Remote work has gone from a trendy perk to the default for global tech teams, digital nomads, and startups. But with this borderless workforce comes a new challenge: how do you pay people instantly, securely, and without the headaches of international banking? The answer in 2024 is increasingly clear: USDC payroll. Powered by the stability of USD Coin (USDC) and the transparency of blockchain, stablecoin salaries are reshaping how teams think about compensation.

USDC Dominates the Crypto Payroll Surge

The numbers don’t lie. According to Pantera Capital’s 2024 Blockchain Compensation Survey, the share of professionals paid in crypto tripled from 3% in 2023 to 9.6% this year. Even more striking, stablecoins now make up over 90% of all digital asset compensation, and USDC leads the pack with a whopping 63% market share among crypto payrolls (see why USDC is outpacing competitors). This isn’t just hype; it’s a seismic shift driven by real-world demand for fast, reliable cross-border salary payments.

Why Remote Teams Are Flocking to Stablecoin Salaries

The sudden surge in crypto payroll for remote teams isn’t just about being on trend. It’s about solving pain points that have plagued international workforces for years:

Top Reasons Remote Teams Are Choosing USDC Payroll

-

Regulatory Confidence with Circle: USDC is issued by Circle, a company actively pursuing regulatory approvals, including a federal trust bank charter. This commitment to compliance gives businesses and employees peace of mind when handling payroll.

-

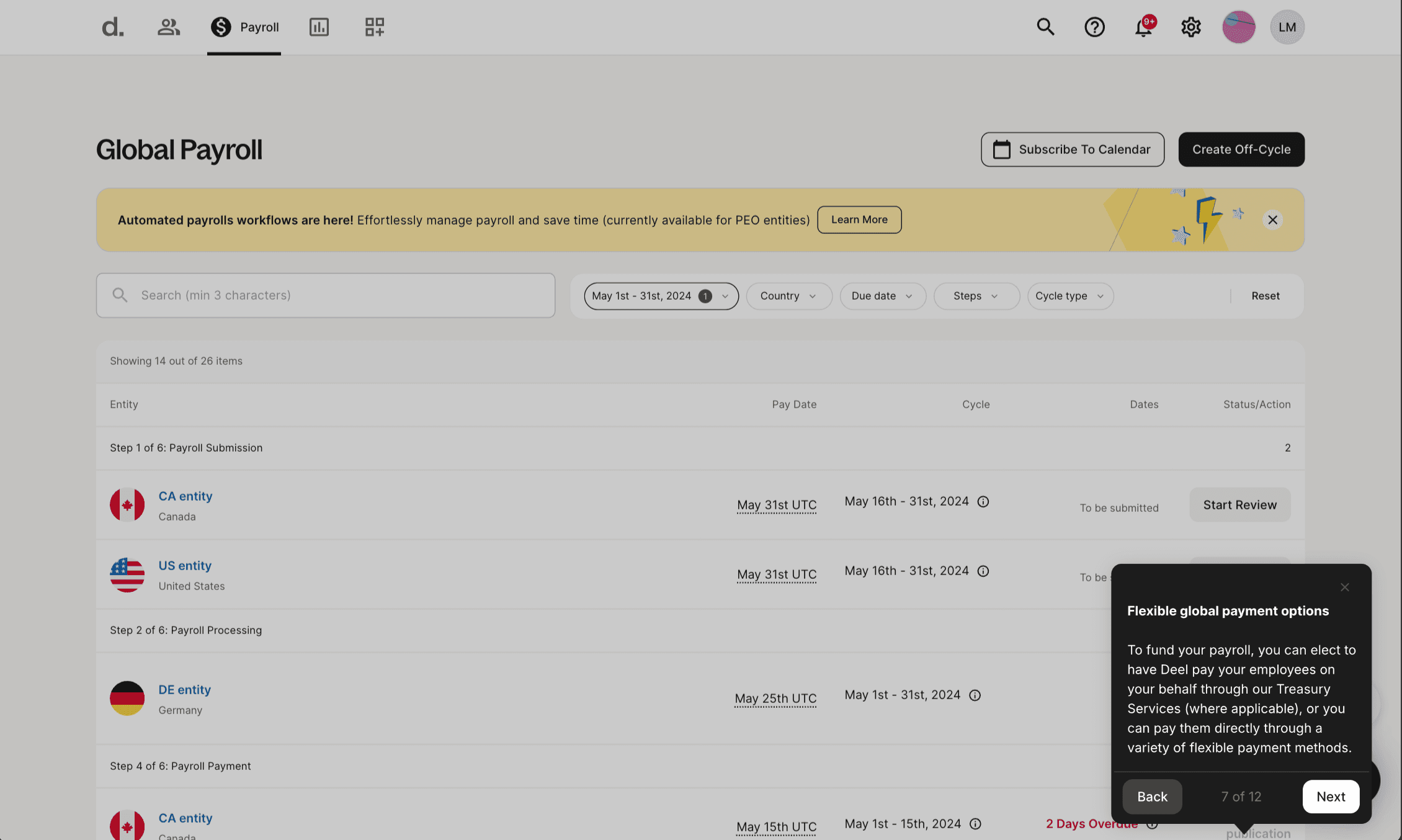

Seamless Integration with Major Payroll Platforms: Leading payroll providers like Remote have integrated USDC payments. As of December 2024, U.S. companies can pay contractors in 69 countries using USDC, making global payroll fast and secure.

-

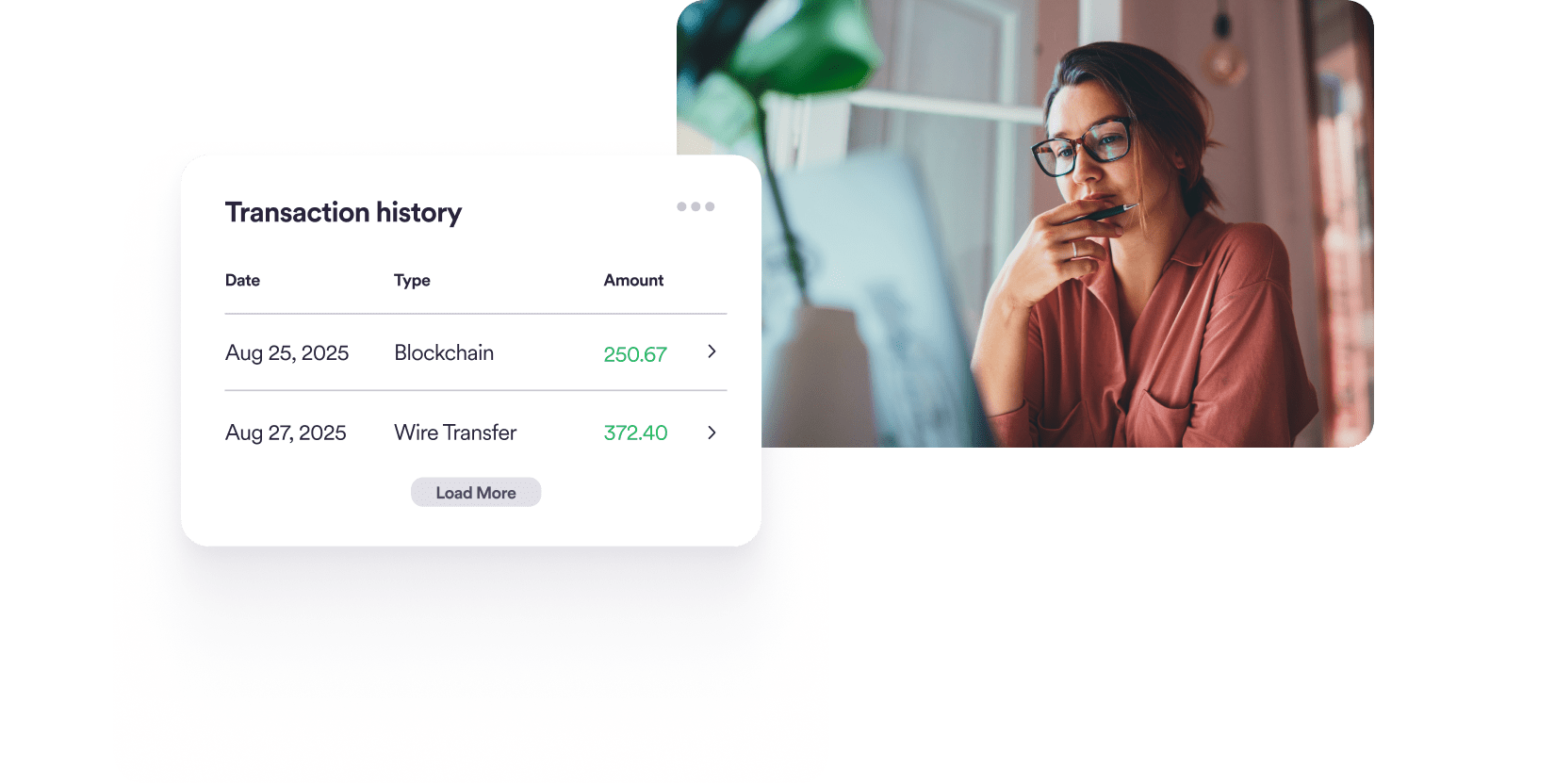

Fast, Low-Cost, and Borderless Payments: USDC enables near-instant, low-fee transactions across borders, eliminating the delays and high costs of traditional international wire transfers.

-

Protection Against Currency Volatility: Pegged 1:1 to the US dollar, USDC shields remote workers from the unpredictable swings of local currencies and other cryptocurrencies.

-

Widespread Adoption and Trust: In 2024, USDC accounted for 63% of all crypto payrolls, far surpassing other stablecoins like USDT. This widespread use signals strong market trust and reliability.

1. Instantaneous Payments Across Borders: No more waiting days for wire transfers or dealing with intermediary bank fees. With USDC, salaries land in wallets within minutes – whether your developer is in Lagos or your designer is in Buenos Aires.

2. Cost Efficiency: Traditional cross-border payments can eat up as much as 5-10% of each transaction through fees and poor exchange rates. With global payroll using USDC, those costs shrink dramatically, empowering both companies and freelancers.

3. Stability and Predictability: Unlike Bitcoin or Ethereum, which can swing wildly day-to-day, USDC is pegged one-to-one with the U. S. dollar. That means employees know exactly what they’re getting – no nasty surprises come payday.

The Compliance Edge: Why Companies Trust USDC

If you’re running payroll at scale, compliance isn’t optional – it’s mission-critical. Here’s where USDC shines even brighter:

- Regulatory Confidence: Circle (the issuer behind USDC) has taken bold steps toward regulatory clarity by seeking federal trust bank status and working closely with U. S. regulators.

- Mainstream Integration: Top platforms like Remote. com now let U. S. -based companies pay contractors in over 69 countries using USDC – combining speed with robust compliance controls (learn how seamless integration works here).

- KYC and AML Safeguards: Modern crypto payroll platforms feature built-in identity checks and anti-money laundering protocols to satisfy even the strictest HR departments.

Paving the Way for Global Talent Without Borders

This shift isn’t just technical; it’s cultural. Offering stablecoin salaries as an employee benefit signals that your company values flexibility and innovation. For top talent choosing between offers, instant global payments can be a game-changer – especially for those living in countries with unstable local currencies or banking restrictions.

But there’s another layer to the USDC payroll story in 2024: it’s not just about speed or saving money. It’s about unlocking whole new markets of talent and giving teams a competitive edge. When you pay in stablecoins like USDC, you’re no longer limited by borders or banking hours. You can hire the best, wherever they are, and compensate them fairly, without delay or friction.

For many digital professionals, especially those in emerging markets, receiving stablecoin salaries is more than just convenient, it’s transformative. Imagine skipping the endless lines at local banks, dodging unpredictable currency swings, and getting paid what you’re truly worth in dollars. That’s the promise of global payroll with USDC, and it’s resonating loudly across continents.

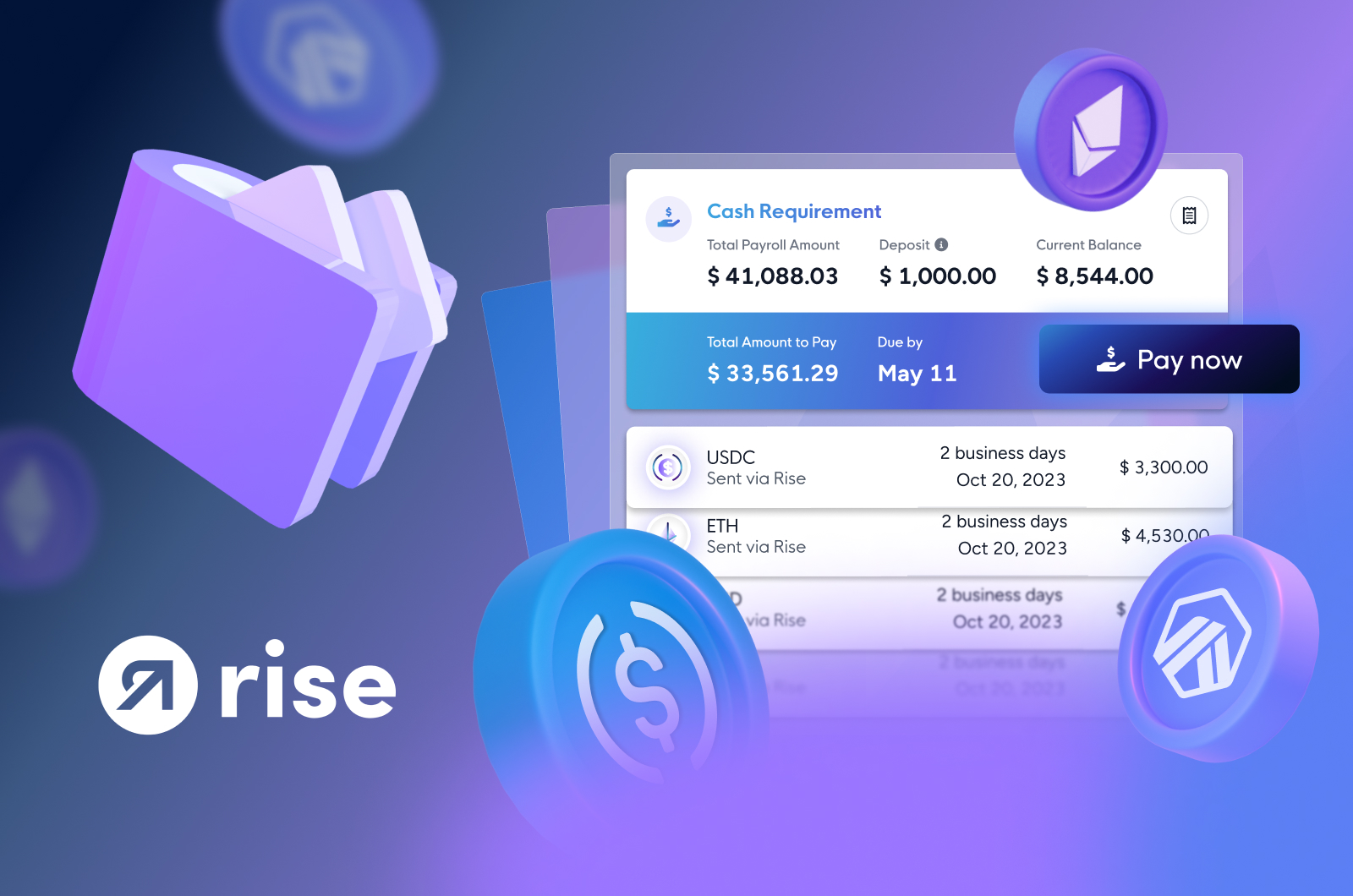

The Practical Side: How Remote Teams Are Rolling Out USDC Payroll

Implementation used to be the stumbling block for crypto payroll adoption. Not anymore. Today’s platforms are built for usability, think one-click mass payouts, automated tax reporting tools, and integrations with your favorite HR stack. Whether you’re a 10-person dev shop or a 1,000-person global org, onboarding is fast and compliant.

Here are the must-haves for rolling out a successful stablecoin payroll:

Key Steps to Launch USDC Payroll for Remote Teams

-

2. Complete Regulatory & Compliance ChecksEnsure your company meets all local and international compliance requirements. Platforms like Circle provide guidance on KYC, AML, and IRS reporting for USDC payroll.

-

3. Integrate USDC Wallets for FundingSet up secure USDC wallets—either through your payroll provider or a trusted wallet service—to fund payroll transactions. Popular options include Coinbase Wallet and MetaMask.

-

4. Onboard Remote Employees & ContractorsInvite your global team to provide their preferred USDC wallet addresses. Platforms like Remote facilitate easy onboarding and wallet management for recipients in over 60 countries.

-

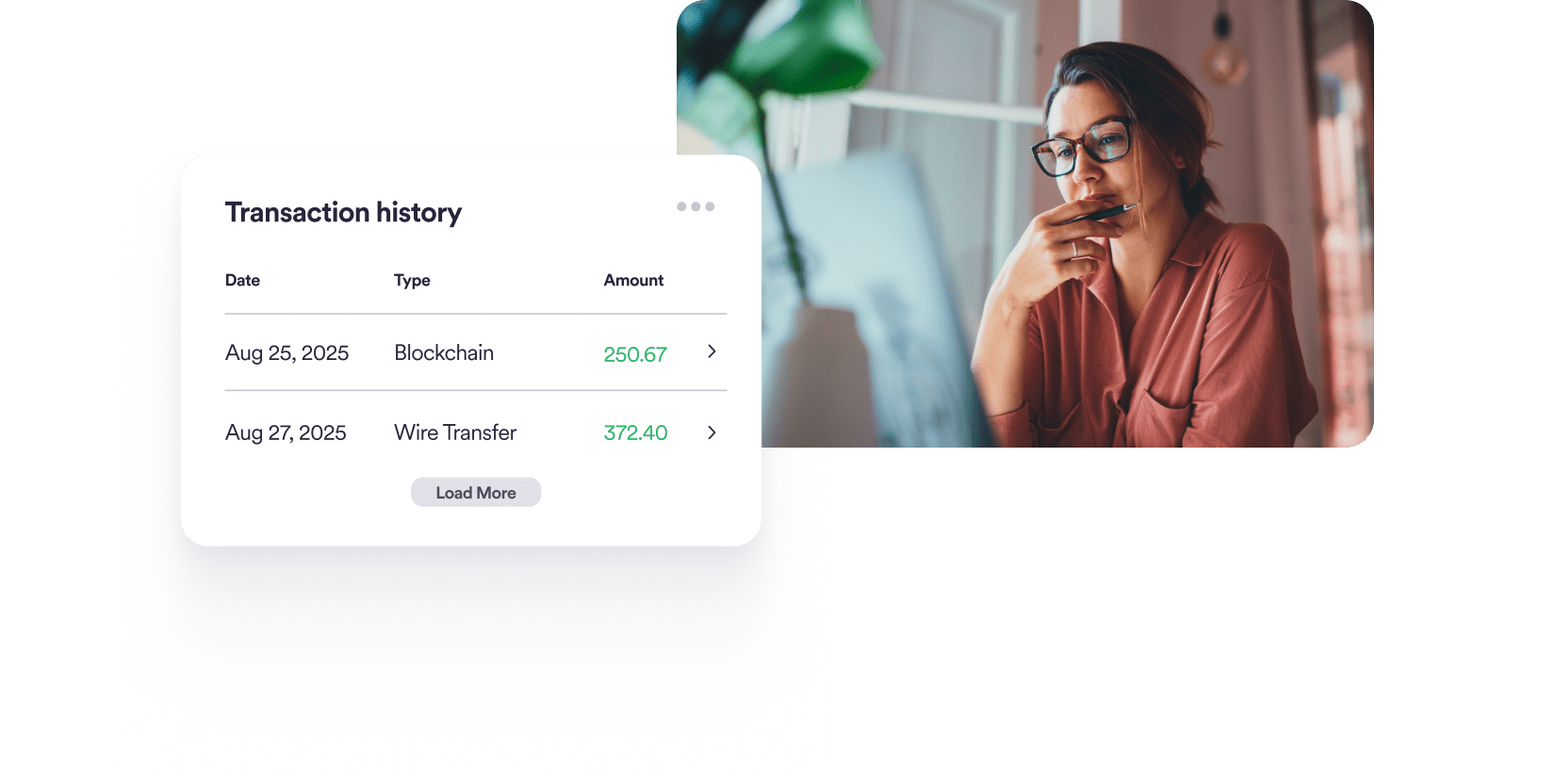

5. Schedule and Automate Payroll DisbursementsUse your payroll platform’s automation features to set payment schedules, ensuring timely and accurate USDC payouts across borders, with transaction records for tax and audit purposes.

Tip: Choose a provider that supports multi-chain payouts (like Ethereum and Polygon) so your team can pick networks with the lowest fees and fastest confirmations.

IRS Rules and The Evolving Compliance Landscape

No discussion of crypto payroll for remote teams would be complete without touching on compliance headaches, especially as IRS rules evolve in 2024. Employers must report stablecoin payments as regular income, track fair market values at payout time, and ensure proper tax withholding where required. The good news? Leading platforms now automate much of this heavy lifting with built-in reporting dashboards tailored for both U. S. and international requirements.

This regulatory clarity is fueling even more adoption among mainstream businesses, and giving peace of mind to finance teams who once worried about gray areas.

The Road Ahead: What’s Next for Stablecoin Salaries?

If current trends hold steady into next year, expect even greater momentum behind cross-border salary payments via USDC and other leading stablecoins. We’ll likely see:

- Bigger enterprises joining the party: As compliance tools mature, Fortune 500s will follow startups’ lead.

- Programmable payroll features: Think milestone-triggered bonuses or dynamic vesting schedules, all powered by smart contracts (see how programmable payroll works).

- Wider network support: More chains mean faster payments and lower costs for everyone involved.

The bottom line? For remote teams hungry for flexibility, and companies looking to attract world-class talent, USDC payroll isn’t just a passing trend. It’s fast becoming the gold standard for borderless compensation in our digital-first era.