In 2026, the landscape of cross-border payroll USDC has shifted dramatically, empowering remote teams with stablecoin salaries that slash costs and eliminate outdated banking hurdles. Companies paying contractors in USDC now enjoy transactions that settle in minutes, not days, while dodging hefty wire fees and volatile exchange rates. This isn’t hype; it’s backed by platforms processing over $1 billion in payments, proving USDC payroll as the go-to for tech firms and digital nomads alike.

Traditional methods bleed efficiency. Bank transfers chew up 5-7% in fees per payout, plus days of waiting that disrupt cash flow for workers in emerging markets. Enter USDC, pegged 1: 1 to the dollar and powered by blockchain rails from innovators like Circle and Rise. A tech firm via TransFi reportedly cut payroll costs by over 60%, redirecting savings to growth instead of intermediaries.

Unpacking Cost Efficiency in USDC Payroll

Let’s get precise on the numbers. Firms switching to stablecoin salaries remote teams report average fee reductions of 60%, turning what was a $10,000 monthly expense into $4,000. Why? No SWIFT networks, no correspondent banks, just direct USDC transfers on efficient chains like Fantom. As of February 21,2026, Multichain Bridged USDC (Fantom) trades at $0.01983518, up 0.01006% from the prior close, with a high of $0.02029896 and low of $0.0195545. This micro-stability underscores why it’s ideal for salaries; no wild swings to erode value.

Ivy’s analysis of top stablecoin companies highlights this edge, noting USDC’s role in cross-border setups that bypass FX volatility. For startups hiring globally, this means predictable budgeting. Imagine paying a developer in Brazil or a marketer in Vietnam without conversion losses; that’s the reality now.

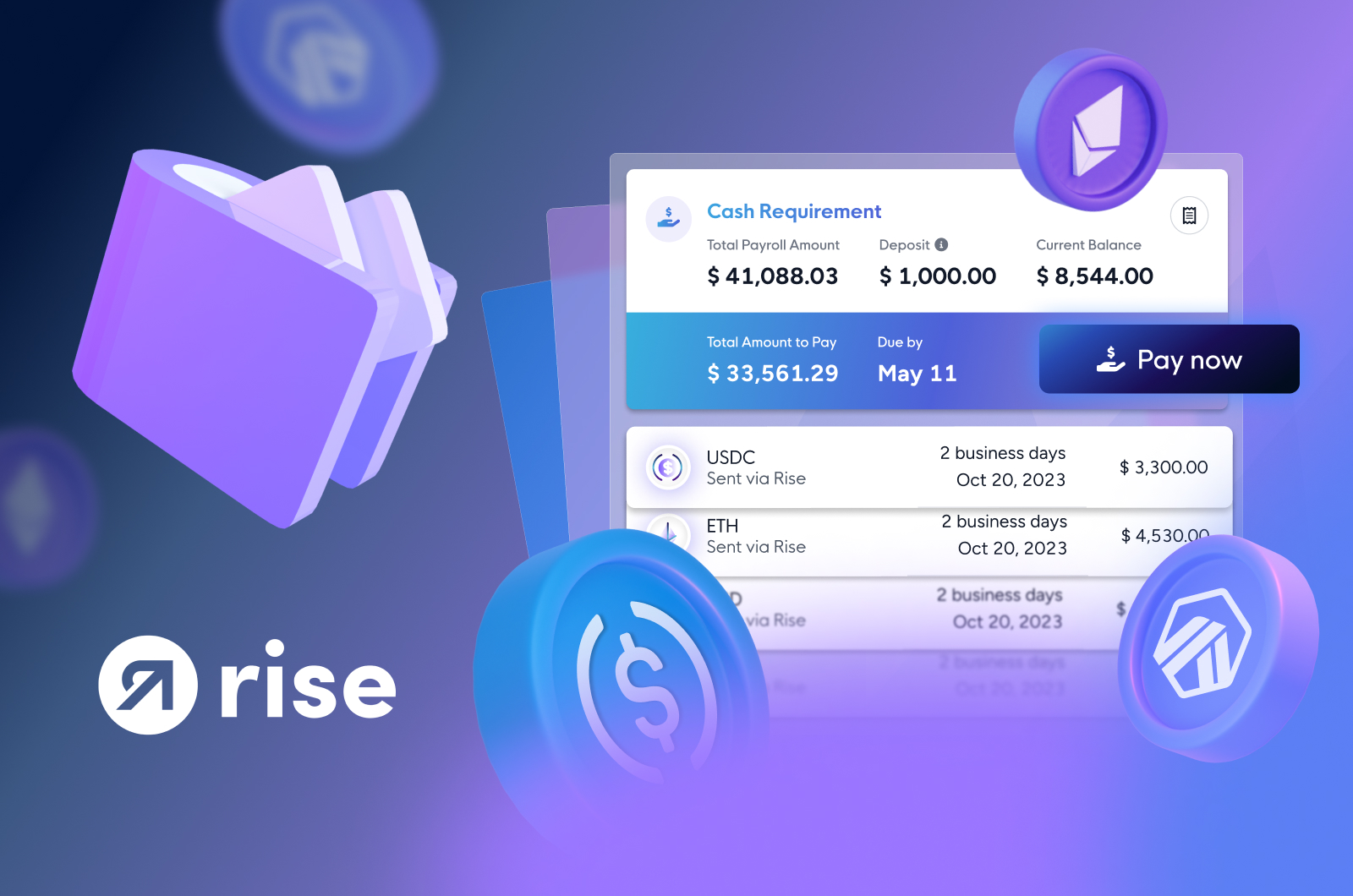

Platforms like Rise exemplify this, blending USDC with fiat rails in 190 and countries. Their multi-chain support ensures low gas fees, often under $0.01 per transaction. Opinion: Ignoring this for legacy payroll is like sticking with fax machines in an email world; it’s not sustainable.

Speed That Fuels Remote Productivity

Delay is the enemy of remote work. Traditional wires take 3-7 days, stranding talent during pay cycles. USDC flips the script: settlements in under 10 minutes. Riseworks data shows teams receiving funds instantly, boosting morale and retention. Thunes’ 2026 trends report flags this as a key driver for stablecoin adoption in payments.

Stablecoin-native payroll eliminates friction, offering flexibility and transparency beyond traditional rails.

(Adapted from Toku. com insights. ) Hurupay’s Remote Work Playbook 2026 emphasizes structuring hires around such fast payments to scale without friction. For contractors, this means cash available for immediate needs, not IOUs from slow banks.

Real-world proof? Rise’s Circle integration replaces days-long waits with near-instant transfers, as detailed in their case studies. I’ve seen firms transform operations by embedding this; one client halved their payout admin time.

Global Reach Without the Headaches

Pay contractors in USDC opens doors to talent anywhere, from Manila to Mexico City, sans currency mazes. Workers convert to local fiat at optimal rates or hold for stability. CryptoPayroll. info notes this revolutionizes payments in volatile economies, where local currencies can drop 20% overnight.

EasyStaff’s freelancer guide for 2026 covers receiving USDT/USDC seamlessly, underscoring accessibility. Ogletree’s compliance overview praises stablecoins for low-cost transfers that meet regs effortlessly. With blockchain’s audit trail, disputes vanish; every satoshi is traceable.

USD Coin (USDC) Price Prediction 2027-2032

Stability-focused forecasts amid rising adoption in remote team payroll and cross-border payments

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from 2026 $1.00) |

|---|---|---|---|---|

| 2027 | $0.95 | $1.00 | $1.03 | 0.0% |

| 2028 | $0.96 | $1.00 | $1.02 | 0.0% |

| 2029 | $0.97 | $1.00 | $1.02 | 0.0% |

| 2030 | $0.98 | $1.00 | $1.01 | 0.0% |

| 2031 | $0.99 | $1.00 | $1.01 | 0.0% |

| 2032 | $0.995 | $1.00 | $1.005 | 0.0% |

Price Prediction Summary

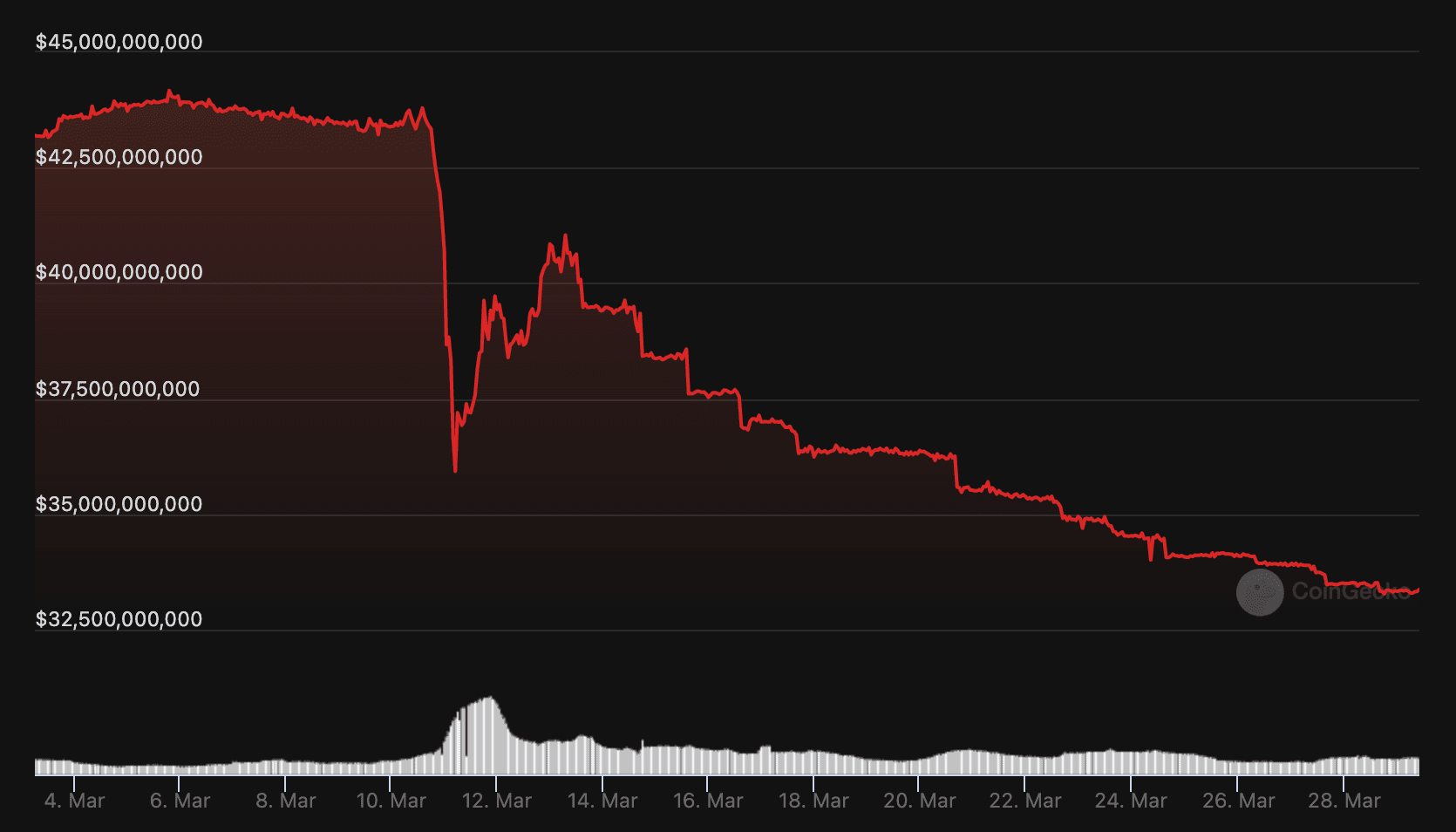

USDC is projected to maintain a strong peg to the US dollar at an average of $1.00 through 2032, with tightening min/max ranges reflecting improved liquidity and stability from payroll adoption. Bearish scenarios account for potential depegs during crypto winters or regulatory hurdles, while bullish cases see minor premiums from high demand in global payments.

Key Factors Affecting USD Coin Price

- Massive adoption in stablecoin payroll platforms like Rise and TransFi, cutting cross-border costs by 60%

- Regulatory compliance enhancements and transparency via blockchain for audits

- Technological advancements in multi-chain support and faster settlements (minutes vs. days)

- Crypto market cycles influencing liquidity, with bearish dips to $0.95 possible in downturns

- Competition from USDT/USDT but USDC’s Circle backing and partnerships provide edge

- Global remote work growth driving demand, supporting peg stability and reserve growth

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

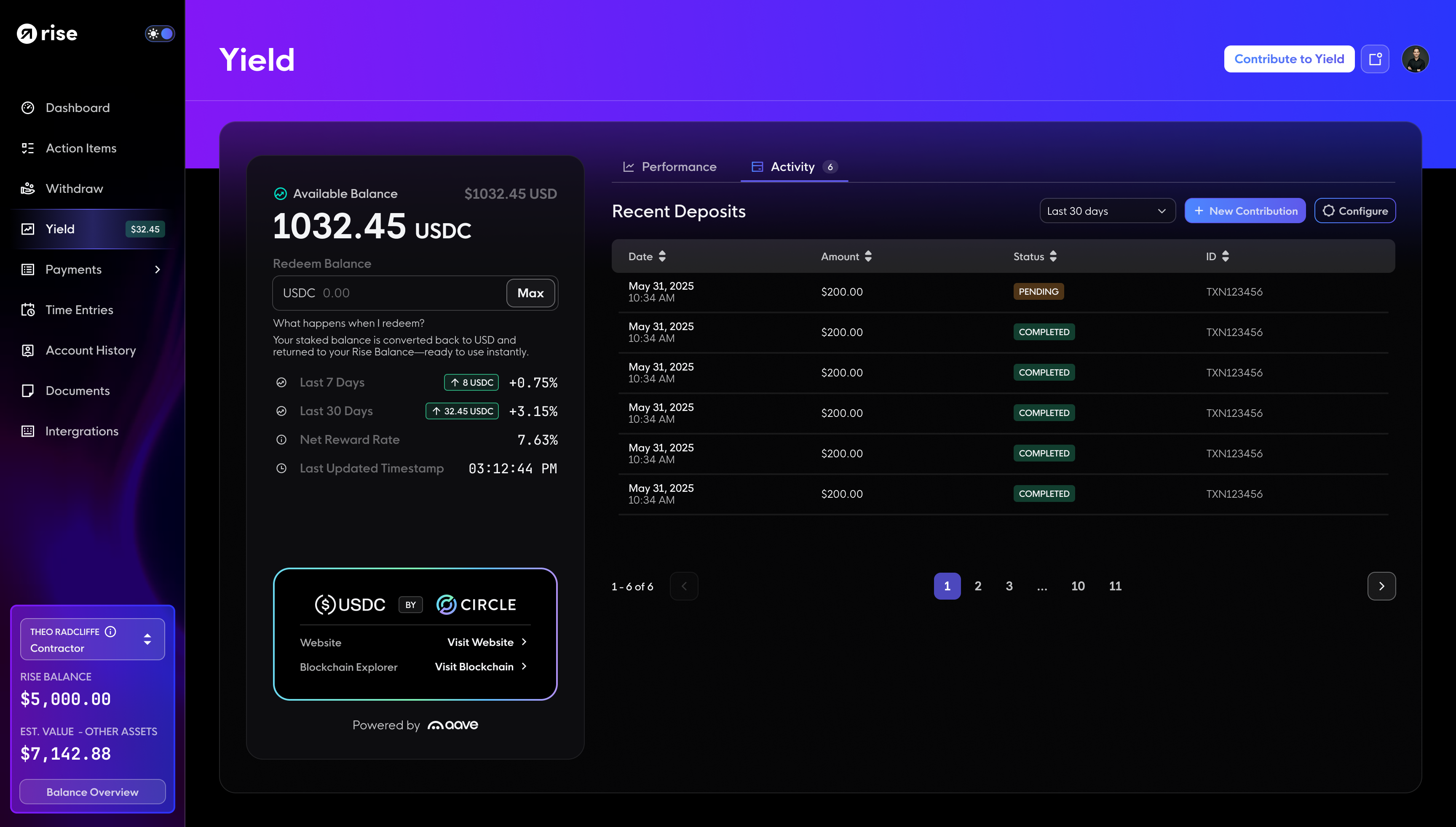

For international crypto payroll in 2026, USDC isn’t optional; it’s the efficient backbone. Platforms automate KYC and tax forms, easing burdens. StablecoinInsider’s Rise review confirms $1B and processed, proving scale.

That $1B milestone isn’t just a number; it’s a testament to reliability at scale, with multi-chain support keeping fees negligible even during peak volumes.

Navigating Compliance in Crypto Payroll International 2026

Compliance often trips up global payroll, but USDC flips that narrative. Blockchain’s immutable ledger turns every transaction into an auditor’s dream: fully traceable, tamper-proof records that satisfy IRS, FATCA, and local tax bodies without endless paperwork. Rise’s automated tools handle worker classification and identity verification upfront, slashing risks of missteps that plague traditional setups.

Ogletree’s insights on crypto payrolls stress this: stablecoins like USDC enable compliant, lightning-fast transfers that dodge the delays of legacy compliance checks. In my decade analyzing frameworks, I’ve seen firms avoid penalties by embedding KYC at payout, ensuring USDC payroll aligns with MiCA in Europe or SEC guidelines stateside. It’s meticulous, yes, but it builds unshakeable trust.

Riseworks positions USDC as the compliance king for remote contractor teams, integrating identity checks that keep you audit-ready. For businesses, this means no more scrambling during tax season; transparency is baked in.

Real-World Wins: Case Studies in Action

Consider a distributed marketing agency paying 50 contractors across Asia-Pacific. Switching to USDC via platforms like Toku cut their monthly fees from $5,000 to $1,800, with funds landing same-day. Or TransFi’s tech client, who pocketed 60% savings, freeing capital for hires. These aren’t outliers; StablecoinInsider logs similar outcomes with Rise, processing billions without a hitch.

Thunes’ stablecoin trends for 2026 predict deeper integration, with liquidity pools ensuring instant conversions. Hurupay’s playbook advises building remote structures around this, creating scalable ops that flex with growth. My take: firms clinging to wires will lose talent to agile competitors wielding stablecoin salaries remote teams.

Top 5 USDC Payroll Benefits

-

60% Fee Cuts: Up to 60% reduction in payroll processing fees compared to traditional methods, as seen with TransFi’s USDC integration for remote tech firms. Source

-

Minutes-Long Settlements: USDC transactions settle in minutes, versus 3–7 days for bank wires, boosting efficiency via platforms like Rise. Source

-

FX Stability: Pegged 1:1 to USD, USDC provides currency stability for teams in volatile markets, eliminating conversion risks.

-

Auto-Compliance: Blockchain transparency and automated features from Rise ensure regulatory adherence and simplify audits for cross-border payments. Source

-

Global Fiat Ramps: Payouts to 190+ countries in local fiat via Rise, with USDC flexibility for instant conversions worldwide.

Freelancers echo this. EasyStaff’s 2026 guide details USDC receipts as seamless, with wallets converting to local cash effortlessly. No more begging banks for weekend wires.

Getting Started with Cross-Border Payroll USDC

Implementation is straightforward. Select a vetted platform like Rise or Riseworks: onboard via API, link your treasury wallet, input team details, and schedule USDC batches. Most handle conversions to 190 and fiat currencies, so workers pick their preference. Test with a small payout first; monitor that Multichain Bridged USDC (Fantom) at $0.01983518, holding steady with a 24-hour range from $0.0195545 to $0.02029896.

Key tip: Prioritize platforms with Circle’s USDC backing for reserves transparency; it’s audited monthly, quelling any peg worries. Link payroll to HR tools for automated invoicing, and you’re set. Costs? Under 1% total, versus banks’ gouge.

| Traditional Payroll | USDC Payroll |

|---|---|

| 3-7 days settlement | and lt;10 minutes |

| 5-7% fees | and lt;1% |

| Currency risk | 1: 1 USD peg |

| Opaque tracking | Blockchain audit trail |

For pay contractors in USDC, this table crystallizes the shift. I’ve advised teams through transitions; the ROI hits within one cycle.

As 2026 unfolds, expect regulators to embrace stablecoins further, with clearer guidelines accelerating adoption. Platforms will layer AI for predictive compliance, making crypto payroll international 2026 even more robust. Remote teams thrive when paid reliably, and USDC delivers that edge, turning global talent pools into profit engines without the drag. Forward-thinking leaders get this: stability meets speed, costs plummet, and trust soars.