In 2026, USDC payroll stands as a reliable pillar for remote teams navigating the complexities of cross-border payroll crypto. With platforms like Remote enabling payouts in 69 countries and World App expanding USDC salary services globally, businesses now achieve near-instant settlements without the drag of traditional banking delays. Visa’s pilots for assignee salaries in USDC further underscore this shift, delivering faster processing and slashed fees. This evolution addresses core pain points in stablecoin salaries remote teams face, from volatile exchange rates to bureaucratic hurdles.

Native USDC maintains its peg through Circle’s robust reserves, powering everything from remittances to B2B payments. Yet, as seen with Multichain Bridged USDC on Fantom trading at $0.0198 – down 0.000420% over 24 hours with a high of $0.0200 and low of $0.0178 – bridged variants highlight the importance of sticking to regulated, fully backed stablecoins for payroll. This precision in token selection minimizes de-peg risks, ensuring teams receive exact salary values.

Accelerating Global USDC Payments in 2026

Cross-border salaries demand speed and predictability. Traditional wires can take days, exposing payments to FX fluctuations and intermediary fees averaging 6-7%. USDC flips this script: transactions settle in seconds on blockchains like Ethereum or Solana, with costs under $0.01. FinTech Weekly predicts stablecoins will dominate B2B flows and treasury ops this year, fueled by ISO 20022 adoption and real-time rails outlined in Thunes’ 2026 trends report.

Stablecoins offer faster cross-border payments, avoid exchange rate losses, and eliminate banking bureaucracy. (Cyber Defense Magazine)

For tech startups and digital nomads, this means payroll runs like clockwork. Remote workers in high-inflation regions convert USDC to local currency at optimal rates, bypassing SWIFT’s inefficiencies. Our risk frameworks at Cross-Border Payroll integrate these rails, hedging volatility through automated USDC conversions where needed.

Top Advantages Driving Stablecoin Payroll Compliance

Stablecoin payroll compliance has matured significantly. Freelancers report income at USDC’s fair market value upon receipt – a $5,000 payout equals $5,000 taxable income, per easystaff. io’s guide. Ogletree notes efficiencies for distributed teams but flags tax and regulatory risks; solutions lie in automated withholding and jurisdiction-specific reporting via platforms like ours.

- Faster Payments: Seconds vs. days, per Riseworks’ top 10 benefits.

- Lower Fees: Sub-cent transactions crush wire costs.

- Currency Stability: USDC’s 1: 1 USD backing, unlike volatile fiat pairs.

- Transparency: Blockchain ledgers provide immutable audit trails.

- Inclusion: Unbanked contractors access salaries via wallets.

Hexn details real setups: embed wallets for seamless distribution, monitor de-peg events (rare for USDC), and mitigate freeze risks through diversified custodians. Gen Z freelancers, per LinkedIn insights, propel this trend with zero-fee, borderless demands. Circle’s USDC economy report confirms its role in merchant and remittance flows, positioning it as payroll infrastructure.

While opportunities abound, prudent risk management defines success. De-peg events, though minimal for USDC, warrant on-chain monitoring tools. Operational errors in crypto payroll, as Cyber Defense warns, stem from manual processes; automation via smart contracts enforces accuracy. We recommend multi-signature wallets and compliance layers to handle evolving regs across 100 and countries.

INXY Payments ranks USDC among 2026’s safest stablecoins for its reserve audits and use cases. For remote teams, this translates to protected profits: batch payrolls in USDC, settle instantly, and convert locally as needed. Pair this with hedging strategies – options on USDC pairs if exposure grows – to minimize surprises entirely.

Businesses deploying USDC payroll benefit from these layered protections, turning potential pitfalls into managed variables. Our platforms embed real-time alerts for any deviation from the $1 peg, drawing on Circle’s transparent reserves to reassure stakeholders.

Practical Deployment: Setting Up Stablecoin Salaries for Remote Teams

Transitioning to stablecoin salaries remote teams requires a structured rollout. Begin with wallet integration: non-custodial options like embedded wallets allow contractors to receive funds without prior crypto experience. Platforms automate batch distributions, calculating withholdings based on recipient jurisdictions. For instance, a developer in Brazil or a marketer in Ukraine receives exact USDC equivalents, convertible via local ramps at market rates.

Key Steps for USDC Payroll

-

1. Select a compliant platform: Choose providers like Remote for USDC payouts in 69 countries or Circle for direct infrastructure, ensuring regulatory alignment.

-

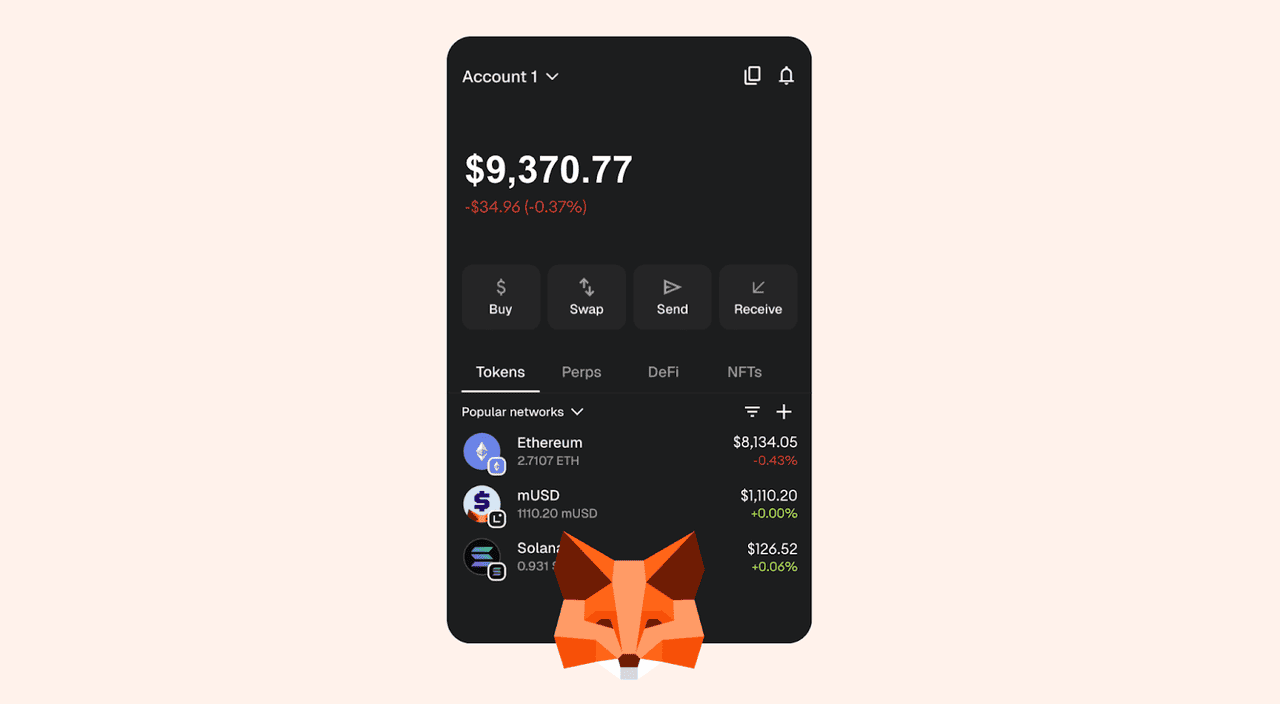

2. Set up company wallet: Create a business account with Circle to securely hold and manage USDC across chains like Ethereum and Solana.

-

3. Onboard team wallets: Instruct employees to use non-custodial wallets like MetaMask (Ethereum) or Phantom (Solana) compatible with USDC.

-

4. Conduct compliance checks: Complete KYC/AML verifications and confirm tax reporting at USDC fair market value per IRS rules, consulting local experts.

-

5. Configure payroll settings: Define USDC salaries, schedules, and automations via platform APIs for reliable cross-border execution.

-

6. Test transactions: Execute small pilot payments to verify speed, receipt, and low fees before full deployment, minimizing risks.

This setup slashes administrative overhead. Where traditional payroll demands multi-bank reconciliations, USDC ledger queries provide instant verification. Thunes’ 2026 trends highlight how real-time rails amplify this, syncing with ISO 20022 for legacy system compatibility. Remote teams report 90% faster cycles, per industry benchmarks, freeing CFOs for strategic focus.

Real-World Wins: USDC in Action for Global Teams

Consider a SaaS firm with 50 contractors across Asia-Pacific: monthly wires previously incurred $2,500 in fees and three-day delays. Switching to USDC via Cross-Border Payroll cut costs to pennies and enabled payday alignment with UTC. Visa’s Madrid pilot mirrors this, paying assignees in stablecoins for seamless settlements. World App’s expansions further prove scalability, serving freelancers in emerging markets without banking friction.

Remote workers are now getting paid across borders with no bank delays or fees. (Shehroz K. on LinkedIn)

Gen Z’s preference for crypto-native payroll accelerates adoption, as they prioritize speed over legacy norms. Riseworks outlines ten benefits, from inclusion for unbanked talent to programmable salaries via smart contracts. Yet, success hinges on vetted stablecoins: USDC’s audits outshine competitors, per INXY Payments’ 2026 rankings.

Our hedging frameworks complement this, using options to cap FX exposure during conversions. A team holding USDC through quarter-end avoids volatility spikes, locking in purchasing power.

Navigating Compliance in Cross-Border Payroll Crypto

Regulatory landscapes evolve, but stablecoin payroll compliance tools keep pace. USDC transactions trigger fair market value reporting – treat $10,000 received as $10,000 income, regardless of later volatility. Ogletree flags risks like misclassification; counter with geo-fencing and automated 1099-K forms. Hexn’s guide stresses diversified custodians to sidestep freeze events, rare but monitored via on-chain analytics.

For enterprises, this means audit-ready trails: every transfer timestamped, traceable to reserves. Pair with KYC/AML via integrated oracles, and you’re positioned for audits across jurisdictions.

Looking ahead, global USDC payments 2026 will integrate deeper with DeFi yields, letting idle payroll funds earn while compliant. FinTech Weekly envisions stablecoins as plumbing for treasury ops, a reality we’re building today. Remote teams gain not just efficiency, but resilience – payroll as a strategic asset, buffered against global shocks.

At Cross-Border Payroll, we streamline this for you: instant setups, zero surprises. Deploy USDC confidently, protect your margins, and scale globally without the old-world drag. Your teams deserve payments as borderless as their talent.