For remote teams and global businesses, traditional payroll systems are riddled with friction: delays due to banking hours, high foreign exchange fees, and opaque processes that frustrate both employers and employees. In a digital-first world where remote work is the norm, these legacy inefficiencies are no longer acceptable. Enter stablecoin payroll solutions: a transformative approach that eliminates wait times and slashes costs for distributed teams worldwide.

Why Traditional Payroll Fails Remote Teams

When companies pay international staff via conventional bank wires or payment processors, the process can take three to five business days or more. Each step, from currency conversion to intermediary bank fees, adds cost and uncertainty. For contractors in emerging markets or regions with limited banking infrastructure, these challenges are even more pronounced. Hidden charges and fluctuating FX rates can eat into take-home pay, while payment delays disrupt cash flow for workers who depend on timely salaries.

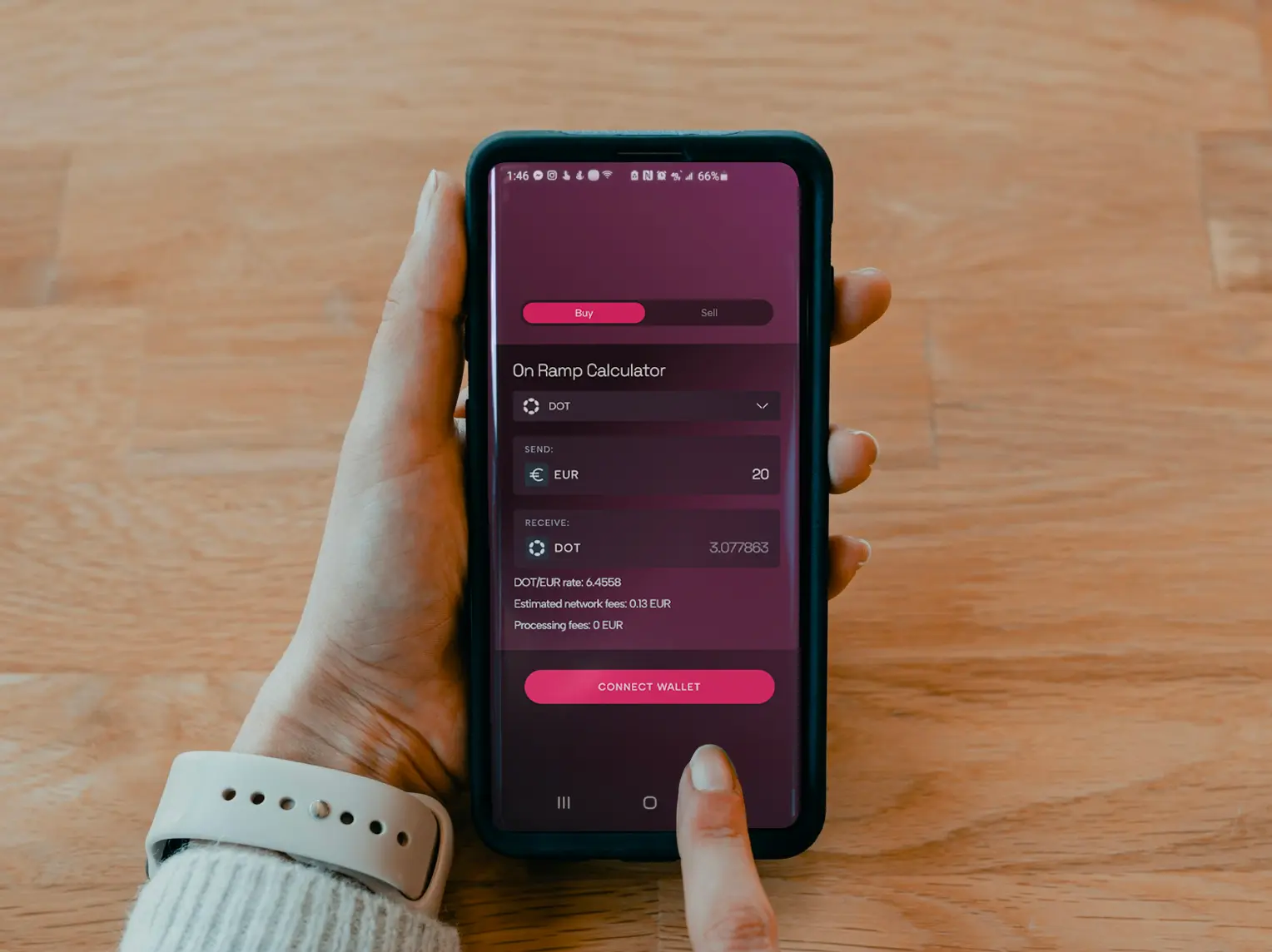

This is where crypto salary payments, especially those using stablecoins like USDC, are gaining traction. By leveraging blockchain’s speed and transparency, stablecoin payroll platforms remove unnecessary intermediaries from the process, offering instant settlement and dramatically lower transaction costs.

The Edge of Stablecoin Payroll: Instant Settlement and Lower Fees

Stablecoins, such as USDC (USD Coin) and USDT (Tether), are digital assets pegged 1: 1 to fiat currencies like the US dollar. Their real advantage in payroll lies in their ability to combine price stability with borderless blockchain technology. Here’s how this changes the game for remote teams:

- Instantaneous Payments: Unlike bank wires that get stuck over weekends or holidays, stablecoin transactions settle within minutes, regardless of geography or time zone.

- Reduced Transaction Fees: By bypassing banks and payment processors, companies can cut international payroll fees by over 70%. This means more money reaches employees’ wallets without being siphoned off by middlemen.

- No FX Surprises: Paying in a digital dollar eliminates unpredictable currency swings and conversion losses for both sender and recipient.

A recent analysis from Rise revealed that switching to stablecoin payroll systems led companies to realize a 60% reduction in transaction costs, while also speeding up salary processing by three to five days. For many businesses operating across borders, or hiring talent in underbanked regions, the impact is immediate and measurable.

Real-World Adoption: From Freelancers to Fortune 500s

The shift toward borderless payroll solutions isn’t just theoretical; it’s already happening at scale. In December 2024, Remote, a leading HR platform, partnered with Stripe to enable USDC payouts for contractors across 69 countries. This integration lets businesses pay global contractors securely on-chain within minutes while maintaining compliance with local laws.

Similarly, Bitwage has implemented USDC payments via the Stellar blockchain, streamlining compensation for remote workers who previously struggled with slow wires or unreliable local banking infrastructure. Platforms like Rise now offer dual funding options (fiat or stablecoins), automated payment schedules, and built-in compliance tools, all designed to make USDC payroll seamless for distributed teams.

The Transparency and Security Advantage

The benefits extend beyond speed and cost savings. Blockchain-based salary distribution introduces real-time transparency, every transaction is visible on-chain for both employer and employee to verify instantly. The decentralized nature of these systems also reduces fraud risk compared to legacy financial rails.

For remote-first companies, the operational impact of stablecoin payroll is profound. Payroll teams are no longer shackled by banking holidays, batch processing windows, or the opaque fee structures that plague traditional cross-border payments. Instead, payroll can be executed on-demand, whether it’s a scheduled monthly salary or an urgent bonus payout. This level of agility is especially valuable for startups and growing tech companies who compete for talent across multiple continents and need to deliver compensation reliably and predictably.

Practical Considerations: What to Know Before Switching

While the advantages are clear, implementing stablecoin salary compliance requires thoughtful planning. Regulatory frameworks around digital assets are evolving rapidly. Companies must ensure their crypto salary payments adhere to both local employment laws and international anti-money laundering (AML) requirements. Leading platforms now offer built-in KYC/AML checks and automated tax reporting features to help streamline compliance for global teams.

Another consideration is employee choice. Not every team member will be ready to receive their full compensation in stablecoins. The best solutions offer flexible payout options, allowing workers to opt for partial or full payment in USDC, with seamless conversion to local fiat if desired. Education is key: providing resources on wallet security and conversion processes ensures staff feel confident managing their digital earnings.

Top 3 Benefits of Stablecoin Payroll for Remote Teams

-

1. Instantaneous Global Payments: Stablecoin payroll solutions enable near-instant salary transfers worldwide, eliminating the typical 3–5 day delays of traditional bank wires. Remote workers receive funds within minutes, ensuring timely compensation regardless of location. (Example: Remote and Stripe’s USDC payouts settle in minutes across 69 countries.)

-

2. Significantly Lower Fees: By bypassing banks and intermediaries, stablecoin payroll reduces transaction fees by over 70% compared to traditional cross-border payments. This means more take-home pay for remote employees and substantial cost savings for companies. (Example: Bitwage’s USDC payments on Stellar offer low-cost, rapid transfers.)

-

3. Enhanced Accessibility & Financial Inclusion: Stablecoins allow companies to pay team members in regions with limited banking infrastructure, promoting financial inclusion and expanding access to global talent. (Example: Rise’s stablecoin payroll platform supports workers in underbanked areas.)

Measurable Outcomes: Reduced Costs, Happier Teams

The numbers speak volumes. Companies switching to stablecoin payroll systems have reported:

- 60% and reduction in transaction costs compared to legacy bank wires

- 3, 5 days faster processing times, ensuring workers get paid when they need it most

- Greater retention among global contractors, who value fast access to funds and transparent payment tracking

This new paradigm isn’t just about efficiency, it’s about building trust and loyalty within distributed teams by eliminating financial friction at every stage of the payroll process.

“Stablecoin payroll isn’t just a trend, it’s a competitive advantage for companies hiring globally. “

If you’re considering a move toward borderless, instant salary distribution, explore our detailed guide on how to pay remote teams with USDC. For organizations operating in high-inflation markets or regions with volatile local currencies, adopting a stablecoin salary strategy can further protect employee earnings against devaluation.

The Future of Global Work: Why Stablecoin Payroll Is Here To Stay

The rise of crypto salary payments signals a broader shift toward programmable money and frictionless finance in the workplace. As more businesses adopt instant, transparent payment rails powered by USDC and other leading stablecoins, legacy bottlenecks will continue to fade into obsolescence.

The bottom line: Stablecoin payroll enables truly borderless workforces, empowering both employers and employees with greater speed, lower costs, and financial autonomy. For those building the future of work, embracing these innovations isn’t just smart; it’s inevitable.