Integrating crypto payroll solutions with your HR and accounting stack is no longer a theoretical exercise. With the rise of remote-first teams and the demand for borderless payments, businesses are actively seeking ways to streamline operations by embedding cryptocurrency into their payroll workflows. Done right, this integration can dramatically reduce manual errors, accelerate salary distribution, and give employees flexible payment options like USDC or Bitcoin. However, successful implementation requires a methodical approach that balances innovation with compliance and risk management.

Assessing Your Existing HR and Accounting Infrastructure

Before jumping into crypto payroll HR integration, take inventory of your current systems. Most organizations rely on robust HRIS (Human Resource Information Systems) and accounting platforms such as QuickBooks or SoftLedger. The key question is: Can your existing stack support cryptocurrency transactions? Some legacy systems lack native support for digital assets or may require middleware/API connectors to bridge the gap.

If you’re using cloud-based software with open API access, integration will be significantly smoother. For example, Integral’s platform offers direct automation of crypto payroll with QuickBooks for real-time updates. Bitwage has also rolled out integrations with 23 U. S. payroll providers, making it easier to route a portion of salaries into stablecoins or other cryptocurrencies (details here).

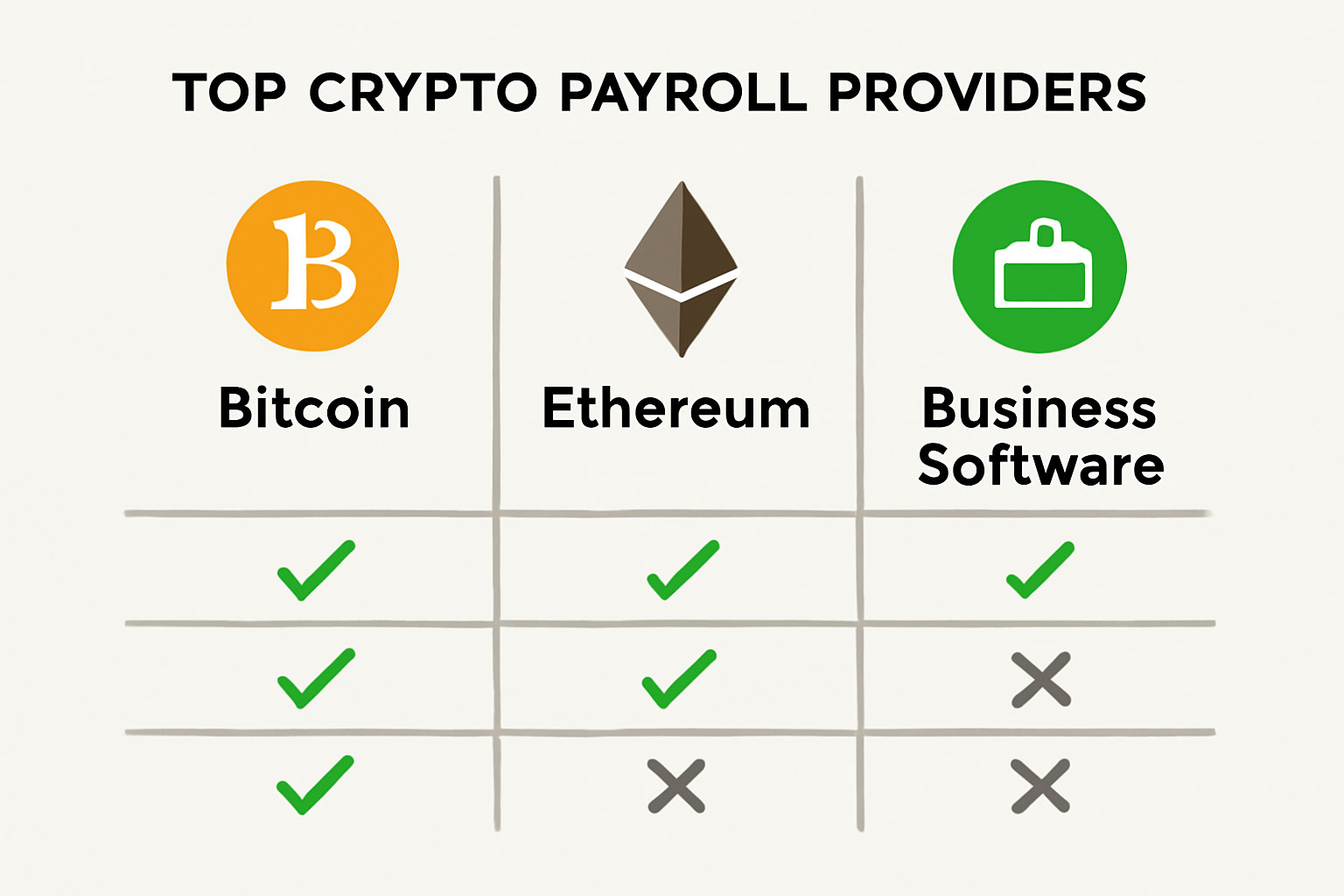

Selecting the Right Crypto Payroll Solution

The next step is choosing a provider that fits both your technical requirements and compliance needs. Not all crypto payroll services are created equal; some specialize in seamless accounting integrations while others focus on multi-currency flexibility or advanced reporting.

Top Features in Crypto Payroll Accounting Software

-

Seamless Integration with HR & Accounting Systems: Look for software that offers robust API connections to major HRIS and accounting platforms such as QuickBooks, Xero, and ADP for automated data syncing and real-time financial updates.

-

Automated Crypto Cost Basis & Tax Reporting: Ensure the platform can accurately calculate crypto cost basis, generate compliance-ready tax reports, and support multi-currency payroll for both fiat and cryptocurrencies.

-

Multi-Currency & Stablecoin Support: The software should allow payroll in major cryptocurrencies like Bitcoin, Ethereum, and stablecoins such as USDC and USDT, providing flexibility for global teams.

-

Regulatory Compliance & Security: Prioritize solutions with robust compliance tools (KYC/AML), secure wallet management, and data encryption to protect employee information and meet local legal requirements.

-

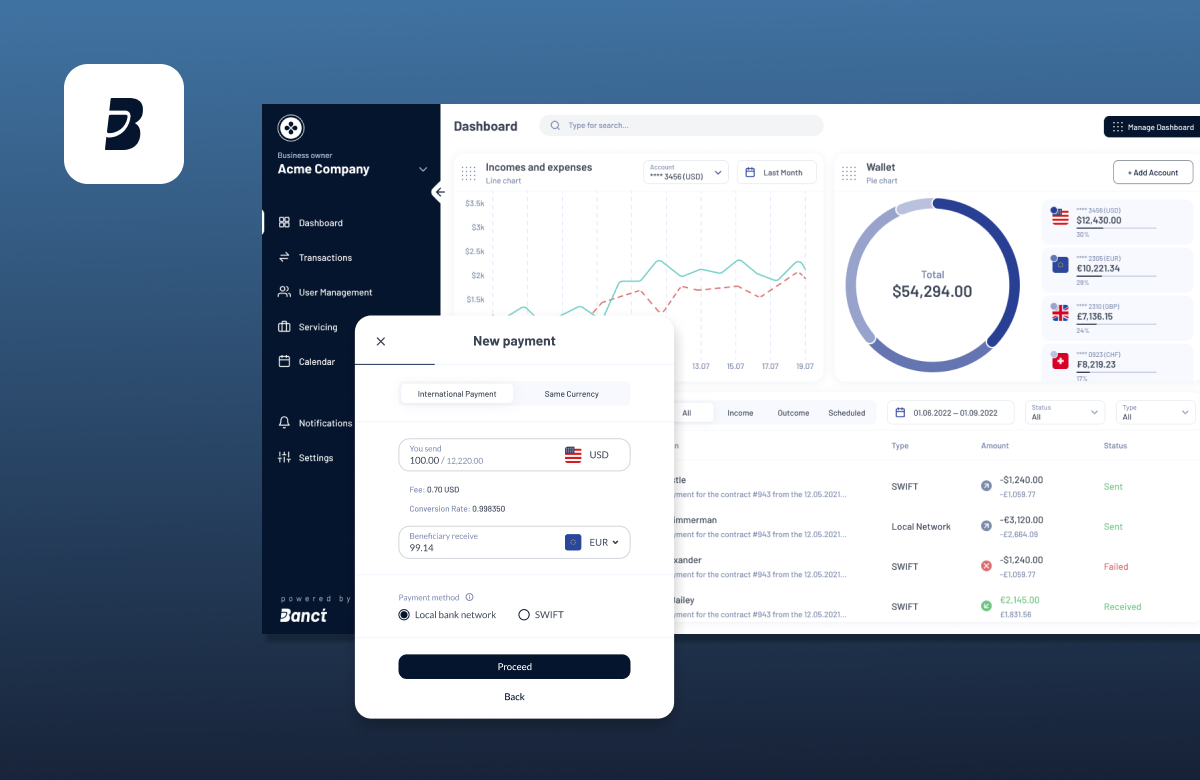

User-Friendly Employee Portals: Opt for platforms that offer intuitive dashboards for employees to view payment history, manage wallet addresses, and access educational resources about crypto payroll.

-

Real-Time Payment Tracking & Notifications: Choose software with real-time transaction tracking and automated notifications for both employers and employees, ensuring transparency and timely payments.

-

Scalable Global Payment Capabilities: Select solutions that support cross-border payments, multiple jurisdictions, and local currency conversions, enabling efficient payroll for international teams.

Consider platforms like BitPay for international teams – it lets you fund payroll in fiat currency that’s automatically converted to digital assets for global distribution (see BitPay’s solution). Meanwhile, vendors like Integral stand out for their deep hooks into popular accounting tools, ensuring every crypto transaction is categorized correctly for audit trails and tax reporting.

Ensuring Compliance and Security from Day One

Integrating cryptocurrency into your payroll process isn’t just about convenience – it’s about staying compliant in a rapidly evolving regulatory environment. Tax authorities worldwide are scrutinizing digital asset transactions more closely than ever. Make sure your chosen provider supports automated compliance workflows such as withholding calculations, W-2/1099 generation (for US-based businesses), and robust KYC/AML checks.

Security should be non-negotiable. Look for platforms that offer end-to-end encryption, multi-factor authentication, audit logs, and wallet segregation features to safeguard both company funds and sensitive employee data.

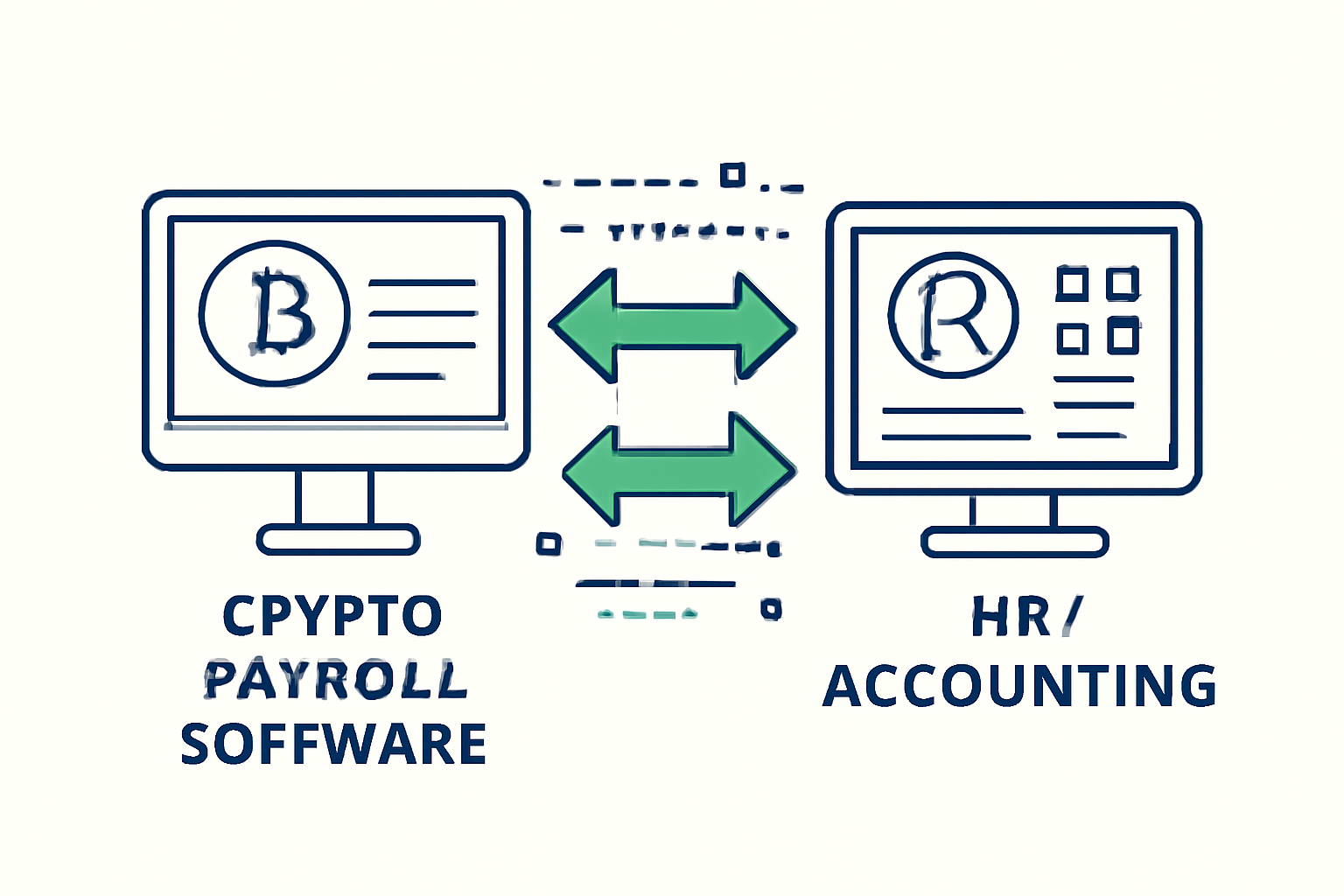

The Power of Seamless Integration

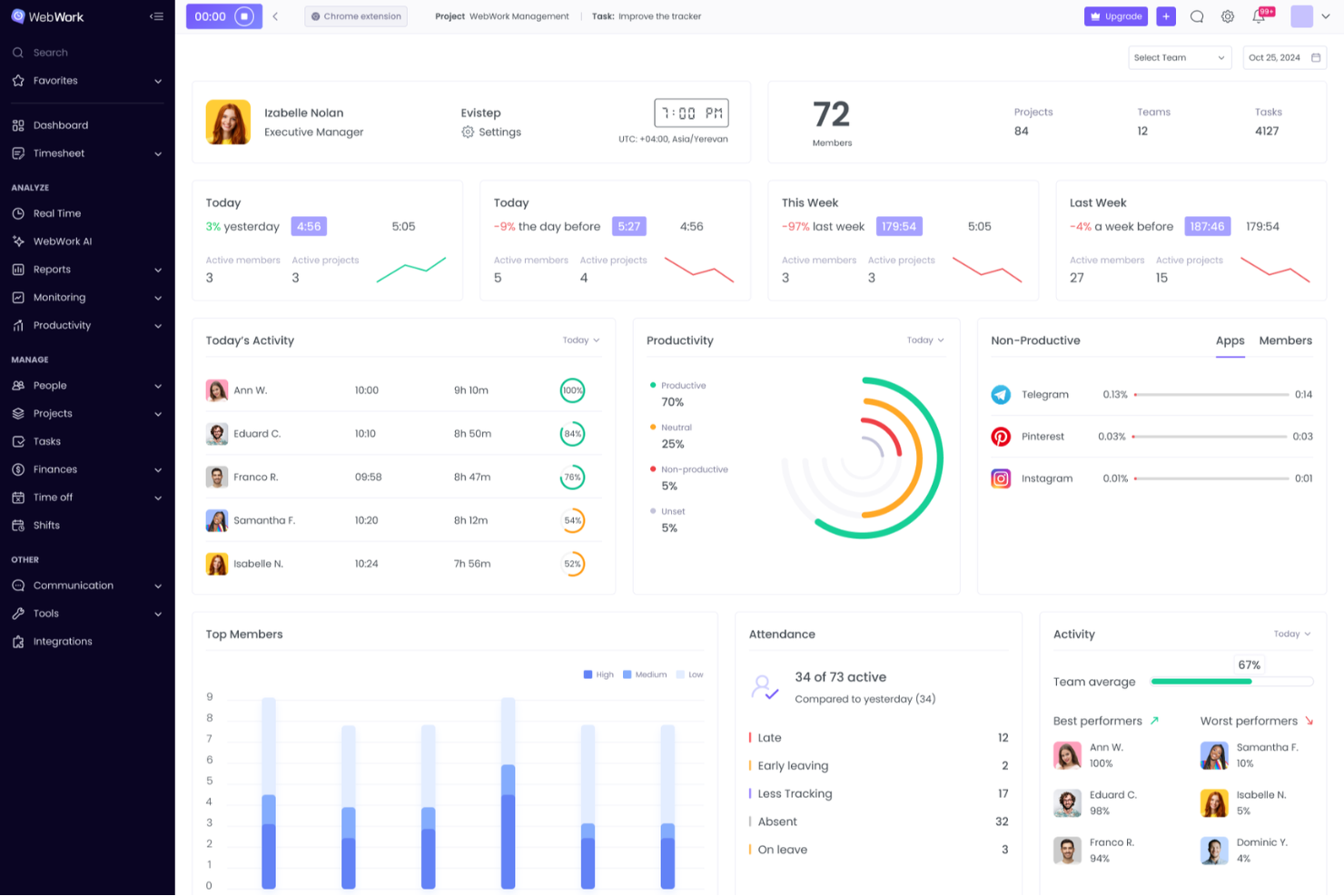

The real value emerges when you successfully integrate cryptocurrency payroll with HRIS and accounting software. Automated data transfer reduces manual entry errors – a common pain point in traditional cross-border payments – while ensuring accurate financial records across multiple jurisdictions.

This integration empowers finance teams to generate real-time reports on salary disbursements in both fiat and cryptocurrencies. It also simplifies reconciliation at month-end; every transaction is automatically categorized according to your chart of accounts.

Forward-thinking organizations are leveraging these integrations to build a more agile and resilient payroll function. With real-time visibility into both fiat and crypto outflows, finance leaders can proactively manage treasury risk, address compliance requirements, and respond swiftly to queries from auditors or regulators.

Educating Your Team and Fostering Adoption

Rolling out crypto payroll is as much a people challenge as it is a technical one. Employees need clear, jargon-free guidance on how to receive and manage digital assets. Provide resources on wallet setup, safe storage practices, and the implications of being paid in stablecoins versus volatile tokens. Consider running internal workshops or Q and A sessions to demystify the process and build trust in the new system.

Transparency about tax reporting is also essential. Many employees will want to know how their crypto earnings are taxed, how to access transaction histories for their records, and what support the company provides for compliance. Proactively addressing these topics helps reduce friction during rollout.

Monitoring Performance and Staying Compliant

After integration, continuous monitoring is critical. Regularly audit data flows between your HRIS, accounting software, and crypto payroll provider. Set up alerts for failed transactions or reconciliation mismatches. Stay current with evolving regulations, especially as tax authorities update their guidelines on digital asset compensation.

Key Metrics to Track After Crypto Payroll Integration

-

Payroll Processing Time: Measure the average time required to process payroll from initiation to completion after integrating crypto solutions. Reduced processing time indicates improved efficiency.

-

Transaction Fees and Cost Savings: Track all transaction fees associated with crypto payroll compared to traditional methods. Monitoring these costs helps assess the financial impact of the integration.

-

Employee Adoption Rate: Monitor the percentage of employees opting to receive all or part of their salary in cryptocurrency. High adoption rates suggest successful onboarding and satisfaction.

-

Compliance and Tax Reporting Accuracy: Evaluate the accuracy and timeliness of tax withholdings, filings, and compliance reports generated through the integrated system.

-

Wallet and Payment Error Rate: Track the frequency of failed or delayed payments due to wallet address errors or network issues. A low error rate reflects robust integration and data accuracy.

-

Integration Uptime and Reliability: Monitor the uptime and reliability of the connection between crypto payroll, HR, and accounting systems to ensure continuous, error-free operations.

-

Cost Basis and Accounting Reconciliation: Assess how accurately the integrated system calculates crypto cost basis and reconciles payroll transactions in accounting records, as highlighted by platforms like Bitwage and SoftLedger.

Leading platforms often provide dashboards that visualize payment status across currencies, highlight anomalies, and simplify end-of-period reporting, making it easier for finance teams to spot issues early.

Looking Ahead: The Future of Crypto Payroll Integrations

The landscape of crypto payroll HR integration continues to evolve rapidly. As APIs become more standardized and regulatory clarity improves worldwide, expect even tighter connections between digital asset payment rails and enterprise software stacks. This trend will further reduce administrative overhead while enhancing transparency for all stakeholders.

Ultimately, integrating cryptocurrency payroll with your existing HR and accounting infrastructure is not just a technical upgrade, it’s a strategic move that positions your organization at the forefront of global workforce management. By prioritizing compliance, automation, security, and employee education from day one, you’ll unlock new efficiencies while empowering your team with greater flexibility in how they’re paid.