As remote work becomes the new norm, more companies are turning to stablecoins like USDC to pay digital nomads with stablecoins. This approach offers rapid, low-cost, and borderless salary distribution. However, navigating this landscape requires careful attention to compliance, security, and operational efficiency. Below, we’ll break down the top five best practices that ensure your stablecoin payroll is both seamless and secure for digital nomads in 2024.

1. Prioritize Regulatory Compliance and Tax Reporting

The global regulatory climate for cryptocurrency is rapidly evolving. When paying digital nomads with stablecoins, it’s essential to prioritize regulatory compliance and tax reporting. Different countries have distinct rules regarding crypto payrolls, from how they classify digital assets to how they tax them. For example, some jurisdictions treat USDC salaries as regular income subject to standard income tax; others may see them as capital gains or require special disclosures.

To avoid costly penalties or legal complications, always consult with a cross-border tax specialist familiar with crypto payrolls. Ensure you’re collecting the right documentation from your remote workers and reporting payments accurately in line with local requirements. For further reading on legal aspects of stablecoin payrolls, check out this detailed guide from Bitwage: USDT vs USDC for Payroll: Which Stablecoin Is Right for Your Business?

2. Use Reputable, Non-Custodial Wallets for USDC Storage

Storing salaries in a reputable non-custodial wallet gives digital nomads full control over their funds and reduces reliance on third-party custodians that may be vulnerable to hacks or regulatory actions. Non-custodial wallets allow users to manage their own private keys, a critical step in safeguarding assets against unauthorized access.

When selecting wallets for USDC storage, prioritize those with robust reputations and strong security track records. Encourage your team members to back up their wallet seed phrases securely and never share private keys online or through insecure channels.

3. Verify Counterparty Identities and Use Smart Contracts for Payroll Automation

Identity verification is crucial when sending funds across borders, especially when dealing with anonymous blockchain addresses. Always verify the identity of each counterparty before executing payments. This not only helps prevent fraud but also supports anti-money laundering (AML) compliance.

Smart contracts can further streamline your payroll process by automating recurring payments based on predefined criteria (such as project milestones or weekly intervals). By leveraging smart contracts, you reduce manual errors while increasing transparency, each payment is recorded immutably on-chain.

The Technical Edge: Leverage Low-Fee Networks and Implement Robust Security

The next steps involve choosing the right blockchain networks and maximizing security measures, both topics we’ll explore in detail in the second half of this article.

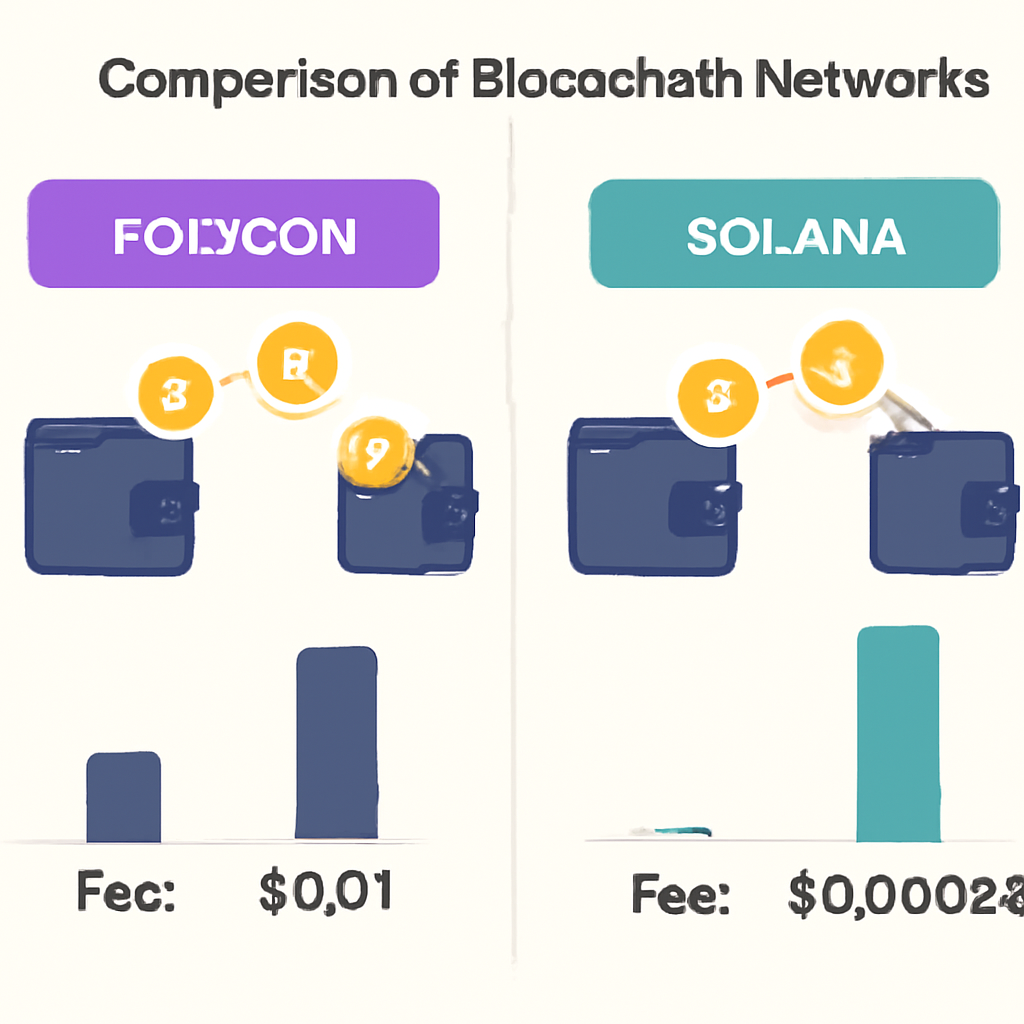

4. Leverage Low-Fee, High-Liquidity Stablecoin Networks (e. g. , Polygon, Solana)

Transaction fees can quickly erode the benefits of crypto payroll if you’re not strategic about network selection. While Ethereum remains a popular choice for stablecoin transfers, its gas fees can spike unpredictably and cut into your team’s take-home pay. Instead, consider leveraging alternative networks like Polygon or Solana, which offer both high liquidity and consistently low transaction costs.

For example, sending USDC via Polygon typically costs a fraction of a cent and settles in seconds, making it ideal for frequent payroll disbursements. Solana is also gaining traction thanks to its speed and scalability. Choosing the right network not only saves money but also ensures that digital nomads receive their salaries promptly, no matter where they are in the world.

For more on integrating stablecoins with local payment rails and reducing cross-border costs, explore this resource from TransFi: Stablecoin Payments in Canada: On-Chain Payroll and. . .

5. Implement Robust Security Measures Including Hardware Wallets and 2FA

The decentralized nature of stablecoins like USDC puts security squarely in the hands of users, and that’s both an opportunity and a challenge for digital nomads. To protect against hacks, phishing attacks, and unauthorized access, always implement hardware wallets for storing significant balances. Unlike hot wallets connected to the internet, hardware wallets keep private keys offline, drastically reducing exposure to cyber threats.

Additionally, enable two-factor authentication (2FA) on all wallet apps and exchange accounts used by your team. This simple step adds an extra layer of protection by requiring a secondary verification method beyond just a password.

Encourage regular security audits within your organization, review wallet permissions, rotate backup phrases as needed, and train team members on best practices for digital asset safety. The upfront investment in security pays dividends by ensuring your payroll operations remain uninterrupted and trustworthy.

Why Mastering These Best Practices Matters

The landscape for paying digital nomads with stablecoins is rapidly maturing. By prioritizing regulatory compliance and tax reporting, using reputable non-custodial wallets for USDC storage, verifying counterparties while automating payments via smart contracts, leveraging low-fee networks such as Polygon or Solana, and implementing robust security measures including hardware wallets and 2FA, you position your business at the forefront of global payroll innovation.

This approach doesn’t just help you attract top talent from anywhere on earth; it also reassures regulators that your processes are above board while giving workers peace of mind that their earnings are secure. For startups scaling across borders or established companies embracing remote work at scale, these principles are essential to building trust, and maintaining operational agility, in 2024’s dynamic market.