For global businesses and remote teams, managing cross-border payroll is often a tangled web of intermediaries, hidden fees, and frustrating delays. Traditional bank wires and legacy payment systems force companies to navigate a maze of compliance checks and opaque transaction trails. This lack of transparency not only erodes trust but also increases the risk of errors and disputes. Enter blockchain technology: a game-changer that’s rewriting the rules for international payroll with its promise of radical transparency, security, and efficiency.

Why Transparency Matters in Global Payroll

Transparency isn’t just a buzzword – it’s the backbone of reliable cross-border payroll operations. When employees and contractors are scattered across continents, the ability to track payments in real-time becomes crucial. Blockchain’s decentralized ledger records every transaction immutably, providing an auditable trail from employer to employee. This means no more guessing when funds will arrive or whether they’ve been tampered with along the way.

According to AcademyFlex, blockchain creates a public record that both employers and employees can access at any time. This shared visibility eliminates blind spots, reduces disputes over payment status, and fosters trust across borders. As more companies embrace blockchain payroll transparency, employees gain confidence that their compensation is handled fairly and efficiently.

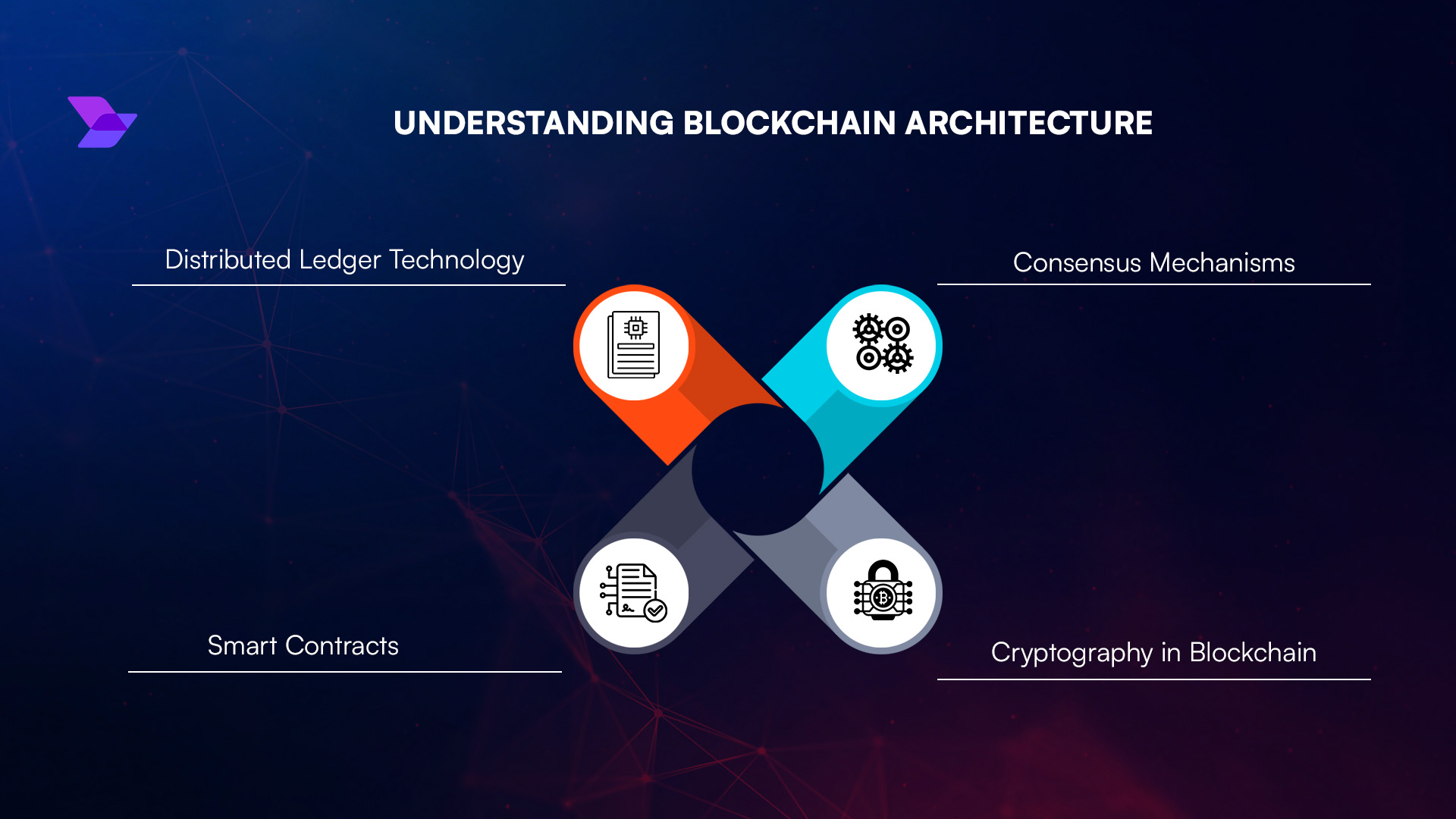

The Mechanics: How Blockchain Delivers Crystal-Clear Payroll Records

The heart of blockchain’s value lies in its structure: every transaction is grouped into a block, cryptographically secured, then linked to the previous block to form an unbreakable chain. Once recorded, these transactions can’t be altered without consensus from the network – making fraud or retroactive changes nearly impossible.

This tamper-proof environment is especially powerful for audits and compliance. Regulators or internal auditors can quickly verify payment histories without sifting through messy spreadsheets or relying on third-party banks for confirmation. As noted by ResearchGate, this level of security significantly reduces the risks associated with cross-border payroll fraud.

Key Benefits of Blockchain in Cross-Border Payroll

-

Real-Time Payment Transparency: Blockchain’s public ledger records every payroll transaction in a transparent, tamper-proof way, allowing both employers and employees to track payments in real time and verify accurate, prompt transfers.

-

Enhanced Security and Fraud Prevention: Payroll data on blockchain is encrypted and decentralized, making it highly resistant to unauthorized access, tampering, and fraud. Each transaction is validated by multiple network nodes, ensuring robust protection.

-

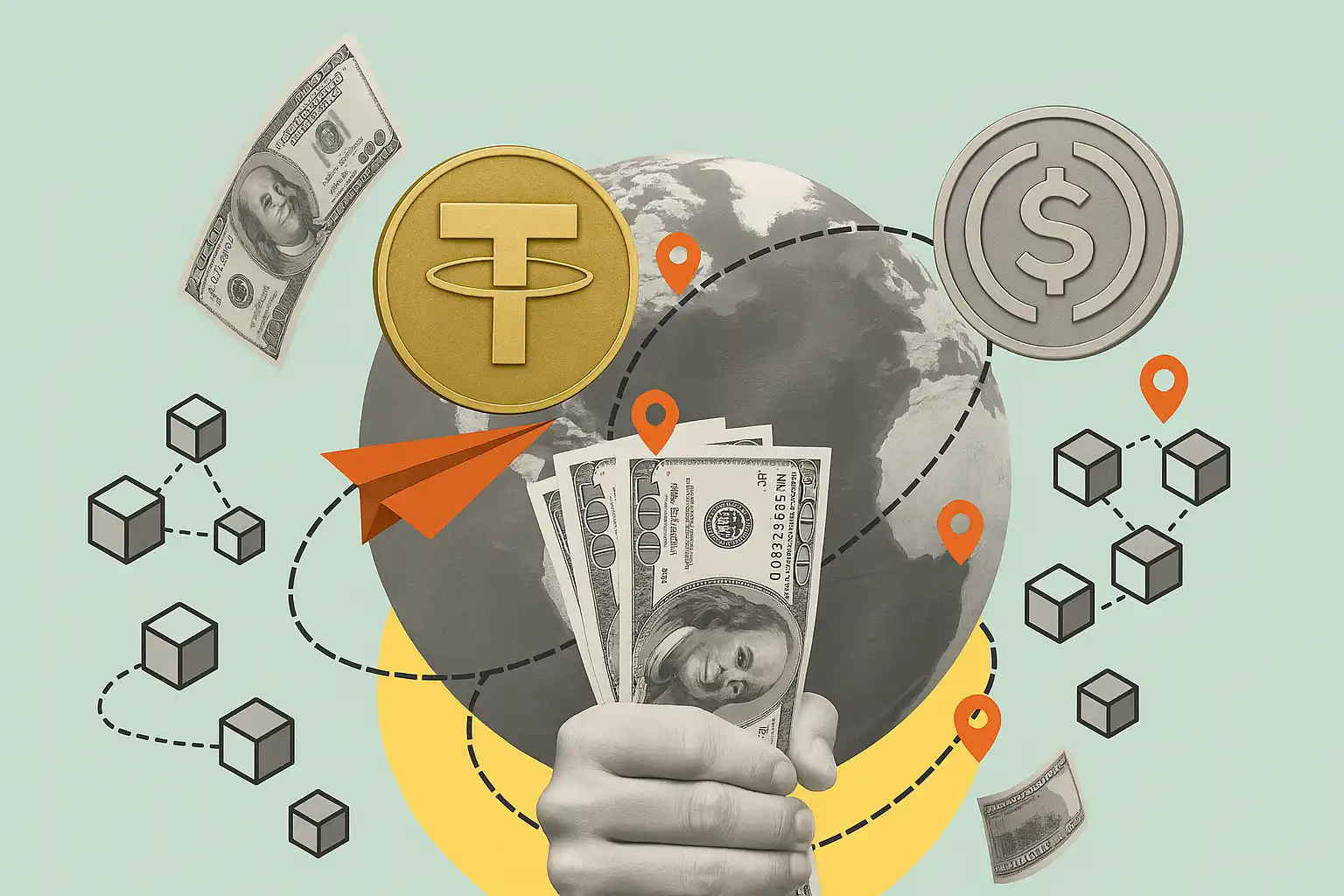

Lower Costs and Faster Settlements: By eliminating intermediaries like banks and payment processors, blockchain reduces transaction fees and enables cross-border payroll payments to be completed within minutes instead of days.

-

Simplified Compliance and Auditability: Blockchain’s immutable ledger provides a clear, verifiable audit trail for all payroll transactions, streamlining compliance with international regulations and tax laws while making audits more efficient.

-

Proven Real-World Solutions: Companies such as TruBit Business use blockchain and stablecoins like USDT to help U.S. tech firms pay employees in Latin America quickly, transparently, and cost-effectively.

Real-Time Payments Without Borders

Blockchain’s transparency is matched by its speed. By cutting out banking intermediaries, crypto payroll solutions enable instant settlement – no more waiting days for funds to clear or dealing with surprise deductions from correspondent banks. Employees receive their salaries promptly in stablecoins like USDC or USDT, which hold their value regardless of local currency fluctuations.

A compelling example comes from TruBit Business’ USDT solution: U. S. -based tech firms now pay Latin American staff in minutes rather than days, with every step visible on-chain (The Block Beats). The result? Transparent processes that empower both employers aiming for global reach and talent seeking predictable compensation.