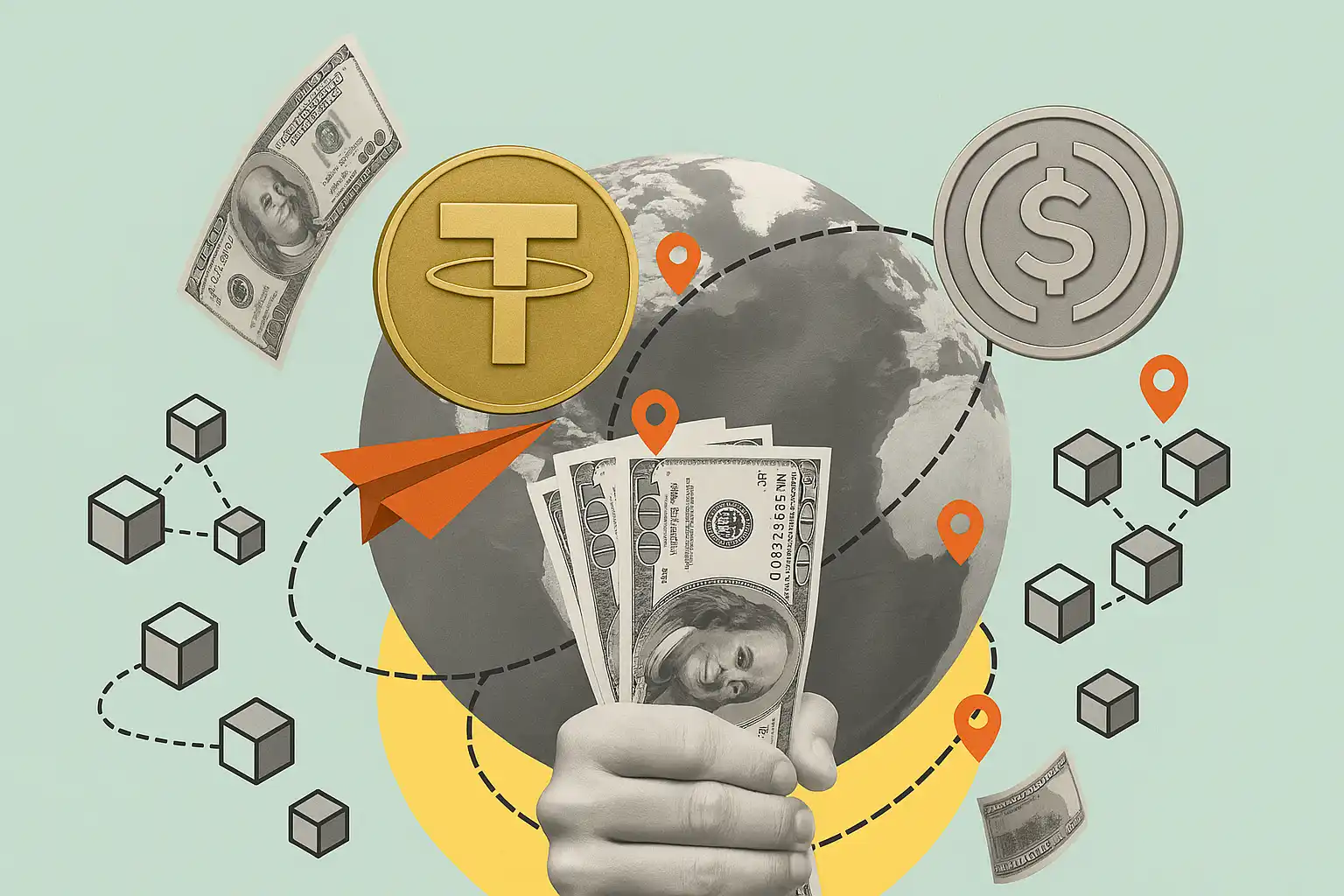

In 2024, the global payroll landscape is undergoing a seismic shift as stablecoins, particularly USDC (USD Coin), redefine how salaries are paid across borders. What was once a niche experiment has now become a mainstream trend: according to Pantera Capital’s 2024 Blockchain Compensation Survey, the share of workers receiving part or all of their salary in cryptocurrency tripled from 3% in 2023 to 9.6% in 2024. Of those crypto salaries, USDC is the clear frontrunner, accounting for an impressive 63% market share, leaving rivals like USDT trailing at 28.6%. This momentum signals not just a technological upgrade, but a fundamental rethinking of how value moves worldwide.

Why USDC Payroll Is Winning Over Global Teams

The rise of USDC payroll is no accident. Businesses and freelancers alike are gravitating toward stablecoin payroll for its unique blend of speed, cost-efficiency, and regulatory clarity. Unlike traditional bank wires, which can take days and rack up hefty fees, USDC payments settle within minutes on blockchain rails, with transaction costs often measured in cents rather than dollars.

This innovation is especially transformative for remote teams spanning continents. In regions plagued by currency instability or banking restrictions, USDC offers direct access to U. S. dollar value without the friction of legacy financial systems. For example, countries like Turkey have emerged as key markets for international USDC flows, reflecting both demand for dollar exposure and frustration with local banking bottlenecks.

“Stablecoin payroll enables faster, cheaper, and borderless payments for global teams. ”

The Data Behind Crypto Salary Growth in 2024

The numbers tell a compelling story about stablecoin payroll adoption. In just one year:

Top Reasons Companies Are Switching to USDC Payroll

-

Faster, Borderless Payments: USDC enables near-instant cross-border salary transfers, eliminating delays common with traditional banking systems and benefitting global teams.

-

Lower Transaction Fees: Sending salaries via USDC significantly reduces transaction costs compared to international wire transfers, especially for distributed workforces.

-

Regulatory Compliance and Transparency: USDC stands out for its regulatory adherence and monthly reserve disclosures by Circle, instilling trust for both employers and employees.

-

Protection Against Currency Instability: USDC payroll gives employees access to U.S. dollar value, providing stability in regions with volatile local currencies or banking restrictions.

-

Flexible Hybrid Compensation Models: Companies can offer salaries split between fiat and USDC, allowing employees to dollar-cost average into crypto or spend directly from Web3 wallets.

-

Advanced Payroll and Treasury Tools: The rise of crypto-native platforms has brought robust treasury management, real-time payroll rails, and accounting solutions tailored for digital assets, simplifying USDC payroll adoption.

This surge isn’t just anecdotal, it’s backed by robust data:

- Tripling Adoption: The percentage of workers paid in crypto jumped from 3% to 9.6% year-over-year (source).

- USDC Dominance: Of all crypto salaries paid globally, 63% flowed through USDC wallets.

- $8.9 Trillion Stablecoin Volume: The overall stablecoin market processed nearly $8.9T in volume, much of it driven by payroll transactions.

- Mainstream Business Adoption: Nearly one in four global businesses now uses some form of crypto compensation.

The Compliance Edge: Why Companies Prefer USDC vs USDT Payroll

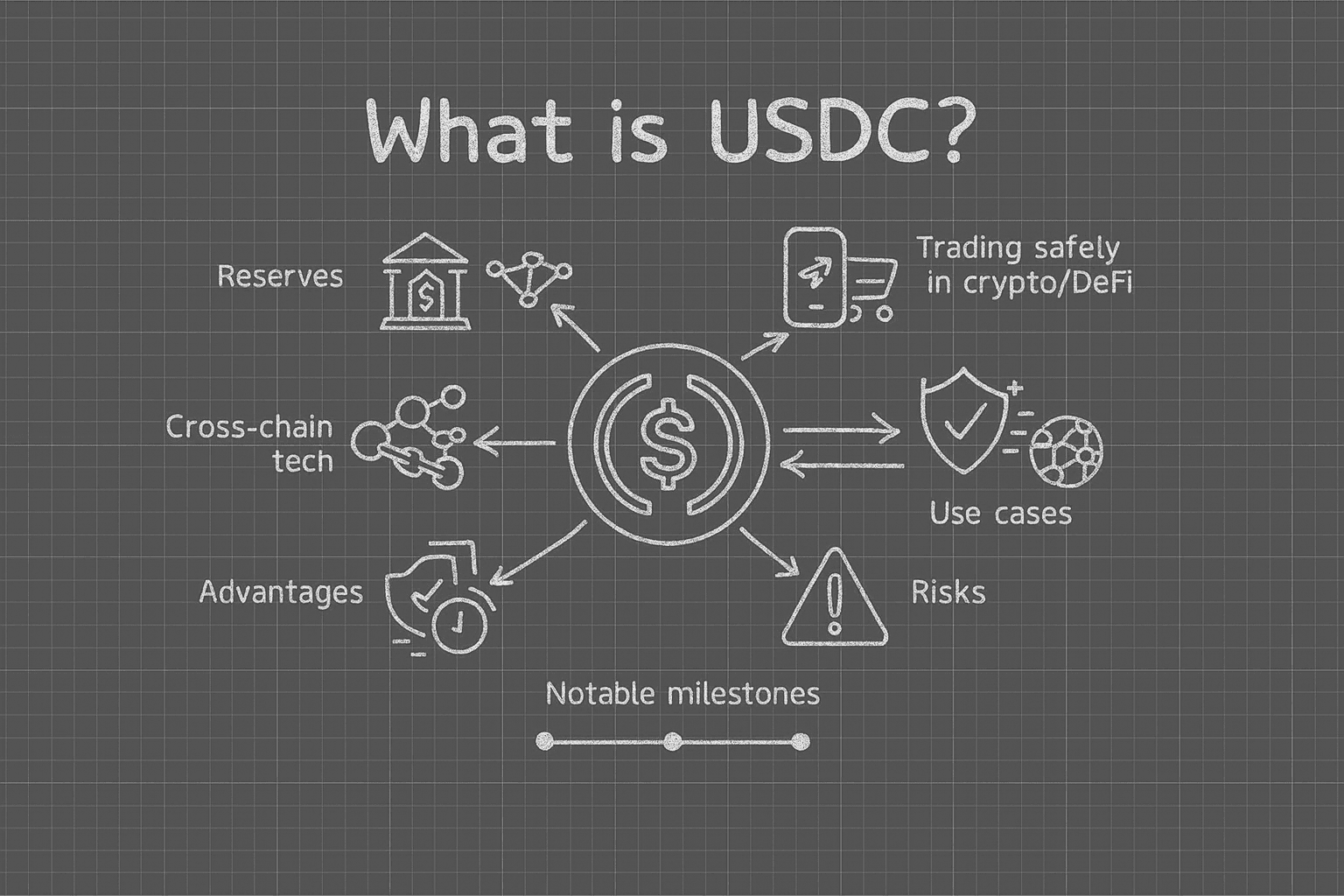

If you’re wondering why USDC vs USDT payroll is such a hot topic among CFOs and HR leads, look no further than compliance and transparency. While both stablecoins peg their value to the U. S. dollar and offer fast settlement times, only USDC provides monthly reserve disclosures backed by U. S. Treasuries, a critical factor for risk-averse organizations handling large-scale salary distributions.

This regulatory rigor has made it easier for companies to satisfy auditors and tax authorities when compensating employees or contractors across jurisdictions, a crucial advantage as governments tighten scrutiny around digital assets.

Beyond compliance, the transparency of USDC’s reserve structure is winning trust among both employers and employees. When businesses pay in USDC, they can point to clear, auditable proof of funds, an essential requirement for cross-border salary payments in 2024. This stands in contrast to USDT, which, despite its liquidity and trading dominance, faces ongoing questions about reserve backing and regulatory oversight. For organizations prioritizing risk management and global payroll compliance, USDC has become the default stablecoin.

The benefits are not just theoretical. As more jurisdictions introduce reporting requirements for crypto payrolls, the ability to demonstrate that each token is fully backed by U. S. dollar reserves (as Circle does with USDC) simplifies everything from tax filings to anti-money laundering checks. This clarity is invaluable for multinational teams operating across complex legal environments.

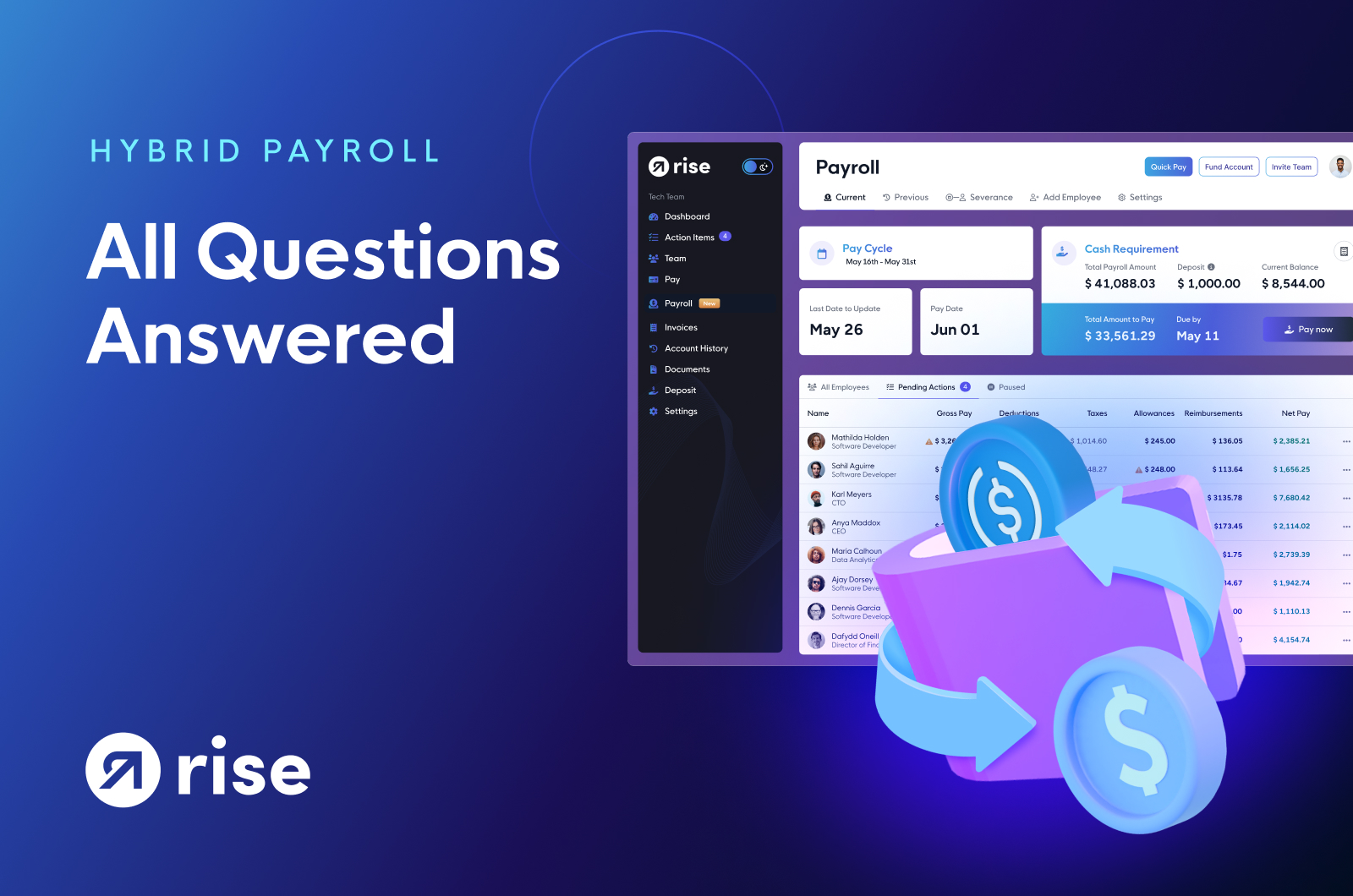

Hybrid Payroll Models: Bridging Fiat and Crypto in 2024

Another key trend emerging in crypto salary 2024 is the rise of hybrid compensation models. Instead of choosing between fiat or crypto, companies now let employees split their salaries, allocating a portion to traditional bank accounts and another directly into Web3 wallets as USDC. This approach offers several advantages:

Key Benefits of Hybrid Payroll Models (Fiat & USDC)

-

Faster, Borderless Payments: Hybrid payroll enables instant cross-border salary transfers using USDC, eliminating traditional banking delays and benefiting global teams.

-

Lower Transaction Fees: Paying with USDC reduces international wire and conversion costs compared to fiat-only payroll, saving employers and employees money.

-

Access to Stable Dollar Value: Employees in countries with currency instability can receive part of their salary in USDC, protecting their earnings from local currency fluctuations.

-

Regulatory Compliance & Transparency: USDC is backed by monthly reserve attestations from Circle and U.S. Treasuries, providing confidence for both employers and employees.

-

Flexible Compensation Options: Hybrid models allow employees to split their salary between fiat and crypto, enabling strategies like dollar-cost averaging or direct Web3 spending.

-

Improved Access for the Unbanked: Workers without traditional bank accounts can receive USDC directly to Web3 wallets, increasing financial inclusion.

-

Streamlined Payroll Operations: Modern platforms like Deel and Bitwage integrate hybrid payroll, automating compliance, reporting, and multi-currency disbursements.

For workers in high-inflation economies or those seeking exposure to digital assets, this flexibility is a game-changer. Employees can dollar-cost average into crypto markets automatically with each paycheck or spend their earnings instantly using DeFi apps and crypto debit cards.

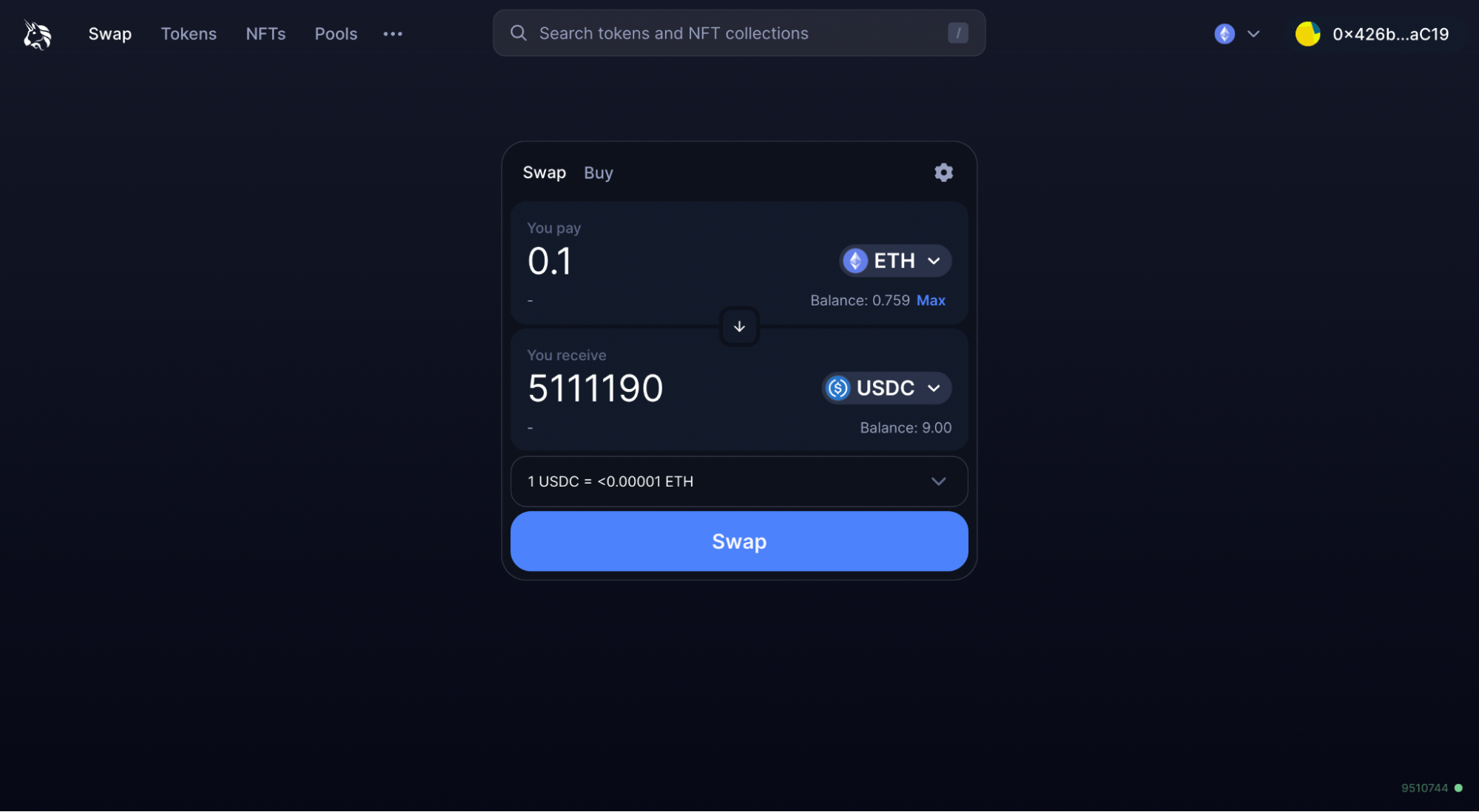

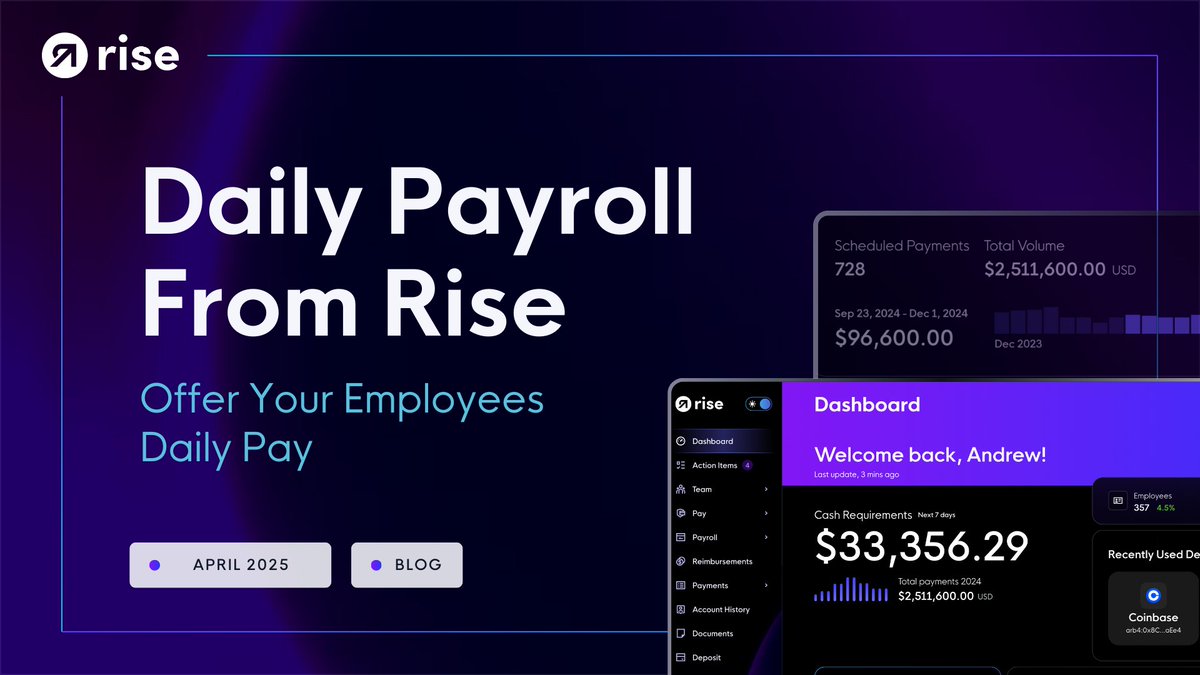

Streamlining Operations With On-Chain Payroll Platforms

The infrastructure supporting cross-border salary payments has matured rapidly. New platforms now offer seamless onboarding for international hires, automated tax documentation, and real-time payment tracking, all built on blockchain rails. These tools eliminate much of the friction that previously limited crypto payroll adoption among mainstream businesses.

For example, accounting software tailored for digital assets can reconcile transactions automatically against company ledgers while providing audit trails that satisfy both internal controls and external regulators. Treasury management solutions allow CFOs to manage fiat-to-stablecoin conversions efficiently, reducing FX risk and ensuring liquidity across multiple markets.

What’s Next for Stablecoin Payroll Adoption?

The momentum behind stablecoin payroll adoption shows no signs of slowing as we move toward 2025. With nearly one in ten workers already receiving part of their pay in crypto, and almost two-thirds of those salaries flowing through USDC wallets, the question is no longer if digital assets will reshape compensation but how quickly businesses will adapt.

As regulatory clarity improves and on-chain tools become ever more user-friendly, expect even greater uptake among tech companies, startups, and remote-first organizations seeking borderless efficiency.

- The bottom line: For globally distributed teams seeking speed, cost savings, compliance confidence, and access to U. S. -dollar stability provides USDC payroll has emerged as the gold standard in 2024.