Global remote work is no longer a trend – it’s the new standard. As teams stretch across continents and time zones, businesses are reimagining how to pay their people quickly, securely, and cost-effectively. In 2024, stablecoin payroll services are at the heart of this transformation, offering a pragmatic answer to the persistent challenges of cross-border salary payments.

Why Stablecoins Are Gaining Ground in Payroll

Traditional international payroll systems are notorious for their complexity: slow bank transfers, high fees, currency conversion headaches, and opaque delays. Stablecoins like USDC have emerged as a solution that cuts through these obstacles. By pegging their value to the US dollar and leveraging blockchain rails, stablecoins deliver predictable value, near-instant settlement, and transparent records.

The latest partnership between Remote and Stripe underscores this shift. As of December 2024, companies can pay contractors in 69 countries using USDC on the Base network – eliminating ACH bottlenecks and giving recipients immediate access to funds in a stable currency (source). This isn’t just about speed; it’s about empowering workers with financial autonomy in an unpredictable global economy.

The Practical Benefits for Remote Teams

Key Advantages of Stablecoin Payroll for Global Teams

-

Near-Instant Global Payments: Platforms like Remote and Stripe now enable contractors in 69 countries to receive stablecoin payments (e.g., USDC on Base) within minutes, eliminating traditional banking delays.

-

Protection from Currency Volatility: Stablecoins such as USDC are pegged to the US dollar, helping remote workers avoid unpredictable local currency swings and ensuring consistent value in their earnings.

-

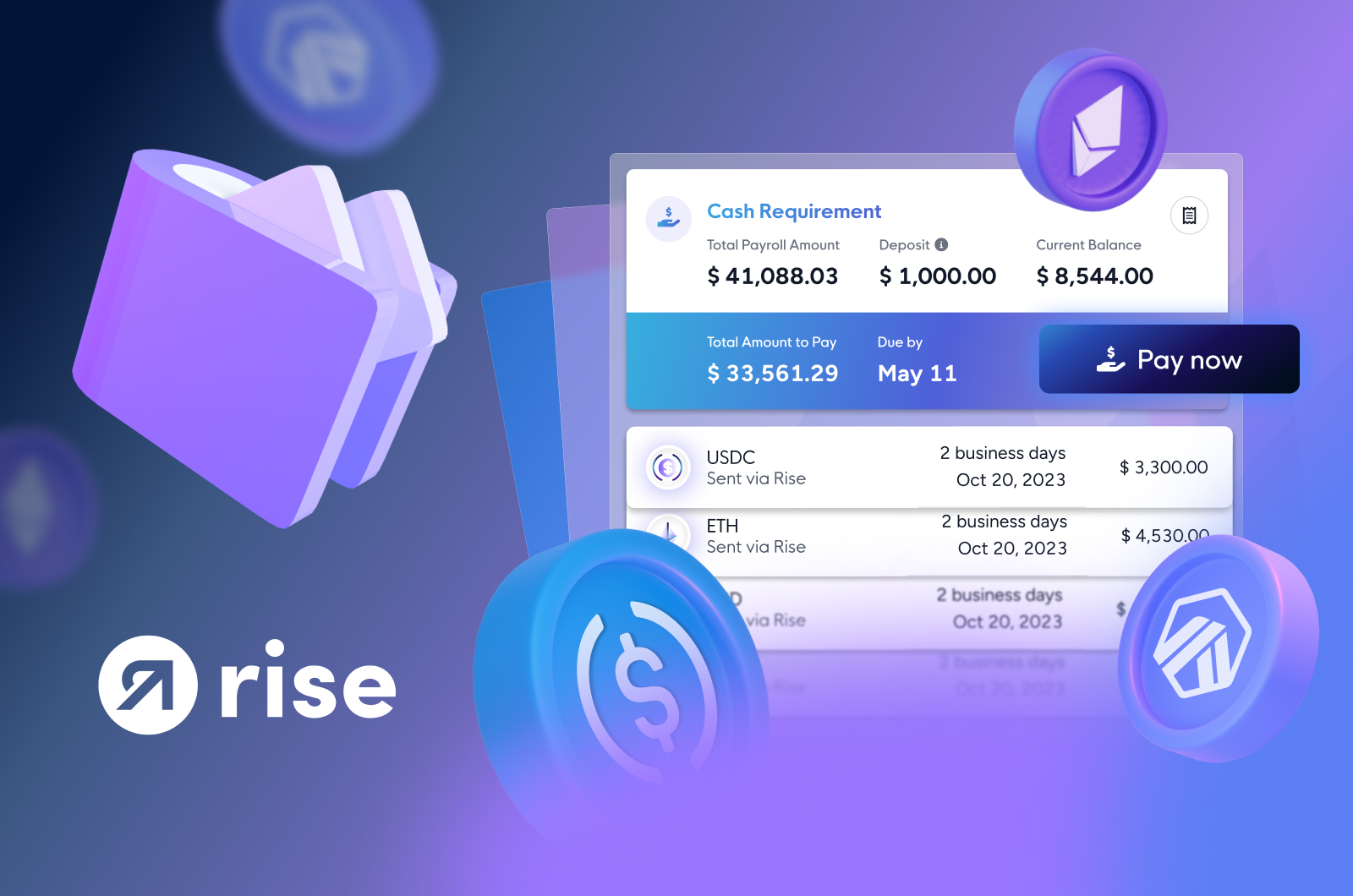

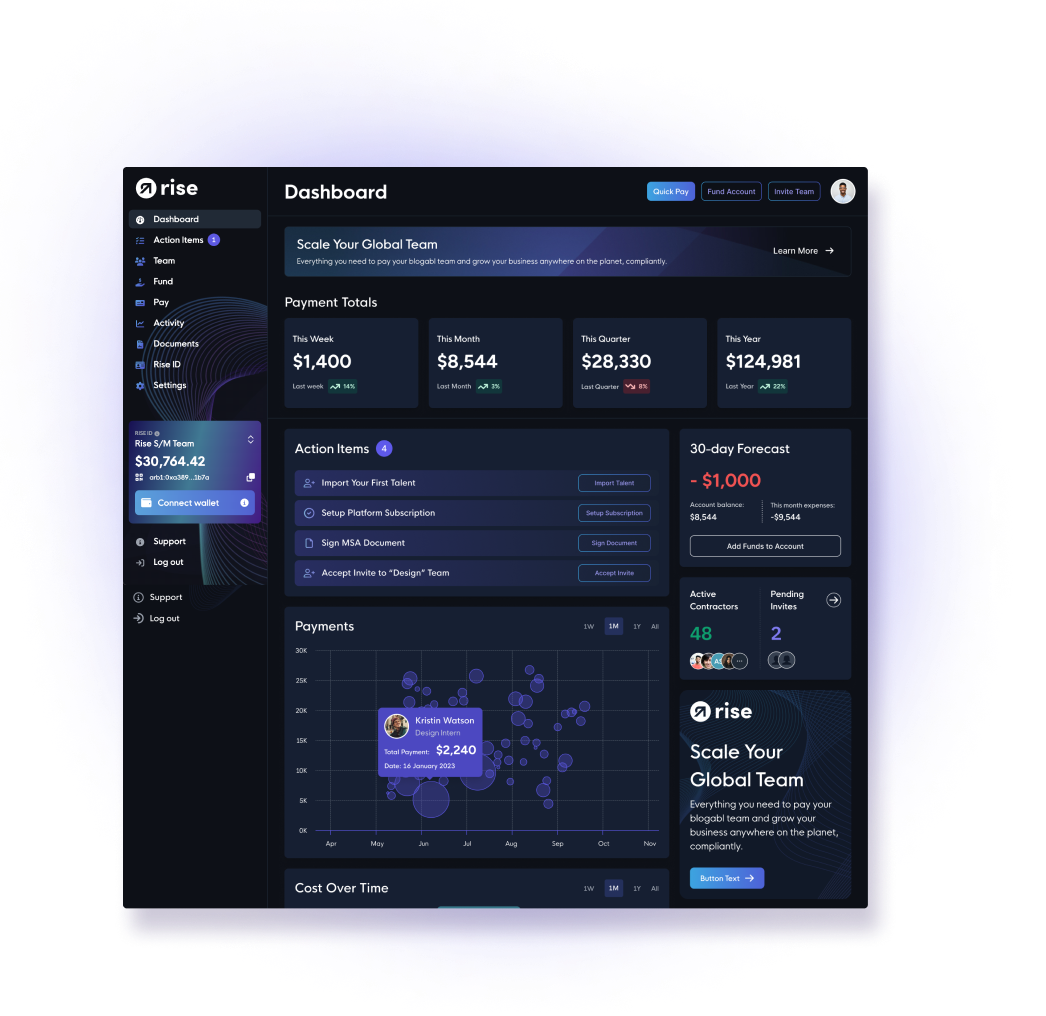

Lower Transaction Fees: Leading platforms like Rise and Bitwage offer stablecoin payroll with significantly reduced cross-border fees compared to banks or wire transfers, maximizing take-home pay for freelancers.

-

Greater Financial Autonomy: Receiving pay in stablecoins gives remote workers direct access to their funds, which can be used instantly for savings, spending, or investing in DeFi applications—no waiting for bank processing.

-

Streamlined Compliance and Reporting: Platforms such as Toku integrate stablecoin payroll with existing HR systems, providing clear pay stubs, automated tax reporting, and reducing administrative headaches for both employers and employees.

The appeal goes beyond fast transactions. Stablecoin salary benefits include:

- Reduced transaction costs: No more wire transfer fees or hidden bank charges eating into paychecks.

- Borderless payments: Teams can be paid anywhere there’s internet access – no local bank account required.

- Financial transparency: Blockchain records provide clear audit trails and instant reporting for both employers and employees.

- No currency conversion loss: Salaries stay pegged to the dollar with USDC salary payments, protecting against local currency devaluation.

This operational smoothness leads to fewer disputes over pay amounts and timing – a win for compliance teams and workers alike (source). As noted by Bitwage and other crypto payroll pioneers, these efficiencies are driving rapid adoption among startups, tech firms, and digital nomads seeking reliable cross-border payroll solutions.

From Niche to Mainstream: The Expansion of Crypto Payroll Platforms

The landscape of crypto payroll for remote teams is evolving fast. Platforms like Rise Works have set new benchmarks with low fees and fast processing times. Meanwhile, integrations such as Toku’s partnership with Gusto simplify onboarding international contractors without overhauling existing HR infrastructure. Even established players like Remote are now supporting stablecoin payouts alongside fiat options – reflecting growing demand from both employers and talent pools worldwide.

This surge is not just anecdotal; it’s backed by market data showing increased adoption rates throughout 2024. Companies are recognizing that offering payment in stablecoins is not just an operational upgrade but also a competitive advantage when attracting top remote talent.

With stablecoin payroll services, the process of paying international freelancers and contractors becomes seamless. Workers no longer wait days for funds to clear or lose a portion of their earnings to intermediary fees. Instead, they receive USDC salary payments in minutes, with the confidence that their compensation will retain its value regardless of local currency volatility. This is particularly vital for digital nomads and remote professionals in regions grappling with inflation or restrictive banking systems.

Navigating Compliance and Security in Crypto Payroll

Of course, integrating stablecoins into payroll isn’t just about convenience. Regulatory compliance remains essential. In the United States, employers can pay wages in stablecoins like USDC as long as employees consent and all tax obligations are met (source). Leading platforms are building robust compliance frameworks to ensure reporting is accurate and transparent, reducing risk for both sides of the employment relationship.

Security is another cornerstone. Blockchain technology offers immutable records and end-to-end traceability, but it’s crucial that companies choose providers with strong security protocols and user-friendly interfaces. As always, educating teams on wallet management and phishing risks is part of responsible global payroll operations.

For businesses making the switch to crypto payroll for remote teams, the transition need not be daunting. Most platforms now offer guided onboarding, automated tax documentation, and integrations with popular HR tools, making it easier than ever to manage cross-border payroll solutions at scale.

What’s Next? The Future of Stablecoin Salaries

The momentum behind stablecoin salary benefits shows no sign of slowing as we move into 2025. Industry leaders predict that more countries will clarify regulations around digital assets, paving the way for even broader adoption. Meanwhile, competition among platforms is driving down costs and improving user experience, benefiting both employers and remote workers alike.

Stablecoin payroll isn’t just a new payment method, it’s a fundamental shift in how we think about work and compensation across borders.

The bottom line: Stablecoins like USDC are empowering remote professionals with timely payments and financial stability while giving businesses a practical edge in a fiercely competitive talent market. As this ecosystem matures, expect to see even more innovation around instant payouts, DeFi savings options for workers, and sophisticated compliance tools designed for a global workforce.