Paying remote teams used to mean navigating a labyrinth of wire transfers, banking delays, and currency conversion headaches. Today, USDC payroll is redefining how global businesses compensate talent, offering instant, borderless salary payments that are as simple as sending an email. As stablecoins like USD Coin (USDC) gain traction, founders and finance teams are discovering a smarter way to handle cross-border payroll without the friction of legacy systems.

Why Stablecoin Salaries Are the Future of Global Payroll

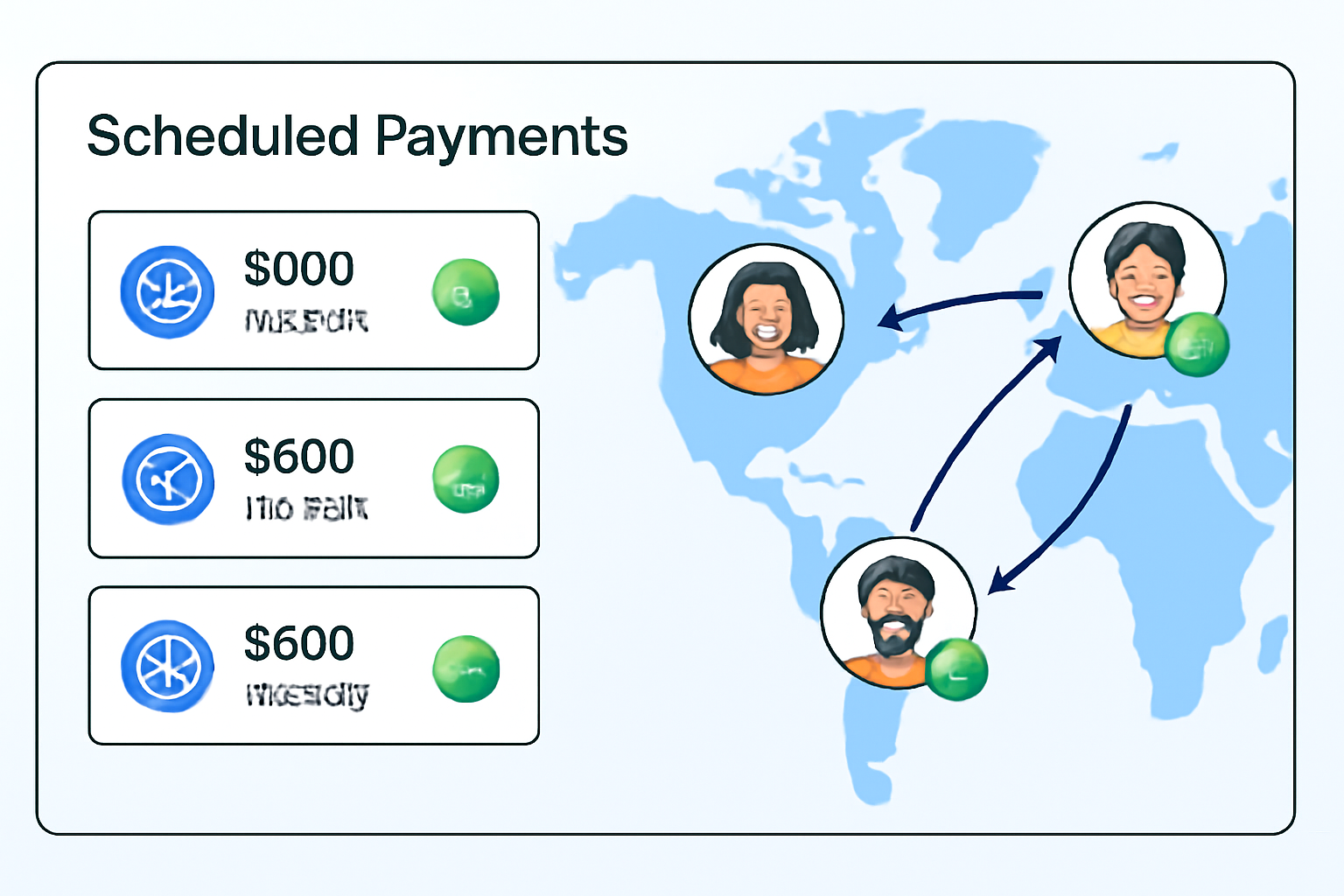

Traditional payment rails simply can’t keep up with the pace of modern work. International wire transfers can take days to settle and often come with high fees or unpredictable exchange rates. In contrast, USDC payroll allows companies to pay employees and contractors worldwide in seconds, no matter where they live or bank.

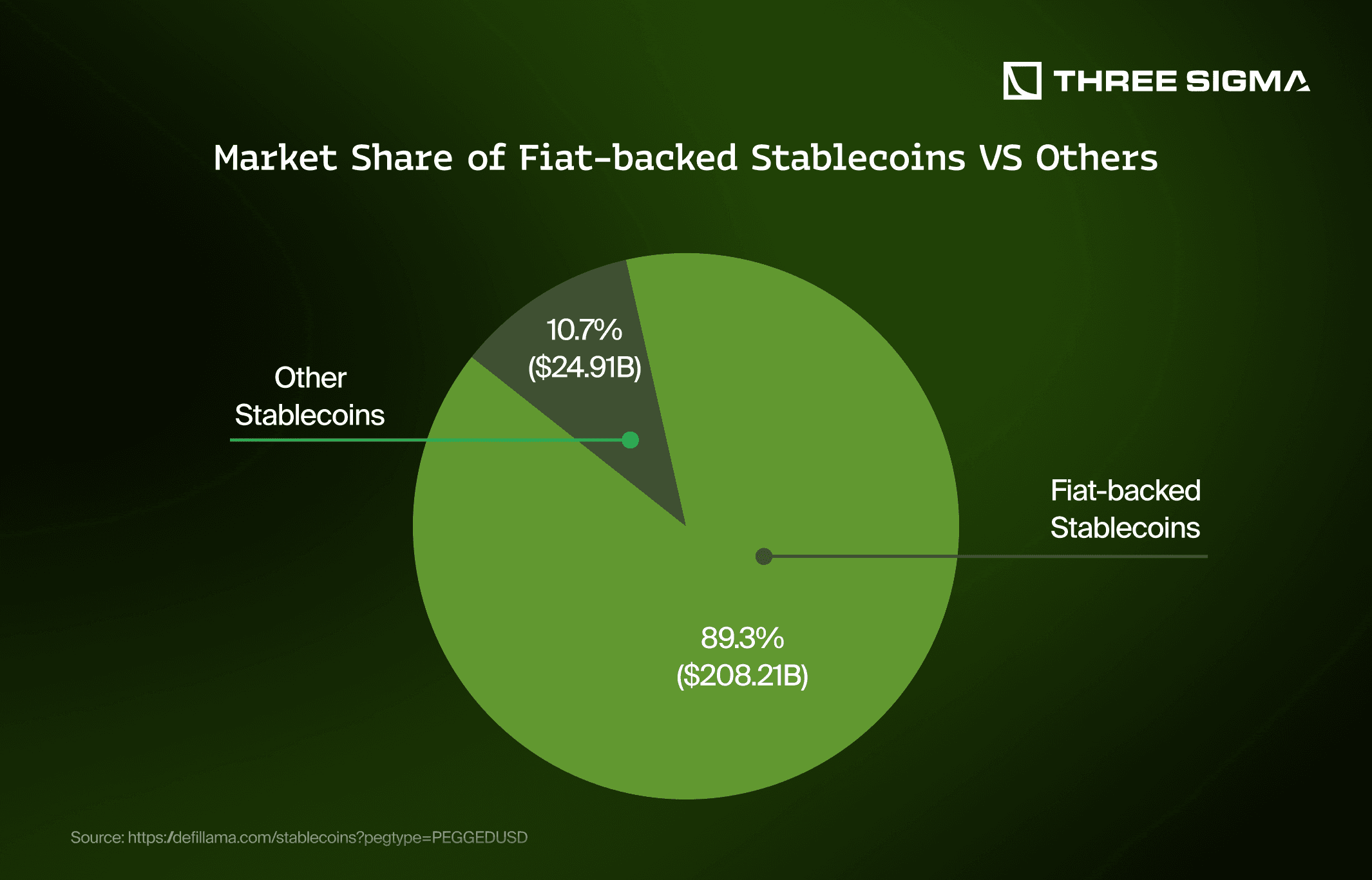

What makes USDC so appealing? It’s a stablecoin pegged 1: 1 to the US dollar, eliminating the volatility that plagues other cryptocurrencies. This means remote teams get paid in a digital asset that holds its value and can be easily converted into local currency.

Top 5 Benefits of Using USDC for Remote Payroll

-

Near-Instant Global Payments: USDC transactions settle in seconds, allowing remote team members worldwide to receive their earnings almost instantly, regardless of location or banking hours.

-

Lower Transaction Costs: Paying with USDC eliminates expensive wire transfer fees and currency conversion markups, making cross-border payroll significantly more cost-effective for businesses.

-

Stable Value Pegged to USD: As a stablecoin, USDC maintains a 1:1 value with the US dollar, protecting both employers and employees from the price volatility common with other cryptocurrencies.

-

Enhanced Accessibility for Global Teams: USDC can be sent and received by anyone with a compatible digital wallet, bypassing traditional banking barriers and enabling seamless payments to contractors in over 69 countries via platforms like Remote and Bitwage.

-

Compliance and Security: Leading payroll platforms like Remote, Bitwage, and Deel offer robust compliance tools and secure infrastructure, ensuring legal, tax, and data protection requirements are met for international payroll.

How Instant Global Salary Payments Actually Work

The beauty of crypto payroll for remote teams lies in its simplicity. Here’s what happens behind the scenes:

- Your business funds a digital wallet with USDC, either by purchasing it on an exchange or converting from another crypto asset.

- You choose a compliant payroll platform, such as Remote (now offering USDC payouts in 69 countries), Bitwage, Deel, or TransFi. These platforms automate compliance checks and tax reporting while streamlining onboarding.

- Your team receives payments instantly, directly into their crypto wallets, no intermediary banks or costly delays involved.

- If needed, recipients convert USDC into their local currency, often at more favorable rates than traditional remittance services provide.

This model not only slashes costs but also empowers workers in emerging markets who may lack access to reliable banking infrastructure. For those interested in step-by-step guidance on setting up these systems, see our practical resource: How to Pay Remote Teams with USDC: A Step-by-Step Guide for Crypto Payroll.

The Platforms Powering Cross-Border Payroll Solutions

A new generation of fintech platforms has emerged to make stablecoin salaries not just possible but practical at scale. Here’s how some leading solutions compare:

- Remote x Stripe: Pay contractors in 69 countries with secure, near-instant USDC payouts on the Base network, fully compliant across jurisdictions.

- Bitwage: Supports same-day stablecoin payments to nearly 200 countries, letting workers choose between local currency or crypto.

- Deel: Enables direct funding from Coinbase accounts for seamless international payroll execution in USDC.

- TransFi: Offers API-based automation and compliance-ready setups for multi-country payouts, perfect for scaling tech teams fast.

The core advantage? These platforms abstract away regulatory complexity and operational risk so you can focus on growing your business, not chasing down lost wires or reconciling FX statements. For startups evaluating which solution fits best, our comparison guide dives deeper: USDC vs Traditional Wire Transfers: Which Is Better for Global Payroll?

Despite the clear benefits, some founders still wonder: Is crypto payroll for remote teams truly reliable and sustainable? The answer increasingly looks like yes, especially as regulatory clarity improves and mainstream adoption accelerates. Major payroll providers have built robust compliance frameworks, and stablecoins like USDC are audited regularly to ensure transparency. Payment settlement is no longer bound by banking hours or international holidays; your team can receive their salary in minutes, even on weekends.

Security is paramount when sending digital assets across borders. Choose platforms with strong encryption, robust KYC/AML policies, and insured custodial wallets where possible. Educating your team about wallet safety and private key management is just as important as the technology itself.

Empowering Teams in Emerging Markets

The impact of instant global salary payments goes beyond convenience. For talent in emerging markets, USDC payroll offers a lifeline: access to stable currency without the friction of local banking barriers or runaway inflation. Developers, designers, and creatives can participate in the global economy on equal footing, no need to wait days or lose value to predatory exchange rates.

If you’re ready to empower your distributed workforce with seamless crypto payments, explore our detailed guides for specific industries:

- How to Pay Remote Developers with USDC: A Guide for Global Startups

- How to Pay Remote Employees in Emerging Markets Using USDC Payroll

What’s Next for Cross-Border Payroll?

The future of work is borderless, and so is compensation. As more companies embrace USDC payroll, expect continued innovation around compliance automation, tax reporting integrations, and even real-time salary streaming. With every improvement, the gap between effort and reward narrows for global talent.

If you’re considering making the switch from legacy wires to stablecoin salaries, now is the time. The operational savings alone can be transformative, but so too is the ability to attract world-class talent who value speed, transparency, and financial inclusion.

For further insights on how real-time crypto payroll is transforming salary payments worldwide, check out our comprehensive analysis: How Real-Time Crypto Payroll Is Transforming Global Salary Payments for Remote Teams.