In 2025, the landscape of global payroll is undergoing a seismic shift, powered by the adoption of USD Coin (USDC) for remote teams. As businesses expand across borders and tap into international talent pools, the need for fast, low-cost, and compliant salary payments has never been more urgent. USDC payroll is emerging as the preferred solution, offering a seamless blend of speed, stability, and transparency that traditional banking simply cannot match.

![]()

USDC Payroll: The New Standard for Remote Compensation

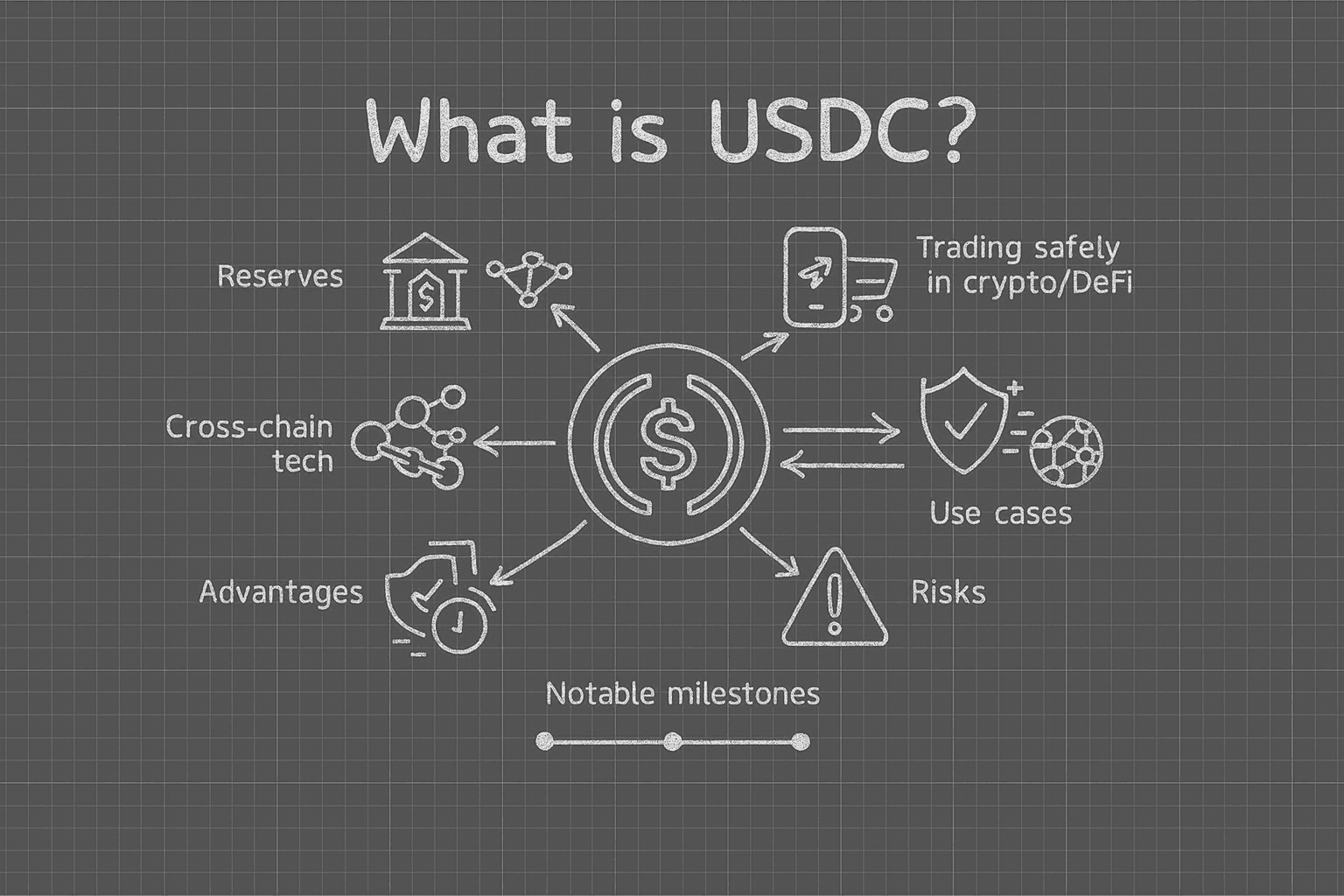

Stablecoins like USDC are fundamentally changing how organizations pay employees and contractors worldwide. Pegged to the U. S. dollar and backed by transparent reserves, USDC enables borderless salary payments that are immune to the volatility plaguing other cryptocurrencies. The result? Remote workers can receive their earnings in minutes rather than days or weeks, regardless of where they live.

This transformation is not just theoretical. In December 2024, Remote, a leading HR platform, joined forces with Stripe to allow U. S. -based companies to pay contractors in 69 countries using USDC on the Base network. This move has set a new benchmark for what’s possible in global payroll: instant settlement, minimal fees, and robust compliance, all integrated into familiar business workflows.

The Business Case: Why CFOs Are Choosing USDC Payroll in 2025

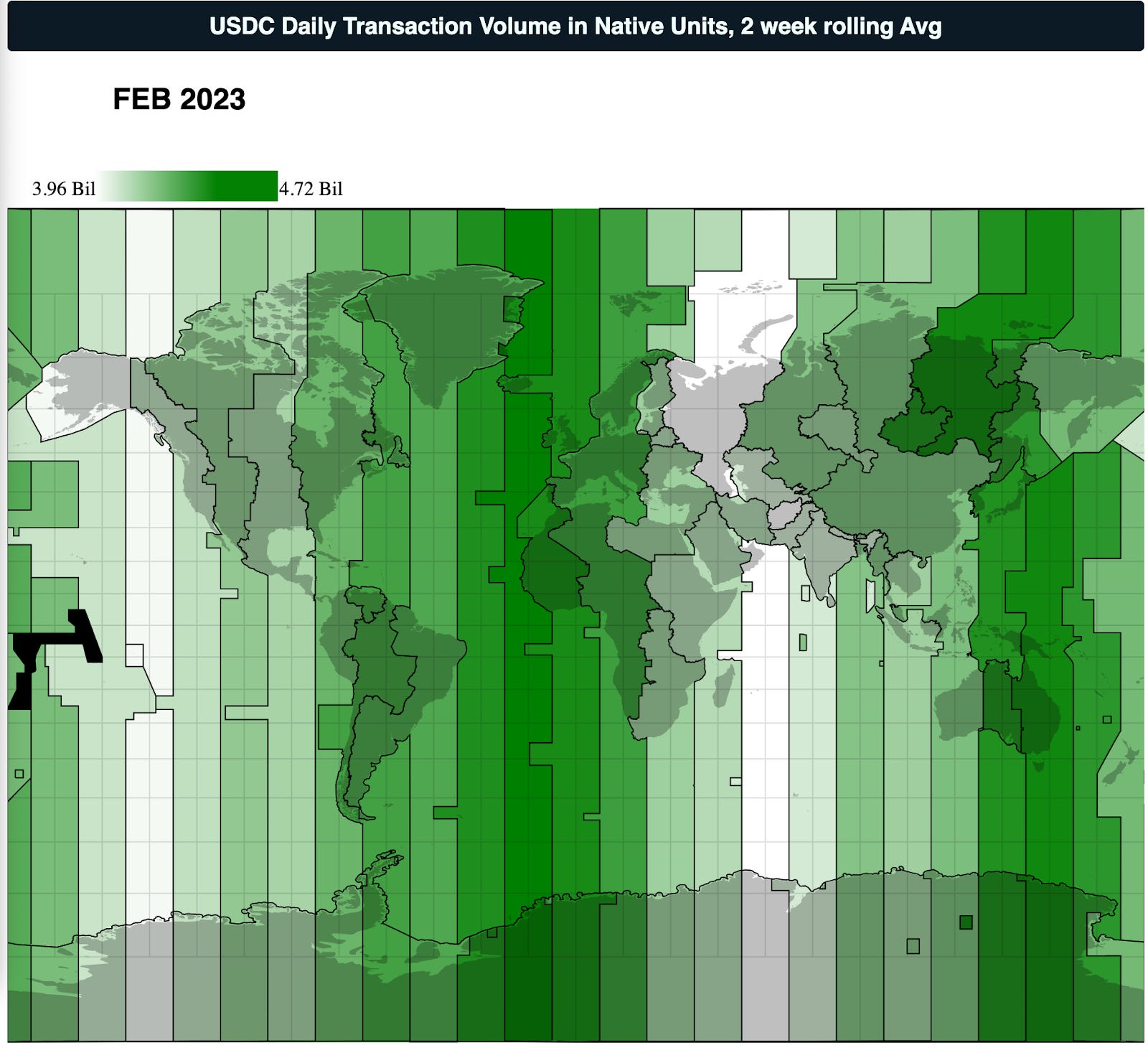

The numbers speak volumes. According to recent industry data:

- 98% reduction in international payment costs compared to legacy wire transfers (RebelFi)

- 3-5% total payroll cost savings thanks to lower transaction and conversion fees

- 90% decrease in B2B transaction friction, enabling smoother operations for globally distributed teams

A standout example is Rise, a hybrid fiat-and-crypto payroll platform, which by June 2025 had processed over $650 million in payroll volume. More than half of their contractors now opt for stablecoin withdrawals such as USDC, underscoring growing demand from both businesses and workers for crypto-native financial solutions.

The Key Benefits: Speed, Savings, Stability, and Compliance

Speed: Unlike traditional wires that can be delayed by weekends or banking holidays, USDC transactions settle within minutes on blockchain networks like Base or Ethereum. This empowers remote workers to access their salaries almost instantly, an advantage that’s especially critical during emergencies or economic uncertainty.

Savings: By eliminating intermediaries such as correspondent banks and reducing reliance on currency conversions, companies save significantly on every cross-border payment. For startups operating on thin margins or scaling quickly across continents, these savings compound rapidly.

Stability: As a fully-backed stablecoin pegged 1: 1 with the U. S. dollar, USDC shields recipients from crypto market swings while providing all the efficiency benefits of digital assets.

Compliance and Transparency: Every USDC payment is recorded on-chain with real-time tracking, streamlining audits and simplifying regulatory reporting across jurisdictions. Platforms like Rise have built-in compliance features that help businesses navigate local tax laws and KYC/AML requirements effortlessly.

A Real-World Shift: How Remote Teams Are Benefiting Today

The practical impact of adopting global payroll with USDC is best illustrated through real-world case studies. For instance, one fully remote tech company was struggling with high fees and slow settlements using traditional banking rails. After switching to USDC payroll via TransFi’s platform in early 2025, they achieved faster settlements (from days to minutes), reduced operational complexity, and boosted employee satisfaction thanks to predictable pay cycles.

This isn’t an isolated story; it reflects a broader trend among tech firms, creative agencies, Web3 projects, and even established multinationals, who are rethinking how they compensate global teams securely and efficiently.

For remote workers, the benefits are tangible: instant access to funds, no surprise deductions from intermediary banks, and the ability to choose how and when to convert their stablecoin salary into local currency. This flexibility is especially valuable in regions with capital controls or volatile local currencies, where traditional banking can be restrictive or unreliable.

Top Advantages of USDC Payroll for Remote Teams in 2025

-

Near-Instant Global Payments: USDC transactions settle within minutes, allowing remote workers to access their earnings almost instantly—no matter where they are in the world.

-

Significantly Lower Transaction Costs: By removing intermediaries, USDC payroll slashes international transfer and currency conversion fees, leading to substantial savings for both companies and remote employees.

-

Enhanced Transparency and Compliance: Blockchain-powered USDC payroll provides real-time transaction tracking, simplifying audits and ensuring compliance with international payroll regulations.

-

Stable Value, No Crypto Volatility: As a stablecoin pegged to the U.S. dollar, USDC protects remote workers from the price swings common in other cryptocurrencies, ensuring predictable compensation.

-

Flexible Payout Options: Remote contractors can choose to receive payments in USDC or convert to local currency, offering flexibility and control over their earnings.

-

Proven Real-World Impact: Companies like those using TransFi have reported faster settlements, reduced costs, and improved payroll experiences for global teams after switching to USDC.

Platforms like Remote and Rise are setting new standards for borderless salary payments. Their integrations ensure that USDC payroll is not only fast and affordable but also user-friendly for both employers and team members. The onboarding process is streamlined; employees can receive USDC directly into a secure digital wallet, often without needing to open a foreign bank account. This democratizes access to global work opportunities while reducing administrative burdens.

Security is another crucial pillar. Because every transaction is cryptographically verified on public blockchains, the risk of payment fraud or misrouting is drastically reduced. Multisig wallets and advanced custody solutions further protect company funds and employee earnings, providing peace of mind in an era where cyber threats are on the rise.

Looking Ahead: What’s Next for Crypto Payroll?

The momentum behind USDC payroll for remote teams shows no signs of slowing as we approach 2026. Regulatory clarity around stablecoins continues to improve, with major jurisdictions recognizing USDC as a legitimate tool for cross-border commerce and compensation. As blockchain infrastructure matures, expect transaction fees to drop further while network speeds increase, making stablecoin salary distribution even more attractive.

The ecosystem of services supporting crypto payroll is rapidly expanding as well. New platforms offer features like automated tax withholding, real-time compliance checks, and seamless fiat-to-crypto conversion options, removing friction points that previously hindered mainstream adoption.

For companies eager to future-proof their operations and attract top talent worldwide, embracing global payroll with USDC isn’t just a competitive edge, it’s becoming table stakes in a world where work knows no borders.

If you’re ready to explore how your organization can pay employees in stablecoins or streamline crypto payroll in 2025, now is the time to evaluate robust solutions tailored for compliance, transparency, and efficiency. As always, consult with compliance experts to ensure your payroll strategy aligns with local regulations, because in this new era of digital finance, compliance remains the cornerstone of trust.