In the fast-paced world of remote work, paying international teams remains a logistical nightmare for many businesses. Traditional wires drag on for 3-5 days, fees devour up to 7% of payroll, and compliance headaches multiply across borders. Enter USDC payroll, the stablecoin powerhouse slashing these barriers in 2026. With near-instant settlements and costs plummeting by 98% in some cases, platforms like Remote and Rise are proving cross-border payroll USDC isn’t just viable, it’s superior. Picture your salaries zipping across continents in seconds, pegged firmly to the dollar via blockchain transparency.

Adoption surges as 25% of global businesses now tap crypto for payroll, up from 15% in 2023. This shift empowers startups and digital nomads alike, turning volatile fiat transfers into reliable stablecoin salaries remote teams crave. No more weekend delays or currency conversion gouges; USDC delivers value exactly as promised.

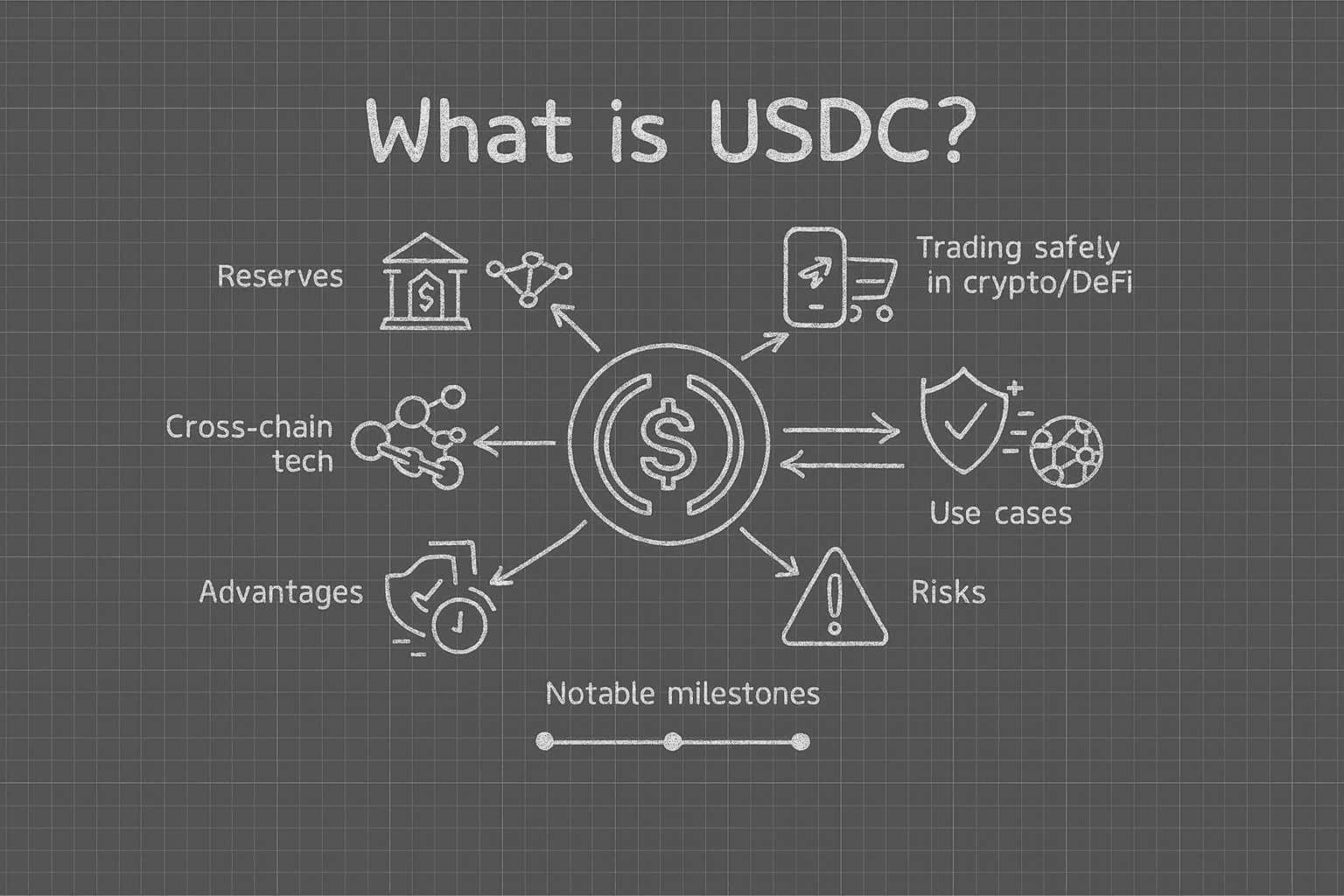

Visualizing the Cost Crunch: Traditional vs USDC Payroll Flows

Imagine a flowchart: left side, legacy banking with arrows looping through SWIFT networks, each bend a fee or delay. Right side, a straight blockchain line from treasury to wallet, labeled ‘seconds, sub-cent fees. ‘ That’s the visual power of USDC global payments 2026. Sources like Riseworks highlight top benefits: eliminate 3-5 day waits, transaction costs drop versus wires. Ogletree notes lightning-fast transfers reduce fees dramatically. For a 100-person team across 20 countries, this translates to thousands saved monthly.

RebelFi reports 3-5% total payroll savings, while Rise’s Circle integration cuts cross-border costs 40%. Visualize your dashboard: one batch push on-chain, local partners handle last-mile via wallets. Tom Squire on LinkedIn paints it perfectly: single payroll run, value propagated globally without friction.

Remote and Rise: Blueprints for USDC Payroll Success

Remote’s partnership with Stripe lights the path. US companies now pay contractors in nearly 70 countries using USDC on Base, compliant and secure. No bank intermediaries; funds land in wallets instantly. Streamline your setup like they did, focusing on growth over payment woes.

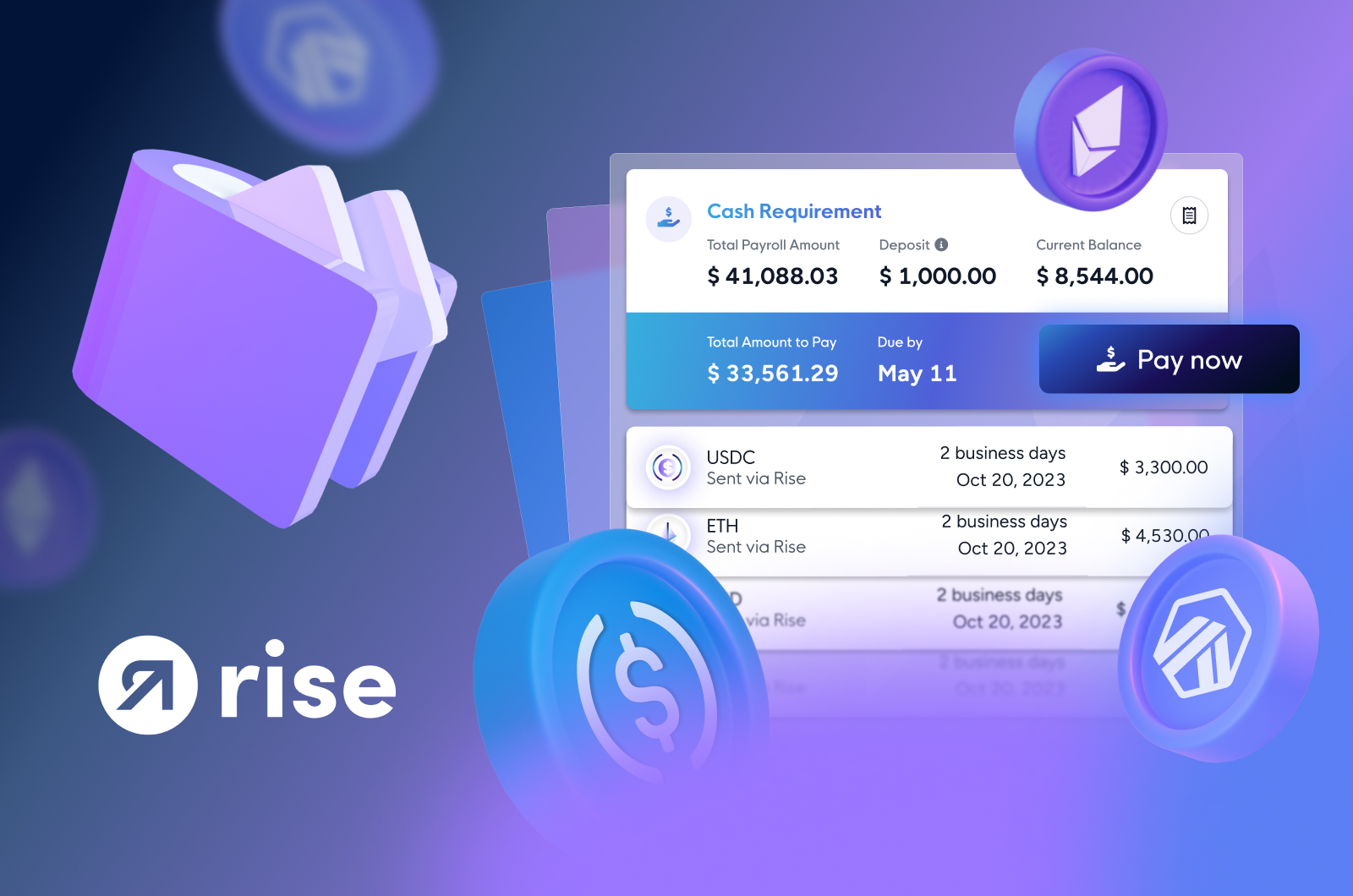

Rise leverages Circle’s USDC for transformative efficiency. Days-long settlements vanish, replaced by near-instant payouts. Defi-Planet details how this hybrid model disrupts global workforce payments. For remote international teams, it’s a game-changer: contractors in Brazil or India receive crypto payroll international contractors style, reporting income at fair market value per Easystaff. A $5,000 USDC drop equals $5,000 taxable, simple as that.

USD Coin (USDC) Price Prediction 2027-2032

Price stability outlook for payroll adoption in remote international teams (pegged to USD with adoption-driven tightening)

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY Change |

|---|---|---|---|---|

| 2027 | $0.98 | $1.00 | $1.03 | 0.00% |

| 2028 | $0.985 | $1.00 | $1.02 | 0.00% |

| 2029 | $0.99 | $1.00 | $1.015 | 0.00% |

| 2030 | $0.995 | $1.00 | $1.01 | 0.00% |

| 2031 | $0.997 | $1.00 | $1.005 | 0.00% |

| 2032 | $0.999 | $1.00 | $1.002 | 0.00% |

Price Prediction Summary

USDC is forecasted to robustly maintain its $1.00 peg through 2027-2032, bolstered by surging adoption in stablecoin payroll for global teams. Minimum prices reflect bearish scenarios like regulatory hurdles or market stress causing brief depegs, averages represent the steady peg, and maximums capture bullish demand premiums from high payroll volumes. Progressive tightening of ranges illustrates maturing ecosystem stability.

Key Factors Affecting USD Coin Price

- Explosive payroll adoption (e.g., Remote’s 69-country USDC payouts, Rise-Circle integration) driving demand and supply adjustments

- Cost savings (98% fee reduction, instant settlements vs. 3-5 day wires) accelerating enterprise use

- Regulatory tailwinds with compliance tools ensuring safe global payments

- Technological advances in layer-2 networks (e.g., Base) enhancing scalability and peg defense

- Competition from USDT/USDe pressuring tight peg maintenance

- Market cap growth tied to $trillions in cross-border payroll volumes

- Risks from depegging events or policy shifts balanced by Circle’s reserves and audits

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Step-by-Step: Implementing USDC Payroll Without the Risks

Start with compliance controls. Tools from StablecoinInsider offer rollout plans for USDC/USDT, embedding reconciliation and ops safeguards. Toku. com breaks down safe global team payments: mint USDC, batch via smart contracts, distribute to non-custodial wallets. Bridge. xyz guides cross-border crypto, urging businesses to centralize treasury with stablecoin access per Hurupay’s playbook.

Follow this guide visually: 1) Integrate platform like Cross-Border Payroll. 2) Verify recipients KYC. 3) Load USDC treasury. 4) Schedule batches. 5) Monitor on-chain. Costs? Pennies versus percentages. Delays? None. For digital nomads, it’s borderless bliss, wallets bridging worlds effortlessly.

Deeper dive reveals blockchain’s edge: immutable ledgers for audits, reducing disputes. Platforms handle volatility risks since USDC stays dollar-pegged, even as bridged variants like Multichain on Fantom trade at $0.0203 amid network dynamics. Stick to native USDC for payroll purity, ensuring every cent lands true.

Tax reporting simplifies too; freelancers log USDC receipts at spot value, no forex flux. Platforms automate 1099s or equivalents, turning audits into afterthoughts. This frictionless flow lets teams focus on output, not paperwork.

Compliance Blueprint: Navigating Crypto Payroll Regulations Visually

Picture a layered chart: base layer FATF travel rule compliance, mid-layer KYC rails, top layer on-chain proofs. Ogletree’s insights map it clearly: stablecoins like USDC shine for crypto payroll international contractors because they’re programmable for geo-fencing and AML flags. Remote’s 70-country rollout embeds these natively, partnering with Stripe for Base network security. No rogue transfers; every payout traces back immutably.

Bridge. xyz stresses business checklists: assess jurisdiction risks, integrate oracle feeds for pricing, enable reversibility where regs demand. Hurupay’s playbook visualizes treasury stacks: fiat in, USDC out, multi-chain for speed. For 2026, expect IRS clarity on stablecoin wages as ordinary income, mirroring fiat. Tools flag variances, like if bridged USDC on Fantom dips to $0.0203 due to liquidity pools, alerting to swap back to native for peg purity.

Tool Arsenal: Best Stablecoin Payroll Platforms Ranked

StablecoinInsider. org ranks them sharp: top tier Cross-Border Payroll for USDC batching, Rise for Circle synergy, Remote for contractor scale, Toku for safety nets. Each dashboard mimics a trading terminal: real-time tx hashes, fee breakdowns, recipient confirmations. Swap costs? Under $0.01 versus wires at $25-50. Visualize savings compounding: a mid-size firm pays 500 contractors, pocketing $10K monthly from fees alone.

Top 5 USDC Payroll Benefits

-

Instant Transfers: Eliminate 3-5 day delays with near-instant USDC settlements via platforms like Remote and Circle’s integration on Base network.

-

98% Fee Cuts: Slash transaction costs by 98% compared to traditional wires, plus 3-5% total payroll savings as per RebelFi and Rise reports.

-

Compliance Automation: Automated controls for global regs via Stripe-Remote partnership, ensuring safe USDC payouts in 69 countries.

-

Tax Simplicity: USDC treated as income at fair market value upon receipt, streamlining reporting for freelancers per EasyStaff guide.

-

Borderless Access: Pay remote teams worldwide with one USDC batch, leveraging Rise-Circle for efficient cross-border payouts.

Easystaff. io nails freelancer angles: USDC hits wallets ready for local ramps or DeFi yields, empowering nomads in Thailand or Portugal. No bank hours dictating paydays; 24/7 execution rules.

Risk Radar: Spotting and Sidestepping USDC Payroll Pitfalls

Smart money charts risks first. Depeg events? Rare for USDC, backed by reserves audited monthly. Bridge exploits? Route via trusted L1s like Ethereum or Base. Wallet hacks? Mandate hardware or MPC setups. Tom Squire’s LinkedIn thread diagrams it: batch on mainnet, fan out via relayers. RebelFi quantifies upside: 3-5% payroll trim, scaling to millions for enterprises.

One glitch I’ve charted in pilots: network congestion spiking gas. Solution? Layer-2 priority queues, keeping latency under 10 seconds. For teams eyeing scale, start small: pilot with 10 contractors, extrapolate ROI visually on a breakeven graph. Fees plummet, speed soars, loyalty spikes as pays land predictably.

By 2026, USDC global payments 2026 dominate remote ops, with blockchain payroll hitting mainstream. Platforms evolve: AI-driven splits for bonuses, yield-bearing salaries parked pre-payout. Digital nomads thrive, businesses cut fat, all on rails of transparency. Chart the trend; it’s bullish across borders. Load your treasury, push the batch, watch value flow true.

Cross-Border Payroll stands ready, fusing these tools into one dashboard. Scale your remote empire without the drag.