In 2025, the landscape of global payroll is being transformed by USDC payroll, offering startups and tech companies a faster, more efficient way to pay remote teams. With USD Coin (USDC) trading at $0.0319 as of November 2025, stablecoin salaries are minimizing currency volatility and cross-border friction. But making the switch isn’t just about sending crypto, it’s a process that demands compliance, robust infrastructure, and operational transparency. Here’s how to lead your organization through the five critical steps for seamless international contractor payment USDC, ensuring you stay ahead in compliance and efficiency.

![]()

1. Assess Legal and Tax Compliance for USDC Payroll in Each Jurisdiction

The foundation of any crypto payroll strategy is regulatory clarity. Before onboarding anyone or moving funds, you must analyze the legal landscape for stablecoin salary compliance in every country where your team operates. Regulations around crypto payroll differ dramatically, some countries classify USDC as a digital asset subject to capital gains tax, while others may treat it as foreign currency income or even restrict its use entirely.

Work with local advisors or specialized global payroll platforms that offer up-to-date compliance intelligence. This step is non-negotiable: failing to address local tax obligations can result in penalties or blocked transactions, jeopardizing your entire remote workforce strategy.

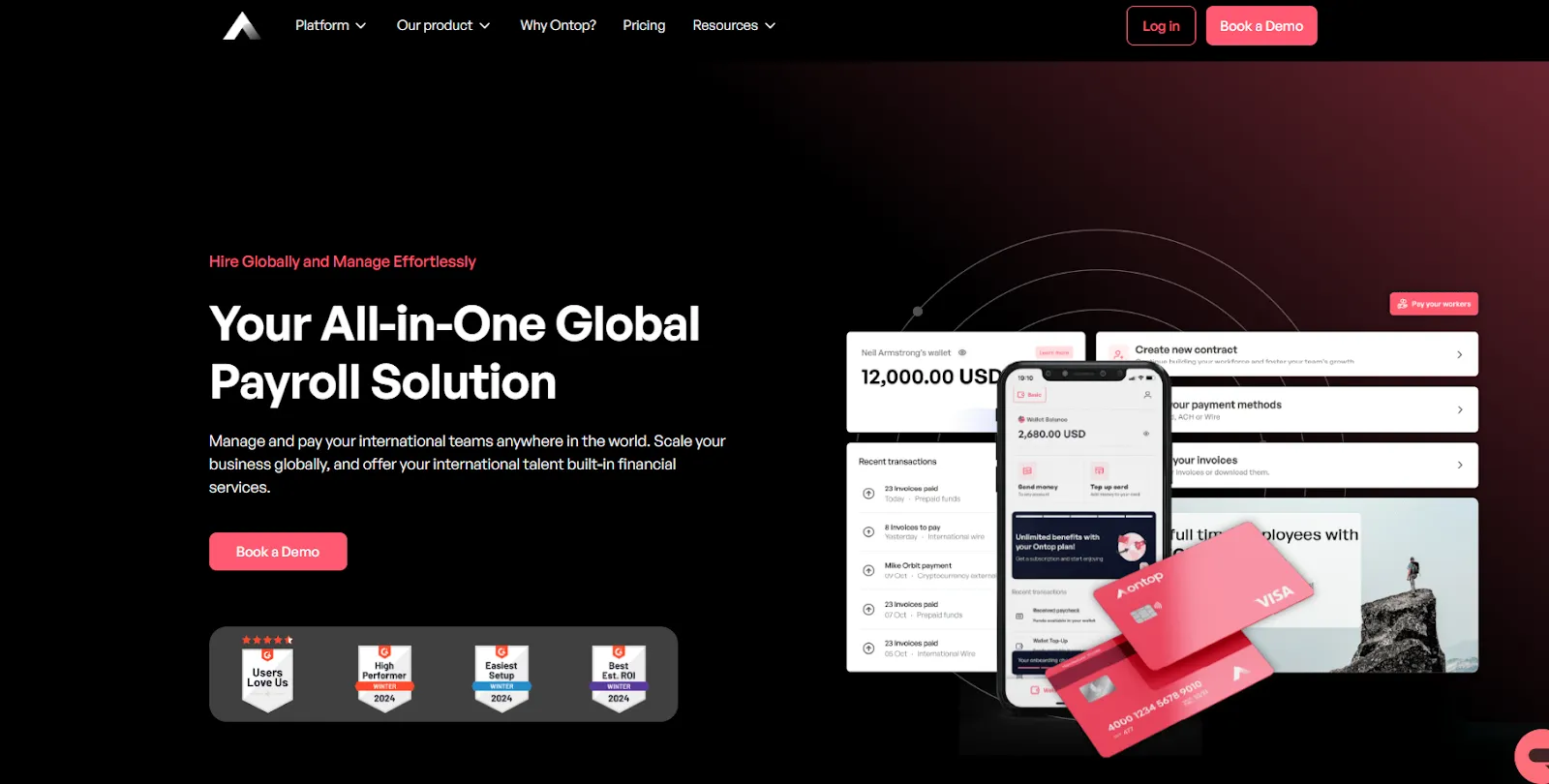

2. Select a Crypto Payroll Platform with Global USDC Support and Automated Reporting

The right platform does more than just process payments, it automates reporting, ensures regulatory adherence, and supports payouts across multiple jurisdictions. In 2025, leading solutions integrate directly with business accounts, offering real-time conversion rates for USDC at $0.0319, automated invoicing, and end-to-end audit trails.

- Prioritize platforms with proven track records in cross-border contractor payments.

- Look for integrations with major blockchains (e. g. , Base Network) for low-fee stablecoin transfers.

- Ensure support for bulk payments and detailed CSV exports for accounting.

This step streamlines operations while giving finance teams peace of mind around documentation, a critical factor during audits or financial reviews. For more on choosing compliant solutions, see our guide on crypto payroll compliance for remote teams.

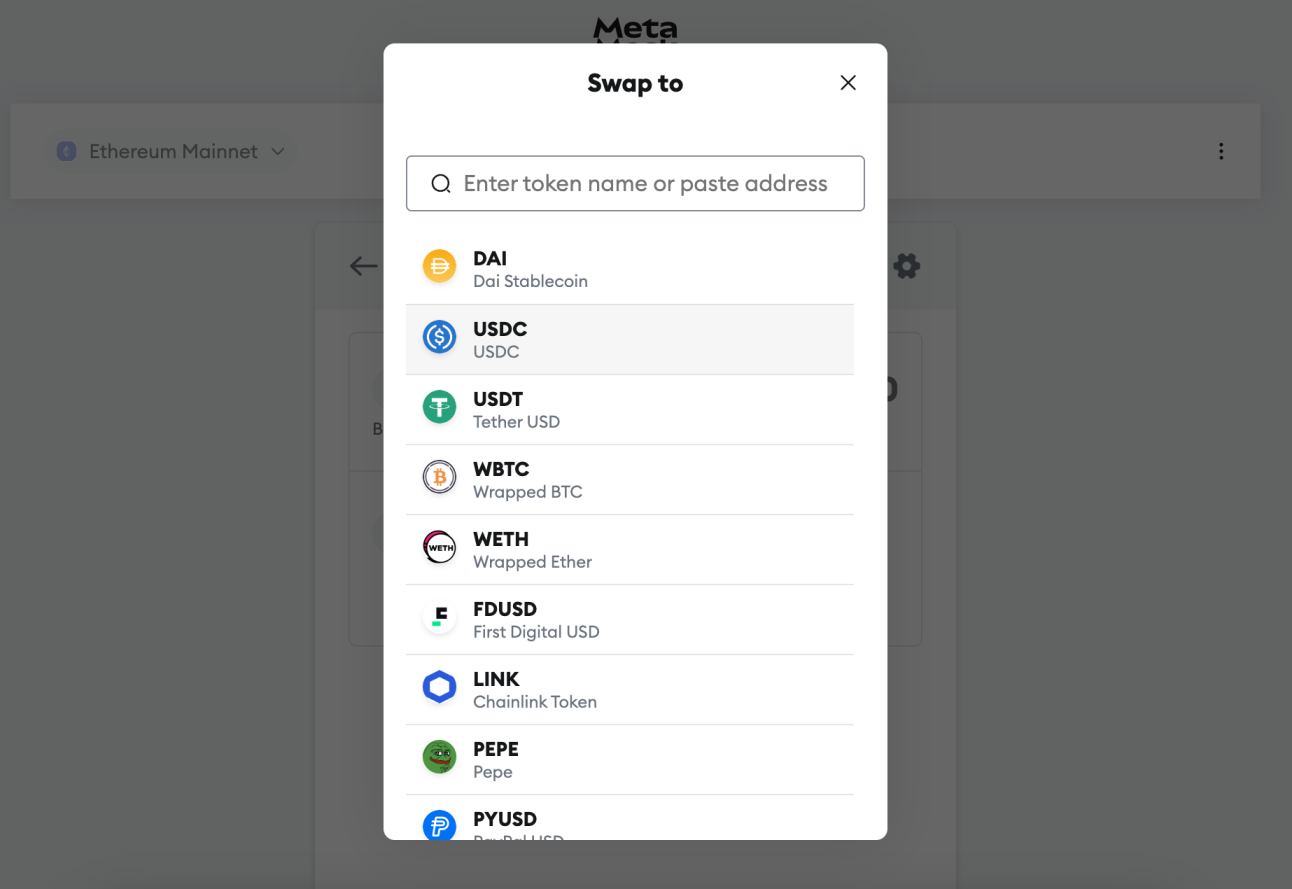

3. Onboard Team Members by Setting Up Secure, Compliant Wallets for Employees and Contractors

No matter how advanced your platform is, your process will stall if employees can’t receive their funds securely. The onboarding phase includes:

- KYC Verification: Ensure each recipient completes know-your-customer checks per jurisdictional requirements.

- Wallet Setup: Guide team members to set up wallets compatible with USDC on the right network (such as Base Network).

- Security Protocols: Educate on best practices, multi-factor authentication, secure key storage, to avoid loss or theft of funds.

This not only empowers your contractors but also protects your company from fraud or accidental mispayments, an essential part of any scalable crypto payroll for startups.

4. Integrate USDC Funding and Conversion Solutions to Streamline Fiat-to-Stablecoin Transfers

Efficiency is the new currency, and nowhere is this truer than in the funding phase of USDC payroll 2025. To minimize delays and FX risk, leverage platforms that offer direct fiat-to-USDC conversion at real-time rates. This ensures you always pay remote teams in USDC at the current market price of $0.0319, with full transparency on conversion costs.

- Utilize automated funding rails that support recurring payroll cycles.

- Choose providers with robust liquidity to avoid slippage, especially for large payouts or volatile markets.

- Consider multi-currency support if you operate in both fiat and crypto environments.

By integrating these solutions, startups and tech companies can reduce manual intervention, lower transaction costs, and ensure every contractor receives their stablecoin salary on time, regardless of location. For a deeper dive into optimizing your payment flows, check out our resource on streamlining cross-border payments for remote teams.

5. Implement Transparent Payroll Processes with Real-Time Tracking, Receipts, and Support

The final step is all about operational excellence: build a transparent payroll experience that instills trust across your global team. Modern crypto payroll platforms now offer:

- Real-Time Payment Tracking: Both admins and recipients can monitor payment status on-chain, no more ticket chasing or uncertainty.

- Automated Receipts and Invoices: Every transaction generates downloadable documentation for compliance and tax reporting.

- Integrated Support Channels: Fast resolution of payout queries through live chat or dedicated help desks.

This level of transparency not only simplifies audits but also boosts morale by giving employees visibility into their compensation, an essential factor for attracting top talent in competitive markets. As global teams grow more distributed, seamless stablecoin salary compliance becomes a core differentiator for forward-thinking organizations.

Why These Five Steps Matter for Crypto Payroll Success

The journey to pay remote teams in USDC isn’t just about speed, it’s about building a resilient system that scales internationally while staying compliant. Each step, from legal assessment to transparent reporting, addresses a critical pain point faced by finance leaders managing borderless workforces. With USDC’s price at $0.0319, businesses can plan budgets with confidence, sidestepping the volatility that once plagued crypto salaries.

If you’re ready to evolve your global payment infrastructure, these five essentials will position your company ahead of regulatory shifts, and empower your team with instant, reliable compensation anywhere in the world.

5 Essential Steps for Paying Remote Teams in USDC

-

Assess Legal and Tax Compliance for USDC Payroll in Each JurisdictionBefore launching USDC payroll, review local regulations and tax requirements for crypto payments in every country where your team operates. This ensures your payroll process remains compliant and avoids legal risks.

-

Select a Crypto Payroll Platform with Global USDC Support and Automated ReportingChoose a reputable platform such as Remote, Deel, or Request Finance that supports USDC payouts worldwide and provides automated reporting for transparency and accounting.

-

Onboard Team Members by Setting Up Secure, Compliant Wallets for Employees and ContractorsGuide your team to create Ethereum-compatible wallets (like MetaMask) or use integrated wallet solutions offered by your payroll provider. Ensure wallets are properly set up for USDC on the Base Network for seamless payouts.

-

Integrate USDC Funding and Conversion Solutions to Streamline Fiat-to-Stablecoin TransfersFund your payroll wallet by purchasing USDC via trusted exchanges (e.g., Coinbase) or through direct platform integrations. This step ensures you can efficiently convert fiat to USDC and maintain liquidity for payroll.

-

Implement Transparent Payroll Processes with Real-Time Tracking, Receipts, and SupportUtilize platforms that offer real-time payment tracking, automated receipts, and dedicated support. This boosts trust and provides clear records for both employers and remote team members.