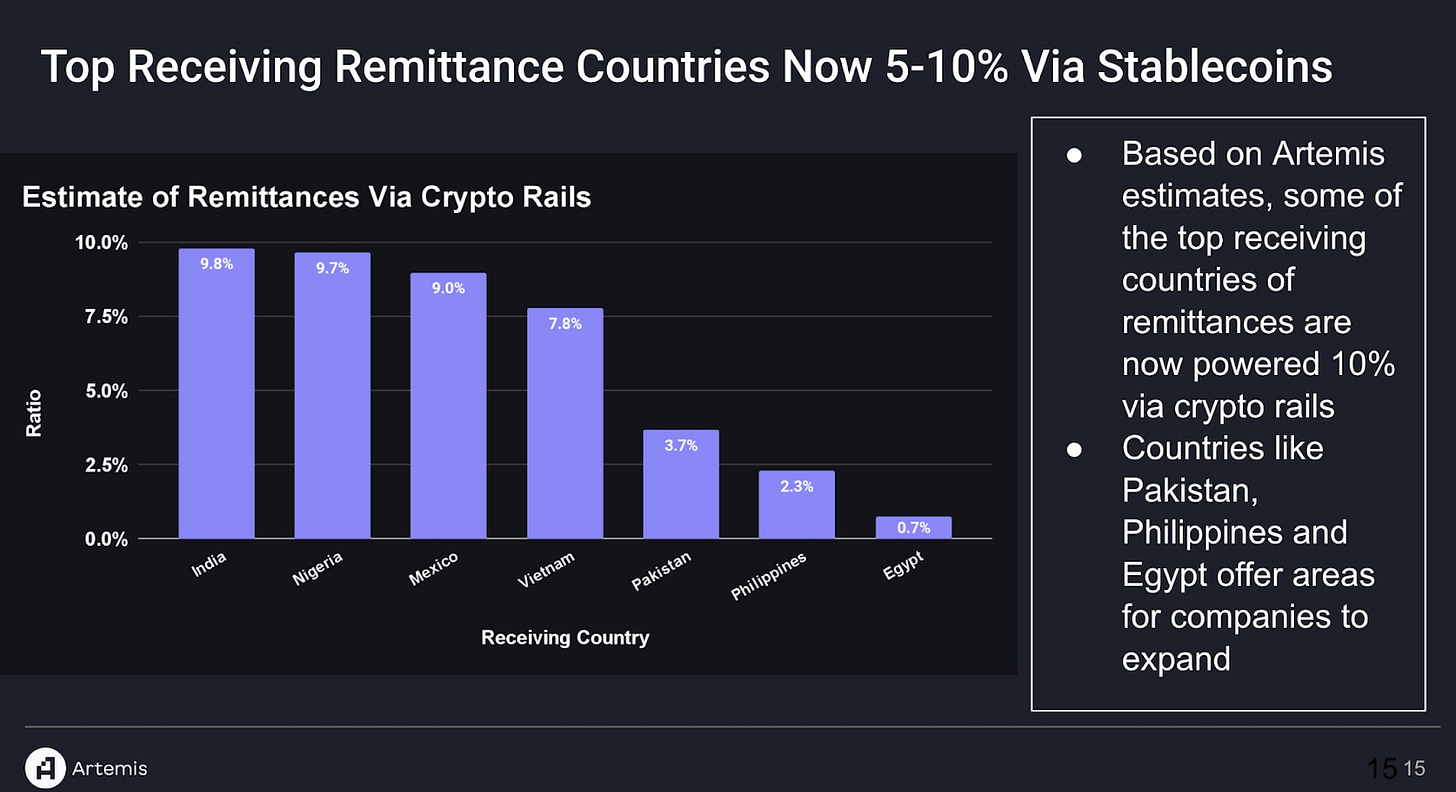

In a world where remote work spans continents and traditional banking lags behind, USDC payroll has emerged as the undisputed leader, capturing 63% of all crypto salaries worldwide. As of August 2025, 9.6% of workers now receive part or all of their pay in digital assets, a sharp rise from 3% in 2023. USDC, pegged steadfastly at $1.00, tops the charts thanks to its reliability in cross-border crypto payroll for remote teams.

USDC’s Grip on the Stablecoin Payroll Market

The Stablecoin Payroll Report 2025 from Riseworks lays it bare: despite a smaller overall market cap compared to rivals like USDT, USDC commands 63% of the stablecoin payroll segment. This isn’t mere hype; it’s rooted in practical advantages for global employers. Platforms like Circle enable seamless integration, slashing settlement times from days to near-instant, as highlighted in their collaboration with Rise. For startups and tech firms managing stablecoin salaries for remote teams, this means predictable cash flow without the volatility that plagues Bitcoin or Ethereum payouts.

Pantera Capital’s 2024 Blockchain Compensation Survey echoes this, pegging USDC at over 60% of crypto wages. Stablecoins now dominate more than 90% of digital asset compensation, with USDC leading the charge. In regions plagued by currency instability, teams in Asia or Latin America bypass local banking hurdles via USDC’s blockchain transparency.

Key Advantages Driving USDC Global Payments Adoption

Faster payments top the list of benefits, but it’s the trifecta of speed, low fees, and ironclad stability that seals the deal for USDC global payments. Traditional wires can cost 5-7% in fees and take 3-5 days; USDC transactions settle in minutes for fractions of a cent. Circle’s monthly reserve reports build trust, confirming full backing and differentiating USDC from less transparent alternatives.

Consider hybrid models gaining traction: fiat topped up with USDC for contractors. This flexibility suits digital nomads and remote developers who value instant access over weekend bank closures. Riseworks’ Top 10 Benefits for 2026 underscores how crypto payroll platforms like these cut costs by up to 80%, per industry benchmarks.

USD Coin (USDC) Price Prediction 2027-2032

Stability Projections Emphasizing $1.00 Peg for Payroll Reliability Amid 63% Crypto Payroll Dominance

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Key Scenario |

|---|---|---|---|---|---|

| 2027 | $0.995 | $1.00 | $1.005 | 0.00% | Regulatory clarity boosts confidence; minor volatility from market cycles |

| 2028 | $0.990 | $1.00 | $1.010 | 0.00% | Bear market depeg risk; quick recovery via Circle reserves |

| 2029 | $0.995 | $1.00 | $1.005 | 0.00% | Bull cycle premium; payroll adoption surges to 70% share |

| 2030 | $0.985 | $1.00 | $1.015 | 0.00% | Competition intensifies; tech upgrades maintain peg |

| 2031 | $0.990 | $1.00 | $1.010 | 0.00% | Global regulation harmonization; hybrid fiat-crypto models |

| 2032 | $0.995 | $1.00 | $1.020 | +0.50% | Mass adoption drives temporary premium; real-time payroll dominance |

Price Prediction Summary

USDC is expected to maintain exceptional price stability around its $1.00 USD peg through 2032, with tight min/max ranges reflecting resilient reserves, 63% payroll market leadership, and growing cross-border use cases. Average prices hold steady at $1.00, with minor deviations in stress scenarios quickly resolved, supporting reliable payroll applications.

Key Factors Affecting USD Coin Price

- Continued 63% dominance in stablecoin payroll transactions

- Circle’s transparent monthly reserve attestations

- Favorable regulatory developments for stablecoins globally

- Technological advancements in real-time cross-border payments (e.g., Circle, Zebec integrations)

- Increasing hybrid fiat-crypto compensation models

- Macro USD strength and competition from USDT/other stablecoins

- Market cycles influencing short-term depegging risks but not long-term peg

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Real-World Wins for Remote Contractor USDC Payments

Zebec’s push into real-time stablecoin payroll previews the future, accelerating rather than upending banks. Wall Street’s scramble for stablecoin talent, with soaring pay packages, signals mainstream buy-in. Yet for everyday remote teams, the proof is in compliance: Bitwage and similar services ensure IRS-friendly tracking, navigating rules that snag pure crypto plays.

A BeInCrypto survey confirms USDC’s 60% payroll market share, while The Tech Report notes stablecoins at 65% of transactions. For tech startups eyeing expansion, check out how USDC payroll streamlines salaries across 100 countries. This pragmatic shift empowers teams to focus on work, not wires.

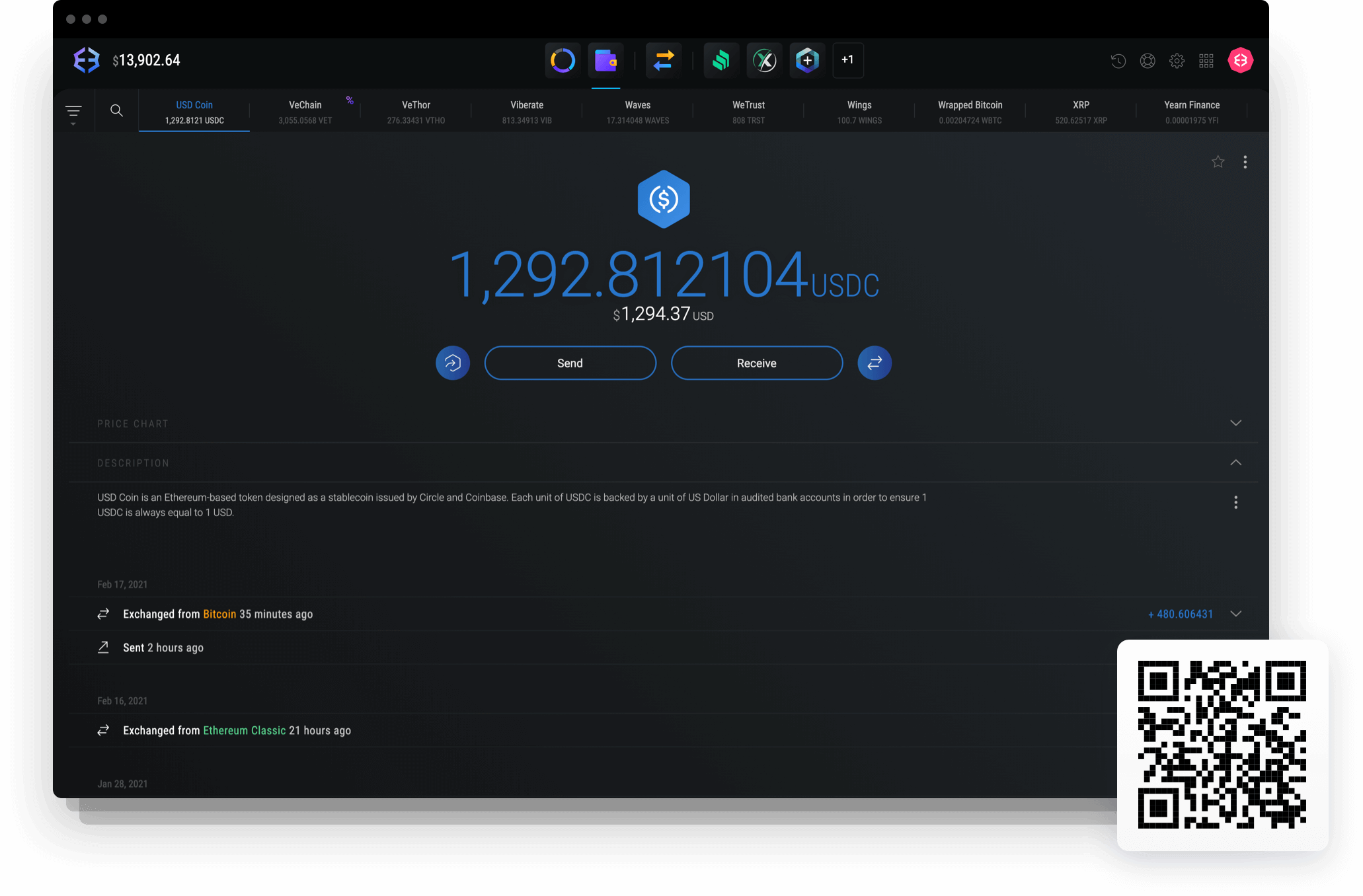

Employers report smoother onboarding for international hires, with embedded wallets simplifying remote contractor USDC payments. No more chasing SWIFT codes or forex losses; blockchain handles it all at $1.00 per USDC.

That stability at $1.00 per USDC eliminates the guesswork, letting finance teams budget with the precision of fiat without the drag of borders.

Navigating Challenges in Stablecoin Salaries for Remote Teams

Regulatory headwinds persist, as IRS guidelines on crypto reporting add layers of complexity. Yet platforms attuned to compliance turn these into manageable steps, automating tax forms and 1099s for USDC payroll. Acuity notes stablecoin payroll’s momentum, with USDC at 63% despite scrutiny; the key lies in transparent on-chain records that auditors appreciate more than opaque wires.

Volatility fears? Negligible for USDC, backed by Circle’s reserves. In contrast to Bitcoin salaries pushed aside by regs, stablecoins align with employer caution. For remote teams in high-inflation zones, USDC acts as a hedge, preserving purchasing power that local currencies erode daily.

Top USDC Payroll Benefits

-

Faster Settlements: Replaces days-long wires with near-instant blockchain transfers, as seen in Circle’s USDC integrations for Rise.

-

80% Cost Cuts: Reduces cross-border fees by up to 80% compared to traditional banks, per Riseworks stablecoin payroll reports.

-

Instant Access: Employees gain 24/7 access to stable $1.00 USDC funds without banking delays or holidays.

-

Compliance Tools: Platforms like Circle provide transparent reserves and IRS-compliant reporting for regulated payroll.

-

Hybrid Options: Combine USDC with fiat payouts, popular in Asia for bypassing restrictions, holding 63% crypto payroll share.

Hybrid setups shine here: 45% of crypto-offering firms blend USDC with fiat, per Rise data, easing transitions for wary employees. This pragmatic blend future-proofs payroll without forcing all-in bets on crypto.

Future-Proofing with Crypto Payroll Platforms

Looking ahead, Zebec’s real-time streams hint at payroll evolution, where salaries drip continuously rather than monthly lumps. Wall Street’s talent war underscores demand; banks now court stablecoin experts with premium pay, signaling institutional pivot. For startups, this levels the field: pay a developer in Manila or Madrid with equal ease via crypto payroll platforms.

Integration is straightforward. Services like Bitwage or Rise plug into existing HR systems, converting fiat to USDC at $1.00 and distributing via wallets or cards. No forex spreads, no holidays delaying funds. Tech firms scaling to 100 countries find this indispensable, as one guide details for streamlining across borders.

Security bolsters adoption: multi-sig wallets and insured custodians mitigate risks, while blockchain’s audit trail outpaces banks. Employees convert USDC to local tender via exchanges or ramps, often cheaper than ATMs abroad.

Costs plummet too. Where wires gobble 7%, USDC hovers under 0.1%, freeing budgets for growth. Remote contractors appreciate instant crediting, ditching weekend waits. As Pantera’s survey projects, USDC’s lead will widen, hitting 70% by 2026 amid rising remote work.

For digital nomads and distributed squads, stablecoin salaries for remote teams aren’t a fad; they’re the efficient backbone of global ops. Platforms embedding wallets further simplify, as explored in resources on embedded solutions. Employers who adapt now sidestep tomorrow’s frictions, balancing innovation with reliability in a borderless workforce.