Paying remote developers in Latin America is no longer a logistical headache or a compliance minefield. Thanks to USDC payroll solutions, startups and tech companies can now deliver stablecoin salaries instantly, securely, and with minimal friction. If you’re scaling a distributed engineering team in Brazil, Argentina, or Mexico, leveraging USDC is a strategic advantage that eliminates currency volatility and banking delays.

Why USDC Payroll Is Transforming Cross-Border Payments

Traditional cross-border payroll for startups is fraught with hurdles: high wire fees, unpredictable exchange rates, and long settlement times. Latin America’s financial infrastructure only compounds these issues with inflation risk and patchy local banking systems. Enter USDC payroll, where stablecoins pegged 1: 1 to the US dollar cut through the noise. Developers receive their pay at full value, on time, every time – no more watching salaries erode due to currency swings.

Platforms like Bitwage and Remote have embraced this model by integrating USDC payouts across the region. Bitwage leverages the Stellar blockchain for lightning-fast settlements, while Remote’s Stripe partnership enables compliant stablecoin salary payments in 69 countries, including all major Latin American tech hubs.

A Step-by-Step Playbook for Paying Remote Developers with Crypto

The process is surprisingly simple yet robust. Here’s how to pay remote developers with crypto using USDC:

Steps to Set Up USDC Payroll for Latin American Developers

-

Create and Verify Your Business AccountRegister your company on the chosen platform and complete all required identity and business verifications to ensure regulatory compliance.

-

Fund Your Payroll AccountDeposit funds via bank transfer or cryptocurrency to your payroll account, ensuring you have enough to cover all upcoming USDC payments.

-

Onboard Your DevelopersInvite developers to the platform and collect their USDC-compatible wallet addresses. Provide guidance on wallet setup and USDC management if needed.

-

Process and Schedule PayrollInput payment details, schedule payouts, and let the platform handle USDC distribution to your developers’ wallets quickly and securely.

-

Stay Compliant with Local RegulationsMonitor crypto payroll regulations in both your country and your developers’ countries. Use platforms that prioritize legal compliance to minimize risk.

1. Select Your Payroll Platform: Compare features between providers like Bitwage (Stellar-based), Remote (Stripe integration), and Conduit (USD-focused). Prioritize platforms that offer compliance support and transparent fee structures.

2. Complete Verification: Onboard your business by submitting KYC documentation, this keeps your operation compliant from day one.

3. Fund Your Account: Deposit USD via bank transfer or crypto rails. Platforms convert these funds into USDC as needed.

4. Onboard Developers: Invite your team to register their own wallets, Metamask, Coinbase Wallet, or any other ERC-20 compatible option works.

5. Schedule Payroll Runs: Enter payment details, set recurring schedules if needed, and trigger payouts directly in USDC.

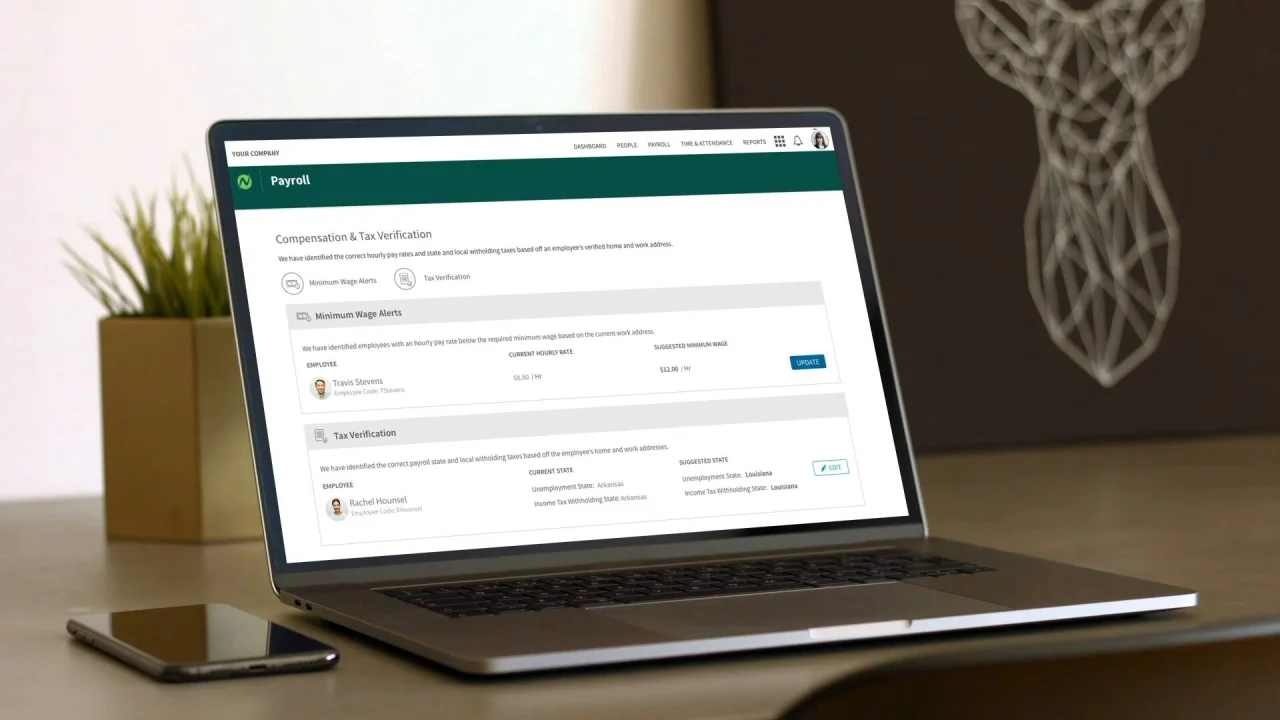

The Compliance Edge: Navigating Taxation and Regulation

No matter how frictionless crypto payroll seems on the surface, regulatory oversight still matters, especially across borders. The best platforms automate compliance checks and provide auditable transaction records for both you and your developers. For instance, Conduit helps teams sidestep local inflation by enabling direct USD payments via crypto rails while maintaining robust reporting tools.

If you’re serious about mitigating legal exposure while scaling globally, always choose services that prioritize tax-compliant payout flows tailored to both sender and recipient jurisdictions.

With the groundwork in place, the operational advantages of USDC payroll for Latin America become clear. Developers enjoy near-instant access to their earnings, and businesses sidestep the bureaucracy and expense of legacy banking rails. The result? Faster team onboarding, increased retention, and a tangible edge in today’s hyper-competitive remote hiring market.

Real-World Impact: What Developers Are Saying

The feedback from Latin American developers paid via stablecoin salary is overwhelmingly positive. Many cite the ability to avoid local currency devaluation as a game-changer for their financial planning. Others appreciate how USDC eliminates delays, no more waiting days for international wires or losing value to hidden conversion fees.

Teams using platforms like Bitwage and Remote report smoother onboarding and fewer payroll disputes. Instead of wrestling with outdated compliance paperwork or explaining wire delays, founders can focus on product velocity and growth.

Key Benefits at a Glance

Top 5 Advantages of USDC Payroll for Cross-Border Tech Teams

-

1. Fast, Reliable Payments: USDC transactions settle within minutes on blockchains like Stellar, enabling remote developers to receive their earnings almost instantly—far quicker than traditional international wire transfers.

-

2. Cost-Effective Cross-Border Transfers: Platforms such as Bitwage and Remote leverage USDC to significantly reduce transaction fees compared to banks and remittance services, saving both employers and developers money on every payroll cycle.

-

3. Protection Against Currency Volatility: USDC is a stablecoin pegged 1:1 to the US dollar, shielding Latin American developers from local currency devaluation and inflation—a major advantage in high-volatility markets.

-

4. Seamless Global Access and Conversion: Developers can easily receive USDC in compatible wallets and convert it to local currency or use it directly for purchases, offering greater financial flexibility and accessibility than traditional banking.

-

5. Enhanced Transparency and Compliance: Leading payroll services like Remote and Conduit offer robust compliance tools, audit trails, and transparent reporting, helping companies stay aligned with international regulations when paying remote tech teams.

Strategic Takeaways for Startups

If you’re building or scaling a distributed engineering team in Latin America, integrating cross-border payroll with crypto isn’t just a technical upgrade, it’s a strategic imperative. Here’s why:

- Competitive advantage: Offer faster, more reliable payments than your rivals still tied to traditional banking.

- Cost control: Reduce overhead by slashing transaction fees and avoiding punitive FX rates.

- Compliance confidence: Choose platforms that automate reporting so you stay ahead of regulatory changes, no surprises at tax time.

The bottom line: stablecoin salary solutions like USDC payroll let you build trust with your remote workforce while streamlining operations. That’s how you attract, and keep, the best technical talent across borders.

If you’re ready to empower your developers with borderless payments, explore providers such as Bitwage, Remote, or Conduit. The future of cross-border payroll is here, and it’s stable, compliant, and built on blockchain transparency.