Paying international contractors efficiently has become a defining challenge for remote teams and global startups. Traditional cross-border payroll methods are often slow, costly, and riddled with compliance hurdles. In contrast, stablecoins like USD Coin (USDC) have emerged as a game-changer, offering a seamless blend of speed, cost efficiency, and regulatory clarity. In this guide, we’ll break down exactly how to pay international contractors with USDC and other stablecoins, step by step, while ensuring compliance and transparency.

Why Choose USDC for International Contractor Payments?

USDC is a fully backed digital dollar stablecoin pegged 1: 1 to the US dollar. This stability makes it an ideal solution for payroll, eliminating the volatility risks associated with traditional cryptocurrencies. For remote teams managing talent across multiple jurisdictions, USDC enables:

- Stability: Contractors receive predictable value without worrying about currency swings.

- Speed: Payments settle in minutes, not days, boosting cash flow.

- Cost Efficiency: Fees are significantly lower than wire transfers or SWIFT payments.

- Borderless Access: Anyone with a compatible crypto wallet can receive funds globally.

This combination is why platforms like Remote and Deel have integrated USDC payroll options for clients in over 69 countries, leveraging blockchain rails for instant settlement. For more on how stablecoins are transforming remote work payments, see this deep dive.

Selecting the Right Platform: DIY vs Regulated Payroll Solutions

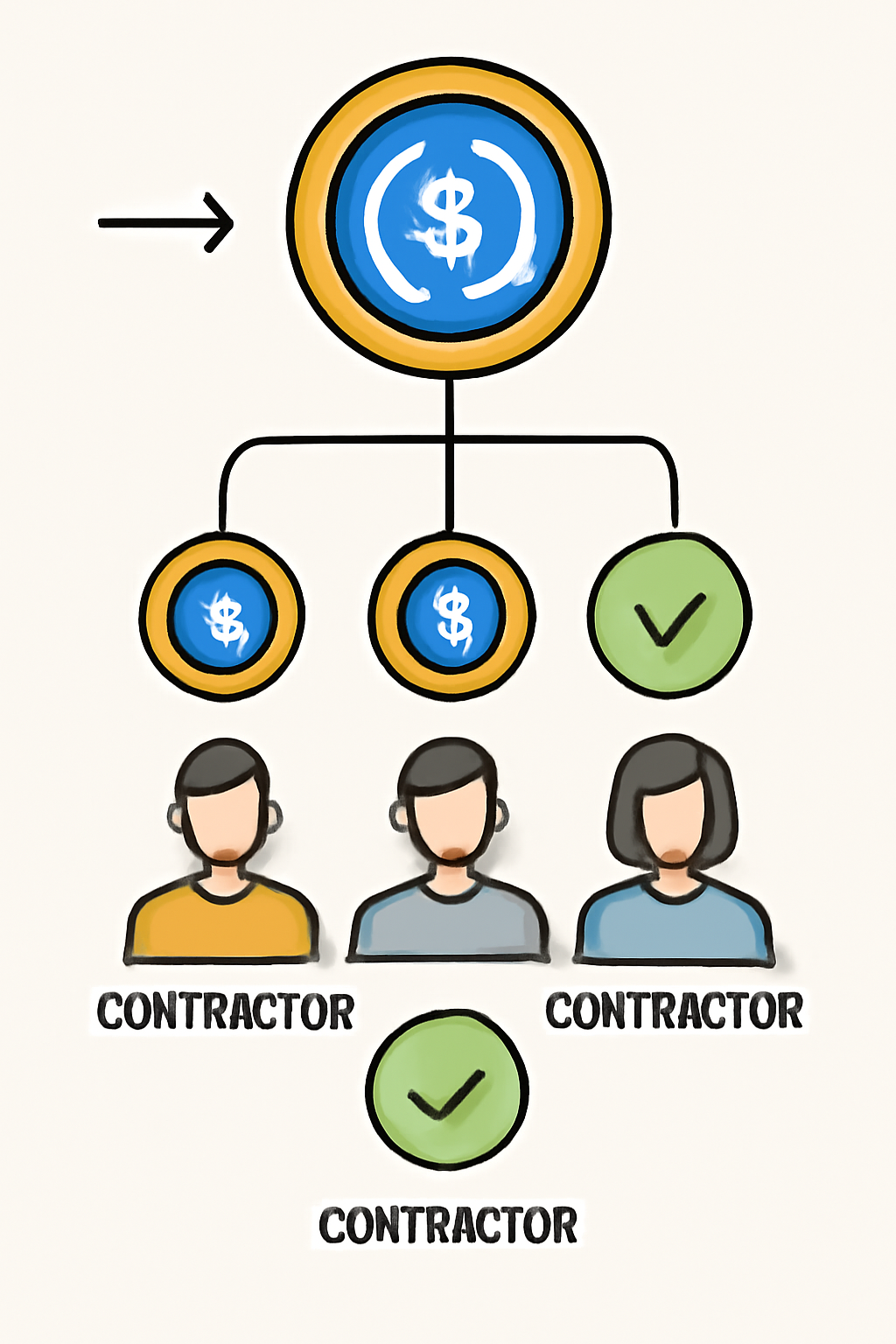

The first major decision is whether to use a global payroll platform or manage payments manually. While it’s technically possible to send USDC directly from your wallet to your contractor’s address, this approach introduces risks around compliance, record-keeping, and tax reporting. According to recent discussions on Reddit’s r/Payroll community, most businesses now prefer regulated workforce management solutions that offer built-in KYC/AML checks and automated compliance workflows.

- Regulated platforms: Services like Remote (integrated with Stripe), Deel, or similar allow you to onboard contractors compliantly, collect tax documents (e. g. , W-8BEN), and automate recurring payments in USDC or other stablecoins.

- Manual approach: You’ll need to verify contractor eligibility yourself, including jurisdictional restrictions, and manage all documentation manually. This route is only recommended for small teams with strong internal controls.

If you’re scaling globally or handling multiple contractors across regions such as Latin America or Southeast Asia, regulated platforms are almost always the safer bet. For more region-specific guidance on paying remote developers with USDC, check out our article on Latin America payroll solutions.

Step-by-Step Guide: Setting Up Stablecoin Payroll for Contractors

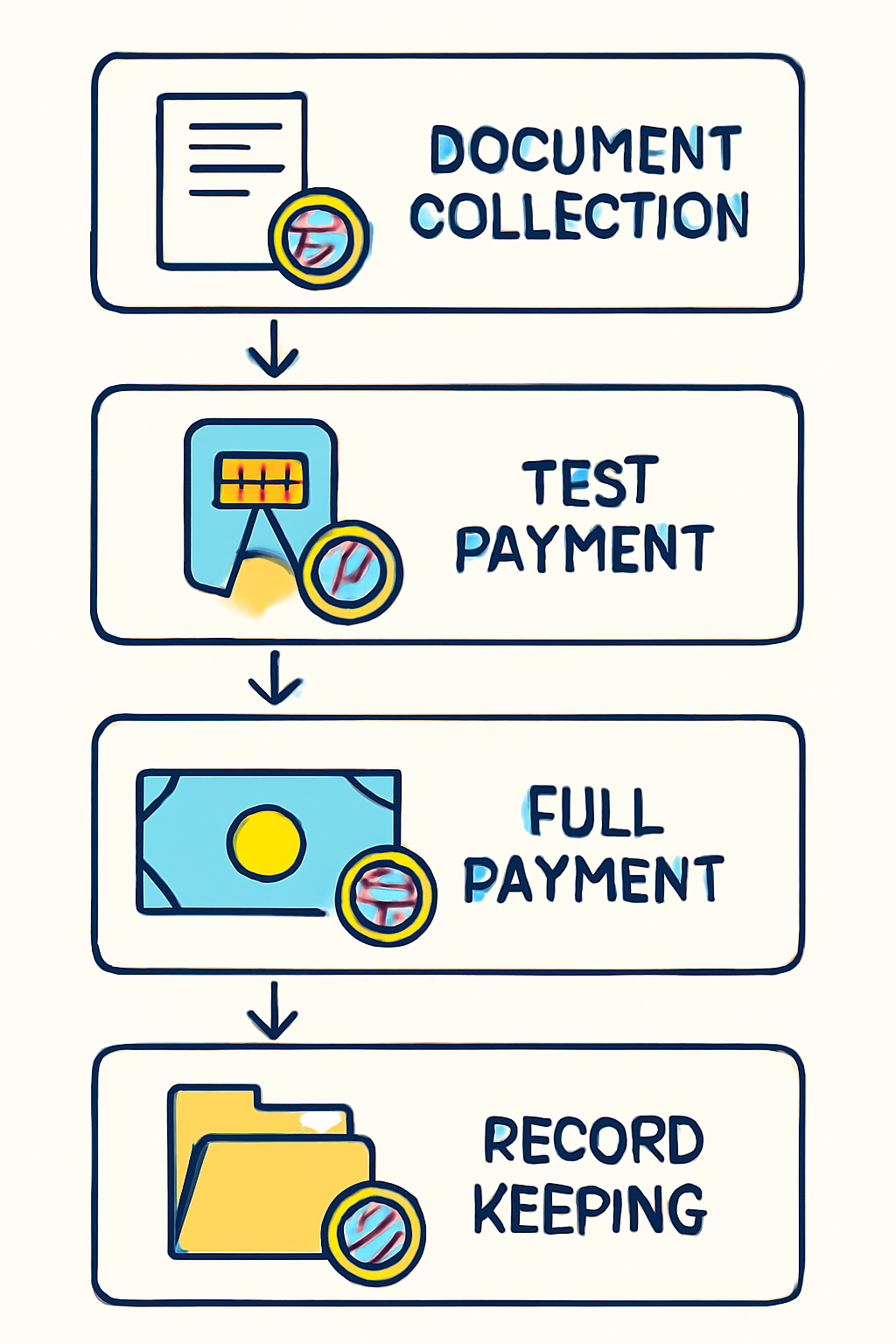

The process of setting up crypto payroll for remote teams can be broken down into clear stages:

1. Confirm Contractor Eligibility and Wallet Setup

- Your contractor must reside in a country supported by your chosen platform (e. g. , Remote supports payouts in 69 countries).

- The contractor needs a compatible crypto wallet, MetaMask is popular, or an exchange account that supports the Base network or Ethereum Layer 2s (Polygon, Arbitrum).

2. Collect Compliance Documentation

- KYC verification: ID and proof of address from each contractor.

- Tax forms: Typically W-8BEN (for individuals) or W-8BEN-E (for entities) if non-US based.

- Add wallet addresses securely through the platform dashboard, always verify accuracy before sending funds.

3. Fund Your Payroll Wallet with USDC

- You can transfer USDC from an exchange account (Coinbase/Binance) or self-custodied wallet into your company’s payroll wallet on the platform of choice.

This setup ensures you’re ready not just to send one-off payments but also automate recurring salaries or milestone-based invoices across borders without friction.

The Compliance Imperative: Tax and Worker Classification Risks

No matter how seamless crypto rails become, regulatory compliance remains non-negotiable when paying international contractors with stablecoins. Failing to collect proper tax forms or misclassifying workers can result in penalties, even if payments are made transparently via blockchain. Always ensure you’re collecting all required documentation at onboarding and maintaining thorough transaction records for audits and year-end reporting.

Once your USDC payroll infrastructure is in place, the next phase is execution and ongoing optimization. The operational realities of stablecoin payroll go beyond just sending tokens; they require robust processes for accuracy, transparency, and scalability.

Executing Payments: Best Practices for Accuracy and Security

Before initiating any payment, double-check wallet addresses, crypto transactions are irreversible. Many platforms now offer test payment features, allowing you to send a nominal USDC amount for confirmation before releasing the full salary or invoice. This reduces the risk of costly errors and builds trust with your contractors.

- Approval workflows: Set up multi-person approval steps for larger payments or bulk payroll runs.

- Multi-signature wallets: For high-value transactions, consider using wallets that require multiple signatures to authorize transfers, adding an extra layer of fraud protection.

- Transaction records: Leverage your platform’s reporting tools to export CSVs or integrate directly with accounting software for streamlined reconciliation.

If you’re managing payments manually, maintain an internal ledger mirroring on-chain transactions. This not only aids compliance but also helps resolve disputes quickly if a payment is delayed or lost due to network congestion.

Real-World Considerations: Communication and Contractor Experience

Your contractors’ experience matters just as much as backend efficiency. Transparent communication about payment timing, expected network fees (which can fluctuate), and wallet security best practices fosters trust. Educate your team on how to manage their wallets securely, phishing attacks remain a risk even with stablecoins like USDC.

- Payout notifications: Automated email or SMS alerts when funds are sent improve contractor satisfaction and reduce support queries.

- User support resources: Offer FAQs or live support channels for troubleshooting wallet issues or understanding tax implications of crypto income.

The goal is not just efficiency but also reliability, making sure every contractor feels confident that their work will be compensated swiftly and safely every pay cycle.

Future-Proofing Your Global Payroll Strategy

The regulatory landscape around crypto payroll continues to evolve. Stay proactive by regularly reviewing local guidance on digital asset taxation in each contractor’s country of residence. Collaborate with legal counsel familiar with both crypto compliance and international labor law to avoid missteps as your organization expands into new markets.

If you’re interested in more advanced strategies, such as integrating stablecoin payroll into your ERP system or leveraging programmable money for performance bonuses, explore our detailed guides like this compliance-focused walkthrough.

Key Takeaways: Streamlined Stablecoin Payroll for Modern Teams

- Select regulated platforms over DIY solutions whenever possible for built-in compliance and scalability.

- Prioritize security through multi-signature wallets, approval workflows, and thorough recordkeeping.

- Automate recurring payments and leverage batch processing as your remote team grows globally.

- Cultivate trust by educating contractors about wallet setup, payout timing, fees, and tax reporting obligations related to USDC income.

- Monitor evolving regulations in all relevant jurisdictions, and partner with experienced advisors, to keep your crypto payroll strategy future-proofed.

The shift toward stablecoin salaries isn’t just a trend, it’s a practical response to the demands of modern cross-border work. By following these steps, remote teams can unlock faster payouts, lower costs, and greater transparency while staying compliant worldwide. For more actionable insights into building resilient global payroll systems with crypto at their core, explore our library of resources on stablecoin-powered compensation models.