For remote teams in high-inflation countries, the way salaries are paid is more than just a technicality, it’s a matter of economic survival. Traditional payroll methods often leave workers exposed to the relentless erosion of local currency value and burdened by costly, slow international transfers. Enter stablecoin payroll: a modern, borderless solution that’s rapidly gaining traction across Latin America, Southeast Asia, Africa, and beyond.

Why Stablecoin Payroll Is a Game-Changer in High-Inflation Markets

Stablecoins like USDC and USDT are digital currencies pegged 1: 1 to the US dollar, offering a level of stability that volatile local currencies simply can’t match. In countries such as Argentina, where inflation reached an astonishing 124% in 2023, receiving your salary in pesos means watching your purchasing power evaporate almost overnight. By opting for stablecoin payroll, workers can preserve the real value of their earnings and sidestep the chaos of hyperinflation.

This isn’t just theory, it’s happening now. According to the Stablecoin Payroll Report 2025, remote teams scattered across Southeast Asian countries have already eliminated excessive fees and waiting periods by switching to stablecoin-based payments. That’s not just convenience; it’s financial empowerment.

The Five Core Benefits of Stablecoin Salaries for Global Teams

Top 5 Advantages of Stablecoin Payroll for Remote Teams

-

Protection Against Inflation: Stablecoins like USDC and USDT are pegged to the US dollar, shielding remote workers in high-inflation countries from local currency devaluation. For example, in Argentina—where inflation soared to 124% in 2023—many professionals now prefer stablecoin payments to safeguard their earnings.

-

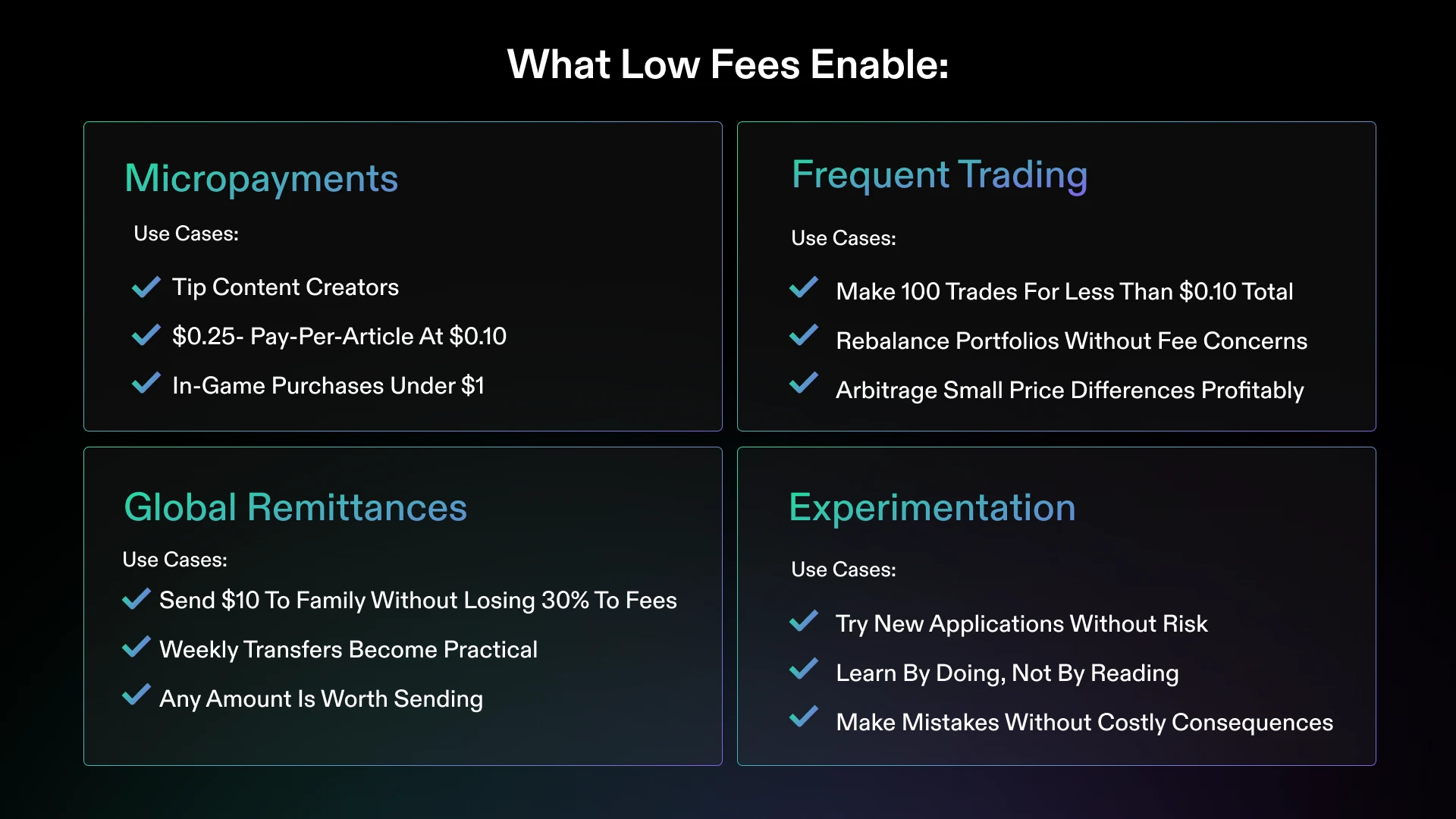

Lower Transaction Costs: Traditional international transfers can charge fees exceeding 6%. With stablecoin payroll, fees typically range from 0.5% to 3%, saving money for both employers and employees. Blockchain-based payouts eliminate costly intermediaries and unnecessary banking charges.

-

Near-Instant Settlements: While conventional cross-border payments may take days, stablecoin transactions are processed within seconds or minutes. This rapid settlement empowers remote teams to access their funds immediately, improving financial planning and security.

-

Enhanced Accessibility and Financial Inclusion: Stablecoins enable workers in developing regions—often unbanked but internet-connected—to receive payments directly into digital wallets. This boosts financial inclusion and participation in the global economy, especially across Southeast Asia, Africa, and Latin America.

-

Transparent and Traceable Transactions: All stablecoin payments are recorded on public blockchains, ensuring full transparency and traceability. This builds trust, reduces disputes, and enhances accountability between employers and remote teams worldwide.

The transformation doesn’t stop at inflation protection. Here’s what makes crypto payroll for remote teams so compelling:

- Inflation Hedge Salary: Workers in high-inflation regions can lock in value with every paycheck.

- Lower Transaction Costs: Average fees drop from over 6% (traditional remittance) to under 3%: sometimes as low as 0.5%: with blockchain-powered transfers.

- Near-Instant Settlement: Instead of waiting days for bank wires, funds arrive within minutes.

- No Bank Account Needed: Anyone with a smartphone can receive payment directly into a digital wallet, no more exclusion due to lack of banking infrastructure.

- Total Transparency: Every transaction is recorded on-chain for easy verification and dispute resolution.

Pioneering Companies Are Leading the Shift

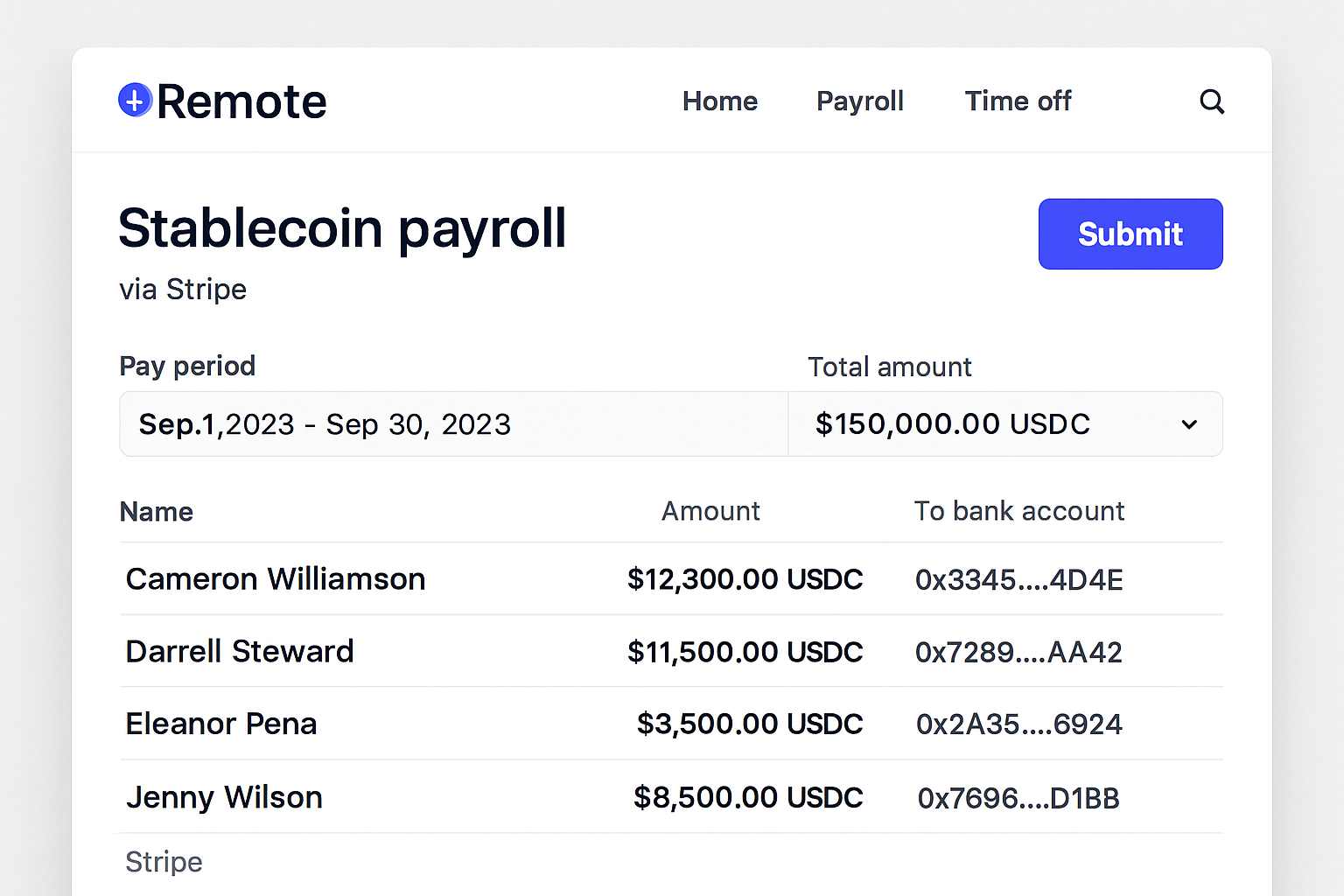

The adoption curve is accelerating fast. In December 2024, Remote partnered with Stripe to enable USDC payments on the Base network for contractors in 69 countries, a move that slashes friction for global HR operations. Meanwhile, Latin America’s largest crypto exchange launched its own stablecoin payroll service in August 2025, offering USDT and USDC payouts that help shield workers from currency volatility.

This isn’t just about tech companies or digital nomads anymore; it’s mainstream. Over 56% of APAC institutions now use stablecoins for international payroll (Hedgeweek). In Africa and Eastern Europe, these innovations represent nothing short of a financial lifeline, a way to sidestep broken banking systems and access global opportunities without borders or bureaucracy.

The Real Impact: Stories from the Front Lines

If you’re wondering how this shift plays out day-to-day, consider freelance developers in Nigeria who once lost up to 10% of their income through conversion fees and delays, or designers in Argentina who watched their peso salaries lose half their value between paydays. Now, with stablecoins like USDC revolutionizing cross-border payroll, they get paid instantly, and keep what they earn.

But it’s not just about speed or savings. Stablecoin payroll is a catalyst for financial inclusion, especially for the unbanked and underbanked. In Southeast Asia, Latin America, and Africa, millions of talented workers have historically been sidelined by outdated financial infrastructure. With stablecoins, all that’s needed is a smartphone and internet access, the world of remote work opens up, no matter where you live.

The numbers speak volumes. In 2025 alone, over $550 billion in stablecoin transactions are projected to flow through Africa and Southeast Asia, with median settlement speeds under five minutes (Yellow Card). That’s not just a technical upgrade, it’s an economic revolution.

How Companies Are Rethinking Global Payroll Strategies

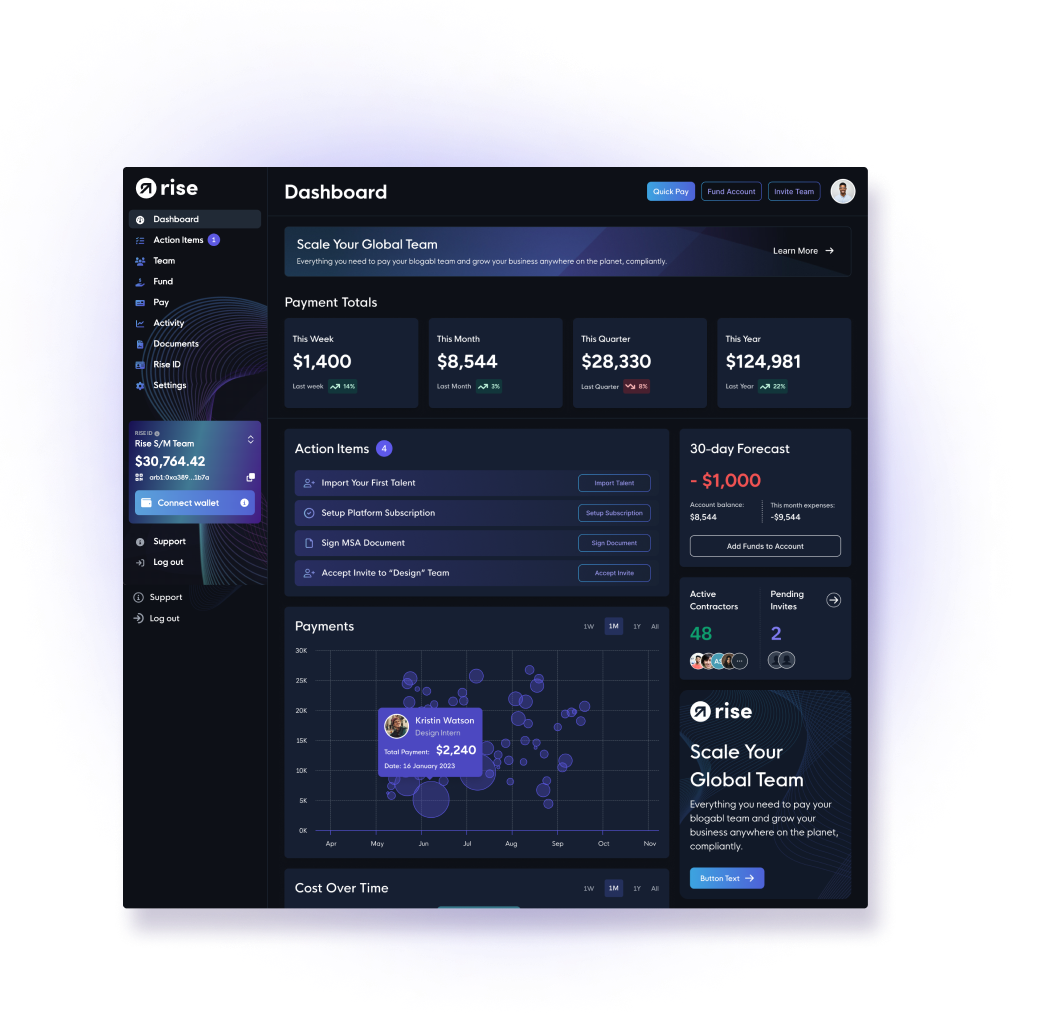

Forward-thinking companies are now building their entire international payroll workflows around stablecoins. Instead of battling with compliance headaches and unpredictable FX rates, they’re leveraging blockchain rails for seamless operations. Payroll managers can execute bulk payments to dozens of countries at once, track every transaction in real time, and offer employees the choice to convert instantly into local cash or hold USDC as a dollar-denominated savings vehicle.

This flexibility is crucial for empowering workers to make smarter financial decisions, whether that means hedging against inflation or tapping into global DeFi opportunities right from their wallets. For teams spread across time zones and continents, it means everyone gets paid fairly and on time, every time.

What Does the Future Hold?

The adoption of crypto payroll for remote teams is only accelerating as more businesses recognize its potential to reduce friction and unlock new talent pools. As regulatory clarity improves across key markets, and as more platforms integrate user-friendly stablecoin payment solutions, the barriers to entry will keep shrinking.

Key Steps to Implement Stablecoin Payroll Safely

-

1. Choose a Reputable StablecoinSelect well-established stablecoins such as USD Coin (USDC) or Tether (USDT), both widely used and pegged to the US dollar. These options offer high liquidity and are supported by major exchanges and wallets.

-

2. Partner with Trusted Payroll PlatformsLeverage platforms like Remote (in partnership with Stripe) or Bitwage to streamline stablecoin payroll, ensure compliance, and provide user-friendly interfaces for both employers and employees.

-

3. Ensure Regulatory ComplianceConsult local legal experts to understand regulations on crypto payroll in each jurisdiction. Use platforms that offer built-in compliance features, such as tax reporting and KYC/AML checks.

-

4. Secure Digital Wallet InfrastructureSet up secure, non-custodial or custodial wallets for your team. Recommend trusted wallets like MetaMask, Trust Wallet, or Coinbase Wallet for easy access and robust security features.

-

5. Educate and Support Your TeamProvide training on using digital wallets, understanding transaction fees, and recognizing scams. Offer ongoing support and clear documentation to empower employees new to crypto payroll.

-

6. Monitor Transaction Fees and Settlement SpeedsRegularly review blockchain network fees and choose the most cost-effective networks (e.g., Base, Polygon, Solana) to minimize costs and ensure near-instant settlements.

-

7. Maintain Transparent Record-KeepingUtilize blockchain explorers and payroll platforms that offer detailed transaction histories. This ensures transparency, traceability, and simplifies audits for both employers and employees.

If you’re considering making the leap to international payroll with cryptocurrency, now is the moment to act. Early adopters are already reaping the rewards: attracting top-tier talent from emerging markets, slashing operational costs, and building resilient teams that thrive even in volatile macro environments.

The bottom line: Stablecoin payroll isn’t just an upgrade, it’s a lifeline for remote workers in high-inflation countries. By putting control back in the hands of employees and removing costly intermediaries, it’s redefining what global work can look like in 2025, and beyond.

Curious how your team can benefit? Explore more on how stablecoin salaries are transforming global payroll, or dive deeper into how USDC payroll simplifies payments for remote tech teams.