Remote work is no longer a niche trend – it’s the new global standard. In 2024, over half of all companies now operate distributed teams across borders, according to McKinsey’s Hybrid Work Adoption Survey. But as businesses scale internationally, traditional payroll systems are buckling under the weight of regulatory complexity, currency volatility, and slow, expensive cross-border payments. Enter USDC payroll, a transformative solution that is rapidly rewriting the rules for remote team payments worldwide.

USDC Overtakes Crypto Payroll: The Data Speaks

The numbers are impossible to ignore. In September 2025, Pantera Capital reported that 9.6% of professionals now receive salaries in stablecoins – a nearly fourfold jump from just 3% in 2023. USDC leads the pack, accounting for 63% of all crypto payrolls this year (source). This dominance isn’t accidental; it’s a direct response to the pain points of legacy banking and fiat rails.

What’s driving this shift? Stablecoin salaries offer speed, transparency, and borderless access in a way that wire transfers simply can’t match. With platforms like Remote teaming up with Stripe to enable US-based companies to pay contractors in 69 countries using USD Coin (details here), the infrastructure for seamless global payroll is finally falling into place.

Why Global Teams Are Switching to Stablecoin Salaries

The advantages of paying employees in USDC go beyond hype:

Top Benefits of USDC Payroll for Remote Teams

-

Near-Instant Global Payments: USDC payroll enables remote workers to receive funds almost instantly, bypassing the delays of traditional international transfers.

-

Lower Cross-Border Transaction Costs: By leveraging blockchain, USDC payroll minimizes intermediary and currency conversion fees, making global payments more cost-effective.

-

Stable Value in Volatile Markets: Contractors in countries with unstable currencies benefit from USDC’s 1:1 peg to the U.S. dollar, protecting their earnings from local inflation and devaluation.

-

Streamlined Compliance and Reporting: Platforms like Remote and Stripe now offer compliant USDC payroll solutions, simplifying tax and regulatory requirements for employers and contractors.

-

Wider Access for Global Talent: USDC payroll allows companies to pay contractors in 69+ countries, expanding access to skilled workers regardless of local banking infrastructure.

- Speed and Efficiency: Payments settle near-instantly on-chain – no more waiting days for international wires.

- Cost Savings: Companies slash intermediary fees and eliminate hidden FX charges.

- Stability: For workers in volatile economies, USDC offers a reliable store of value pegged to the U. S. dollar.

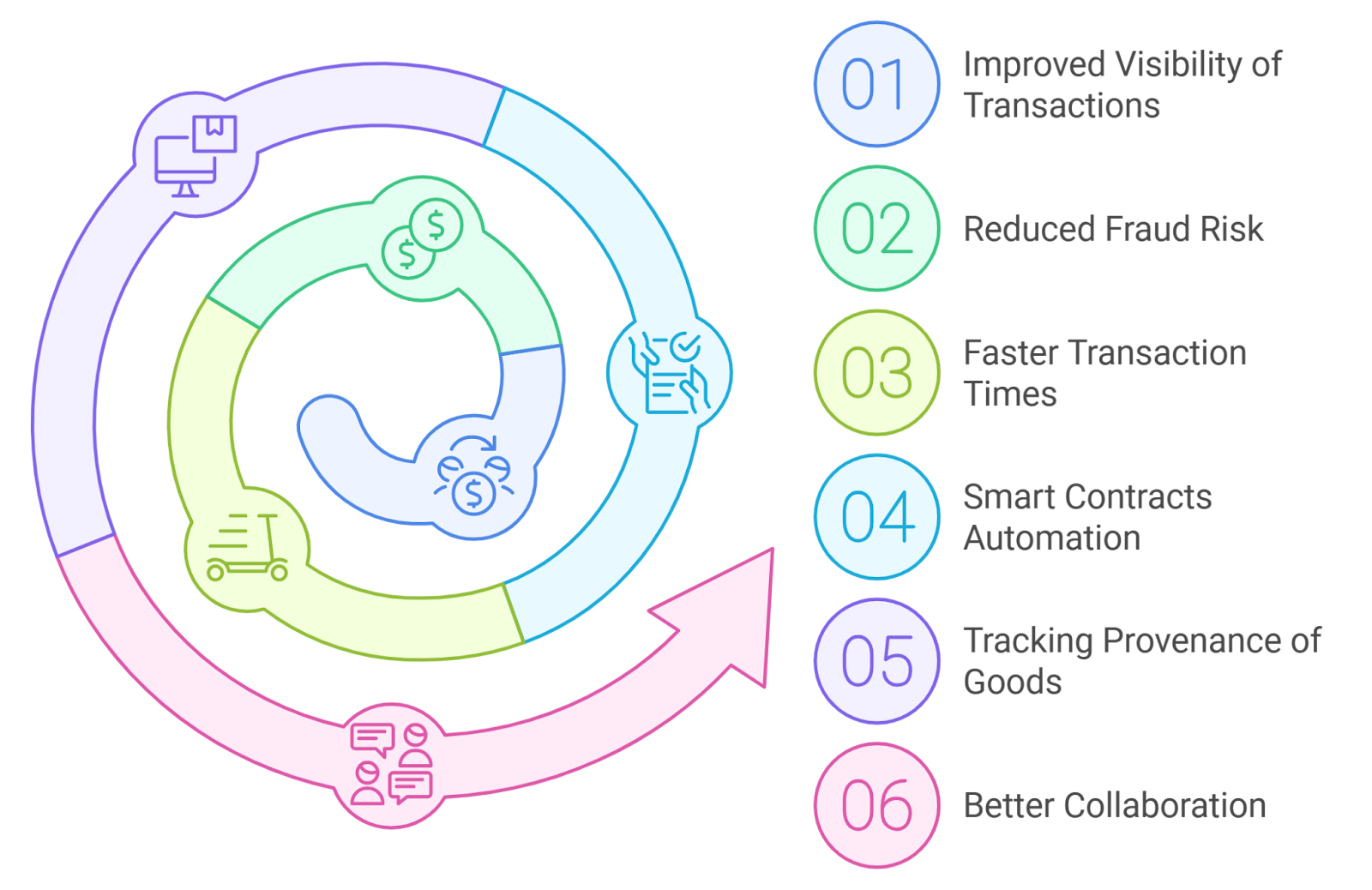

- Simplicity and Transparency: Blockchain records every transaction, simplifying audits and compliance checks.

This isn’t just theoretical. In December 2024, Remote’s integration with Stripe enabled contractors worldwide to receive USDC directly into their Base Network wallets while employers pay out in U. S. dollars – ensuring both compliance and ease-of-use (read more). The result? Near-instant salary delivery minus banking headaches or regional instability.

The Ripple Effect on Cross-Border Payroll Operations

The impact on cross-border payroll is profound. By leveraging stablecoins like USDC, companies can:

- Avoid delays caused by intermediary banks or local holidays

- Simplify tax reporting with transparent blockchain records (though accountants are still catching up)

- Diversify payment options for talent acquisition in competitive markets

- Create new financial inclusion pathways for unbanked contractors globally

This shift isn’t without challenges – tax clarity and compliance frameworks still lag behind technology adoption (as highlighted by ongoing debates among accountants). Yet the momentum is undeniable: stablecoins processed $8.9 trillion globally last year alone as crypto salaries tripled before most institutions even caught up (Pantera Capital survey).

For remote-first organizations, the calculus is simple: adapt or get left behind. As crypto payroll 2024 becomes the new normal, companies that embrace USDC not only gain a competitive edge in talent acquisition but also future-proof their operations against legacy inefficiencies. The rise of stablecoin salaries is no longer a fringe experiment, it’s a structural shift in how global payroll is managed.

Navigating Compliance and Taxation in the New Era

Of course, with innovation comes complexity. While USDC payroll offers unprecedented advantages, it also introduces new compliance and tax considerations. Many finance leaders are still wary, waiting for clearer regulatory guidance before committing to large-scale adoption. As reported by MEXC and echoed across industry surveys, broader adoption hinges on accountants feeling comfortable with the evolving landscape of crypto taxation.

That said, solutions are emerging fast. Platforms now integrate automated tax reporting tools and KYC checks directly into payment flows, reducing friction for both employers and contractors. The partnership between Remote and Stripe exemplifies this trend, by billing employers in U. S. dollars while paying out in USDC, they bridge the gap between traditional finance requirements and next-generation salary delivery (see details).

What’s Next for Global Payroll with Cryptocurrency?

The trajectory is clear: as more companies witness the operational gains of paying employees in USDC, resistance will give way to rapid mainstream adoption. The data already paints a compelling picture, over 90% of crypto salaries are now paid in either USDC or USDT, with USDC firmly at the top (source). Even major banks like JPMorgan have begun acknowledging stablecoins’ legitimacy as cross-border payment rails.

The bottom line: For startups scaling globally or established enterprises seeking efficiency, integrating global payroll with cryptocurrency isn’t just an option, it’s fast becoming a necessity.

Final Takeaways for Forward-Thinking Teams

- If you’re operating across borders, explore stablecoin payout options now, don’t wait for your competitors to move first.

- Stay proactive about compliance by working with platforms that offer built-in reporting and regulatory support.

- Educate your finance team on blockchain basics; removing fear and uncertainty accelerates adoption internally.

The shift to stablecoin salaries isn’t just about faster payments, it’s about building resilient, borderless teams ready for whatever comes next. With USDC leading the charge into 2025 and beyond, remote work payments aren’t just catching up, they’re setting the pace for a new era of global employment.