For global businesses, managing international payroll has always been a balancing act between efficiency and cost. Traditional cross-border salary payments are notorious for their complexity, delays, and high fees. In 2025, however, the rise of stablecoins like USDC, USDT, and DAI is fundamentally reshaping how companies approach payroll for remote teams and overseas contractors. Stablecoins are digital assets pegged to stable currencies such as the US dollar, offering a reliable and transparent medium of exchange that is particularly well-suited to the demands of international payroll.

Stablecoins Slash Payroll Transaction Costs

One of the most compelling advantages for employers seeking to reduce payroll transaction costs with stablecoins is the dramatic drop in fees compared to legacy payment rails. Traditional international salary transfers typically involve multiple intermediaries – each taking a cut – resulting in fees that can range from 3% to 5% per transaction. For a company paying $20,000 in monthly salaries across borders, this could mean $600–$1,000 lost to transfer costs alone.

By contrast, stablecoin transactions on public blockchains routinely incur total fees between 0.5% and 3%. This shift translates into substantial monthly savings. For instance, switching to stablecoin-based payroll could save an organization $400–$1,000 every month just in transfer fees (source). These savings scale as teams grow or as payment volumes increase, a key reason why startups and tech companies are leading adoption.

Eliminating Intermediaries: The Blockchain Advantage

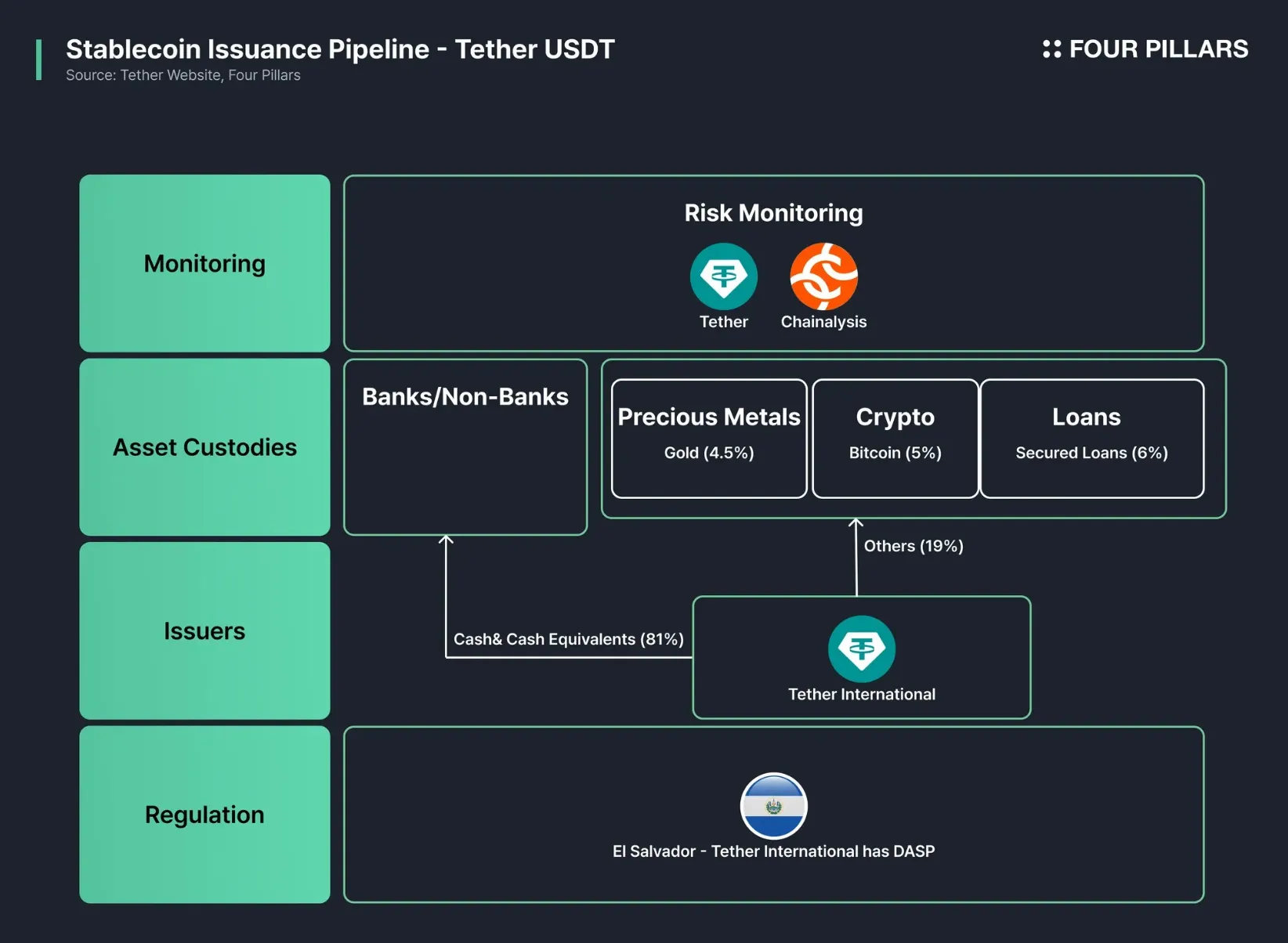

The core driver behind these cost reductions is blockchain’s ability to bypass traditional banking intermediaries entirely. When sending stablecoins like USDC directly from employer wallets to employee wallets abroad, there is no need for correspondent banks or currency conversion desks, two of the main culprits behind inflated wire transfer costs. Stablecoin transfers settle peer-to-peer on-chain within minutes regardless of geography or banking hours.

Top Reasons Stablecoins Lower International Payroll Costs

-

Elimination of Banking Intermediaries: Stablecoin payroll bypasses traditional banks and payment processors, removing multiple layers of fees and reducing overall transaction costs.

-

Lower Transaction Fees: Sending salaries with stablecoins like USDT, USDC, or DAI typically incurs fees between 0.5% and 3%, compared to the 3%–5% charged by international wire transfers.

-

Instant Settlement: Stablecoin payments settle within minutes, eliminating the delays and extra costs associated with cross-border bank transfers that can take 2–5 business days.

-

No Currency Conversion Fees: Stablecoins are pegged to stable currencies like the US dollar, so companies avoid costly foreign exchange fees when paying employees in different countries.

-

Reduced Operational Overhead: Blockchain automation streamlines payroll processing, cutting administrative costs and minimizing manual reconciliation.

-

Enhanced Transparency and Security: Every stablecoin transaction is recorded on a transparent, immutable blockchain ledger, reducing disputes and the need for costly audits.

-

Financial Inclusion for the Unbanked: Stablecoins can be received and stored in digital wallets, enabling payroll access for employees without traditional bank accounts and reducing the need for expensive alternative remittance services.

This disintermediation not only reduces direct financial outlays but also cuts down on hidden operational inefficiencies, such as manual reconciliation and error correction, that plague legacy systems. The result is not just lower costs but also less friction throughout the entire global compensation process.

Speed Meets Transparency: Beyond Just Cost Savings

The benefits of integrating stablecoins into international payroll extend well beyond simple cost reduction. With settlement speeds measured in minutes rather than days, employees receive their earnings promptly, regardless of time zone or local banking holidays. This immediacy improves cash flow management for both sides of the employment relationship.

Furthermore, because all transactions are recorded immutably on-chain, both employers and employees gain instant visibility into payment status. This transparency reduces disputes and builds trust within distributed teams, a critical asset in today’s remote-first business landscape (source).

Stablecoin payroll also introduces new levels of financial empowerment for employees in emerging markets. In countries where local currencies are volatile or subject to inflation, receiving salaries in stablecoins such as USDC means workers can preserve the value of their earnings and avoid the erosive effects of devaluation. For many, this is more than a convenience, it is a vital hedge against economic uncertainty and a means to participate in the global digital economy.

Accessibility is another critical advantage. Stablecoins do not require recipients to have traditional bank accounts; instead, funds can be received and stored in digital wallets accessible from any smartphone or computer. This opens up global hiring possibilities for companies seeking talent in regions with high unbanked populations, while also providing workers with faster access to their pay.

Implementation: What Businesses Need to Know

Transitioning to international payroll with stablecoins requires thoughtful planning but is increasingly straightforward thanks to dedicated platforms. Employers should select a compliant digital wallet solution compatible with their chosen stablecoin, USDC remains the leading option for its regulatory transparency and dollar peg stability. Security training for staff is essential, as is clear communication around tax implications and local regulations. Many organizations partner with specialized crypto payroll providers who manage these complexities end-to-end (source).

For businesses focused on compliance, it’s vital to stay updated on evolving legal frameworks governing digital assets in each jurisdiction where employees reside. Leading crypto payroll platforms offer built-in KYC/AML checks and reporting tools that help streamline these obligations.

The Bottom Line: Sustainable Savings and Strategic Advantage

The cost benefits of switching to stablecoin-based international payroll are quantifiable. Consider this breakdown:

Monthly Cost Comparison: Traditional vs Stablecoin Payroll for 20 Overseas Employees

| Payroll Method | Average Transaction Fee (%) | Total Monthly Payroll (Example: $40,000) | Total Monthly Transaction Fees | Estimated Monthly Savings |

|---|---|---|---|---|

| Traditional International Payroll | 3% – 5% | $40,000 | $1,200 – $2,000 | — |

| Stablecoin Payroll (USDT, USDC, DAI) | 0.5% – 3% | $40,000 | $200 – $1,200 | $400 – $1,000 |

As shown above, even modest-sized teams can realize savings of $400–$1,000 per month by eliminating excessive wire fees and operational overhead (source). These savings compound over time, strengthening margins and freeing up capital for growth initiatives.

The strategic implications are equally significant: faster onboarding of remote talent, improved employee satisfaction through prompt payments, reduced risk from currency volatility, and enhanced transparency across every transaction. For forward-looking companies aiming to optimize global compensation models, stablecoin payroll is no longer an experiment, it’s a pragmatic upgrade whose time has come.