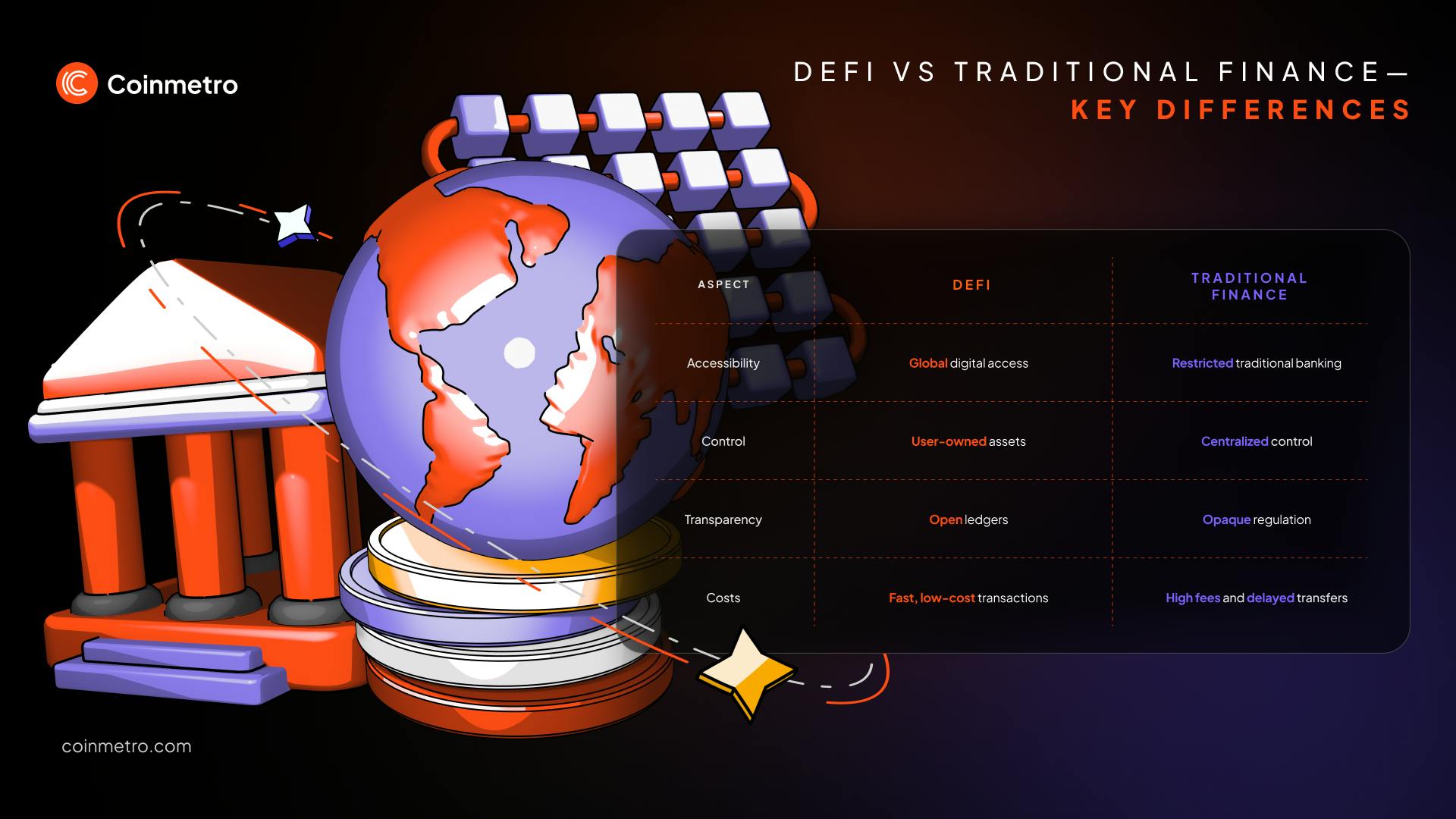

Global payroll is undergoing a seismic shift. The rise of remote work, borderless teams, and the demand for instant, low-cost payments have exposed the inefficiencies of traditional cross-border payroll systems. Enter USDC payroll: a crypto-native solution that combines the stability of the US dollar with the speed and transparency of blockchain. For companies seeking to pay remote teams efficiently, USDC (USD Coin) offers a compelling alternative to wire transfers and SWIFT-based payments.

Why Choose USDC for Paying Remote Teams?

USDC is a regulated stablecoin pegged 1: 1 to the US dollar, designed to maintain price stability and minimize volatility. As of October 9,2025, Multichain Bridged USDC (Fantom) is priced at $0.0550. This price accuracy is critical for finance leaders managing payroll budgets across borders.

The adoption curve is steep: platforms like Remote, Bitwage, and others now enable companies to pay contractors in nearly 70 countries using USDC. This trend isn’t limited to tech unicorns; startups, agencies, and DAOs are all leveraging stablecoin salary payments for their global workforce.

Key advantages of paying remote teams with crypto:

- Speed: Payments settle in minutes, not days

- Cost: Lower transaction fees compared to banks or payment processors

- Compliance: Platforms like Remote ensure local regulatory alignment

- Transparency: Blockchain records provide immutable proof of payment

- No Borders: Pay anyone, anywhere, without currency conversion headaches

The Step-by-Step Process for Cross-Border Payroll in USDC

Navigating crypto payroll compliance requires precision. Here’s how leading companies are implementing cross-border payroll with USDC today:

- Create a Business Crypto Wallet: Choose a secure wallet (e. g. , Binance, Trust Wallet) that supports Ethereum or your preferred network.

- Acquire USDC at Current Market Price: Buy at $0.0550 per token via reputable exchanges.

- Collect Employee Wallet Addresses: Request each team member’s public address and confirm their preferred network (Ethereum, Base Network, Stellar, etc. ).

- Send Payments: Initiate transfers from your business wallet, transactions are typically processed within minutes.

- Notify Employees: Confirm payment completion so recipients can verify funds on-chain.

This process not only streamlines global payroll but also empowers workers with immediate access to their earnings, no more waiting days for international wires or being stung by excessive bank fees.

The Compliance Imperative: Staying Ahead of Regulations

Pioneering companies understand that innovation must coexist with compliance. Platforms such as Remote have built KYC/AML checks directly into their onboarding flows. Contractors simply add their Base Network Wallet Address as a withdrawal method, ensuring smooth payouts while meeting local legal requirements. For more insights on aligning your crypto payroll strategy with evolving regulations, see our detailed guide at How to Pay Remote Teams in USDC: Step-by-Step Guide for Crypto Payroll Compliance.

Key Benefits of Using USDC for International Contractor Payments

-

Faster, Near-Instant Payments: USDC transactions settle within minutes, allowing contractors to access their funds quickly, unlike traditional international wire transfers that may take several days.

-

Lower Transaction Fees: Sending USDC internationally typically incurs much lower fees than banks or money transfer services, helping businesses and contractors save on cross-border payment costs.

-

Stable Value Pegged to the US Dollar: USDC is a stablecoin, meaning its value is pegged 1:1 to the US dollar, reducing the risk of volatility commonly associated with cryptocurrencies and providing predictable compensation for contractors.

-

Enhanced Transparency and Traceability: All USDC transactions are recorded on public blockchains, allowing both employers and contractors to easily verify payment status and history for improved financial transparency.

-

Flexible Payment Options: Contractors can receive any percentage of their salary in USDC, and platforms like Bitwage support customizable payroll splits, offering greater flexibility for global teams.

-

Financial Inclusion for the Unbanked: USDC payments only require a crypto wallet, making it possible for contractors in regions with limited banking infrastructure to participate in the global digital economy.

The next section will explore platform-specific workflows (like Bitwage’s Stellar integration), advanced security recommendations, and how real-world companies are leveraging stablecoins for borderless talent acquisition. Stay tuned as we unpack these critical details for your organization’s next-gen payroll strategy.

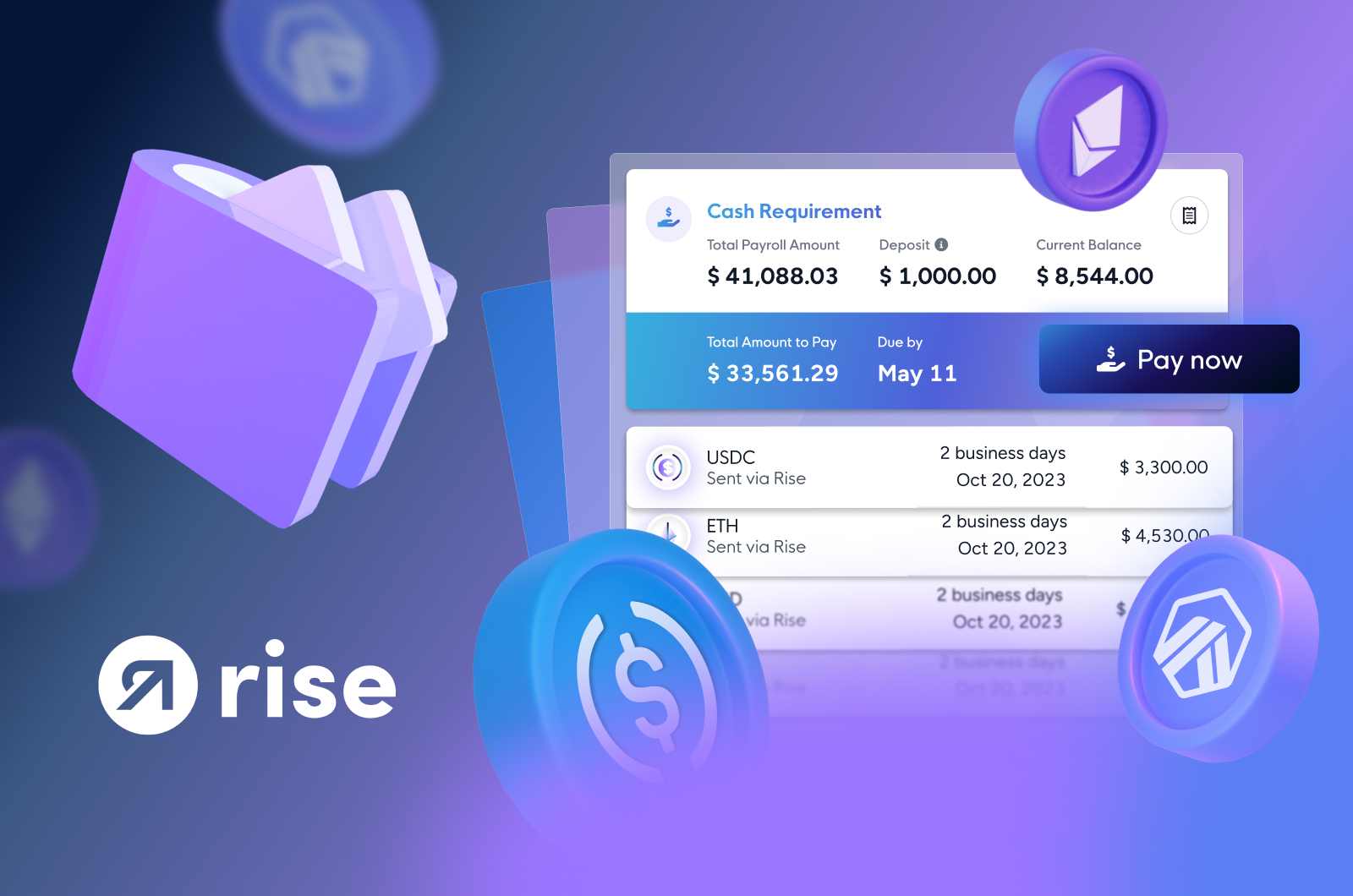

Platform Workflows: Bitwage, Remote, and Beyond

To operationalize cross-border payroll USDC at scale, it’s essential to understand how leading platforms like Bitwage and Remote have designed their workflows for both efficiency and compliance. Bitwage, for example, integrates directly with the Stellar blockchain, allowing employers to send USDC at the current market price of $0.0550 per token. Remote’s system, on the other hand, enables contractors to select USDC as their withdrawal method and simply provide a Base Network Wallet Address. These streamlined processes remove the friction of legacy banking, while automated compliance checks help mitigate regulatory risk.

For a visual breakdown of how these platforms compare, see the list below:

Top USDC Payroll Platforms for Remote Teams

-

Remote: A leading global HR platform, Remote enables companies to pay contractors in 69 countries with USDC. Features include automated compliance, tax documentation, and contractor onboarding. Contractors can select USDC as their withdrawal method by adding a Base Network Wallet Address. Compliance tools include KYC/AML checks and country-specific legal support.

-

Bitwage: Bitwage allows businesses to pay remote workers in USDC via the Stellar blockchain, supporting payouts in over 100 countries. It offers flexible salary splits (fiat and crypto), fast same-day deposits, and automated invoicing. Compliance features include KYC/AML, tax reporting, and integration with accounting tools.

-

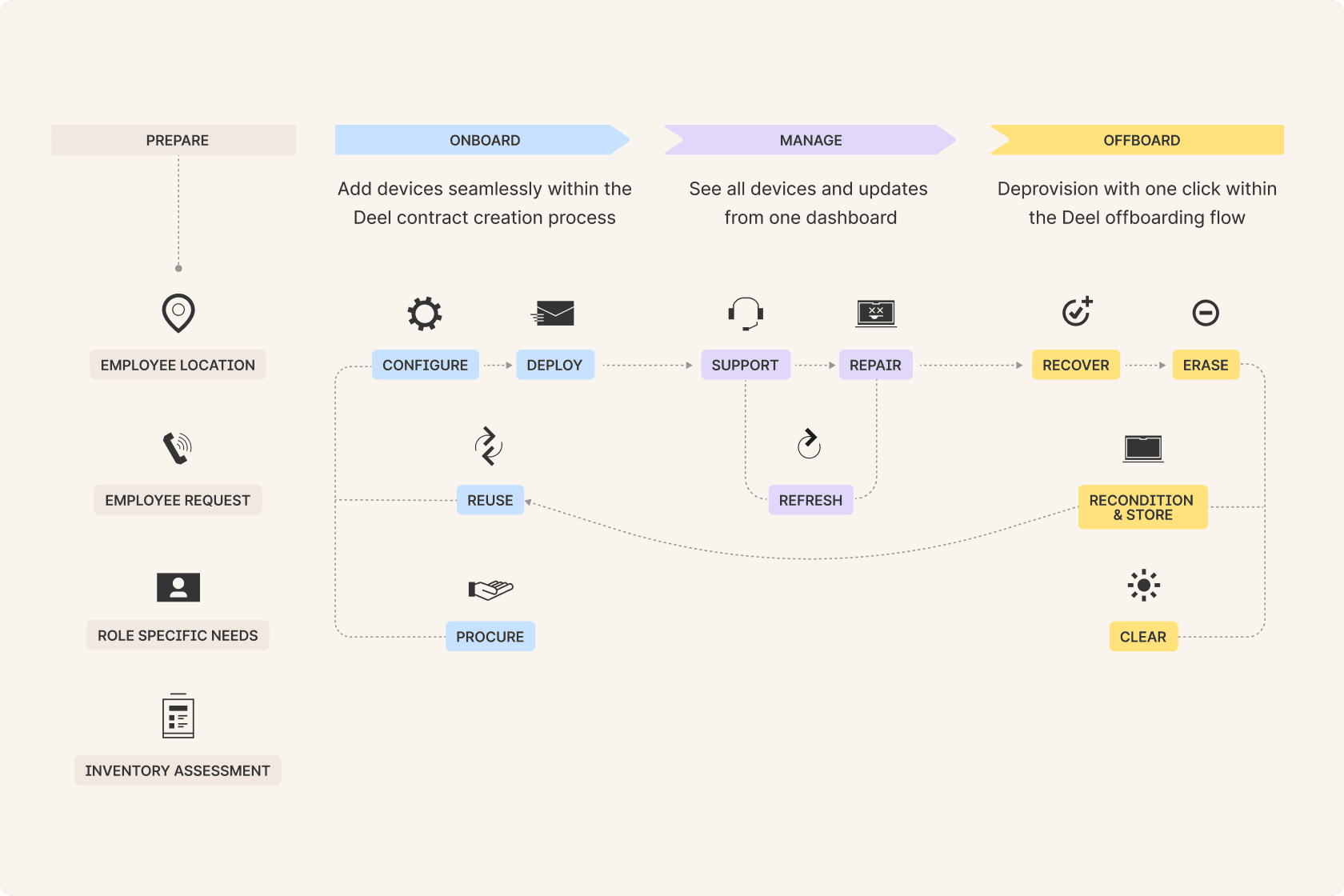

Deel: Deel supports crypto payroll, including USDC, for contractors in over 150 countries. Its platform automates onboarding, compliance, and payments, with contractors able to withdraw in USDC to supported wallets. Compliance tools include automated contract generation, global tax compliance, and KYC verification.

-

Request Finance: Request Finance is a crypto invoicing and payroll platform enabling businesses to pay remote teams in USDC across 60+ countries. Features include bulk payments, automated invoicing, and expense management. Compliance is supported through KYC, transaction tracking, and exportable financial reports.

-

Fipto: Fipto offers crypto and stablecoin payroll solutions, including USDC, for global teams. The platform supports payments in multiple countries, with instant transfers and low fees. Compliance features include KYC, AML, and audit-ready reporting.

Security and Best Practices for USDC Payroll

While stablecoin salary payments offer speed and transparency, security must remain paramount. Businesses should implement multi-signature wallets, enable two-factor authentication on all payroll accounts, and maintain detailed payment logs for audits. It’s also critical to educate both finance teams and recipients about phishing risks and safe wallet management. Leveraging reputable platforms with built-in KYC/AML ensures that your crypto payroll remains both compliant and resilient against fraud.

For those new to crypto payroll, consider starting with a small pilot program. This allows your team to get comfortable with wallet operations, transaction monitoring, and reconciliation, before scaling up to your entire remote workforce.

Real-World Adoption: Stablecoins Powering Global Talent

The adoption of USDC payroll is no longer hypothetical. From LATAM agencies to European SaaS startups, companies are using stablecoins to attract top talent regardless of geography. Contractors in regions with capital controls or volatile local currencies overwhelmingly prefer USDC for its dollar stability and instant settlement. As noted in recent market data, demand for stablecoin salary payments has surged in emerging markets where traditional payouts are slow or unreliable.

Consider this: a software engineer in Argentina can now receive their full salary in USDC at $0.0550 per token, bypassing inflationary pressures and cumbersome currency conversion. This is not just a technical upgrade; it’s a meaningful improvement in financial inclusion for remote professionals worldwide.

Pro Tip: Always verify the current price of USDC before funding your payroll. As of October 9,2025, Multichain Bridged USDC (Fantom) is priced at $0.0550. Use real-time price widgets or trusted exchange data to avoid discrepancies in payout calculations.

Moving Forward: Building a Resilient Crypto Payroll Strategy

As regulations evolve, the most successful organizations will be those that combine agility with robust compliance. Monitor legislative updates in each jurisdiction where you employ remote workers, and partner with platforms that proactively adapt their KYC/AML protocols. For deep dives into regulatory best practices, refer to How to Pay Remote Teams in USDC: Step-by-Step Guide for Crypto Payroll Compliance.

Ultimately, paying remote teams with USDC is about more than just efficiency, it’s a strategic advantage in the global talent marketplace. By embracing stablecoin payroll, you position your company as forward-thinking, borderless, and truly competitive in the digital economy.