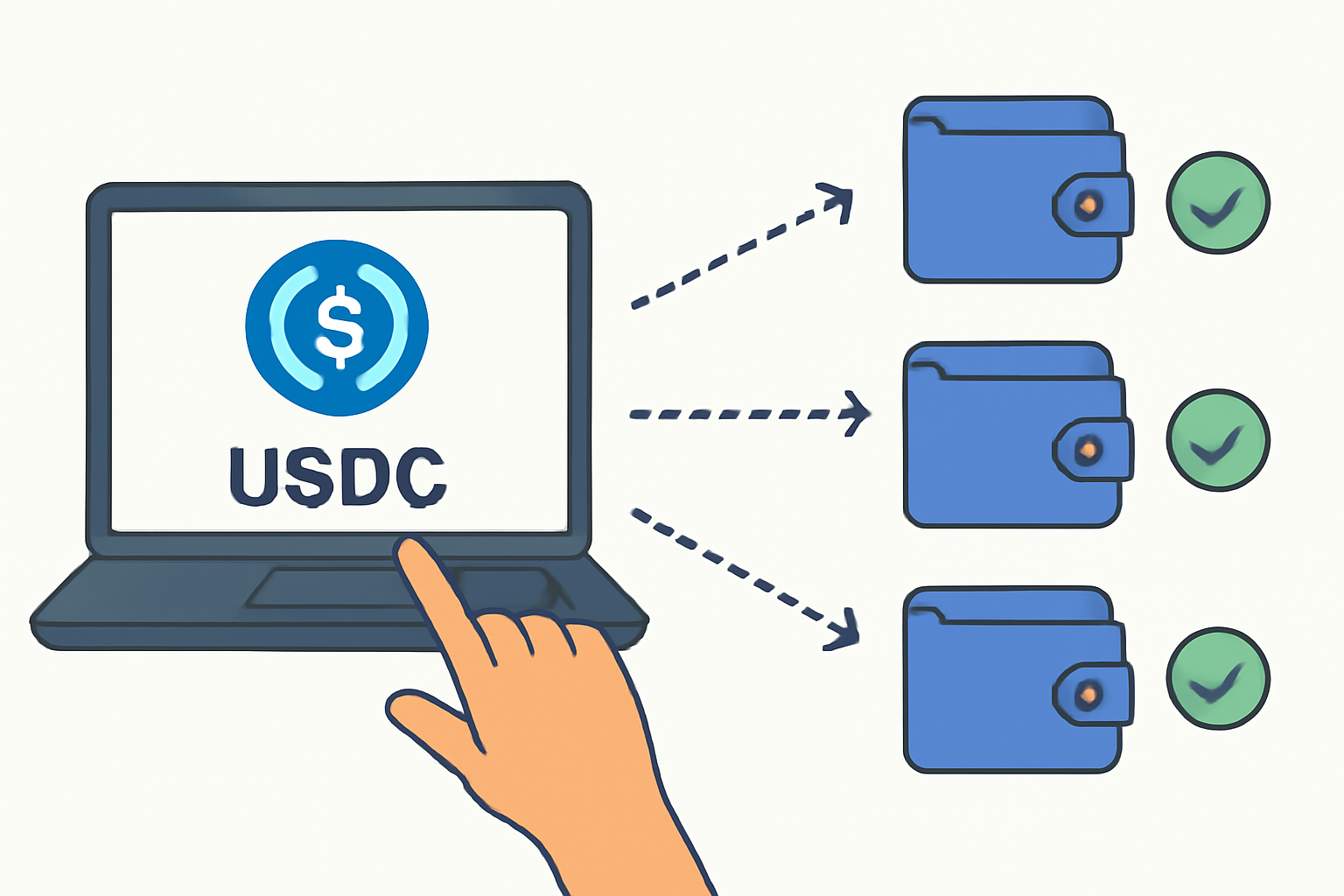

Stablecoins like USDC have changed the game for international payroll. Unlike volatile cryptocurrencies, USDC is pegged 1: 1 to the U. S. dollar (though on Fantom it currently trades at $0.0564), providing predictable value for both employers and employees. Companies such as Remote, Bitwage, and Riseworks now let you pay contractors in nearly 70 countries instantly with stablecoins, no more waiting days for bank settlements or losing money to hidden FX charges.

The benefits are clear:

- Near-instant settlement: Payments arrive in minutes rather than days.

- Lower transaction costs: Especially when compared to SWIFT or PayPal.

- Borderless access: Empower your team no matter where they live or bank.

- Transparency and traceability: Every transaction is visible on-chain.

This shift isn’t just about convenience, it’s about compliance too. As more regulators clarify crypto payroll rules, companies can confidently adopt stablecoin salaries with proper safeguards in place.

The Compliance Checklist: Setting Up USDC Payroll Correctly

The biggest risk when paying remote teams in stablecoins isn’t technology, it’s compliance missteps. Here’s how to get it right from step one:

- Verify Legal Eligibility: Confirm that paying in USDC is legal in each employee’s country. In the U. S. , this requires employee consent and adherence to minimum wage laws.

- Obtain Written Consent: Every recipient must agree, in writing, to receive their salary in USDC, with clear terms around exchange rates and payment schedules.

- Set Up Secure Digital Wallets: Both your company and your team need wallets compatible with USDC on your chosen blockchain (e. g. , Fantom). Platforms like Request Finance make wallet onboarding seamless.

- Select a Crypto Payroll Platform: Specialized providers such as Toku, Riseworks, or Request Finance streamline payments, compliance tracking, and reporting across jurisdictions.

- Calculate Compensation and Tax Withholdings: Use the market value of USDC at payment time ($0.0564 as of this writing) to determine gross/net pay. In most countries, including the U. S.: crypto is taxed as property; ensure you’re withholding appropriately.

Navigating Real-Time Price Fluctuations and Record-Keeping

Pegged assets like USDC are designed for stability, but always reference current prices ($0.0564) when calculating compensation or reporting taxes. Even minor deviations can impact payroll accuracy if ignored over time. Integrating a price widget or using an automated crypto payroll system reduces manual errors while keeping your records audit-ready.

This meticulous approach ensures you remain compliant while reaping all the advantages of borderless salary distribution. For a deeper dive into cross-border payroll with stablecoins, including advanced tax strategies, see our dedicated guide: How to Pay Remote Teams in USDC: A Step-by-Step Guide for Startups.

One often overlooked aspect of crypto payroll compliance is the need for robust documentation. Every payment in USDC should be accompanied by a detailed transaction record: date, time, wallet addresses, and the exact market value at disbursement. This is not just best practice but a regulatory expectation in most jurisdictions. Integrating your payroll platform with accounting software can automate much of this process, reducing manual workload and minimizing risk of audit issues down the line.

Automating Cross-Border Payroll with USDC

Adopting automation tools is crucial as your remote team grows. Modern crypto payroll platforms like Riseworks and Request Finance are designed for scale: they offer batch payments, built-in compliance checks, and seamless integration with HR systems. These platforms also provide real-time conversion rates, so when USDC (Fantom) trades at $0.0564, you can lock in that rate for each pay cycle, ensuring fairness and transparency for both employer and employee.

Another key advantage of using these platforms is their ability to handle multi-currency environments. If some team members prefer local fiat payouts while others choose stablecoins, you can accommodate both within a single dashboard, streamlining global payroll operations without sacrificing compliance or control.

Staying Ahead of Regulatory Changes

The regulatory landscape for crypto payroll continues to evolve rapidly. Countries are introducing new tax reporting requirements, KYC/AML standards, and even specific rules for stablecoin usage. To remain compliant:

- Monitor local regulations: Assign someone on your team or work with a provider who tracks global compliance updates.

- Schedule regular reviews: Quarterly check-ins with legal or tax advisors will help you adapt quickly if laws change.

- Educate your workforce: Provide clear onboarding materials explaining how USDC payroll works, potential risks, and how to report earnings correctly in their home country.

This proactive approach helps future-proof your cross-border payroll strategy as stablecoins become more mainstream.

Common Pitfalls (and How to Avoid Them)

- Mismatched wallet addresses: Always double-check before sending funds; blockchain transactions are irreversible.

- Ignoring tax withholding: Crypto does not exempt you from local tax obligations, work closely with professionals familiar with crypto taxation.

- Poor record-keeping: Use automated tools to log every transaction at the correct market price ($0.0564) for easy audits later.

If you’re ready to implement a scalable, compliant solution for paying remote teams in USDC, or want more technical detail on setting up stablecoin salary workflows, explore our comprehensive resource: How to Pay Remote Teams With USDC: A Step-by-Step Guide for Tech Startups.