For tech startups with distributed teams, the challenge of global payroll is as much about speed and compliance as it is about cost. Traditional cross-border payments are slow, expensive, and often unpredictable. Enter USDC: a regulated, dollar-pegged stablecoin that has rapidly become the preferred solution for USDC payroll for remote teams. With the right strategy, startups can pay employees and contractors worldwide instantly, securely, and without the headaches of legacy banking.

![]()

Why Tech Startups Are Turning to USDC for Payroll

The volatility of crypto is well-documented, but stablecoins like USDC have solved this pain point by maintaining a 1: 1 peg to the U. S. dollar. This stability is critical when paying international teams who need predictability in their earnings. As of September 21,2025, platforms such as Remote and Bitwage let companies send salaries in USDC to nearly 70 countries, often at a fraction of the cost and time required by traditional banks.

Key drivers behind this shift include:

- Speed: Payments settle in minutes instead of days.

- Cost savings: Lower transaction fees compared to SWIFT or wire transfers.

- Simplicity: No need to navigate multiple currencies or unpredictable FX rates.

- Compliance: Leading platforms integrate robust KYC/KYB processes to keep startups on the right side of global regulations.

The Step-by-Step Process: Paying Remote Teams with USDC

The mechanics are straightforward but require diligence at each stage. Here’s how forward-thinking startups manage cross-border payroll compliance using stablecoins:

Selecting Your Crypto Payroll Platform

The foundation of any successful crypto payroll operation is choosing a reliable platform. Options like Bitwage, which leverages the Stellar blockchain for fast settlements, or Remote, which partners with Stripe for seamless onboarding and compliance checks, are industry leaders. Evaluate each platform’s network compatibility (e. g. , Base vs. Stellar), fee structure, supported jurisdictions, and regulatory standards before committing.

Navigating Onboarding and Compliance for Crypto Payroll

KYC (Know Your Customer) and KYB (Know Your Business) protocols aren’t just regulatory box-ticking, they protect your company from fraud and ensure legal clarity across borders. Expect to provide detailed business information during onboarding; your remote staff will also need to supply compliant wallet addresses compatible with your chosen blockchain network.

Key Compliance Tips for Global Crypto Payrolls

-

Confirm Wallet and Network Compatibility: Collect USDC-compatible wallet addresses from team members and verify they match the blockchain network supported by your payroll platform (e.g., Base for Remote, Stellar for Bitwage).

-

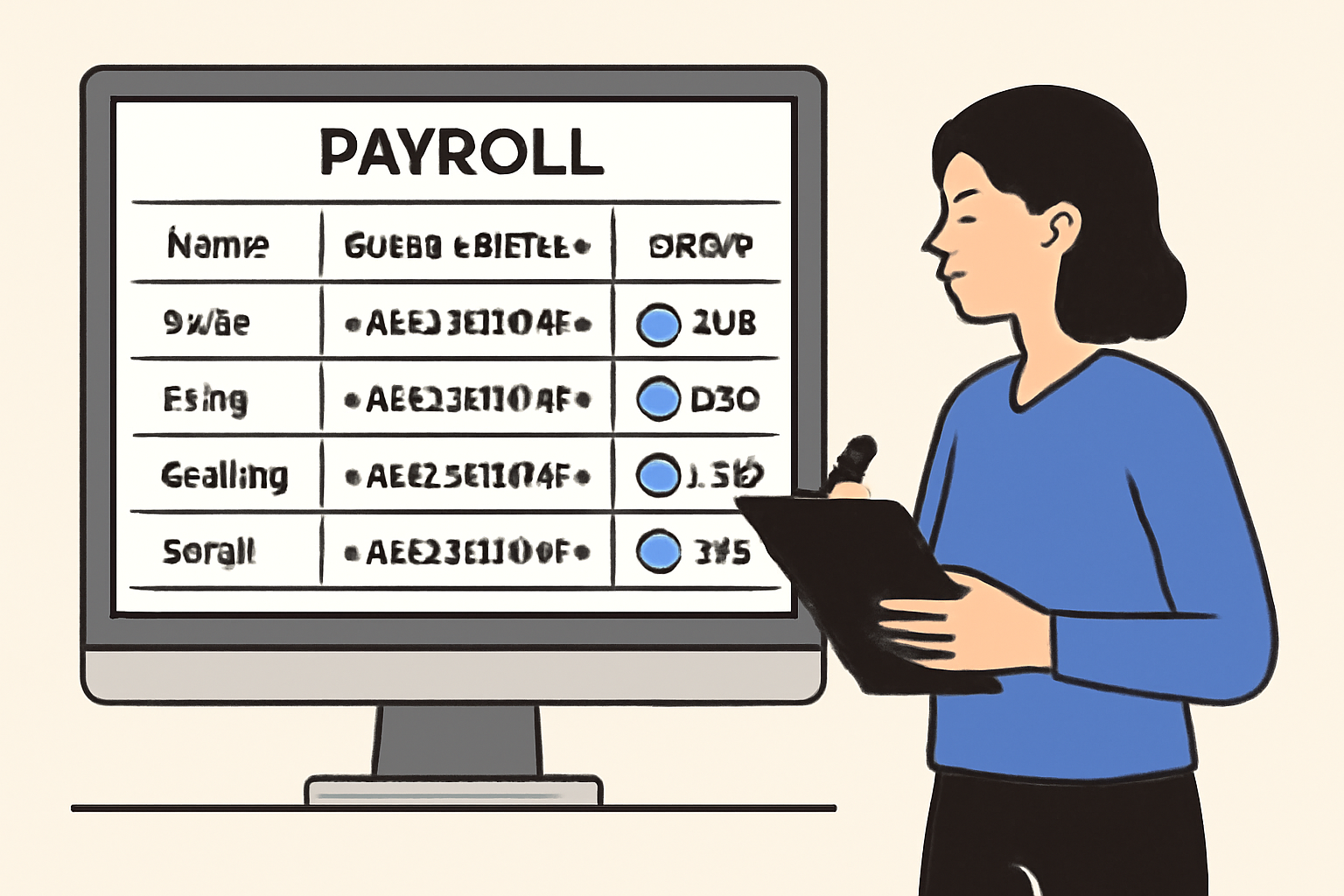

Maintain Detailed Payroll and Tax Records: Accurately document every USDC payment for tax reporting and compliance. Use platform-generated reports and consult local tax professionals as needed.

-

Monitor Regulatory Updates in All Jurisdictions: Stay informed about evolving crypto payroll regulations in both your company’s and your team members’ countries to ensure ongoing legal compliance.

-

Use Established, Compliant Payroll Platforms: Select reputable services like Remote, Bitwage, or Velocity Global that prioritize compliance, offer robust audit trails, and support cross-border USDC payments.

This rigorous approach means every payment is traceable on-chain, an advantage when auditing or preparing tax documentation later on.

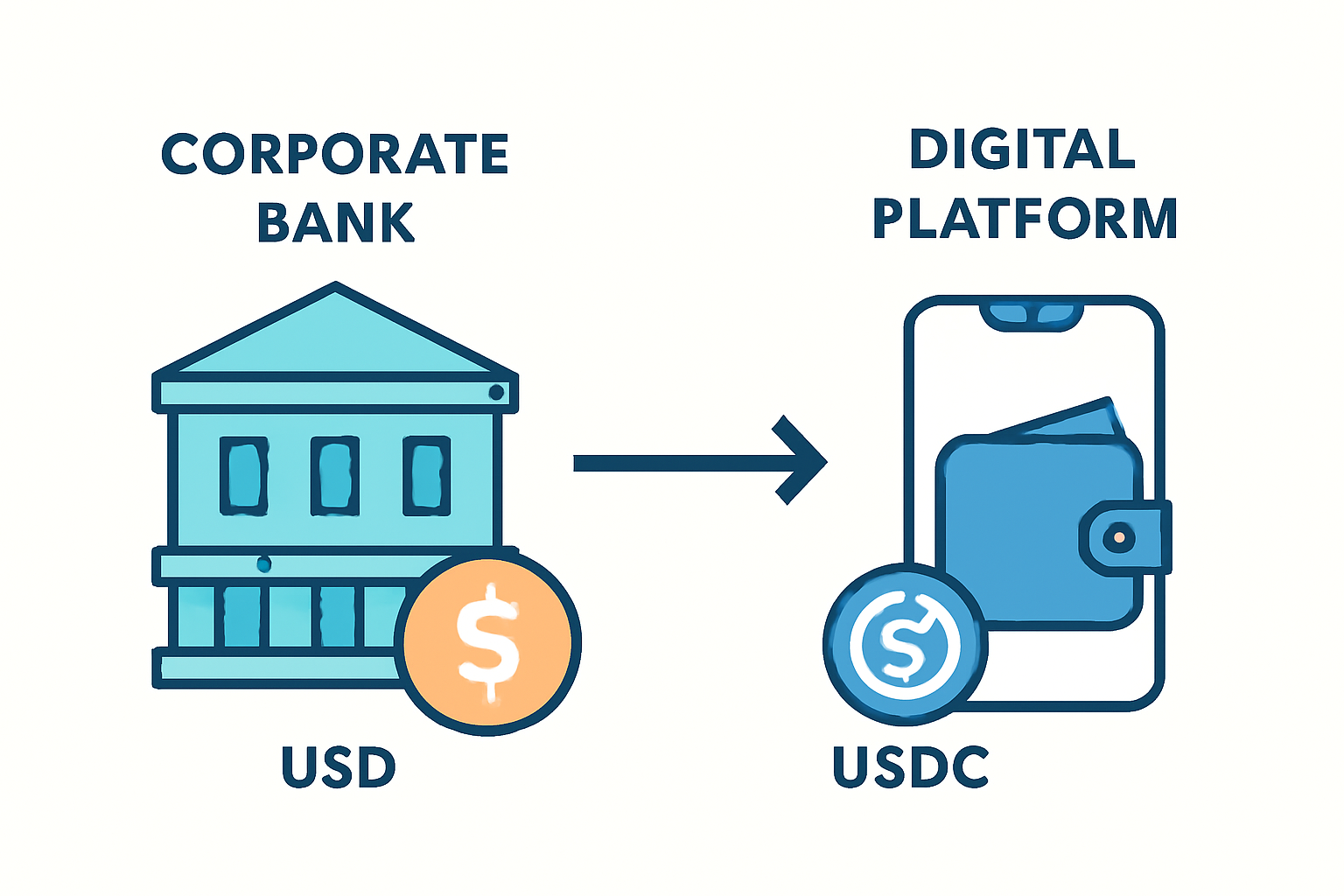

Once your compliance framework is in place, the operational side of USDC payroll becomes highly streamlined. Funding your account is typically as simple as transferring USD from your business bank to the platform, then converting to USDC at market rates. This process, now routine on platforms like Remote and Bitwage, ensures that you always have sufficient stablecoins ready for each pay cycle. The conversion is transparent and occurs at the prevailing rate, eliminating hidden FX markups that plague traditional banking.

Best Practices for Collecting Wallet Information

Securing accurate wallet addresses from remote team members is non-negotiable. Mismatched networks or typos can lead to irreversible loss of funds. Communicate clearly with employees about which wallets and blockchain networks (e. g. , Base or Stellar) are supported by your chosen platform. Offer step-by-step guidance or short training sessions to ensure everyone understands how to receive USDC safely.

It’s also wise to maintain an internal record of wallet addresses and payment confirmations for reference during audits or disputes. Some startups go further by integrating automated address verification tools within onboarding flows, minimizing manual errors and boosting confidence on both sides of the transaction.

Mitigating Risk and Ensuring Global Access

Paying employees with stablecoins isn’t just about efficiency, it’s a hedge against local currency instability and banking restrictions. In emerging markets where inflation erodes purchasing power or capital controls limit access to USD, USDC payroll empowers remote workers with immediate, borderless value storage. However, not all jurisdictions treat crypto income equally; tax treatment varies widely. Engage a cross-border tax advisor familiar with digital assets to ensure proper withholding and reporting in every relevant country.

Additionally, educate your team on how to convert USDC into local currency if needed, including guidance on reputable exchanges or peer-to-peer options where direct fiat offramps are unavailable. This extra step can make a significant difference in employee satisfaction and retention.

Optimizing Your Global Payroll Workflow

The most agile tech startups don’t just switch to crypto, they optimize every stage of their global payroll with cryptocurrency. Automate recurring payments where possible, use multi-sig wallets for treasury management, and set up alerts for successful transfers or unusual activity. Regularly review fee schedules as network congestion can impact costs; platforms like Bitwage often provide real-time analytics so you can fine-tune processes.

Finally, keep communication lines open with your distributed team. Solicit feedback on payout experiences and be proactive in addressing any friction points, whether they’re regulatory hurdles or technical snags related to wallet compatibility.

The Bottom Line: Future-Proofing Payroll

The rise of crypto payroll for tech startups is not a passing trend but a pragmatic response to the realities of distributed workforces and global talent competition. By leveraging USDC’s stability, speed, and compliance-ready infrastructure, startups can scale internationally without legacy financial bottlenecks holding them back.