In the long sweep of financial history, few innovations have reshaped global compensation as rapidly as stablecoins did in 2024. The idea of programmable payroll – where salary disbursement becomes as flexible, transparent, and automated as software itself – has moved from theoretical to practical reality. This transformation is not just a technical upgrade; it’s a strategic leap for companies competing in the borderless digital economy.

Stablecoins, such as USDC and USDT, are cryptocurrencies pegged to assets like the US dollar. Their price stability and blockchain foundation have made them the backbone of next-generation payroll systems. In 2024, adoption rates soared: EasyStaff reported a 6.8-fold year-over-year increase in corporate stablecoin payroll usage, with average deposit sizes more than doubling. This surge marks a decisive shift away from legacy banking rails toward programmable, compliant crypto payroll for remote teams.

Why Programmable Payroll Matters for Global Teams

The traditional payroll process has always been hobbled by friction: slow bank transfers, costly intermediaries, opaque fee structures, and unpredictable delays due to holidays or local banking hours. For distributed workforces scattered across continents, these inefficiencies become strategic liabilities.

Enter programmable payroll via stablecoins. By leveraging smart contracts – self-executing code on blockchains – companies can automate recurring payments, milestone-based bonuses, or instant expense reimbursements with precision and transparency. No more waiting for wires to clear or worrying about currency devaluation; stablecoin salary solutions in 2024 offer real-time settlement, often within seconds.

The Mechanics: How Stablecoin Payroll Works in 2024

Modern platforms like Rain and Toku have partnered to deliver real-time stablecoin payroll infrastructure across more than 100 jurisdictions (source). Here’s how it typically unfolds:

- Employer funds a wallet: The company loads USDC into a secure wallet integrated with their payroll provider.

- Smart contract triggers payout: On payday (or any programmed schedule), smart contracts execute salary distribution instantly to each employee’s crypto address.

- Global reach: Contractors and employees in over 100 countries receive funds near-instantly – no SWIFT codes or intermediary banks required.

- Auditability: Every transaction is transparently recorded on-chain for compliance and tax reporting.

Key Benefits of Programmable Stablecoin Payroll in 2024

-

Real-Time Global Payments: Platforms like Rain and Toku enable instant, compliant payroll settlements in stablecoins, allowing startups to pay team members worldwide in seconds, regardless of banking hours or national borders.

-

Lower Transaction Costs: By leveraging stablecoins such as USDC and USDT, companies bypass traditional banking intermediaries, significantly reducing cross-border payment fees and administrative overhead.

-

Currency Stability for Workers: Paying in USD-pegged stablecoins protects remote teams from local currency devaluation and inflation, ensuring predictable and reliable compensation.

-

Programmable and Automated Payouts: Smart contracts on blockchains like Base (Coinbase’s Layer 2) enable automated salary disbursements, milestone-based bonuses, and transparent audit trails, streamlining payroll management for startups.

-

Enhanced Security and Transparency: Blockchain-based payroll provides immutable records and end-to-end transaction visibility, reducing fraud risk and simplifying compliance for distributed teams.

-

Wider Global Access: Providers like Remote allow startups to pay contractors in 69 countries directly in stablecoins, expanding access to global talent without the friction of local banking systems.

-

Regulatory Momentum: The GENIUS Act (July 2025) enables banks to issue fiat-backed stablecoins, boosting institutional trust and paving the way for broader adoption in payroll infrastructure.

The Strategic Advantages of Stablecoin Salary Solutions in 2024

The rise of programmable payroll using stablecoins isn’t just about speed or cost savings (though both are significant). It’s about unlocking new operational models for the modern workforce:

- No Borders: Companies can tap global talent pools without worrying about local banking compatibility or currency risk.

- No Delays: Payments settle instantly, even on weekends or holidays – critical for gig workers relying on timely income.

- No Surprises: USD-pegged stablecoins shield earners from hyperinflation or sudden FX swings common in emerging markets.

- No Guesswork: Smart contracts ensure precise execution of every pay cycle with full transparency.

This new paradigm is already visible at scale: Remote now enables contractor payments in 69 countries directly in USDC on Base, Coinbase’s Layer 2 blockchain (source). As regulatory clarity improves – notably with the passage of the GENIUS Act in July 2025 allowing banks to issue fiat-backed stablecoins – mainstream adoption is accelerating further.

Yet programmable payroll’s true power lies in its flexibility and composability. Teams can now build compensation structures as dynamic as their business models. Want to automate milestone bonuses for a software sprint? Or pay out instant referral rewards the moment a candidate is hired? With platforms like Superfluid and Request Finance, these workflows are not only possible but trivial to configure. The result: payroll evolves from a rigid monthly ritual into a living, breathing system that adapts to project velocity and team incentives.

Regulatory progress is also reshaping the landscape. The GENIUS Act of July 2025 has brought long-awaited certainty, allowing US banks to issue stablecoins directly backed by fiat or high-quality collateral. This has catalyzed institutional adoption, with payroll providers racing to integrate USDC payroll automation into their offerings. For global teams, this means even greater assurance that their digital salaries are both compliant and secure.

Challenges and Considerations: Beyond the Hype

No technological leap comes without friction. While programmable stablecoin salary solutions offer dramatic improvements over legacy rails, they also introduce new considerations:

- Tax Complexity: Payroll in crypto requires employers to track fair market value at the moment of payment for tax reporting – a process still maturing across jurisdictions.

- User Experience: Not all employees or contractors are crypto-savvy; onboarding, wallet management, and private key security remain hurdles for mass adoption.

- Regulatory Patchwork: While US clarity is improving, cross-border payroll smart contracts must still navigate an evolving global compliance mosaic.

Yet these challenges are far from insurmountable. Leading platforms are building robust compliance modules, integrating KYC/AML checks, and providing seamless fiat off-ramps for users who prefer local currency withdrawals. As infrastructure matures throughout 2024 and beyond, expect these frictions to diminish rapidly.

Looking Forward: The Endgame for Programmable Payroll Stablecoins

The momentum behind programmable payroll stablecoins is unmistakable. In less than two years, what began as an experiment among crypto-native startups has become a strategic imperative for mainstream enterprises seeking efficiency, transparency, and agility in global compensation. The data speaks volumes: corporate stablecoin deposits have more than doubled year-over-year (source). Early adopters have already reduced cross-border costs by up to 95% while delivering real-time payments that keep pace with the speed of modern work.

Steps to Launch USDC Payroll Automation in 2024

-

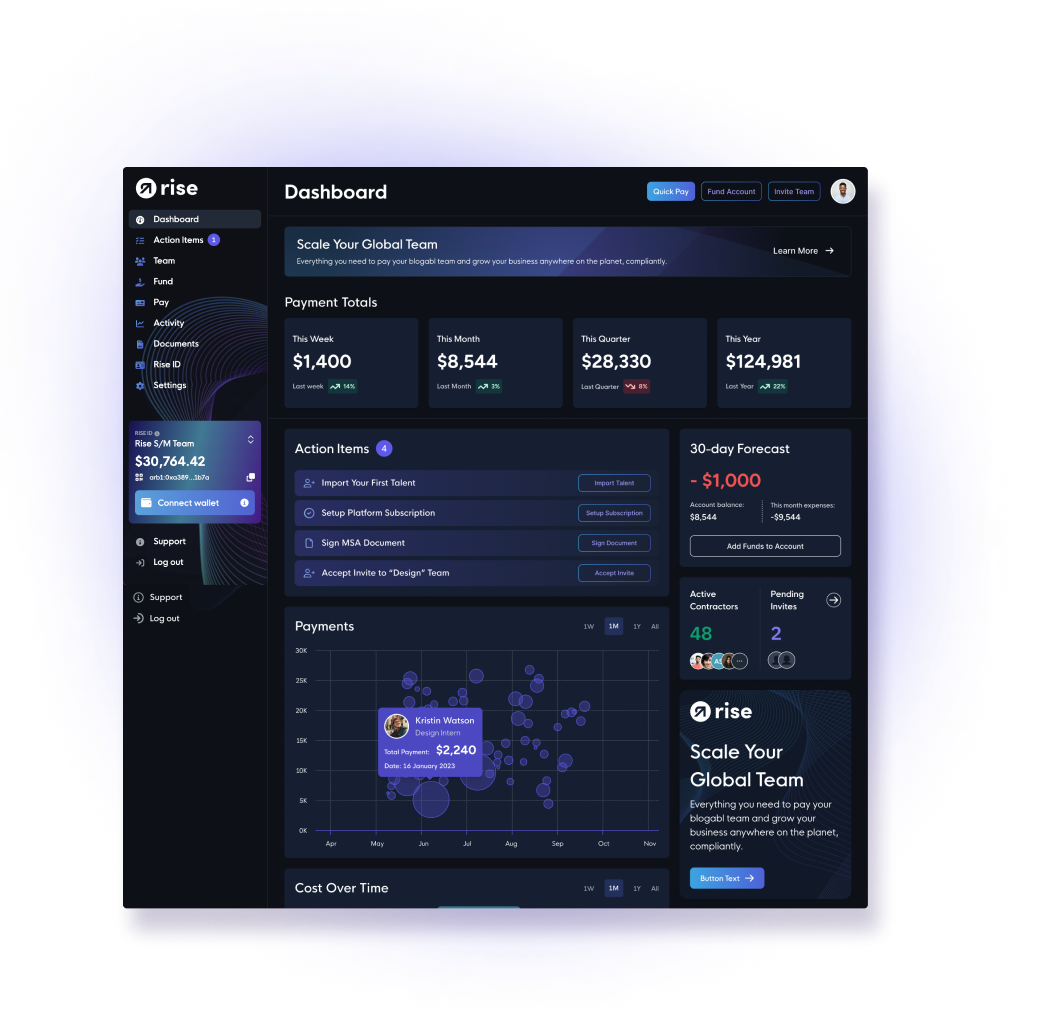

1. Select a Compliant Crypto Payroll PlatformChoose a reputable provider such as Remote, Bitwage, or Rise Works that supports USDC payroll, offers global compliance, and integrates with your HR systems.

-

2. Set Up Corporate Wallets for USDCCreate a secure, enterprise-grade crypto wallet (e.g., Fireblocks or Coinbase Prime) to hold and manage USDC funds for payroll disbursement.

-

3. Integrate Payroll Automation ToolsConnect your payroll platform to automation tools or APIs (like Rain x Toku real-time payroll) to enable programmable, scheduled, or milestone-based USDC payouts.

-

4. Onboard Global Employees and ContractorsInvite team members to provide their preferred USDC-compatible wallet addresses (e.g., MetaMask, Coinbase Wallet) and complete required KYC/AML checks.

-

5. Ensure Regulatory Compliance and ReportingWork with platforms that offer automated tax documentation and compliance features to meet local and international regulations, especially under the 2025 GENIUS Act.

-

6. Fund Payroll and Launch Automated DisbursementsDeposit USDC into your corporate wallet and initiate automated, auditable payroll runs—enabling instant, borderless payments to your global workforce.

The future of work is borderless, on-demand, and increasingly automated. Stablecoin salary solutions put programmable money at the heart of this transformation – not just as a technical upgrade but as a strategic lever for attracting top talent worldwide. For leaders willing to embrace change, programmable payroll isn’t just possible in 2024; it’s inevitable.