Global payroll is undergoing a rapid transformation as real-time stablecoin payroll and instant lending solutions become operational at scale. Companies like Rain and Toku have pioneered the first real-time, compliant stablecoin payroll systems for global teams, unlocking unprecedented speed, efficiency, and regulatory alignment in workforce payments. The integration of programmable stablecoins such as USDC is not only eliminating legacy frictions like wire cut-off times and multi-day settlement delays, but also enabling new forms of financial access for workers worldwide.

Stablecoin Payroll: From Web3 Niche to Global Standard

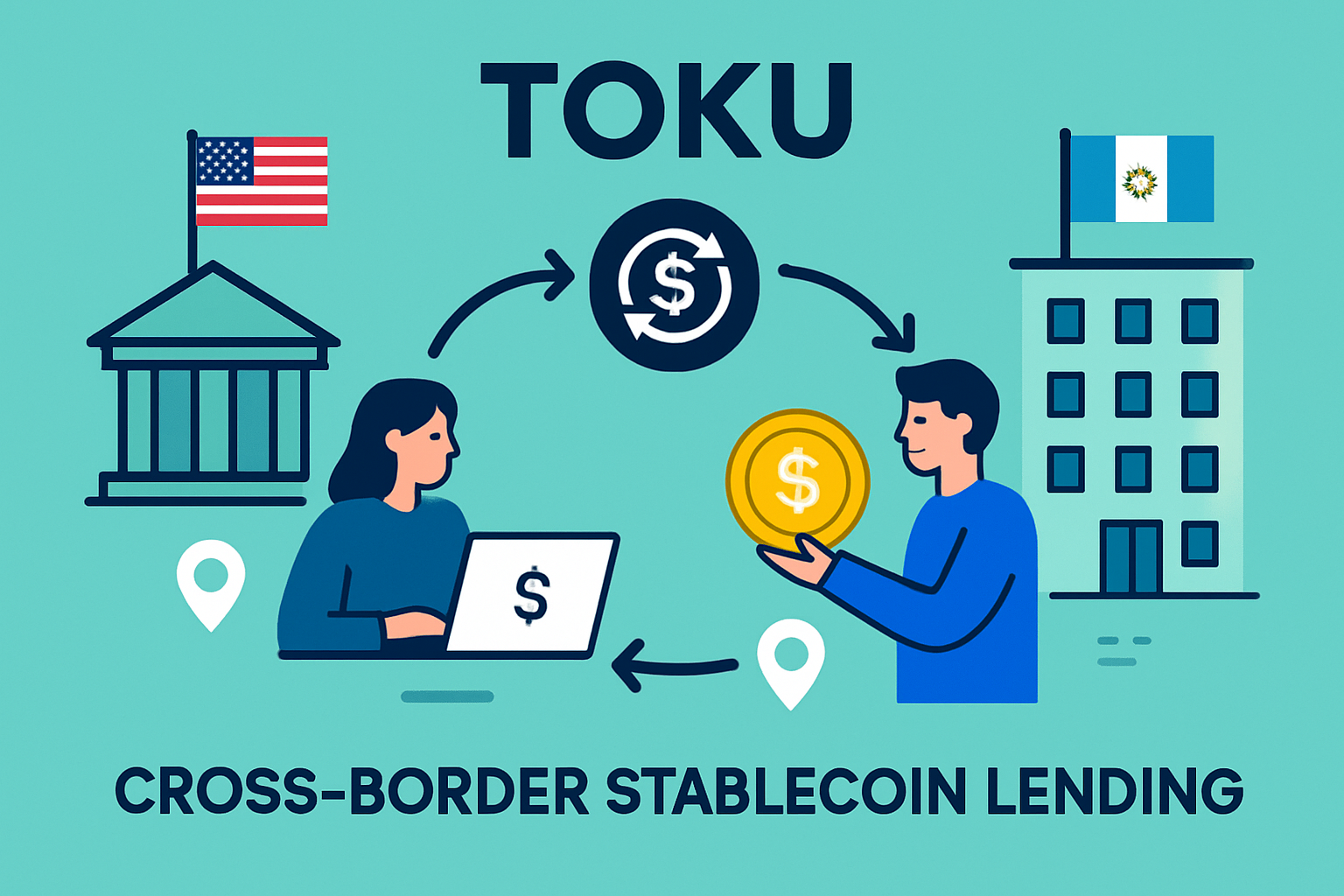

Until recently, crypto payroll solutions were largely the domain of Web3 startups and tech-forward companies. However, regulatory clarity in major jurisdictions and the maturation of stablecoin infrastructure have catalyzed mainstream adoption. According to Rain and Toku’s recent partnership, employers can now fund and settle payroll instantly in stablecoins across more than 100 jurisdictions. This leap is not just about speed – it’s about cross-border payroll compliance, real-time programmable pay, and seamless integration with existing HR workflows.

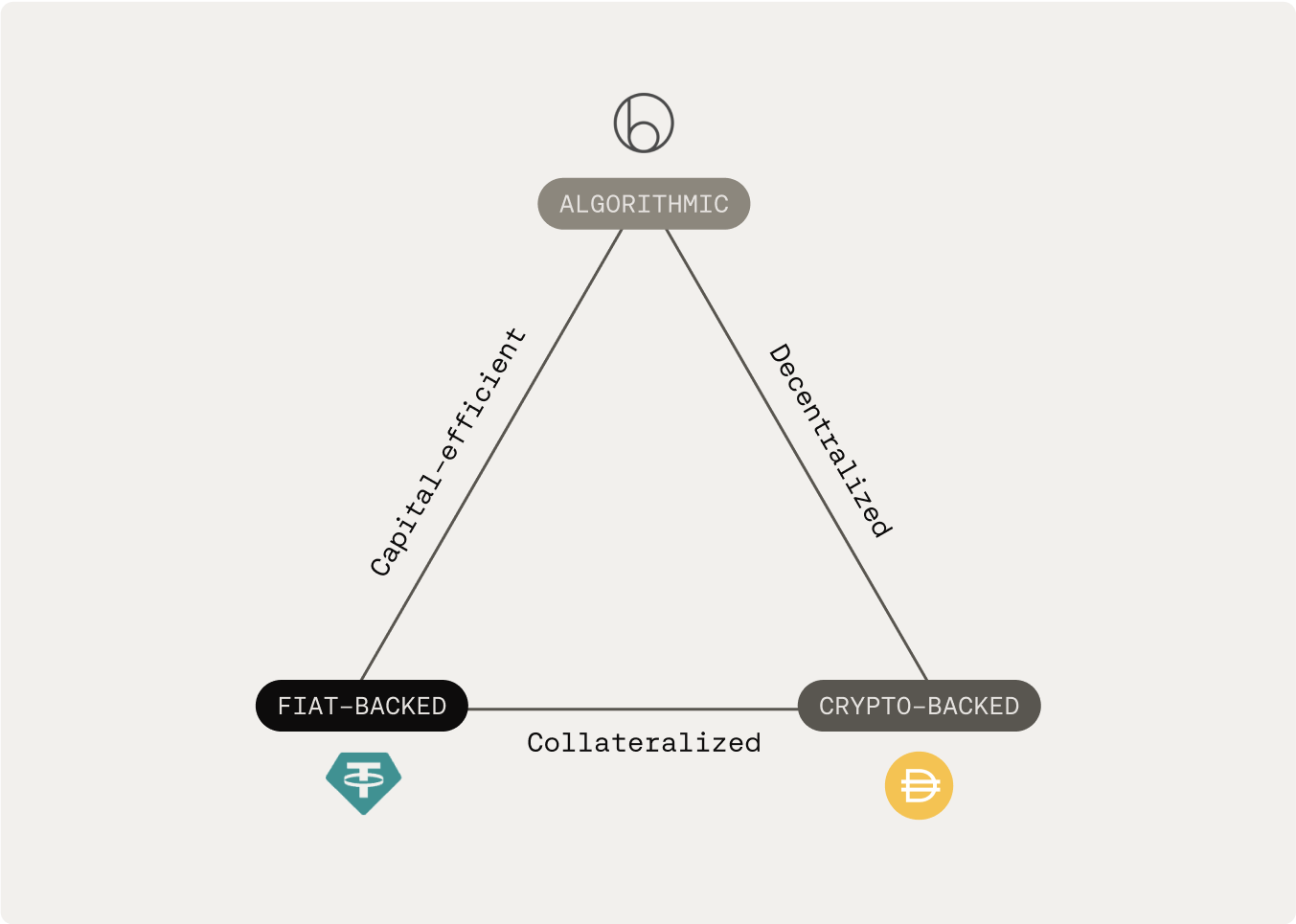

The appeal is clear: stablecoins like USDC maintain a 1: 1 peg to the US dollar, providing a hedge against local currency volatility while enabling borderless crypto payouts. Platforms such as Toku and Utila allow companies to maintain control, custody, and regulatory compliance while delivering instant salary disbursements to employees or contractors worldwide.

Programmable Pay and Instant Settlement: Core Features Driving Adoption

The unique programmability of stablecoin-based payroll means that wages can be distributed in real time – down to the second if needed – rather than waiting for traditional biweekly or monthly cycles. This feature is especially valuable for remote teams, gig workers, or contractors who need immediate access to funds. For example, YY Group’s integration of regulated stablecoin payments on its gig worker platform allows users to access earnings as soon as work is completed, removing cash flow bottlenecks that often plague freelancers in emerging markets (source).

Key Benefits of Real-Time Stablecoin Payroll

-

Instant Settlement Across Borders: Real-time stablecoin payroll platforms like Toku and Rain enable employers to fund and settle payroll instantly in stablecoins, eliminating the multi-day delays of traditional bank wires, especially for global teams in over 100 jurisdictions.

-

Significantly Lower Transaction Costs: Stablecoin payroll reduces or eliminates wire transfer fees and intermediary banking charges, making cross-border payments more cost-effective for both employers and employees.

-

Enhanced Regulatory Compliance: Solutions such as Toku ensure payroll operations meet local tax and employment regulations, streamlining compliance for distributed workforces compared to the complexities of international bank wires.

-

Programmable and Flexible Payments: Stablecoin payroll systems offer programmable pay, allowing for features like on-demand wage access, daily payroll, and automated bonuses—capabilities not possible with legacy banking infrastructure.

-

Financial Inclusion for Underbanked Workers: Platforms like YY Group integrate regulated stablecoin payments, providing gig and remote workers—especially in underbanked regions—faster access to earnings without the need for traditional bank accounts.

-

Reduced Foreign Exchange (FX) Risk: Stablecoins, pegged to fiat currencies, minimize FX volatility and conversion costs, ensuring employees receive predictable, stable-value payments compared to fluctuating international wire transfers.

-

Seamless Integration with Instant Lending: Real-time stablecoin payroll infrastructure enables integration with instant lending platforms, allowing workers to access earned wages or credit immediately, bypassing the slow approval processes of traditional banks.

Instant liquidity for businesses is another game changer. Instead of pre-funding multiple accounts or navigating complex cross-border banking relationships, treasury teams can execute global payroll in a single transaction with full transparency on the blockchain. The reduction in FX costs and elimination of intermediary fees translates directly into savings for both employers and employees.

Instant Lending Meets Payroll: Unlocking New Liquidity Models

The convergence of real-time stablecoin payroll with instant lending is opening new avenues for worker financial wellness. By leveraging stablecoin infrastructure, platforms can offer earned wage access or microloans instantly, bypassing traditional banking rails entirely. This model gives workers in underbanked regions the ability to tap into their future earnings or secure short-term liquidity without punitive interest rates or bureaucratic hurdles.

For startups and high-growth companies operating across borders, these payroll lending solutions provide both risk mitigation and operational agility. Funds can be disbursed on-chain in seconds, with smart contracts ensuring compliance and auditability at every step.

As regulatory frameworks mature and infrastructure providers like Toku, Rain, and YY Group scale their offerings, the stablecoin payroll ecosystem is rapidly moving from proof-of-concept to enterprise-grade reliability. The impact is especially pronounced for global teams and digital nomads, who now benefit from borderless, 24/7 access to wages and flexible liquidity solutions that would have been unthinkable in the era of correspondent banking.

Programmable payroll flows are also enabling new forms of compensation. With USDC payroll integration, companies can offer dynamic payment schedules, milestone-based bonuses, or split salaries across multiple wallets or currencies – all with full transparency and auditability. This level of flexibility is particularly attractive for tech startups and gig economy platforms seeking to attract top talent globally without the friction of legacy rails.

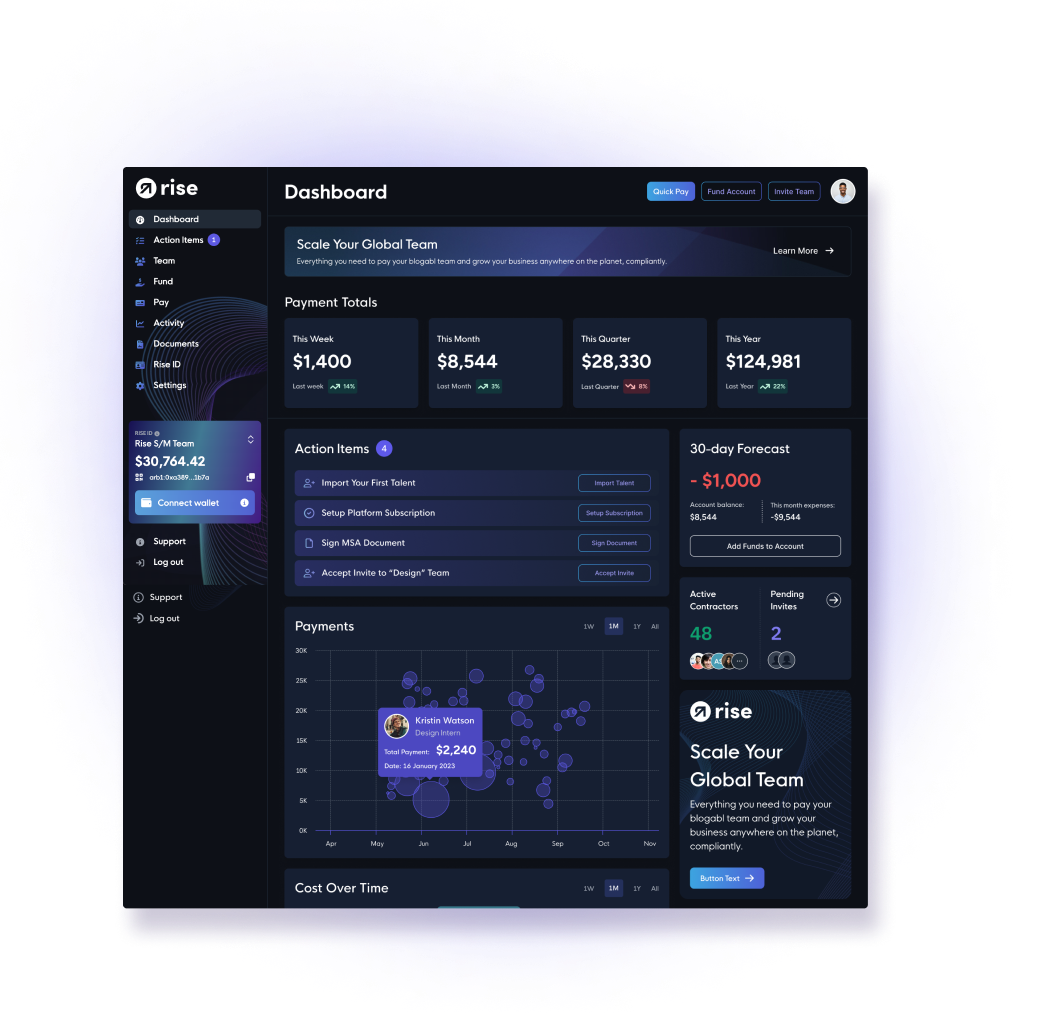

Operational Efficiency: Why Treasury Teams Are Adopting Crypto Payroll

The technical advantages of stablecoin payroll extend beyond speed and compliance. Treasury teams gain real-time visibility into cash flows, can automate reconciliation via blockchain explorers, and reduce exposure to FX volatility by settling salaries in a stable digital dollar. This is a significant upgrade from traditional cross-border payroll processes that are often opaque, error-prone, and subject to unpredictable delays.

Moreover, with instant lending mechanisms built atop stablecoin rails, workers can unlock earned wage access at any point in the pay cycle. This not only improves employee satisfaction but also reduces turnover – a critical metric for distributed teams operating in competitive talent markets.

Key Use Cases for Instant Lending in Stablecoin Payroll

-

Earned Wage Access (EWA) via Stablecoins: Platforms like Rain enable employees to instantly borrow against accrued wages, receiving stablecoin payouts in real time. This reduces reliance on payday loans and offers immediate liquidity.

-

Emergency Liquidity for Gig Workers: YY Group integrates instant lending with stablecoin payroll, allowing gig workers to access short-term loans directly through the platform, facilitating rapid financial support for unforeseen expenses.

-

Cross-Border Lending with Stablecoin Settlement: Toku and Utila offer instant lending solutions for distributed teams, enabling compliant, cross-border loans disbursed and repaid in stablecoins, eliminating traditional banking delays and FX costs.

-

On-Demand Payroll Advances for Remote Teams: Rise provides crypto-friendly daily payroll and instant advances, letting remote employees access a portion of their earned salary in stablecoins before the scheduled payday.

-

Automated Credit Scoring and Lending via Smart Contracts: Platforms leveraging stablecoins use programmable smart contracts to automate credit assessment and instant disbursement of loans, improving transparency and reducing processing times for global workforces.

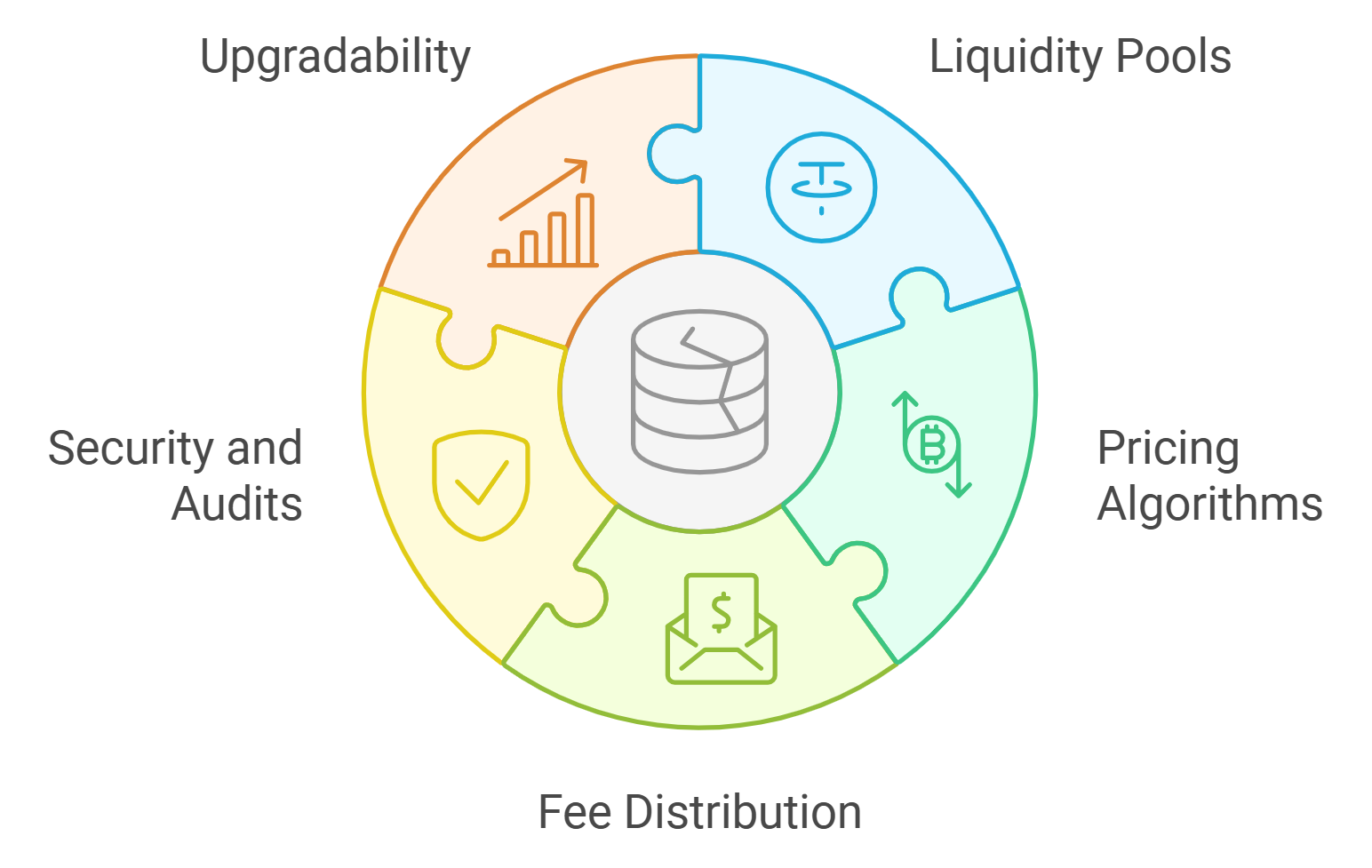

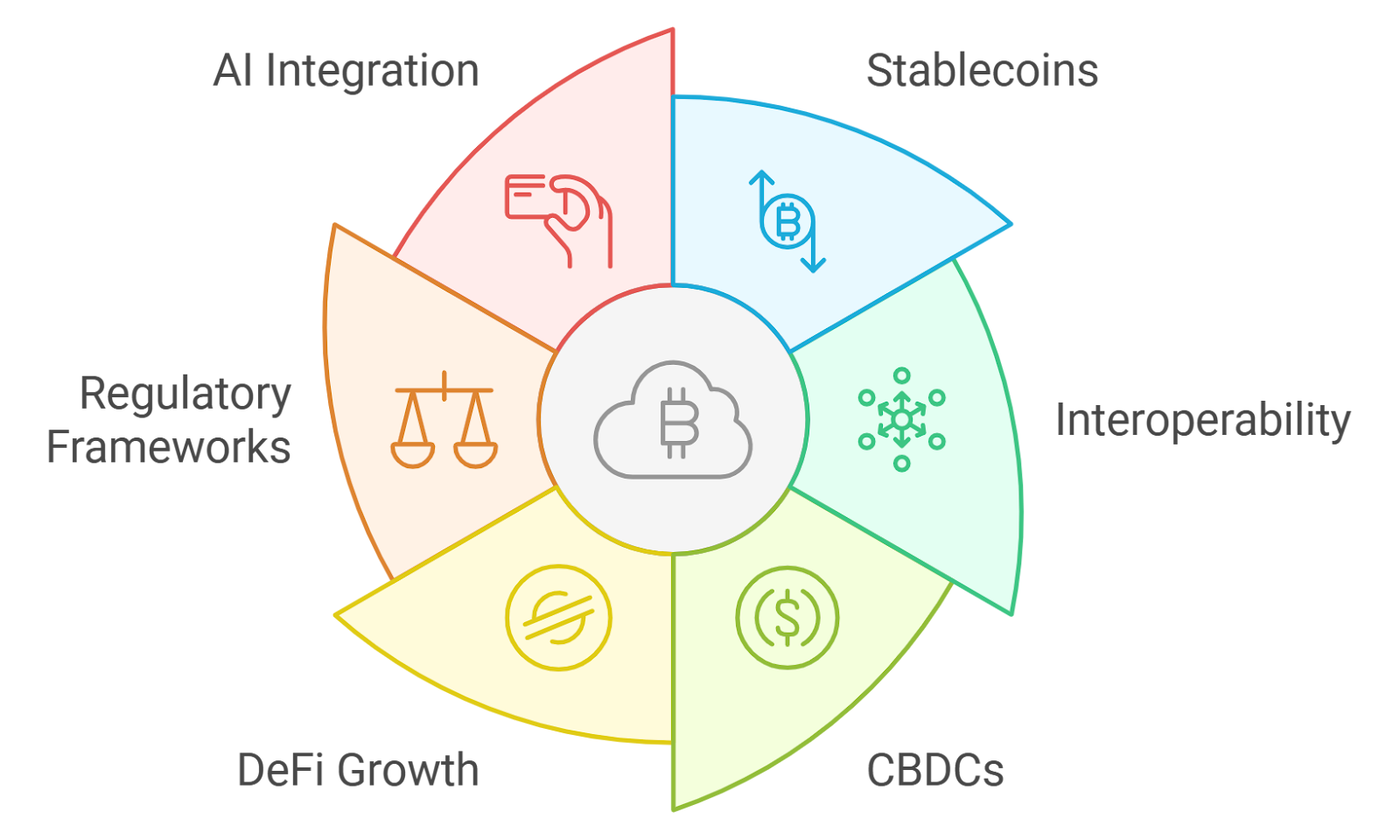

As adoption accelerates, expect continued innovation around compliance automation, tax withholding modules, and integrations with mainstream HR software. The next wave will likely see further convergence between DeFi protocols and enterprise payroll platforms – driving down transaction costs even further while expanding access to programmable financial services for all workers.

Looking Ahead: The Future of Global Workforce Payments

The trajectory is clear: real-time stablecoin payroll combined with instant lending is no longer a niche experiment but a foundational layer for modern workforce payments. As regulatory certainty grows and technical standards converge, we will see continued migration away from legacy systems toward programmable, compliant crypto-native solutions that deliver tangible benefits across speed, cost efficiency, and financial inclusion.

For organizations ready to embrace this shift, platforms like Rain and Toku’s real-time stablecoin infrastructure (read more here) or YY Group’s gig worker payments (details here) provide a proven path forward – enabling global teams to operate with agility while meeting the highest standards of cross-border payroll compliance.