Stablecoin salaries are rapidly reshaping the way remote teams get paid, eliminating the friction and unpredictability of traditional cross-border payroll. In a world where talent is global but legacy banking systems are stuck in the past, stablecoins like USDC are emerging as the backbone for fast, efficient, and borderless salary payments. No more waiting for wire transfers to clear or watching hard-earned income erode through hidden fees and currency conversions. Instead, remote workers can now receive their pay almost instantly, in a digital dollar that holds its value regardless of location.

Why Stablecoin Salaries Are Gaining Traction

The rise of stablecoin payroll isn’t just hype – it’s driven by real pain points in international compensation. Traditional payroll rails are slow and expensive. Global wires often take 5, 10 business days to settle, with fees stacking up at every step. On top of that, volatile currency swings can eat into earnings before they ever reach an employee’s account.

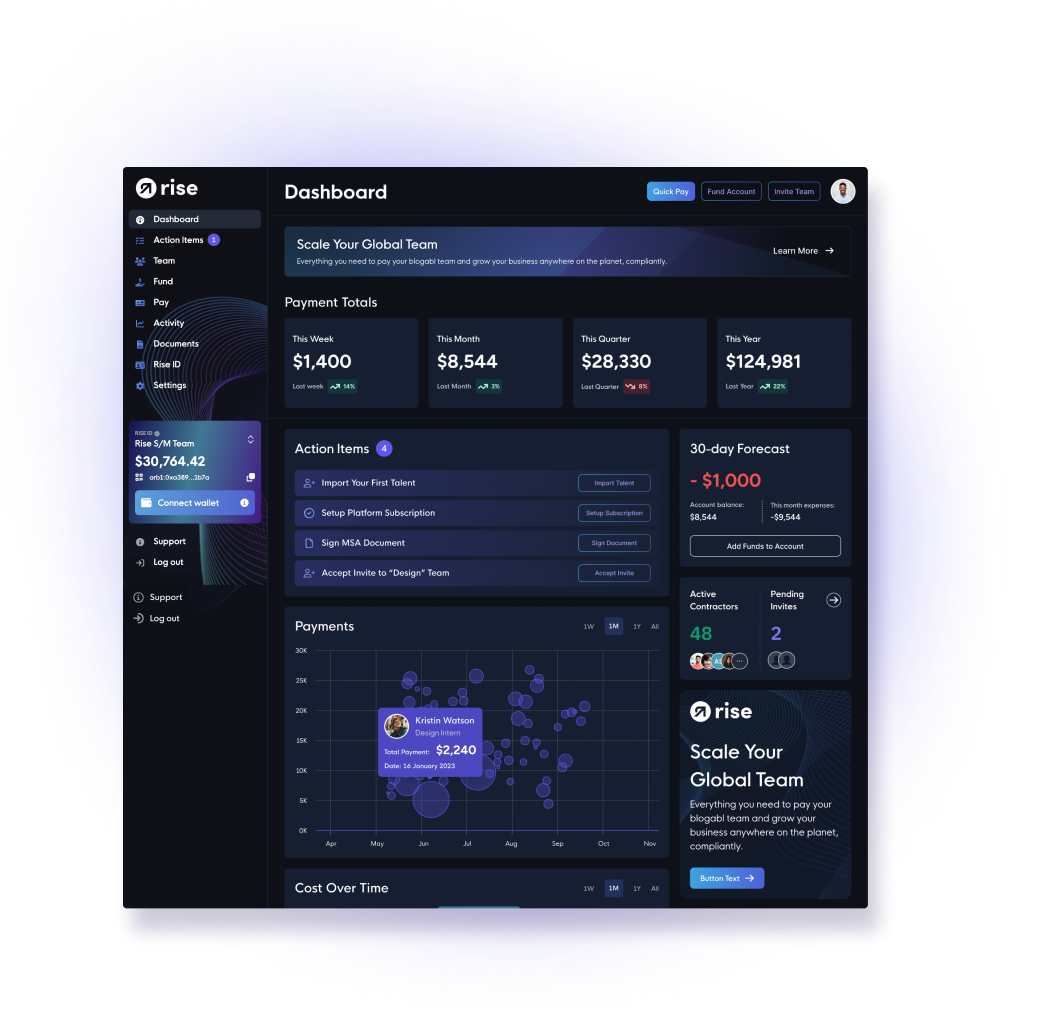

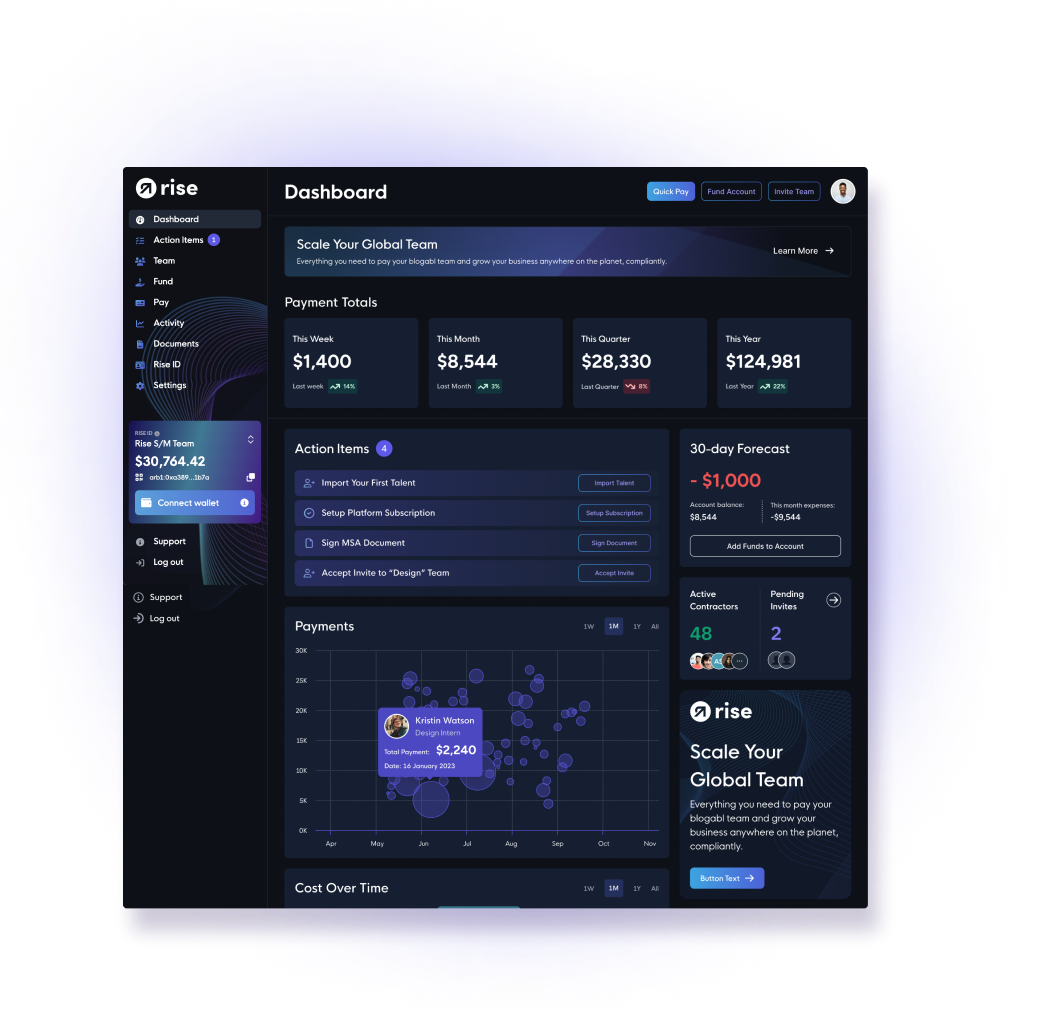

This is where stablecoins shine. By leveraging blockchain technology, platforms like Remote (in partnership with Stripe) now enable companies to pay contractors in 69 countries using USDC on the Base network. Read about Remote’s stablecoin integration here. The result? Near-instant transactions and drastically reduced costs compared to legacy banking.

Key Benefits of Paying Remote Teams with Stablecoins

-

Lower Transaction Fees: Using stablecoins like USDC and USDT on networks such as Base significantly reduces cross-border payment fees compared to wire transfers or SWIFT.

-

Predictable Value and Stability: Stablecoins are pegged to the US dollar, ensuring employees receive a predictable value that protects against crypto market volatility.

-

Financial Inclusion & Flexibility: Platforms like Bitwage allow workers to receive salaries in stablecoins, even without access to traditional banking, expanding payment options for the unbanked.

-

Streamlined Compliance: Services such as Remote and TransFi offer built-in compliance tools, helping companies navigate local regulations when paying in stablecoins.

The Mechanics: How Cross-Border Payroll Crypto Works

Let’s break down what actually happens behind the scenes when a company opts for USDC payroll. Instead of sending fiat through multiple correspondent banks (each taking a cut), employers simply fund a digital wallet with USDC or another major stablecoin. Payroll platforms like Bitwage then handle distribution directly to workers’ wallets worldwide – no intermediaries required. Workers can hold their salary in USDC or convert it seamlessly into local currency as needed.

This approach isn’t limited to crypto-native startups; fintechs and even traditional businesses are jumping on board thanks to compliance-focused solutions that address regulatory requirements across multiple jurisdictions. Flexibility is key: some employees opt for partial crypto payments while retaining fiat for expenses, while others embrace full digital compensation for maximum speed and transparency. Explore Bitwage’s global payroll solution here.

Speed, Savings and Simplicity: The New Standard

The data doesn’t lie: according to recent reports, stablecoins now account for over 90% of reported digital asset payouts in the crypto sector (Thomson Reuters tax and accounting). The appeal goes far beyond just tech startups. Fintechs, AI teams, and even creative agencies are adopting stablecoin salaries as part of modern compensation packages – right alongside remote-first work policies and flexible PTO.

But it’s not just about being trendy; it’s about operational efficiency. Stablecoin payroll slashes foreign exchange headaches by locking in predictable values (no more waking up to surprise losses from overnight FX moves). Plus, there’s no need for costly intermediary banks or convoluted payment corridors – just direct wallet-to-wallet transfers that settle in minutes.

Regulatory compliance remains a central concern for any company considering cross-border payroll crypto. While stablecoin salaries offer unmatched speed and cost savings, firms must ensure they’re meeting local tax reporting and employment law requirements. Forward-thinking payroll platforms now bake in compliance features, streamlining KYC/AML checks and generating the right documentation for both sides of the transaction. This is crucial as tax authorities worldwide, including the IRS, are sharpening their focus on digital asset compensation. Staying ahead of evolving regulations means choosing partners who prioritize transparency and legal clarity.

Unlocking Talent and Financial Inclusion

The impact of global payroll stablecoins extends far beyond operational efficiency. Stablecoin salaries are unlocking job opportunities for skilled workers in emerging markets who previously faced barriers to international banking or currency volatility. Now, anyone with a smartphone and a crypto wallet can participate in the global digital economy, no bank account required. This democratization of access is already reshaping how companies recruit and retain top talent across borders.

For remote teams, this means more than just faster paydays; it’s about empowerment. Workers gain real-time control over their earnings, can avoid predatory remittance fees, and even choose how to store or convert their salary for maximum benefit. For employers, it’s a way to stand out in an increasingly competitive hiring landscape, offering flexibility that today’s workforce demands.

Why Remote Workers Opt for Stablecoin Salaries

-

Fast, Near-Instant Payments: Platforms like Remote and Stripe enable remote workers to receive stablecoin salaries almost instantly, eliminating traditional banking delays.

-

Lower Transaction Fees: Stablecoins such as USDC and USDT allow workers to avoid high international wire fees, making cross-border payments more cost-effective.

-

Currency Stability and Predictable Value: Receiving salaries in stablecoins like USDC ensures payments are pegged to the US dollar, protecting workers from crypto market volatility.

-

Global Access and Financial Inclusion: Services like Bitwage let workers in 69+ countries access their earnings, even without traditional bank accounts.

-

Flexible Payment Options: Stablecoin payroll platforms often let workers split their salary between fiat and crypto, offering greater control over how they get paid.

-

Compliance and Transparency: Modern solutions like Remote with Stripe ensure payments comply with local regulations, giving workers peace of mind.

What’s Next for Crypto Payroll?

The trajectory is clear: USDC payroll and similar solutions are fast becoming the default for agile, borderless teams. As more platforms integrate stablecoin payouts (see how Remote leverages Stripe and Base network here), expect adoption to accelerate across industries, not just crypto-native firms.

The next wave will see even tighter integration with traditional HR systems, smarter compliance automation, and broader acceptance by regulators as stablecoins cement their role in mainstream finance. For companies willing to adapt now, the rewards are immediate: lower costs, happier teams, and a truly global reach.

If you’re ready to ditch slow wires and embrace the future of work with remote team salary crypto, now’s the time to act. The infrastructure is here, and so is the talent waiting to be unlocked.