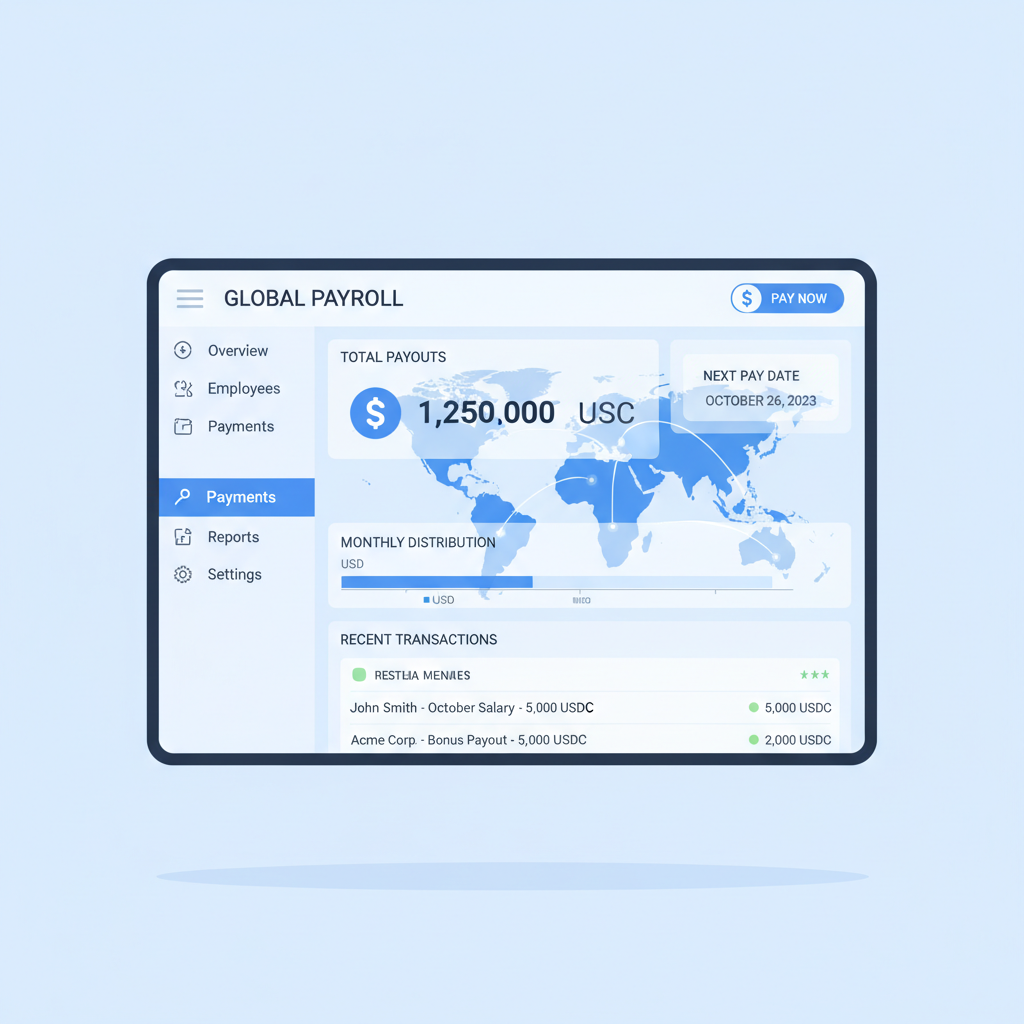

Managing USDC payroll for remote teams in 2026 means ditching the headaches of traditional cross-border salaries. Remote workers in Latin America, Asia, or Europe expect fast access to funds without watching fees eat into their paychecks. Platforms like Remote now enable payments in nearly 70 countries using USDC on Coinbase’s Base network, partnering with Stripe for seamless, compliant transfers. Rise takes it further with automated compliance and flexible withdrawals, proving stablecoins like USDC are no longer experimental-they’re essential for global operations.

This bridged USDC variant on Fantom highlights blockchain’s reach, trading at $0.0200 amid minor fluctuations. Yet for payroll, standard USDC’s 1: 1 USD peg delivers the stability businesses crave, powering cross-border USDC salaries without volatility risks.

From my experience advising enterprises, the appeal boils down to tangible gains over legacy systems. Crypto payrolls via stablecoins cut delays and costs, as Ogletree notes in their compliance overview. Let’s break down the top benefits driving adoption among startups and tech firms hiring digital nomads.

Instant Cross-Border Settlements: Goodbye to 3-5 Day Delays

Picture authorizing payroll on Friday night from New York, and your developer in Jakarta receives it Saturday morning. Instant cross-border settlements with USDC eliminate the 3-5 day waits of wires, as Riseworks highlights in their 2026 benefits list. Blockchain confirms transactions in seconds, not days. Remote’s rollout exemplifies this; contractors grab funds near-instantly to their wallets. For stablecoin payroll startups, this speed keeps teams productive, not chasing payments.

Near-Zero Transaction Fees and 24/7 Availability

Traditional wires gobble 3-7% in fees; USDC slashes that by 90%, often to pennies per transfer. Combine this with 24/7 payment availability, and you authorize runs anytime, worldwide-no banking hours dictating your schedule. Bitwage echoes this for fee-free global payroll. HR teams love it: fund in fiat, pay in USDC, workers cash out locally via Rise or World App expansions in Japan and South Korea. It’s pragmatic efficiency at scale.

These first two benefits alone transform cash flow. But stability seals the deal.

USD-Pegged Stability Meets Seamless Global Reach

USDC’s USD-pegged stability means zero volatility-no watching salaries swing like BTC. Backed 1: 1 by reserves, it’s ideal for predictable compensation. Pair it with seamless global reach to 190 and countries sans intermediaries, and remote teams thrive. Toku. com details safe global team payments; no banks, no borders. I’ve guided firms paying contractors from Taiwan to Brazil this way, bypassing FX headaches.

Next up, transparency and cost savings amplify the value.

USDC Price Prediction 2027-2032

Stablecoin peg stability forecasts amid payroll adoption and cross-border payment growth

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario |

|---|---|---|---|---|---|

| 2027 | $0.990 | $1.000 | $1.010 | 0.0% | Increased payroll adoption stabilizes peg; minor depegs in bear markets |

| 2028 | $0.995 | $1.000 | $1.005 | 0.0% | Regulatory clarity boosts confidence; tighter volatility range |

| 2029 | $0.997 | $1.000 | $1.003 | +0.1% | Tech upgrades and multi-chain expansion; slight premium in bull cycle |

| 2030 | $0.998 | $1.000 | $1.002 | 0.0% | Dominant payroll use case; competition from USDT pressures peg |

| 2031 | $0.998 | $1.000 | $1.002 | 0.0% | Global regulatory harmonization; resilient to crypto winters |

| 2032 | $0.999 | $1.000 | $1.001 | 0.0% | Mature stablecoin market; near-perfect peg maintenance |

Price Prediction Summary

USDC is forecasted to robustly maintain its $1 USD peg from 2027-2032, with low volatility (min-max spreads under 1%) driven by surging payroll and remittance adoption, regulatory tailwinds, and Circle’s infrastructure expansions. Bullish demand may introduce minor premiums, while bearish crypto cycles pose limited depeg risks.

Key Factors Affecting USD Coin Price

- Massive USDC payroll adoption by platforms like Remote, Rise, and World App reducing transfer fees and delays

- Favorable U.S. and global regulations enhancing stablecoin compliance and trust

- Technological advancements in blockchain scalability and multi-chain bridging

- Competition from USDT/USDe but USDC’s transparency and reserves advantage

- Crypto market cycles: stablecoins resilient to volatility, with demand spikes during downturns

- Growing market cap from treasury and institutional integrations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Blockchain Transparency and Minimized FX Losses

Every USDC transfer leaves an immutable audit trail on blockchain, simplifying compliance reporting. Regulators demand proof; USDC delivers it effortlessly. Stablecoin Insider ranks this high for 2026 tools. Meanwhile, minimized FX losses erase conversion fees and bad rates-freelancers report full fair market value, per EasyStaff’s guide. A $5,000 USDC payout stays $5,000, no slippage.

Circle’s work with Rise shows real-world impact: days-long settlements become near-instant. For crypto payroll global contractors, this builds trust. Compliance follows suit.

Regulatory Compliance and Scalability for Growth

2026 standards require KYC/AML; USDC platforms embed them natively. Bridge. xyz guides businesses here for efficient payouts. Regulatory compliance is baked in, automating tax docs globally via Rise. Scalable for startups? Absolutely-handle 10 or 10,000 remote workers without ops overload. Hurupay’s playbook centralizes treasury with stablecoins.

One more edge remains: talent attraction, which we’ll explore next.

Attract Top Talent: USDC Salaries for Digital Nomads

Digital nomads flock to roles offering USDC international payments 2026 style: fast, borderless, and reliable. In a talent war, promising instant access to earnings sets you apart. Platforms like World App expanding USDC payroll to Singapore and Taiwan make this feasible, letting contractors cash out in local currencies or hold stable value. I’ve seen startups double their applicant pool by advertising USDC payroll; it’s a signal of modernity and efficiency that legacy firms can’t match.

Stack these ten benefits, and USDC payroll for remote teams isn’t just viable, it’s superior. From instant settlements to talent magnetism, stablecoins rewrite the rules for cross-border USDC salaries. Remote’s Stripe integration proves scale; Rise handles compliance end-to-end. Blockchain’s transparency ensures every dollar traces back, while zero fees preserve margins for stablecoin payroll startups.

Implementing USDC Payroll: A Pragmatic Rollout

Transitioning demands focus on tools vetted for 2026. Start with platforms embedding compliance, like those from Circle or Bitwage, funding in multiple currencies without FX markups. Hurupay’s remote work playbook stresses centralizing operations; pair foreign accounts with USDC for hybrid flexibility. For crypto payroll global contractors, reconciliation shines: immutable ledgers cut audit time by 80%.

Challenges? Volatility isn’t one with USDC’s peg, but wallet education matters. Train teams on secure storage; most platforms offer non-custodial options. Tax reporting simplifies too: freelancers log USDC at receipt value, as EasyStaff outlines. Ogletree’s crypto payroll insights confirm stablecoins meet regulatory muster when KYC’d properly.

Real adopters thrive. Rise swaps settlement drags for seconds; contractors in Latin America access funds weekends via World App. Stablecoin Insider’s tool roundup favors USDC for ops controls. Bottom line: for growing teams, this scales without friction.

Opt for proven providers to sidestep pitfalls. Cross-Border Payroll specializes in USDC setups, streamlining everything from treasury to payouts. Businesses paying nomads worldwide cut costs 90%, boost satisfaction, and stay ahead. The shift is here; position your team to win with stablecoin precision.