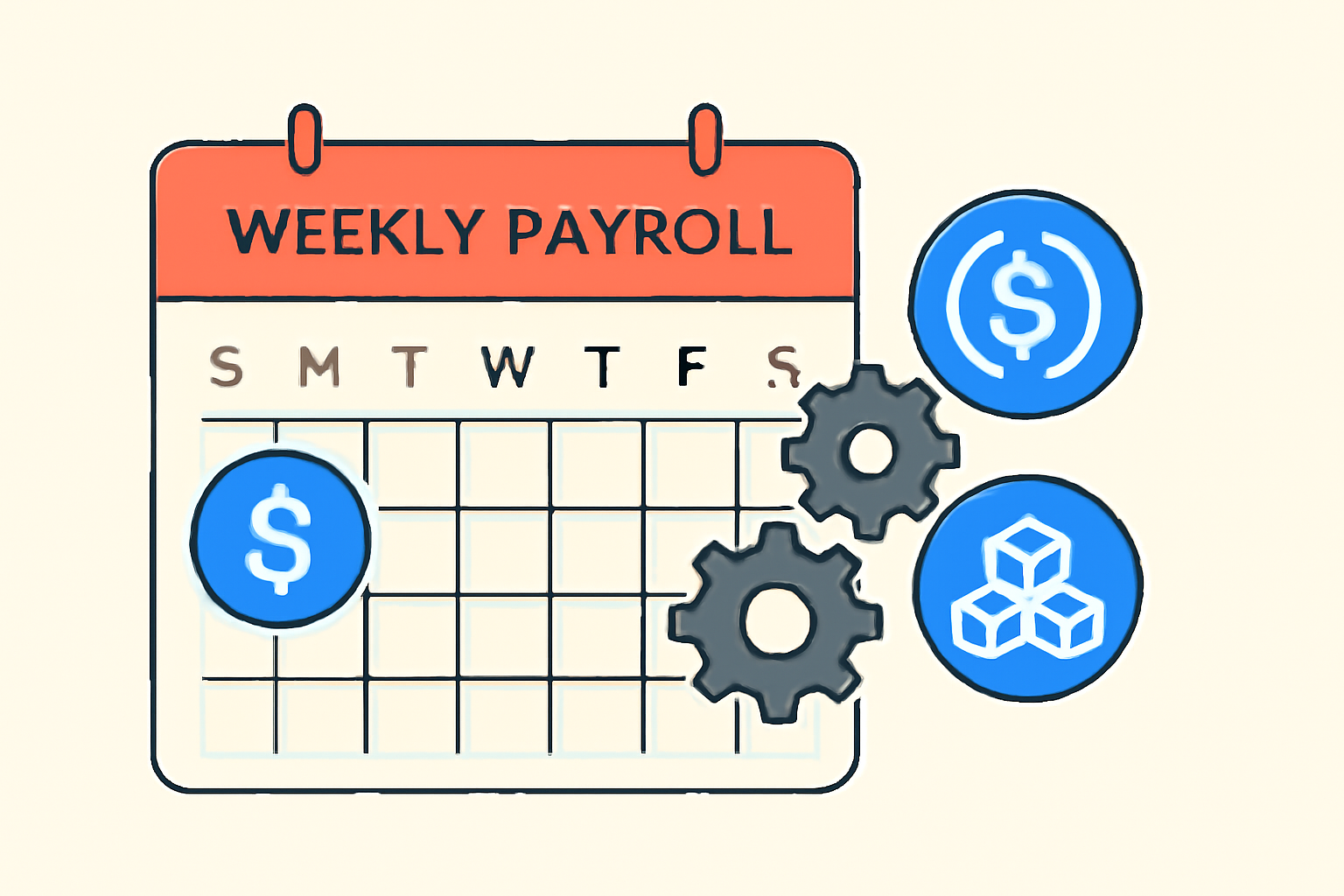

Managing payroll for remote teams scattered across borders tests even the most disciplined operations. Slow bank transfers, currency conversion headaches, and fees that eat into budgets create friction in an era where speed defines success. Enter USDC payroll: a stablecoin solution that delivers instant, low-cost USDC international payments while maintaining dollar parity. For startups and tech firms, this means empowering global talent without the traditional drag.

USDC’s blockchain backbone ensures transactions clear in minutes, not days. Remote workers in volatile economies gain stability, receiving funds pegged 1: 1 to the USD. Platforms like Rise and Toku highlight how this shifts crypto payroll global teams toward efficiency, bypassing SWIFT limitations.

Speed That Fuels Remote Team Momentum

Imagine paying a contractor in Colombia or a developer in Vietnam without waiting 3-5 business days. USDC transactions settle almost instantly, often under 10 minutes on networks like Ethereum or Polygon. This cross-border payroll USDC advantage proves vital for time-sensitive projects, where delays erode trust and productivity.

Faster global payments: Crypto payroll avoids banking delays, especially handy for cross-border teams. (Source: Lano. io)

Discipline in payroll means predictable cash flow. With USDC, teams access funds immediately, converting to local currency via exchanges if needed. No more chasing wires or explaining forex losses to employees.

Slash Costs Without Sacrificing Stability

Traditional cross-border wires charge 0.5% to 3% per transaction, plus hidden FX spreads. USDC flips this: fees drop to cents per transfer. For a $100,000 monthly payroll, savings hit $5,000-$8,000, freeing capital for growth.

- Fee Reduction: Networks like Solana keep gas under $0.01.

- No FX Risk: Pegged at $1, shielding against inflation in places like Argentina.

- Yield Potential: Hold payroll funds in yield-bearing protocols pre-distribution.

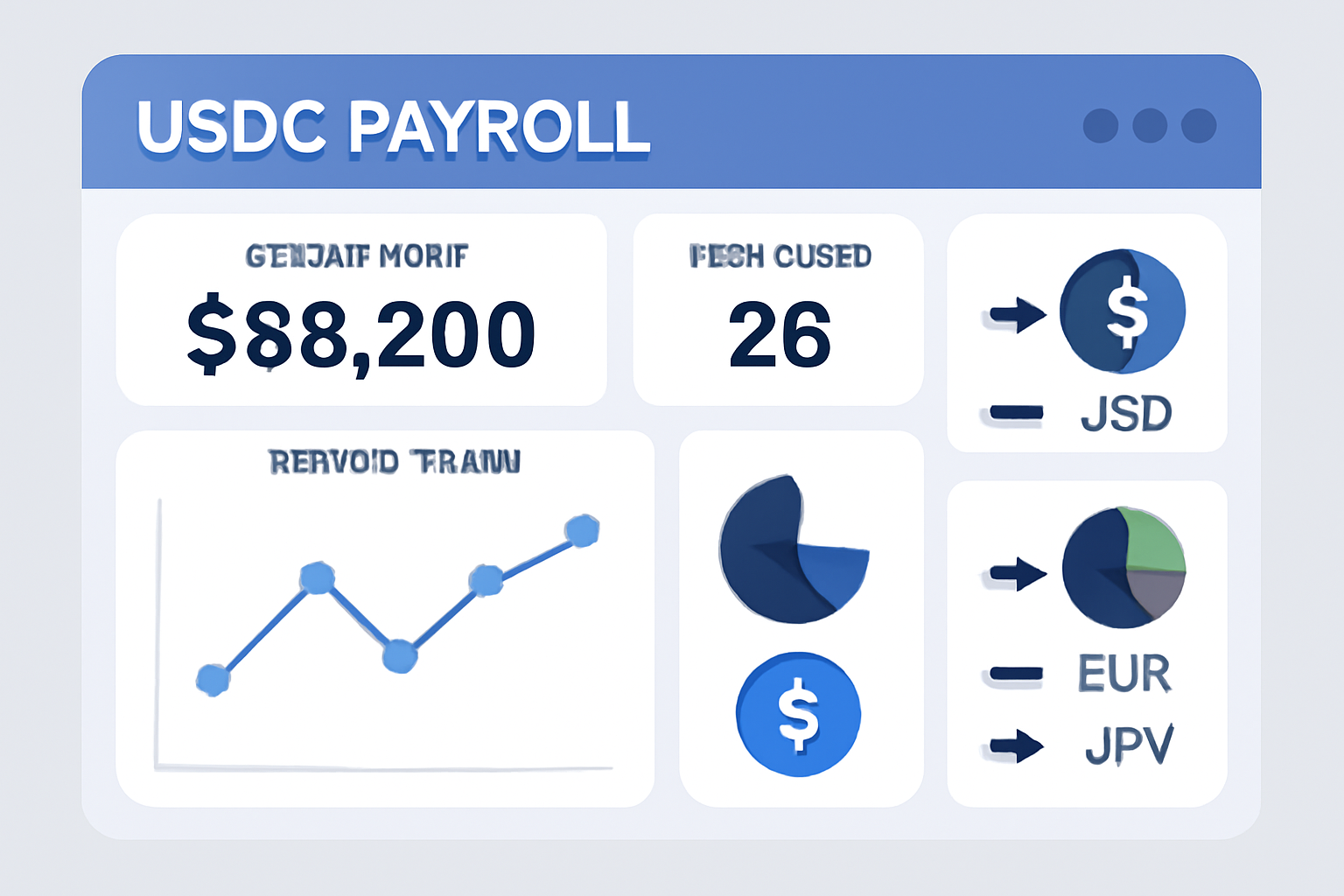

This cost efficiency balances ambition with prudence. Companies report 24h highs and lows irrelevant to USDC’s core strength: reliability amid market noise, like Multichain Bridged USDC (Fantom) at $0.0247 with a -0.0408% 24h change.

USDC Price Stability Prediction 2026-2031

Forecast for Payroll Reliability in Cross-Border Remote Teams

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $0.97 | $1.00 | $1.03 |

| 2027 | $0.98 | $1.00 | $1.02 |

| 2028 | $0.98 | $1.00 | $1.01 |

| 2029 | $0.99 | $1.00 | $1.01 |

| 2030 | $0.99 | $1.00 | $1.005 |

| 2031 | $0.995 | $1.00 | $1.002 |

Price Prediction Summary

USDC is projected to maintain its $1.00 peg with high reliability through 2031, featuring minor fluctuations within a narrowing range. This stability is bolstered by growing adoption in cross-border payroll, robust USD reserves, and regulatory compliance, making it ideal for remote team payments amid market cycles.

Key Factors Affecting USD Coin Price

- Enhanced adoption in payroll and remittances increasing liquidity and peg defense

- Regulatory clarity and Circle’s transparency in audits minimizing depeg risks

- Technological advancements in blockchain scalability and multi-chain support

- Resilience to crypto market cycles due to stablecoin mechanics

- Competition from other stablecoins incentivizing tighter peg maintenance

- Potential short-term depegs from black swan events, but quick recoveries expected

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Global reach amplifies these gains. Pay anyone with a wallet, no bank account required. For stablecoin salaries remote teams, this democratizes access, especially in underbanked regions.

Compliant Setup in Under a Week

Fast setup demands the right platform. Start by selecting one with AML/KYC built-in, like those offering contractor onboarding and tax tools. Cross-Border Payroll integrates seamlessly, handling compliance across 100 and countries.

- Verify team wallets and complete KYC.

- Fund your platform wallet with USDC.

- Automate payroll runs via API.

Educate your team on wallets like MetaMask or platform-embedded options. Resources from Riseworks emphasize simplicity: convert local currencies like COP to USDC effortlessly. Link your accounting software for end-to-end visibility.

For tech startups, check our step-by-step guide. This disciplined approach minimizes errors, ensuring every payday builds momentum.

Compliance isn’t optional; it’s foundational. Platforms manage 1099s, W-8BEN, and local filings, reducing HR burden. Remote workers appreciate the transparency: blockchain ledgers prove payments instantly.

Transitioning yields operational lift. One firm shifted via Transfi, cutting payout times from weeks to hours. Your team deserves this edge.

Quantifying these gains starts with a direct side-by-side look at traditional wires versus USDC transfers. The numbers underscore why disciplined leaders pivot now, channeling savings into talent retention and scaling.

Traditional Bank Transfers vs. USDC Payroll Comparison

| Method | Avg Time | Fees on $10k Payout | FX Risk | Global Reach |

|---|---|---|---|---|

| Traditional Banks | 3-5 days | 1-3% ($100-$300) | High | Limited |

| USDC Payroll | Minutes | < $0.50 | None | 100+ countries |

Such efficiencies compound. A tech firm handling $100,000 monthly payroll might pocket $5,000 to $8,000 in fees alone, per RebelFi insights, while parking funds in yield protocols for extra returns. This isn’t speculation; it’s calculated discipline amid stablecoin reliability.

Setup demands precision, not complexity. Platforms streamline KYC, wallet issuance, and batch payments, fitting into weekly cycles. Focus on automation to sustain momentum across time zones.

Once live, compliance flows naturally. Automated 1099s and W-8BEN forms handle tax nuances, from U. S. contractors to EU remote staff. Blockchain transparency verifies every payout, building trust without endless emails.

Team adoption seals the deal. Offer quick-start guides for wallets like Phantom or embedded options, plus off-ramps to local banks. Workers in high-inflation spots, say Argentina or Colombia, value the pegged stability over volatile fiat. One Colombian business detailed COP-to-USDC swaps via Mural Pay, proving the process takes under an hour.

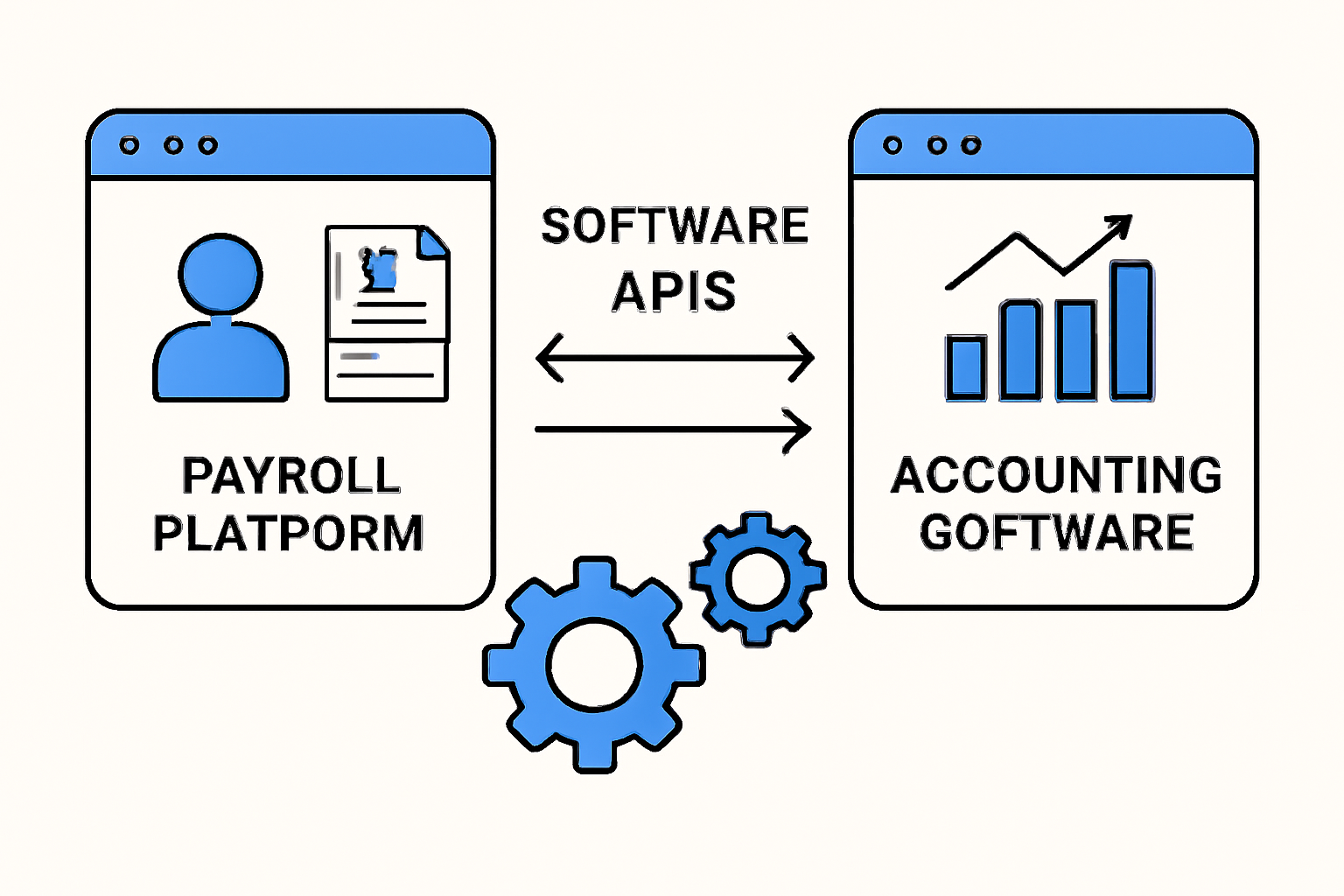

Integration elevates it further. APIs from services like Transfi sync with QuickBooks or Xero, tracking USDC alongside fiat. No silos; just unified ledgers for CFOs who prioritize oversight.

Real teams thrive on this. Remote devs cash out instantly for project milestones, freelancers in Asia sidestep weekend banking blackouts. Deel notes global workers endure inconsistent transfers; USDC erases that, fueling productivity without payroll drama.

For deeper dives, explore streamlining cross-border contractor payments or our USDC payroll for instant global salaries. The shift demands initial effort but rewards with borderless agility.

Remote operations demand tools that match their pace. USDC payroll delivers that edge: faster funds, leaner costs, ironclad stability. Adapt your process today, analyze the wins quarterly, and watch your global team achieve more. Cross-Border Payroll stands ready to power it all.