In 2024, the global payroll landscape underwent a seismic shift as stablecoins, particularly USDC (USD Coin), emerged as the go-to solution for cross-border salary payments. According to Pantera Capital’s Blockchain Compensation Survey, the percentage of professionals paid in crypto tripled from 3% in 2023 to 9.6% by year-end. Even more striking: stablecoins now account for a staggering 90% of all crypto salaries, with USDC alone capturing a dominant 63% market share. This rapid acceleration isn’t just a blip; it’s the result of deep-rooted structural changes in how businesses and talent want to move money globally.

USDC’s Market Leadership: From Niche to Mainstream Payroll

Stablecoins have been around for years, but it’s only recently that their utility in payroll has become crystal clear. USDC’s monthly transaction volume hit $1 trillion in November 2024, with an all-time volume surpassing $18 trillion (Circle Internet). These figures aren’t just impressive; they signal real-world adoption at scale. For context, USDC and USDT together now facilitate over 90% of all crypto salary payments globally (Blockworks), but institutional support is tilting heavily toward USDC.

The reasons are technical and practical. Major payroll providers like Deel, Remote, and Rippling have integrated support for USDC but not for alternatives like USDT. This is partly due to USDC’s superior compliance infrastructure, regular reserve attestations, and Circle’s proactive engagement with regulators worldwide.

Regulatory Clarity Drives Institutional Adoption

The passage of the GENIUS Act in July 2025 was a game-changer. By mandating full reserve backing and robust anti-money laundering protocols for stablecoin issuers, the legislation removed much of the uncertainty that previously held enterprises back from crypto payroll solutions. Circle responded by doubling down on transparency, publishing frequent reserve reports and ensuring strict regulatory adherence, which further cemented trust among large organizations.

This regulatory clarity is more than just legalese; it translates directly into business confidence. Companies can now pay global teams with stablecoin salaries knowing they’re operating within a compliant framework, no small feat when navigating international payroll complexities.

Why Teams Prefer Global Payroll with USDC

The appeal of global payroll with USDC boils down to speed, cost savings, and reliability:

- Instant Settlement: Traditional wire transfers can take days, sometimes weeks, for cross-border payments to settle. With USDC on blockchain rails, settlement times drop from days to seconds.

- Lower Transaction Costs: Banks charge hefty fees for international wires and currency conversions. Stablecoin-based payroll solutions slash these costs dramatically by eliminating intermediaries.

- No Currency Volatility: Unlike paying directly in Bitcoin or Ethereum (with their wild price swings), USDC is pegged 1: 1 to the U. S. dollar, giving both employers and employees peace of mind.

- Programmable Payroll: Smart contracts enable automated payment schedules, bonuses, or even compliance checks, features impossible with legacy systems. For more details on programmable payouts, see this guide on programmable payroll.

The Rise of Crypto Payroll Trends in 2024

The numbers speak volumes: individual crypto payroll adoption tripled between 2023 and 2024 before most institutions even caught on (Rise Works). Now that enterprise platforms are integrating stablecoin rails natively, and regulators have set clear guardrails, the trend line points sharply upward.

This isn’t just about paying developers at Web3 startups anymore; mainstream tech firms, remote-first teams, and even traditional multinationals are embracing USDC-powered cross-border payroll. The result? Faster onboarding for talent worldwide and fewer headaches dealing with outdated banking infrastructure.

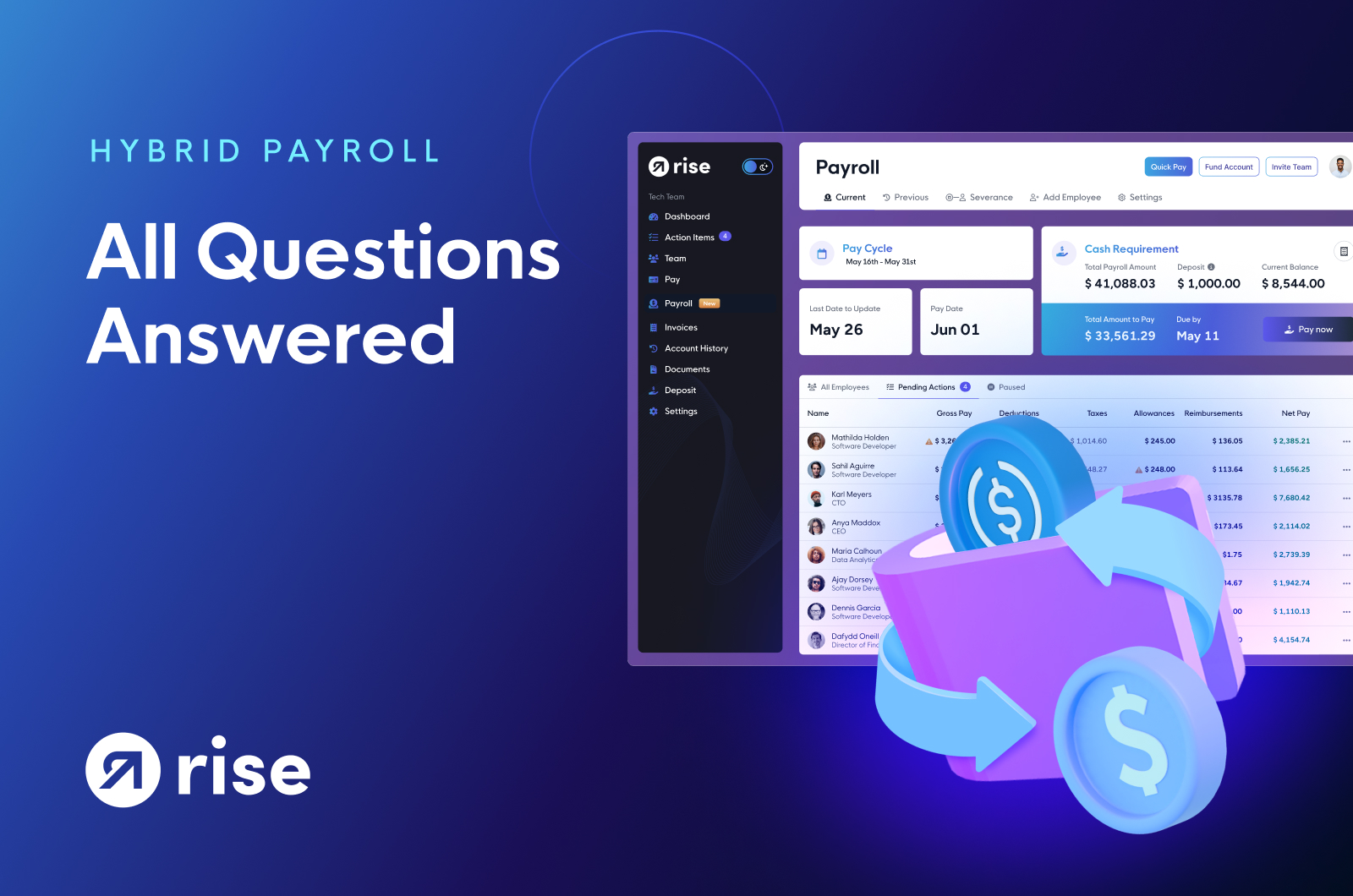

USDC’s dominance in the payroll sector is being reinforced by a wave of strategic partnerships and technical integrations. The June 2025 collaboration between Rise and Circle, for instance, didn’t just make headlines, it set a new standard for payroll efficiency. By leveraging USDC’s blockchain infrastructure, Rise reduced salary transfer times from days to mere seconds while providing auditable, real-time payment records. This move was quickly followed by other global payroll providers eager to tap into the same benefits.

But it’s not only about speed and transparency. USDC payroll solutions also unlock access to a truly global talent pool. Contractors and employees in emerging markets can receive stablecoin salaries without the friction of local banking challenges or currency instability. For digital nomads and remote teams, this means greater financial inclusion and less dependence on unreliable intermediaries.

Key Benefits of USDC Payroll in 2024

-

Instant Settlement: USDC payroll enables near-instant cross-border payments, reducing transfer times from days to seconds—especially after the Rise and Circle partnership in June 2025.

-

Lower Transaction Fees: USDC transactions typically incur lower fees than traditional wire transfers, making it cost-effective for global payroll, especially for remote and distributed teams.

-

Regulatory Compliance: USDC is fully compliant with U.S. regulations, backed by regular reserve disclosures and the GENIUS Act of July 2025, ensuring institutional trust and legal clarity.

-

Global Reach & Accessibility: Supported by major payroll platforms like Deel, Remote, and Rippling, USDC allows companies to pay employees worldwide, even in underbanked regions.

-

Transparency & Trust: Circle’s transparent operations and regular reserve audits position USDC as a reliable and stable choice for enterprise payrolls.

The market data backs this up: stablecoins processed $8.9 trillion in compensation payments in 2024 alone (Rise Works), and over half of organizations not yet using stablecoins expect to adopt them soon (EY). As more companies recognize these advantages, the inertia keeping legacy systems in place is rapidly fading.

USDC vs USDT Payroll: Why Enterprises Are Choosing USDC

While both USDC and USDT facilitate fast digital payments, enterprises overwhelmingly prefer USDC for compliance reasons. Unlike USDT, which still faces questions around reserve transparency, Circle’s regular disclosures and adherence to U. S. regulatory standards have made USDC the gold standard for institutional-grade crypto payrolls.

This preference isn’t just theoretical; it’s reflected in adoption rates. In 2024, USDC captured 63% market share among crypto salaries compared to USDT’s 28.6% (Blockworks). Payroll platforms are increasingly building on top of USDC rails while leaving out alternatives that don’t meet strict compliance benchmarks.

What Comes Next for Cross-Border Payroll Crypto?

The surge in cross-border payroll crypto solutions signals more than just a passing trend, it marks a paradigm shift toward programmable money and borderless compensation models. With regulatory clarity now established by the GENIUS Act and major players like Circle leading on transparency, expect even broader adoption through 2025 and beyond.

The next frontier? Seamless integration with HR platforms, tax automation tools, and DeFi-based benefits, features already being piloted by forward-thinking firms. As stablecoin rails mature further, businesses will continue to optimize global workforce management by leveraging the power of programmable digital dollars.

The bottom line: In 2024-2025, USDC isn’t just winning the stablecoin salary race, it’s redefining what efficient, compliant global payroll looks like for companies of every size.