For decades, global contractor payments have been mired in slow settlement times, excessive fees, and a tangle of compliance headaches. Today, on-chain payroll is rewriting the script. By leveraging blockchain rails and stablecoins like USDC, companies are now able to pay contractors worldwide with unprecedented speed, transparency, and cost-efficiency. This shift is not just a technical upgrade; it’s a fundamental transformation of how value moves across borders.

Why Traditional Cross-Border Payments Are Broken

Sending money to international contractors via legacy banking systems is notoriously inefficient. SWIFT transfers can take days, and intermediary banks often levy unpredictable fees. For contractors, this means delayed access to earnings and sometimes losing a significant slice of their pay to conversion costs and local banking charges. Worse still, those working in underbanked regions may have no reliable way to receive funds at all.

On-chain payroll solutions, by contrast, eliminate these pain points. Payments in USDC or other stablecoins settle in minutes, not days, and transaction fees are a fraction of what banks charge. The blockchain’s open ledger ensures every transaction is auditable and immutable, supporting both transparency and compliance.

The Rise of Crypto Payroll for Contractors

Recent industry moves underscore the momentum behind crypto payroll for contractors. In December 2024, payroll provider Remote and Stripe teamed up to enable US companies to pay contractors in 69 countries using USDC. The result? Near-instant settlements, no waiting for wire transfers, and a built-in hedge against local currency volatility. Bitwage, another pioneer, lets global contractors choose their preferred payout mix, whether it’s local currency, Bitcoin, or stablecoins like USDC.

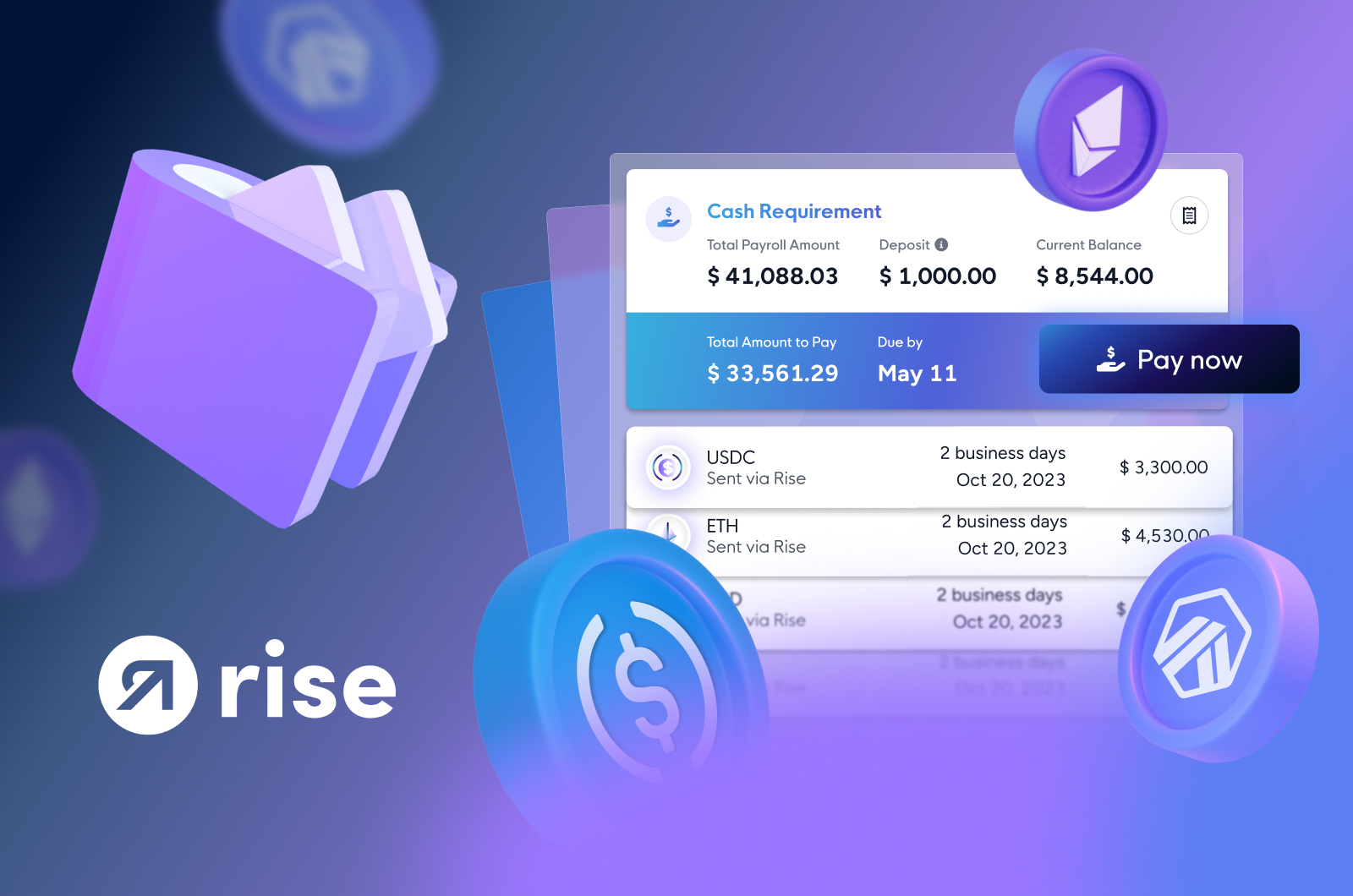

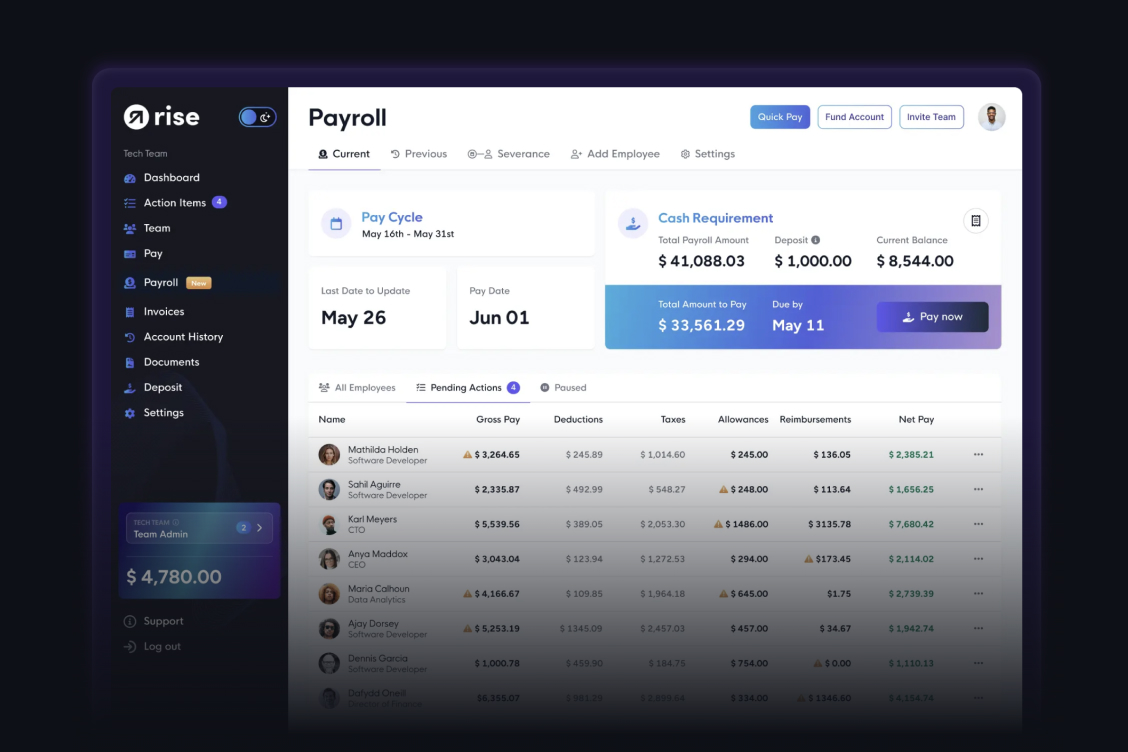

Platforms like Rise have gone further, offering hybrid payroll systems that support both fiat and crypto payouts, while ensuring every step aligns with local tax and labor laws. As a result, the process of paying international freelancers is no longer a compliance minefield, but a streamlined, auditable workflow. For a deeper dive into how real-time crypto payroll is transforming salary payments for remote teams, check out this guide.

Key Benefits of On-Chain Payroll Systems

Key Benefits of On-Chain Payroll for Global Contractors

-

Speed: On-chain payroll systems enable near-instant payments, settling transactions in minutes rather than days. This rapid processing is especially valuable for global contractors who previously faced lengthy bank transfer times.

-

Transparency & Compliance: Blockchain’s immutable ledger ensures every payment is traceable and verifiable, supporting regulatory compliance and reducing errors. Solutions like TransFi highlight this advantage.

-

Financial Inclusion: On-chain payroll allows contractors in underbanked regions to receive payments directly in stablecoins like USDC, bypassing the need for traditional banking infrastructure. This expands opportunities for global talent.

Let’s break down why on-chain payroll is so compelling for businesses and contractors alike:

- Speed: Blockchain payments settle within minutes, eliminating the lag of multi-day wire transfers.

- Reduced Costs: By cutting out intermediaries, transaction fees drop dramatically, often to just a few cents per payment.

- Transparency: The blockchain ledger provides a tamper-proof record of every transaction, simplifying audits and compliance.

- Financial Inclusion: Contractors in underbanked regions can receive payments directly to a crypto wallet, bypassing the need for local banks.

- Predictable Value: Stablecoins like USDC maintain a 1: 1 peg to the US dollar, protecting contractors from FX volatility and ensuring predictable payouts.

According to Pantera Capital, the number of professionals receiving salaries in digital assets tripled in 2024, with 9.6% now paid in stablecoins. Notably, USDC accounted for 63% of these payments, cementing its role as the stablecoin of choice for global payroll. This trend is only accelerating as more companies seek to future-proof their compensation models and tap into new talent pools worldwide.

How to Set Up Global Payroll with USDC

Implementing global payroll with USDC is more straightforward than many expect. Leading platforms like Rise, Bitwage, and others offer step-by-step onboarding, KYC compliance, and seamless wallet integration. Typically, the process involves:

- Creating a business account on a compliant crypto payroll platform

- Onboarding contractors and collecting necessary KYC documentation

- Funding your payroll in USD or directly in USDC

- Setting up one-time or recurring payments, with automatic conversions if needed

The result? Contractors are paid instantly and transparently, with full records for both parties. For companies navigating the regulatory landscape, platforms increasingly offer built-in tools to manage tax reporting and local compliance. For further insights on integrating crypto payroll with HR and accounting systems, see this practical guide.

Security and compliance remain top priorities as adoption scales. Blockchain’s transparency is a double-edged sword: while every transaction is trackable, businesses must ensure they meet evolving regulatory requirements, especially when paying contractors across multiple jurisdictions. Reputable platforms now embed automated compliance checks and generate exportable reports for tax filing, reducing manual workload and risk.

Contractors themselves benefit from greater financial autonomy. With USDC or similar stablecoins, they can instantly convert payments to their local currency, hold funds as a hedge against inflation, or deploy capital in DeFi protocols. This flexibility is especially valuable in regions with volatile currencies or capital controls. As @p100_io noted, on-chain payroll isn’t just a technical upgrade, it’s a tool for global financial empowerment.

Emerging Trends: Stablecoin Salary Solutions and Beyond

The rise of stablecoin salary solutions is only the beginning. We’re seeing a wave of innovation as platforms compete to offer instant settlements, multicurrency support, and even embedded lending. For example, some payroll providers now allow contractors to automatically allocate a portion of their paycheck to savings or decentralized finance products, unlocking new wealth-building opportunities.

Meanwhile, the dominance of USDC in cross-border crypto payments is likely to continue as Circle and other issuers expand their compliance frameworks and on/off-ramp infrastructure. The ability to lock in a 1: 1 USD value, combined with instant global settlement, is simply too compelling for companies scaling internationally.

Top Crypto Payroll Platforms for Global Contractor Payments

-

Remote + Stripe: Remote partnered with Stripe in December 2024 to enable USDC payments to contractors in 69 countries, offering near-instant settlements and protection against currency volatility. Learn more.

-

Bitwage: A pioneer in crypto payroll, Bitwage provides a centralized dashboard for managing global contractor payments, allowing workers to choose payouts in fiat or cryptocurrencies like USDC, BTC, and ETH. Learn more.

-

Rise: Rise offers a hybrid payroll platform that enables companies to pay remote contractors in local currency or crypto (including USDC), while ensuring compliance with tax and labor regulations. Learn more.

-

Lano: Lano supports crypto payroll for global teams, enabling companies to manage international contractor payments in stablecoins and comply with local regulations. Learn more.

-

Deel: Deel is a leading global payroll provider that allows contractors to withdraw earnings in cryptocurrencies, including USDC, offering flexibility and fast access to funds. Learn more.

Still, no solution is one-size-fits-all. Businesses must carefully assess platform security, jurisdictional coverage, and the quality of compliance support. For a deeper look at payroll compliance when paying overseas employees in crypto, explore this resource.

What’s Next for Blockchain Payroll?

The future of on-chain payroll will be shaped by regulatory clarity, user experience, and the continued evolution of blockchain infrastructure. Expect to see tighter integration with HR and accounting tools, more robust identity verification, and a growing ecosystem of financial products built around payroll flows. As the technology matures, the friction of global hiring will shrink even further.

For forward-thinking companies, adopting on-chain payroll isn’t just about efficiency, it’s a strategic advantage in the competition for global talent. As crypto-native compensation models go mainstream, the borderless workforce will expect nothing less than instant, transparent, and predictable payments. The companies that deliver on this promise will lead the next era of work.