Paying remote employees in Latin America with USDC stablecoin is rapidly becoming a preferred strategy for startups and tech companies seeking to streamline cross-border payroll. With the current price of Multichain Bridged USDC (Fantom) at $0.0554, businesses are leveraging the stability, speed, and cost-efficiency of stablecoins to overcome the hurdles of traditional banking and volatile local currencies. This data-driven guide walks you through each critical step for deploying a compliant, transparent, and efficient USDC payroll process tailored for Latin America.

1. Choose a Regulated Crypto Payroll Platform Supporting USDC in Latin America

The foundation of any secure crypto payroll operation is selecting a regulated platform that supports USDC payouts across Latin America. Platforms like Remote and Bitwage have partnered with established payment processors to offer direct stablecoin payments to contractors in over 69 countries, including key Latin American markets. These platforms handle KYC/AML compliance, automate reporting, and provide robust audit trails, eliminating the risks associated with DIY crypto transfers.

Using such a platform ensures your business can pay remote teams instantly, avoid excessive transaction fees, and maintain full compliance with international standards. For more details on how global platforms are rolling out this feature, see Remote’s announcement.

2. Verify Local Compliance and Tax Requirements for Crypto Payments

Compliance isn’t optional. Before initiating crypto payroll in any country within Latin America, it’s essential to research local legal frameworks governing digital asset payments. Regulations can vary significantly between countries, what works seamlessly in Argentina may encounter restrictions or additional reporting requirements in Mexico or Brazil.

This due diligence should include:

- Understanding whether crypto salaries are considered legal tender or subject to special taxation

- Consulting with regional tax advisors familiar with digital assets

- Ensuring your payroll provider offers tools for generating compliant payment records

This step not only protects your business from regulatory penalties but also empowers employees with clarity regarding tax obligations on their USDC earnings.

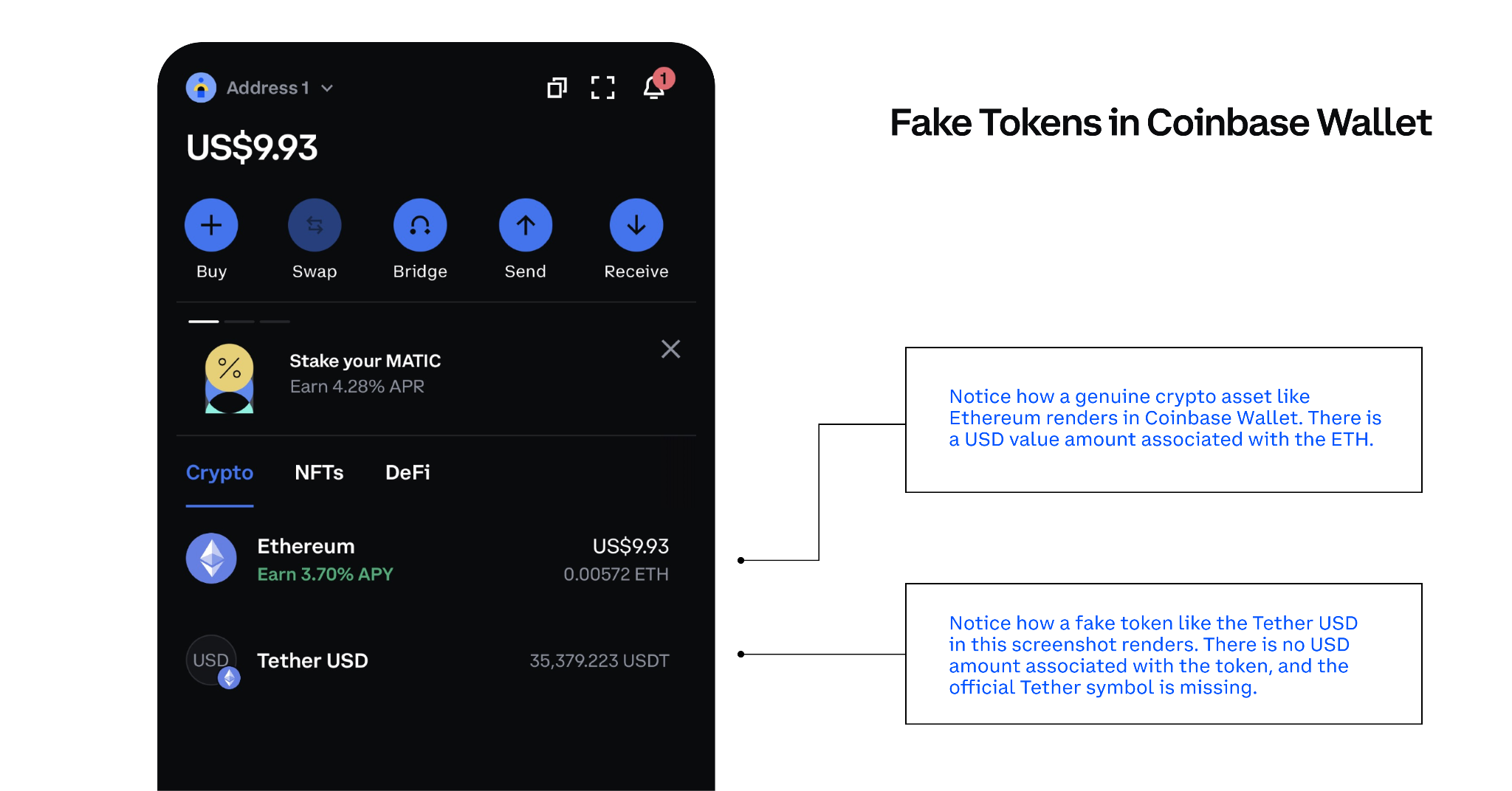

3. Onboard Remote Employees and Collect Their USDC-Compatible Wallet Addresses

The next operational step is onboarding your remote workforce onto your chosen platform and collecting each employee’s USDC-compatible wallet address. Most leading platforms support major blockchains such as Ethereum, Polygon, Optimism, Base Network, and Stellar, giving employees flexibility based on their preferred wallet solutions.

A clear onboarding workflow should include:

- Educating employees about wallet setup (popular choices include MetaMask or Trust Wallet)

- Providing guidance on safeguarding private keys and recovery phrases

- Verifying wallet addresses before first payment disbursal to prevent loss of funds

This step is crucial for ensuring seamless payouts and empowering your team to manage their digital assets securely.

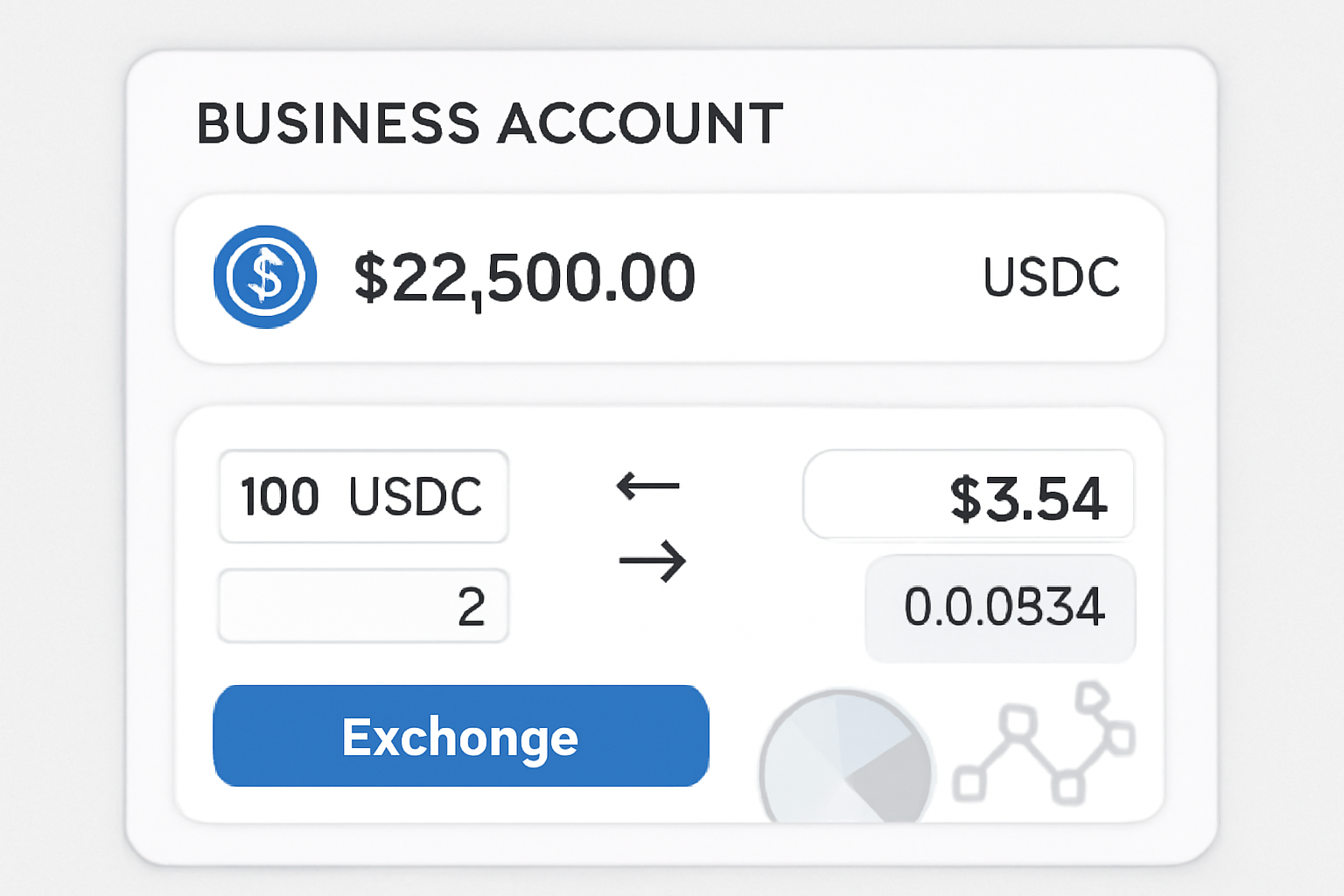

4. Fund Your Payroll Account with USDC via a Trusted Exchange or Payment Provider

Once your workforce is onboarded and wallet addresses are verified, the next step is to fund your payroll account with USDC. Given the current Multichain Bridged USDC (Fantom) price of $0.0554, businesses can accurately budget for monthly payroll outflows, minimizing exposure to currency volatility and transfer delays common in Latin American banking systems.

For best results, use a reputable exchange or payment provider that supports direct USDC purchases and transfers on the preferred blockchain (such as Base Network or Polygon). Many regulated payroll platforms offer integrated funding options, streamlining the process from fiat conversion to stablecoin distribution. Key considerations:

- Ensure your exchange complies with both your home country’s and the destination country’s AML/KYC requirements

- Double-check network compatibility, sending USDC on the wrong blockchain can result in lost funds

- Schedule regular funding cycles to ensure timely salary disbursements without liquidity gaps

This approach provides predictability for both employers and employees, supporting uninterrupted payroll operations across borders.

5. Execute Payroll Disbursements and Provide Transparent Payment Records to Employees

With your payroll account funded, you’re ready to execute disbursements. The leading crypto payroll platforms automate this process, allowing you to initiate bulk payments in just a few clicks. Each employee receives their salary in USDC directly into their wallet, often within minutes, eliminating the multi-day delays associated with traditional wire transfers.

Transparency is paramount. Modern platforms generate detailed payment records for every transaction, including timestamps, transaction hashes on the blockchain, and conversion rates at the moment of payout. This documentation is essential for both internal audits and employee peace of mind. Employees should be able to independently verify receipt of funds using public blockchain explorers.

Key Advantages of Transparent USDC Payroll Records

-

1. Choose a Regulated Crypto Payroll Platform Supporting USDC in Latin AmericaOpt for established platforms like Remote or Bitwage, which offer USDC payroll solutions, ensuring compliance, security, and seamless cross-border payments.

-

2. Verify Local Compliance and Tax Requirements for Crypto PaymentsConsult with legal and tax experts to ensure your USDC payroll process meets the regulations in each employee’s country, supporting auditability and minimizing legal risks.

-

3. Onboard Remote Employees and Collect Their USDC-Compatible Wallet AddressesGuide employees in setting up secure wallets (e.g., MetaMask) that support USDC on supported blockchains, and collect wallet addresses securely for payroll distribution.

-

5. Execute Payroll Disbursements and Provide Transparent Payment Records to EmployeesProcess payments through your payroll platform, leveraging blockchain’s immutable ledger to give employees real-time, transparent access to payment records for easy verification and auditing.

Optimizing Your Cross-Border Payroll Workflow

To further optimize your cross-border crypto payroll process:

- Monitor real-time market data. Stay informed about current USDC prices ($0.0554) and network fees before each disbursement cycle.

- Create an internal FAQ or resource hub. Address common employee questions about receiving, storing, or converting USDC into local currency.

- Cultivate open feedback channels. Regularly solicit input from employees regarding their experience with stablecoin payments so you can refine processes over time.

The shift toward stablecoin-based salaries is fundamentally transforming how startups and tech companies pay remote employees in Latin America. By following these five critical steps, choosing a regulated platform, verifying compliance, onboarding wallets, funding accounts at accurate market prices like $0.0554, and executing transparent disbursements, you not only reduce costs but also empower your workforce with faster access to earnings and greater financial autonomy. As regulatory frameworks evolve across LATAM markets, crypto-native payroll solutions will continue to unlock new efficiencies for global teams seeking agility and transparency in cross-border compensation.