Global payroll is undergoing a seismic shift. In 2025, the rise of real-time crypto payroll is not just a fringe experiment – it’s a mainstream, strategic solution for international businesses and remote teams. The core drivers are clear: speed, cost efficiency, compliance, and the demand for flexible compensation models. Approximately 25% of global companies now use crypto payroll solutions, up sharply from 15% just two years ago. This transformation is fundamentally altering how organizations think about salary distribution, especially across borders.

The Stablecoin Surge: USDC Leads the Pack

The backbone of this revolution is the dominance of stablecoins, particularly USD Coin (USDC) and Tether (USDT). USDC now commands a 63% market share in crypto payroll transactions, thanks to its regulatory clarity and institutional trust. Unlike volatile cryptocurrencies, stablecoins are pegged to the US dollar, providing predictable value and mitigating risk for both employers and employees. This makes them an ideal vehicle for salary disbursement in an era where workforce mobility and borderless hiring are the norm.

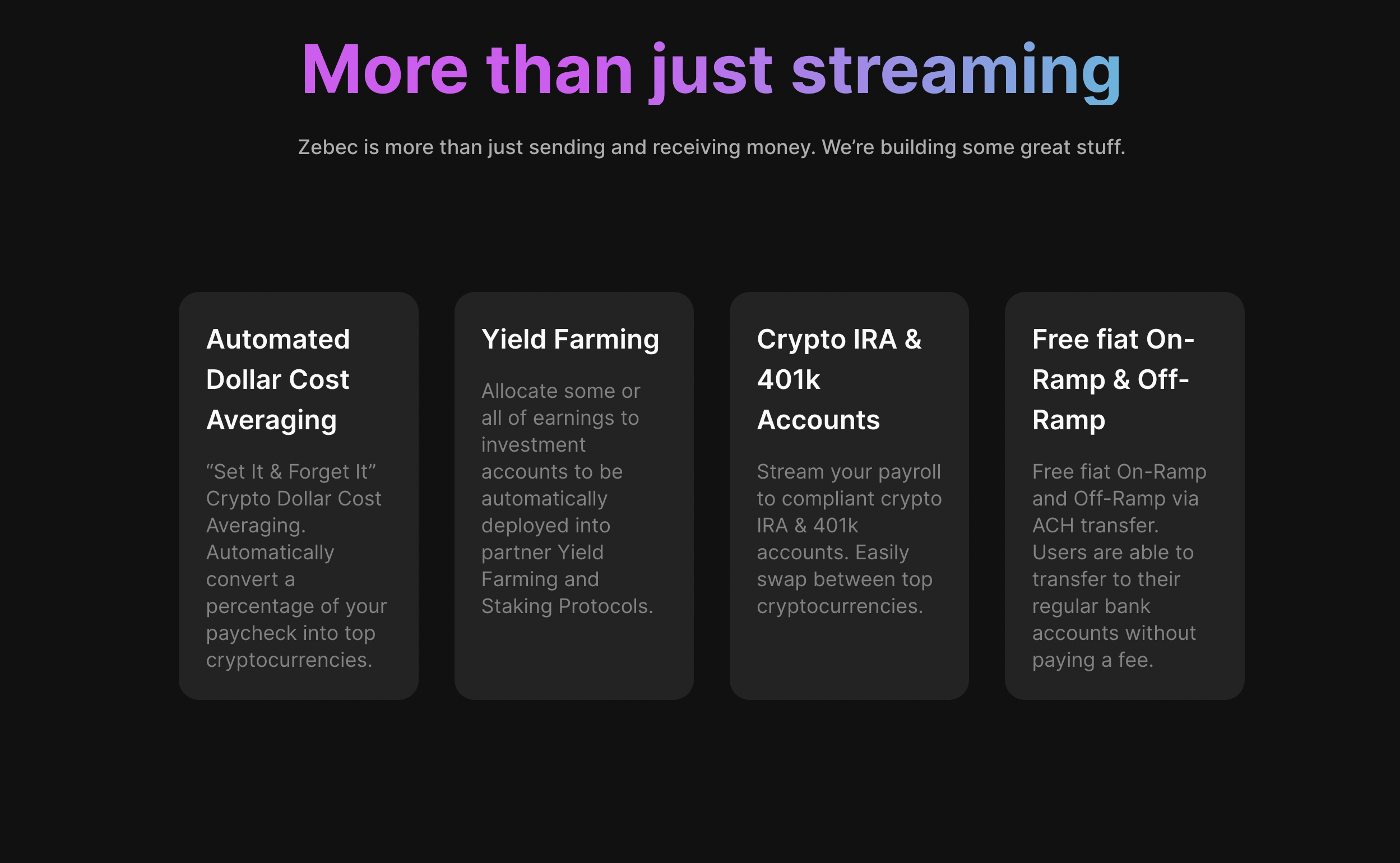

Visa’s direct stablecoin payroll service and platforms like Zebec Pay have set new standards by enabling instant salary streaming to employee wallets. These innovations aren’t limited to niche tech startups; they’re being adopted by enterprises seeking to cut through legacy banking friction. For a deeper dive on how stablecoins are reshaping wage distribution at scale, see how real-time stablecoin payroll is changing global salary distribution in 2025.

Cost Savings and Speed: The New Payroll KPIs

The impact on cost efficiency is immediate and measurable. Average international transaction fees have dropped from 6.62% to under $5 per payout using blockchain-based systems – a game changer for companies paying large distributed teams or contractors in emerging markets. Settlement times that once took days now clear in under two minutes, radically improving cash flow management for both employers and employees.

This speed is not just about convenience; it’s about resilience in regions where traditional banking can be slow or unreliable. For example, tech teams in Africa or Latin America can now receive their salaries instantly via USDC or other stablecoins – sidestepping local currency instability entirely.

Generational Momentum: Gen Z Demands Digital Compensation

The appetite for crypto compensation isn’t evenly distributed across age groups. Recent surveys show that 75% of Gen Z employees want at least part of their salary paid in stablecoins. This generational preference is accelerating adoption as companies compete for top talent globally. Flexible pay structures that blend fiat with digital assets are quickly becoming table stakes for forward-thinking employers.

This trend also creates new challenges around education and compliance – but first movers are gaining reputational advantages among digitally native workers who expect transparency and control over their earnings.

Navigating Regulatory Waters: Compliance as Competitive Advantage

The regulatory landscape is catching up fast. The EU’s Markets in Crypto-Assets (MiCA) regulation went live in January 2025, giving much-needed clarity on digital asset transactions within Europe. While some jurisdictions remain ambiguous, compliant crypto payroll systems are quickly differentiating themselves by integrating KYC/AML protocols directly into their platforms. For practical guidance on ensuring compliance when paying overseas staff with crypto, check out this actionable compliance guide.

With these frameworks in place, companies are no longer flying blind. Instead, they’re leveraging regulatory clarity as a strategic edge, using compliant crypto payroll systems to confidently expand into new markets. The platforms leading this charge, like Deel, Gloroots, and Zebec, offer integrated contract management, tax reporting, and localized payout methods alongside seamless stablecoin distribution. This convergence of compliance and usability is making crypto payroll not just viable but preferable for scaling teams.

Top Features of Leading Crypto Payroll Platforms

-

Instant Settlement: Platforms like Zebec Payroll and Request Finance enable salary payments to settle in under two minutes, eliminating traditional banking delays and ensuring employees receive funds immediately.

-

Automated Compliance Checks: Platforms like Gloroots incorporate real-time regulatory compliance with frameworks such as the EU’s MiCA, helping businesses meet cross-border legal requirements effortlessly.

-

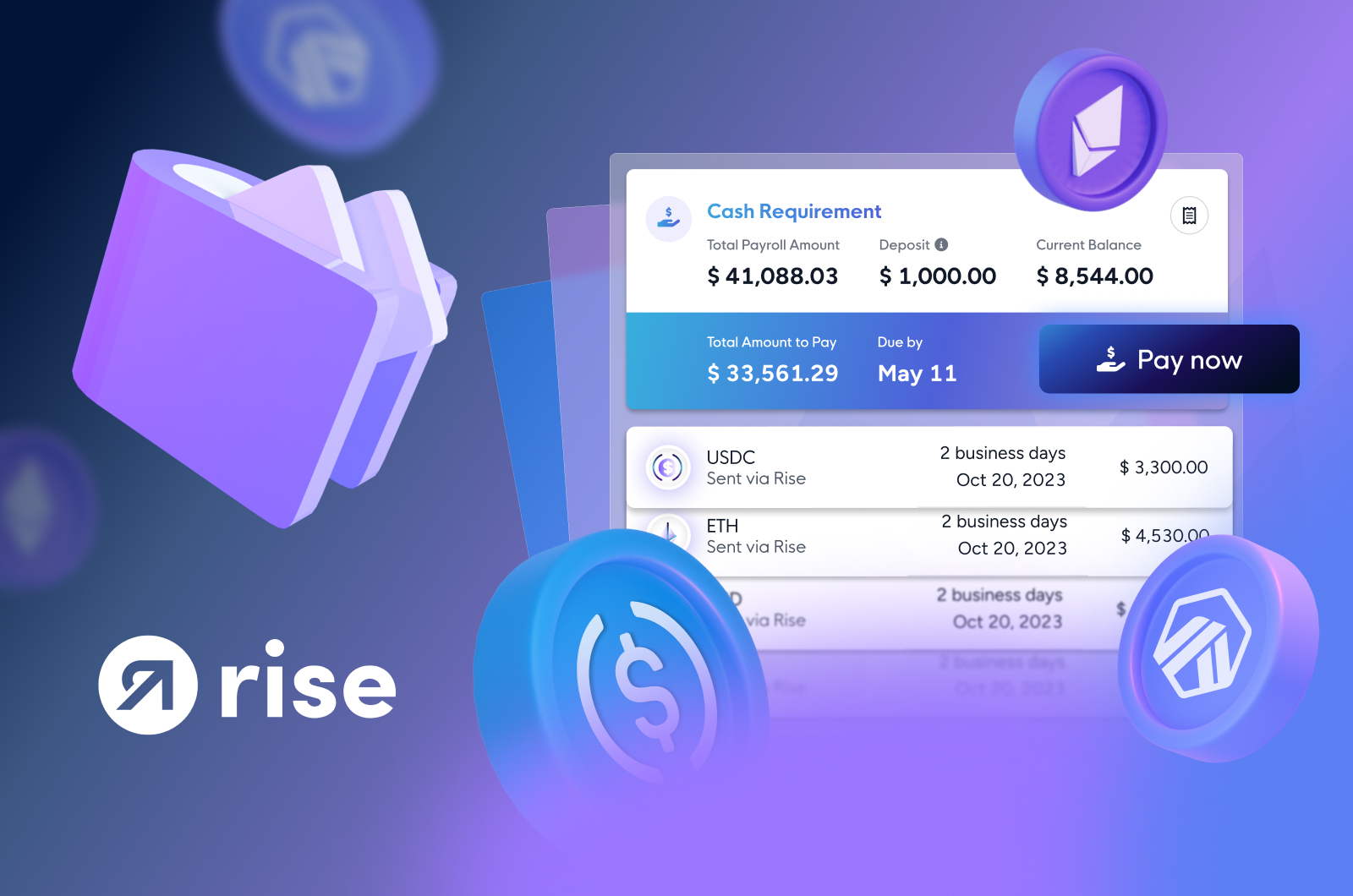

Real-Time Wage Streaming: Zebec Payroll and Rise offer continuous salary streaming, allowing employees to access earnings in real time rather than waiting for traditional pay cycles.

-

Transparent Fee Structures: Request Finance and Papaya Global provide clear, upfront transaction fees—often under $5 per global payment—helping companies manage costs and avoid hidden charges.

Beyond the Hype: Real-World Impact and Enterprise Adoption

The numbers tell the story: by late 2025, stablecoin transaction volumes for payroll are projected to surpass $20 trillion annually. This is not speculative volume, it’s recurring salary payments that reflect deep enterprise adoption. In practice, companies are seeing improved retention among global contractors who value predictable paydays and reduced friction in cross-border compensation.

One standout innovation is per-second wage streaming, which allows employees to access their earnings in real time rather than waiting for biweekly or monthly cycles. This model is already being piloted by Web3-native firms and could soon become standard for remote-first organizations looking to boost workforce liquidity and satisfaction.

Yet it’s not just about speed or cost; it’s about building trust in compensation. Transparent on-chain records mean every payment can be independently verified, eliminating disputes and enhancing accountability across the employment lifecycle.

What’s Next: The Road to 2026

The trajectory is clear. As more businesses recognize the operational advantages of crypto payroll, and as regulatory certainty grows, adoption rates are expected to reach 35-40% globally by 2026. With USDC leading at a 63% market share and robust compliance standards now established in major economies, the barriers to entry are lower than ever.

For organizations still on the fence, now is the time to pilot real-time crypto payroll solutions for select teams or international contractors. Early adopters are already capturing cost savings and talent advantages that will be difficult to replicate later as this technology becomes the norm rather than the exception.

The transformation underway isn’t just technological, it’s cultural. Employees expect transparency and control; employers demand efficiency and compliance. Real-time crypto payroll delivers both. For further insights into how programmable stablecoin payrolls are setting new standards for global teams, explore how stablecoins enable programmable payroll for global teams in 2024.