Global salary payments are being ripped from the slow, expensive legacy rails of traditional banking and dropped onto the blockchain – in real time. For remote teams, this is not just a technical upgrade. It’s a financial revolution that’s slashing costs, boosting speed, and giving workers worldwide more control over their earnings than ever before.

Why Real-Time Crypto Payroll Is Overtaking Traditional Methods

Let’s face it: cross-border payroll has always been a headache. Wire transfers crawl through a maze of banks, each taking a cut and adding days to the process. Currency conversion gouges both employers and workers. In some regions, banking infrastructure barely exists.

Enter real-time crypto payroll. Platforms like Bitwage, Rise, TransFi, and CoinsPaid are flipping the paradigm by letting companies pay in stablecoins like USDC, USDT, or even local fiat – all in minutes, not days. The result? Teams get paid fast, no matter if they’re in New York or Nairobi.

The Core Benefits: Fast, Cheap, Global

Key Benefits of Real-Time Crypto Payroll for Remote Teams

-

Financial Inclusion for the Unbanked: Crypto payroll solutions support remote workers in regions with limited banking infrastructure—such as Africa, Southeast Asia, and Latin America—enabling seamless payments in local currencies or stablecoins.

-

Stable Value with Stablecoins: Paying salaries in stablecoins like USDC or USDT protects remote teams from local currency volatility, especially in high-inflation countries such as Turkey, Argentina, or Nigeria.

-

Enhanced Employee Retention: Studies show that 39% of remote workers would switch jobs for crypto compensation, and 78% of contractors are more likely to stay if paid within 24 hours—boosting satisfaction and loyalty.

-

Compliance and Security: Leading platforms like Rise offer native USDC support with compliance backing from Circle, ensuring secure and regulatory-aligned payments.

-

Seamless Mass Payouts: Services such as CoinsPaid enable businesses to execute mass payouts in over 20 cryptocurrencies, streamlining payroll for large, distributed teams.

The numbers don’t lie. With platforms supporting payouts to nearly 200 countries and same-day settlements as standard (Bitwage), the old excuses for late or lost payments vanish. Here’s what’s driving adoption:

- Speed: Funds land in wallets within five minutes for most locations (TransFi) – not three business days.

- Savings: No more SWIFT fees or hidden intermediary charges. Companies save 60-80% on global payroll costs (RiseWorks).

- No Borders: From Argentina to Nigeria to Southeast Asia, crypto payroll reaches talent where banks cannot.

- No More Currency Nightmares: Stablecoins like USDC shield workers from local currency crashes or inflation spikes.

The USDC Advantage: Stability Meets Speed

If you’re building your global team’s compensation strategy for 2025 and beyond, stablecoins like USDC (USD Coin) are leading the charge. Why?

- Pegged to the dollar: Workers know exactly how much they’ll receive – no wild price swings.

- Natively supported by top platforms: Rise boasts direct USDC integration backed by Circle for compliance and reliability (RiseWorks).

- No bank account needed: Anyone with a smartphone can receive payment instantly.

The Human Impact: Retention and Satisfaction Soar

This tech isn’t just about efficiency – it changes lives. In countries with double-digit inflation or capital controls (think Turkey or Argentina), stablecoin salaries mean security and peace of mind for workers who would otherwise watch their paychecks lose value overnight.

The stats speak volumes: 39% of remote workers would switch jobs for an employer offering crypto compensation, while an eye-popping 78% of contractors say they’d stay longer if paid within 24 hours (RiseWorks). For digital nomads and freelancers juggling multiple gigs across borders, instant access to funds is game-changing.

But the ripple effects go even further. Real-time crypto payroll is creating a new baseline for what workers expect from employers. The days of waiting for slow, opaque bank wires are over. Today’s talent wants transparency, flexibility, and instant access to their earnings, no matter where they’re based. This shift is forcing companies to rethink their global payroll strategy or risk losing out on the best remote professionals.

Compliance and Security: No Corners Cut

One of the biggest myths about crypto payroll is that it’s the Wild West. In reality, leading platforms are laser-focused on compliance and security. For example, Rise leverages Circle’s infrastructure to offer native USDC support with full regulatory oversight and robust KYC/AML processes (RiseWorks). Bitwage and Deel provide detailed audit trails and tax documentation, making it easy for businesses to stay on top of local laws and reporting requirements.

The blockchain backbone also means every transaction is transparent, timestamped, and immutable, no more chasing down missing payments or reconciling international wire receipts. With stablecoins like USDC and USDT pegged to the dollar, treasury teams can plan and report with confidence, while workers enjoy price stability and instant liquidity.

Choosing the Right Platform: Key Players Compared

The competition is fierce in the real-time crypto payroll space. Platforms like Bitwage, Rise, Deel, CoinsPaid, and TransFi each bring unique strengths. Here’s a quick breakdown of what to look for when picking a solution:

Top Real-Time Crypto Payroll Platforms for Global Teams

-

Rise: The #1 crypto payroll platform for 2025, Rise offers native USDC support backed by Circle, real-time global payouts, and compliance features for both employees and contractors worldwide.

-

BitPay: Trusted for its robust crypto payment infrastructure, BitPay enables businesses to pay salaries in Bitcoin and stablecoins, supporting mass payouts and seamless cross-border transactions.

-

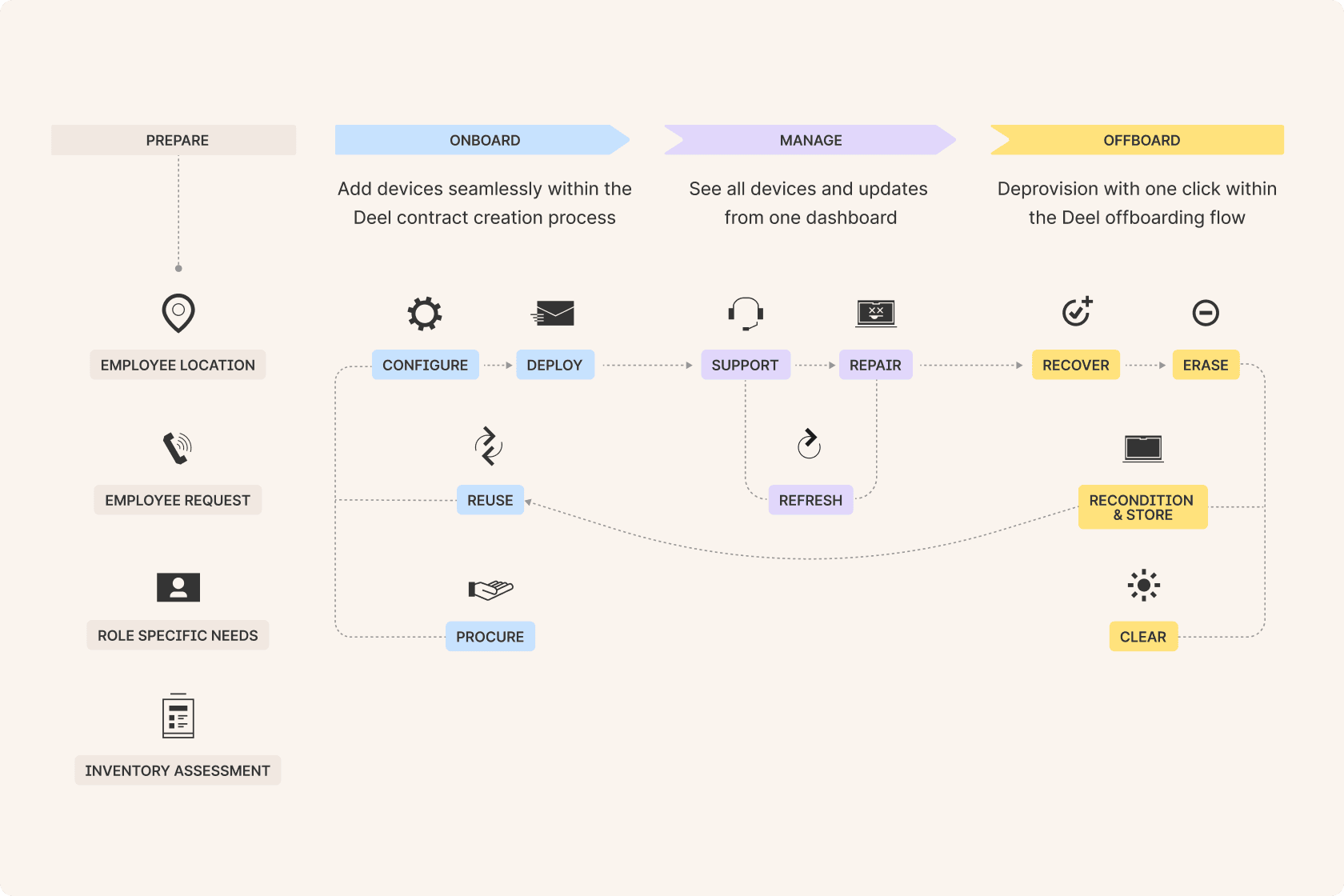

Deel: Known for contract management and compliance, Deel supports real-time crypto payments alongside fiat, making it easy for companies to pay remote teams in their preferred currency.

-

Toku: Specializing in compliant crypto payroll, Toku offers automated tax reporting and supports payments in stablecoins like USDC, ensuring legal and financial compliance for global teams.

-

Bitwage: Operating in nearly 200 countries, Bitwage allows companies to pay employees and contractors in local currencies or crypto, with fast settlement and broad asset support.

-

CoinsPaid: Ideal for mass payouts, CoinsPaid supports over 20 cryptocurrencies and stablecoins, enabling businesses to pay freelancers and remote workers quickly and efficiently.

-

TransFi: Focused on startups and remote teams, TransFi delivers instant payments in USDC and USDT, reducing fees and supporting teams in regions with limited banking access.

-

Request Finance: Streamlines invoicing and payroll, Request Finance supports real-time crypto payments, automated expense tracking, and multi-currency support for global contractors.

-

OneSafe: Empowering DAOs and decentralized teams, OneSafe provides secure, automated crypto mass payouts using USDC, with a focus on transparency and ease of use.

Look for native USDC support, mass payout features, compliance tools, and seamless integration with your existing HR stack. Some platforms even allow employees to split their pay between crypto and local fiat, maximizing flexibility for a global team.

The Future: Crypto Payroll as a Standard, Not a Perk

The momentum is undeniable. As more companies go borderless and hire talent wherever it lives, real-time crypto payroll is quickly becoming the expectation, not the exception. With USDC payroll for remote teams, salary payments are instant, borderless, and resilient against local economic shocks. The old excuses for slow or costly cross-border payments no longer hold up.

If you want to retain top talent and future-proof your business, it’s time to embrace blockchain global payroll solutions. The revolution isn’t coming, it’s here.