For remote tech teams, managing payroll across borders has always been a logistical headache. Traditional banking systems are slow, expensive, and often tangled in regulatory red tape. But the rise of USDC payroll is rapidly changing this landscape, offering a streamlined, compliant, and cost-effective solution tailored for distributed teams that demand agility.

Why USDC Is Dominating the Global Payroll Crypto Market

The latest Blockchain Compensation Survey 2024 from Pantera Capital confirms what many in the industry already suspected: stablecoins like USDC are now the backbone of crypto salaries worldwide. According to their data, USDC accounts for 63% of all crypto payrolls, with USDT following at 28.6%. This means over 90% of blockchain-based salaries are paid using these two stablecoins, a clear signal that stability and trust matter most when paying remote talent.

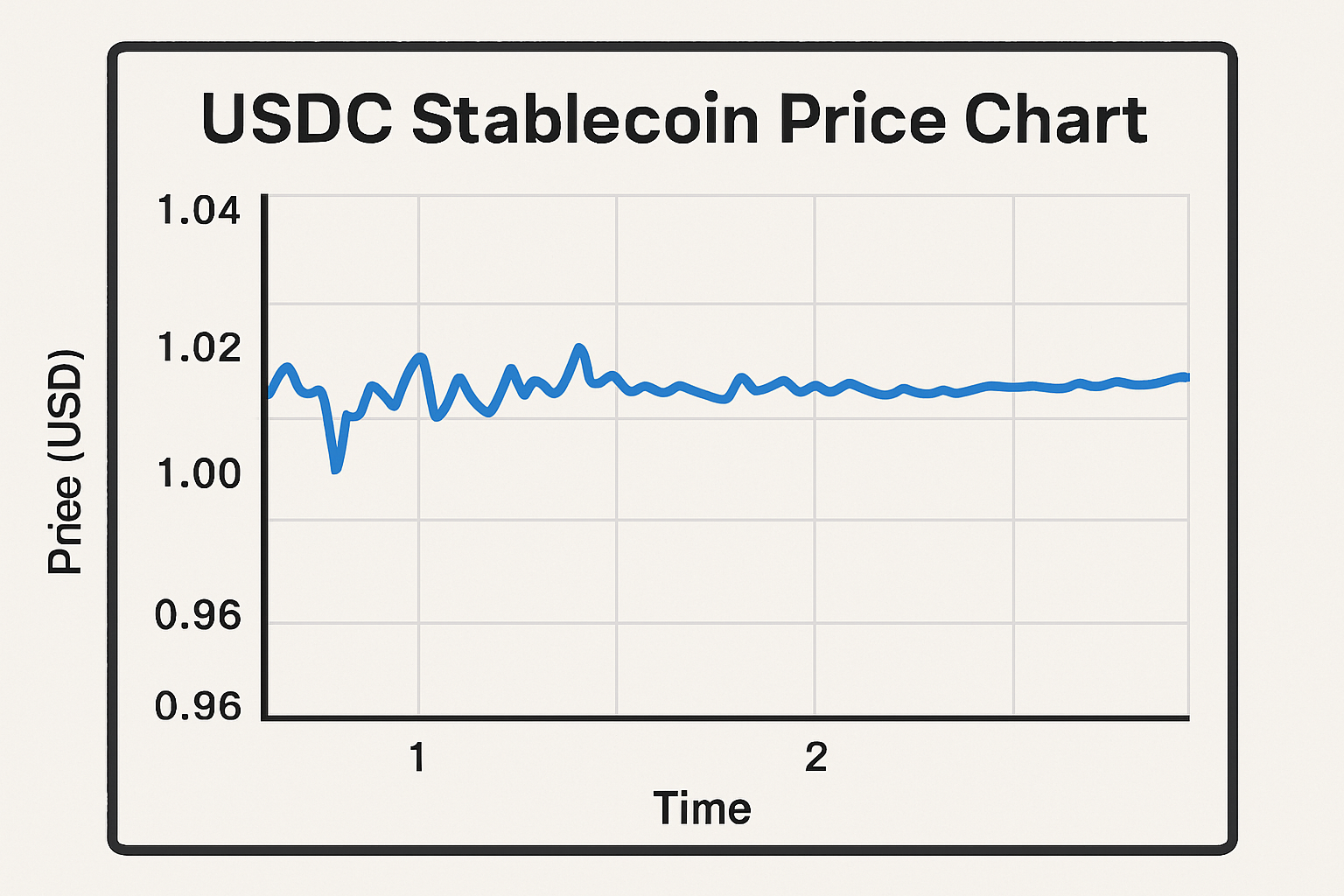

But why is USDC (USD Coin) so popular for cross-border salary distribution? The answer lies in its dollar peg and regulatory transparency. Unlike volatile cryptocurrencies, USDC is designed to maintain parity with the U. S. dollar, making it ideal for predictable compensation packages. Its compliance-first approach also reassures both employers and employees navigating complex international regulations.

The Real-World Impact: Faster Payments and Lower Costs

The benefits of adopting USDC payroll aren’t just theoretical, they’re already being realized by forward-thinking tech companies around the globe. In December 2024, Remote partnered with Stripe to enable U. S. -based firms to pay contractors in 69 countries via USDC on Coinbase’s Base network. This move allows near-instant payments directly to contractor wallets and eliminates the delays commonly associated with SWIFT transfers or intermediary banks.

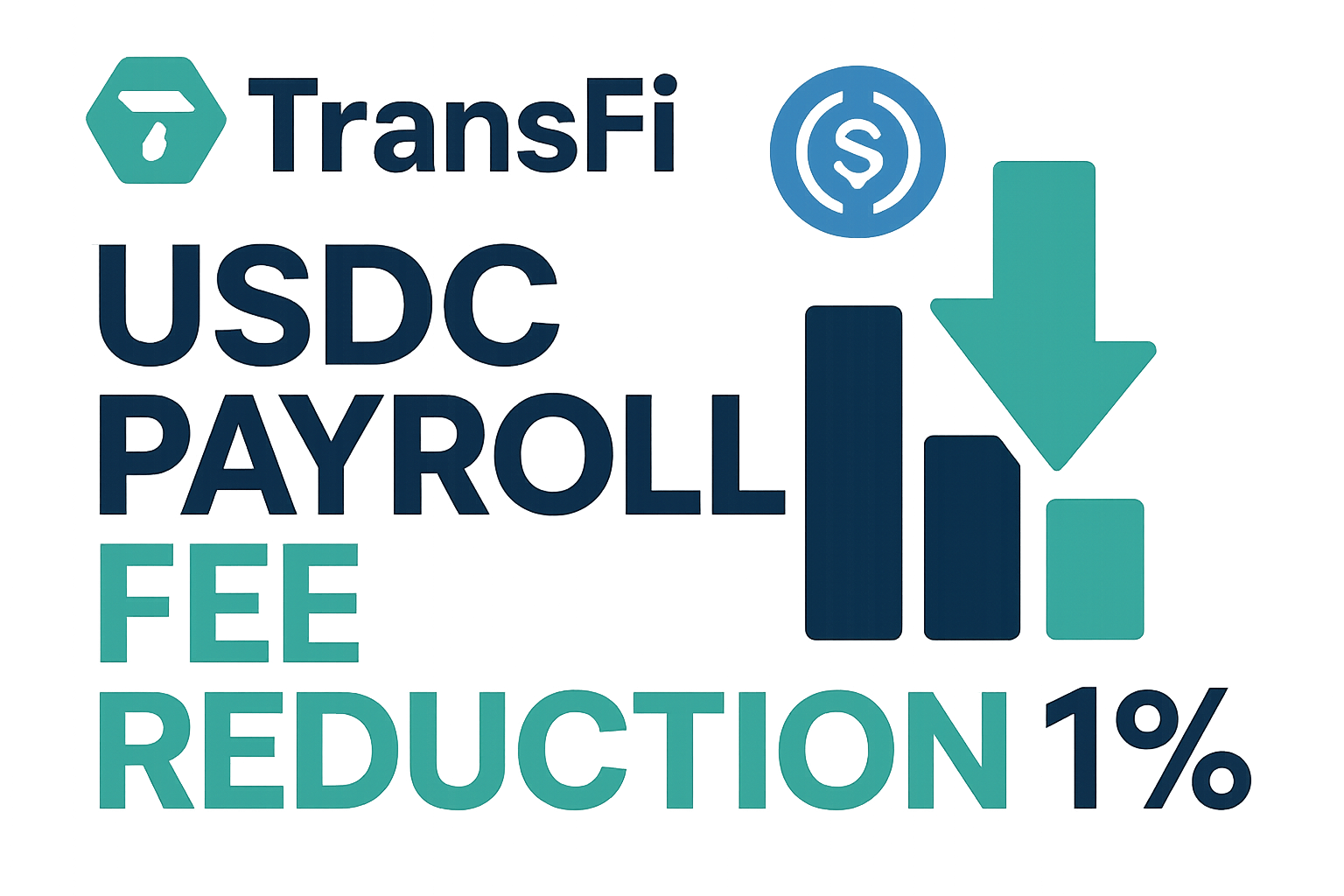

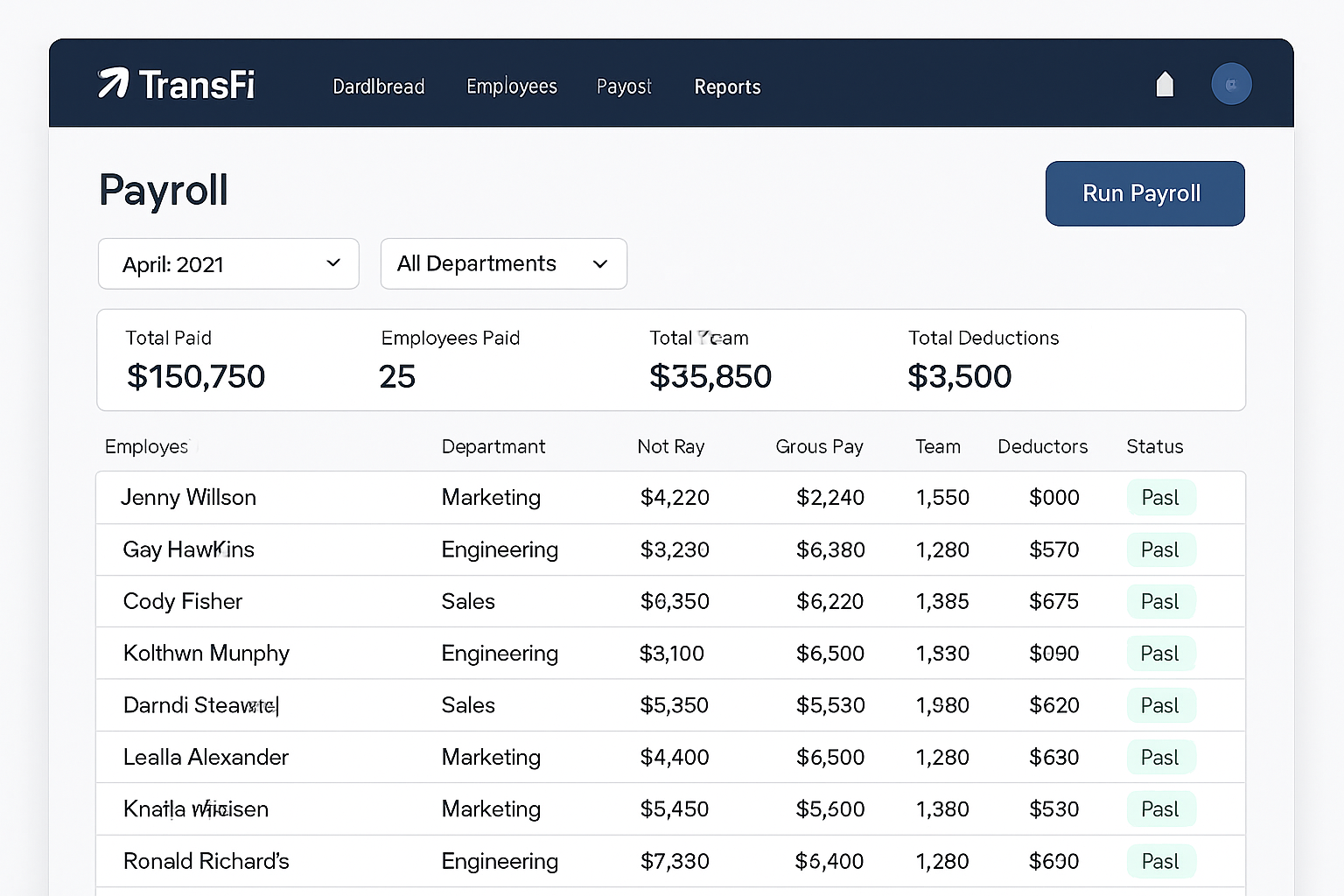

A recent case study from TransFi illustrates these advantages vividly: after switching to USDC payroll rails, a fully remote tech company saw most team members receive their salaries in under 30 minutes, an unprecedented leap from multi-day waits. Even more compelling was a reported reduction in payroll processing fees by over 60%, thanks to bypassing traditional banking infrastructure and currency conversion costs.

Key Benefits After Switching to USDC Payroll with TransFi

-

60% Reduction in Payroll Processing FeesSwitching to TransFi for USDC payroll led to a dramatic drop in processing costs, enabling the company to allocate more resources to growth and innovation.

-

Faster Cross-Border Payments—Under 30 MinutesMost team members now receive their salaries in under 30 minutes, compared to days with traditional banking, thanks to USDC’s blockchain settlement speed.

-

Elimination of Currency Conversion CostsPaying in USD Coin (USDC) removes the need for costly currency exchanges, ensuring employees receive the exact amount intended—no hidden deductions.

-

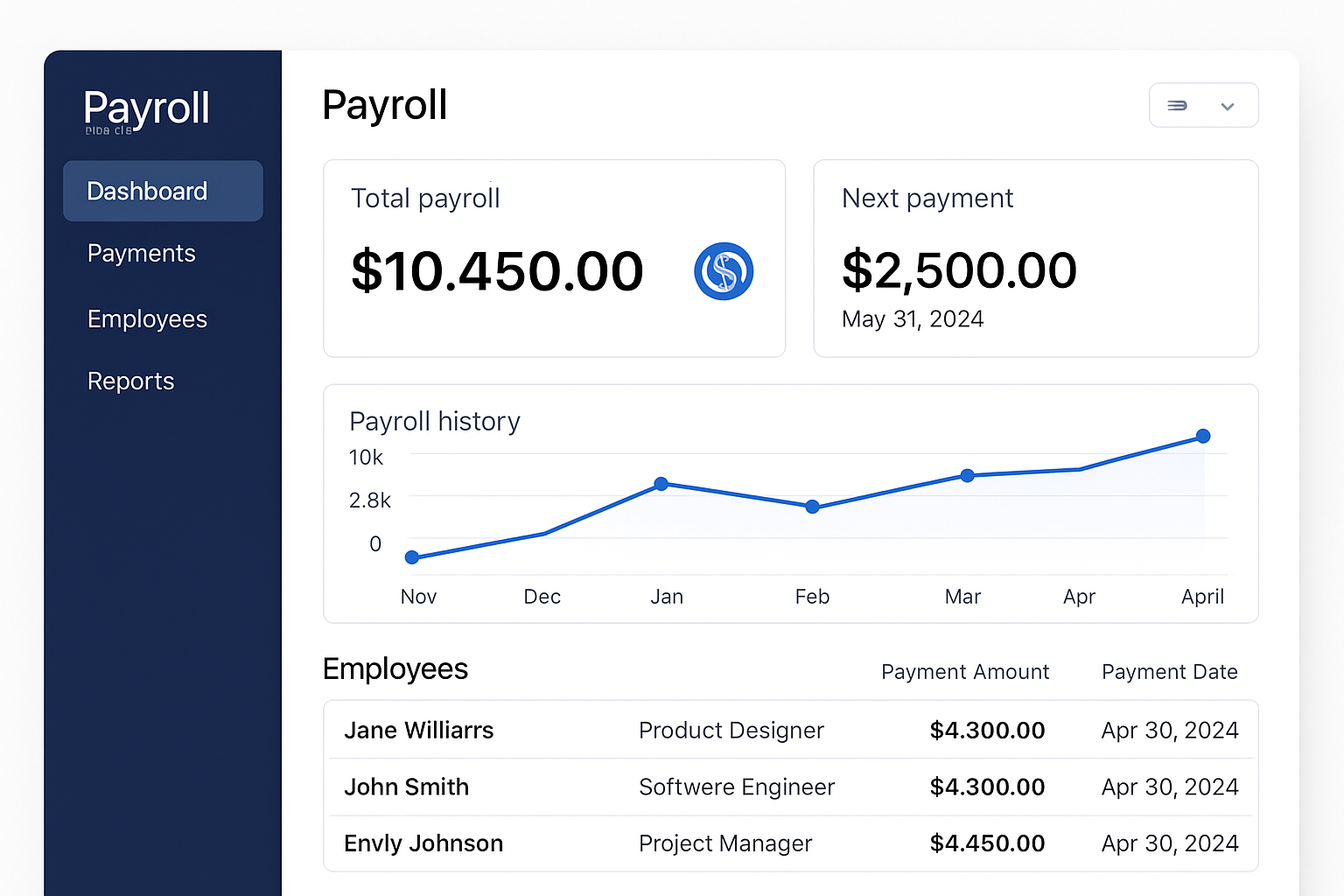

Consolidated Payroll Operations in a Single DashboardTransFi’s platform replaced multiple banking tools, streamlining payroll management and reducing administrative overhead for remote teams.

-

Enhanced Global Accessibility & ComplianceWith USDC payroll, the company can pay team members in 69+ countries, leveraging compliant, secure payments on networks like Coinbase’s Base.

-

Stable Value with USDC Pegged to the US DollarUSDC maintains a 1:1 peg to the US dollar, with the latest Multichain Bridged USDC (Fantom) price at $0.0617, providing predictability for both employers and employees.

Stablecoin Salaries: Compliance Without Compromise

Compliance remains one of the biggest challenges for any organization handling global payments. Fortunately, platforms supporting USDC payroll, such as Rise and Circle-backed solutions, have prioritized regulatory alignment across jurisdictions. For example, when Remote rolled out its new integration with Stripe and Coinbase Base network in late 2024, it allowed employers to be billed in U. S. dollars while ensuring contractors could receive payment directly as digital dollars, no need for manual conversions or multiple bank accounts.

This approach not only simplifies accounting but also supports robust record-keeping for tax purposes, a critical factor as more countries introduce crypto-specific reporting requirements.

USDC Price Update: Multichain Bridged USDC (Fantom) at $0.0617

No discussion about stablecoin salaries would be complete without referencing real-time market data. As of today, Multichain Bridged USDC (Fantom) is priced at $0.0617, with a daily high of $0.0619 and low of $0.0547, a testament to its continued accessibility for mass payouts even as adoption scales globally.

If you’re considering moving your global team onto a streamlined digital dollar system but aren’t sure where to start, check out our step-by-step guide on how to pay remote teams with USDC.

Looking beyond speed and cost, USDC payroll is also redefining the employee experience for remote tech professionals. With near-instant settlements, team members no longer wait days for funds to clear or worry about international wire errors. Instead, salaries arrive in their wallets quickly and securely, giving employees greater control over their earnings, wherever they are in the world.

For employers, this agility translates to a competitive advantage in attracting and retaining top talent. The ability to offer stablecoin salaries signals a forward-thinking culture that values innovation and financial empowerment. It also removes friction from onboarding contractors or new hires in regions traditionally underserved by global banking networks.

Getting Started: What Remote Tech Teams Should Know

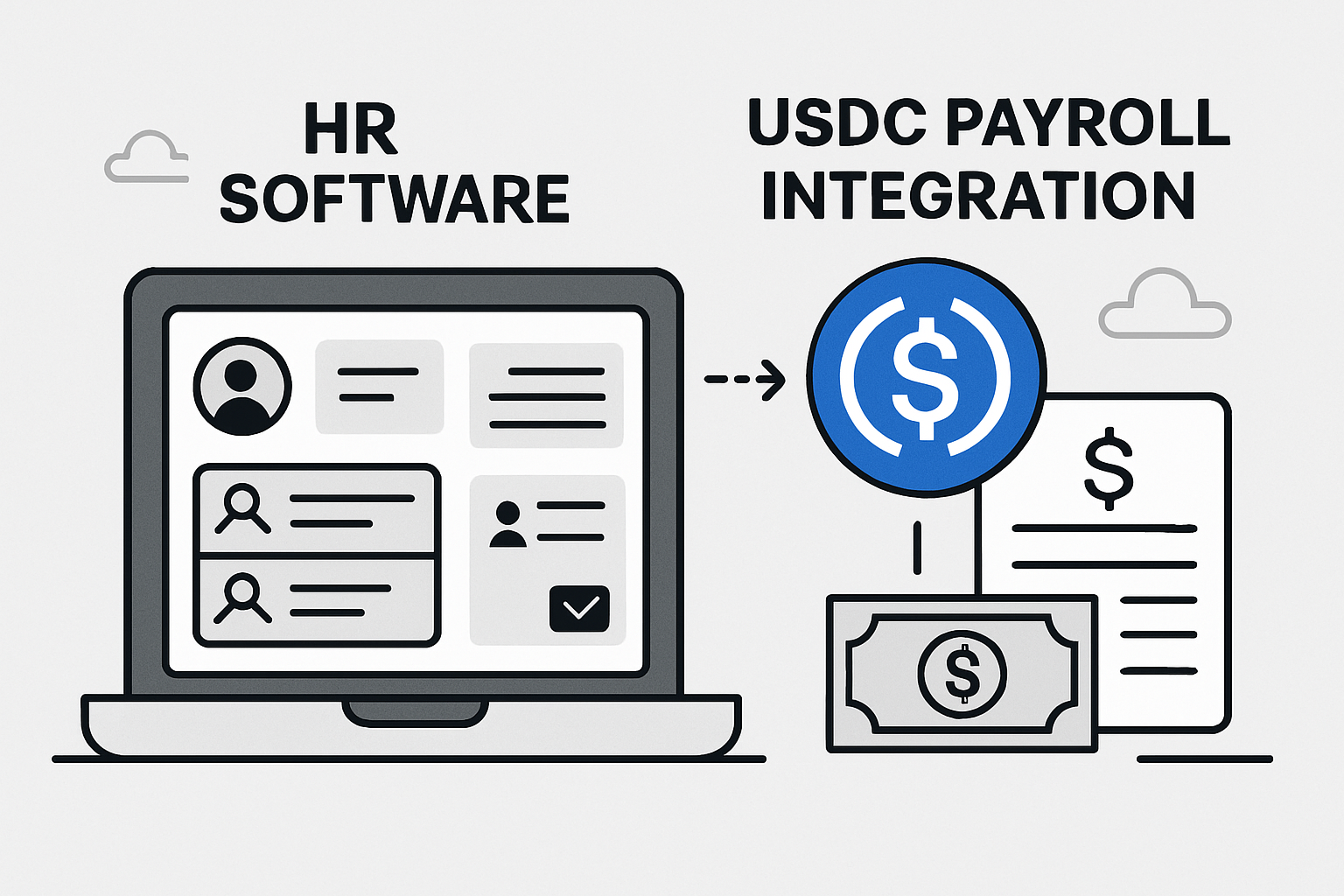

Adopting USDC payroll is more straightforward than many expect. Leading platforms like Rise, TransFi, and Circle provide intuitive dashboards that integrate seamlessly with existing HR systems. Employers simply fund their payroll account in U. S. dollars or USDC, select recipients’ wallet addresses, and initiate payments, all while maintaining full compliance with local regulations.

Key considerations include:

USDC Payroll Launch Checklist for Tech Teams

-

Verify regulatory requirements in each country of operation. Research local crypto payroll laws, tax obligations, and reporting standards. Platforms like Remote and Rise offer compliance support for multiple jurisdictions.

-

Set up secure wallets for staff. Ensure every team member has a compatible wallet, such as Coinbase Wallet or MetaMask, able to receive USDC on supported networks like Base.

-

Integrate with existing HR and payroll tools. Many USDC payroll platforms offer APIs or direct integrations with HR systems (e.g., Remote, Rise, Bitwage). This streamlines onboarding, payroll management, and record-keeping.

-

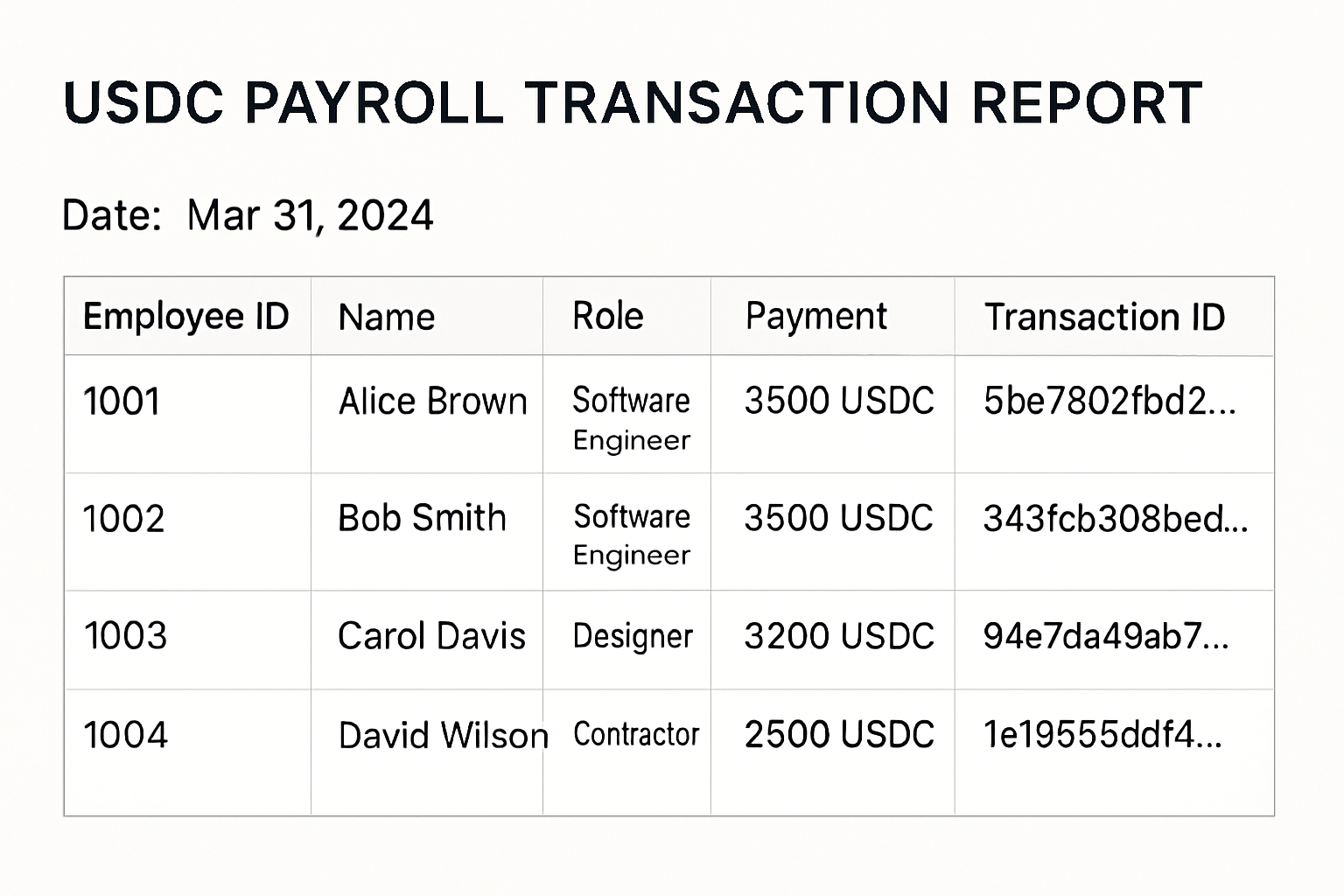

Establish robust reporting and audit protocols. Use platform dashboards and downloadable reports to track payments, ensure tax compliance, and facilitate audits. Most leading platforms provide exportable transaction histories and compliance documentation.

As the market matures, expect even greater automation and analytics capabilities designed specifically for global payroll crypto management, further reducing administrative overhead for finance teams.

The Future of Cross-Border Salary Distribution

The momentum behind stablecoin salaries is only accelerating as more organizations recognize the value of borderless compensation models. According to Pantera Capital’s survey data, over 90% of crypto-based salaries are now paid out via USDC or USDT, a figure likely to increase as regulatory clarity improves worldwide.

With Multichain Bridged USDC (Fantom) currently priced at $0.0617, stablecoin-powered payrolls remain accessible even as transaction volumes surge globally. This price stability is crucial for both employers managing budgets and employees planning personal finances.

USDC vs. Bitcoin & Ethereum: 30-Day Price Stability Comparison

| Cryptocurrency | Current Price | 30-Day Price Range | Payroll Suitability | |

|---|---|---|---|---|

| USDC (Fantom) | $0.0617 | $0.0547 – $0.0619 | 🟩 Very Stable | ✅ Excellent for payroll |

| Bitcoin (BTC) | (Not provided) | (Not provided) | 📈 Highly Volatile | ⚠️ Not ideal for payroll |

| Ethereum (ETH) | (Not provided) | (Not provided) | 📉 Volatile | ⚠️ Not ideal for payroll |

The bottom line: For remote tech teams seeking efficiency without sacrificing compliance or transparency, USDC payroll offers a compelling solution that’s already transforming how global workforces are paid. As adoption grows and technology evolves, expect even more seamless experiences, and empowered employees, across borders.