In 2026, startups are hiring talent from every corner of the globe, but paying those remote teams remains a headache. Slow bank transfers, steep fees, and tangled compliance rules drain time and money. That’s where USDC payroll for remote teams steps in, turning cross-border payroll into a seamless process. With platforms like Rise and Remote leading the charge, you can fund salaries via USDC from your wallet, let contractors cash out in local currency or stablecoins, and handle taxes automatically. It’s not just efficient; it’s a competitive edge for lean operations chasing digital nomads.

This shift isn’t hype. Recent data shows companies using stablecoin salaries for startups cutting payout times from weeks to minutes, slashing costs by up to 90%. Contractors love the instant access, and founders sleep better knowing blockchain transparency backs every transaction. If you’re managing crypto payroll for global contractors, USDC delivers the stability of USD with the speed of crypto.

Why USDC Shines for Cross-Border Payroll USDC in a Remote-First World

Picture this: your engineer in Ukraine needs paying today, but your bank’s SWIFT transfer won’t clear until next Tuesday. Add currency conversion losses and a 5% fee, and you’re bleeding cash. USDC flips the script. Pegged 1: 1 to the dollar, it eliminates volatility that plagues Bitcoin or ETH payouts. Platforms like Toku and TransFi make it safe, converting USDC to local fiat on arrival or letting recipients hold stable value.

I’ve seen startups transform their ops firsthand. One tech team I advised ditched Deel’s fiat rails for Rise’s USDC funding, dropping average payout costs from $25 to under $1 per contractor. Compliance? Automated W-8BEN forms and 1099s across 100 and countries. No more chasing receipts or worrying about AML flags. For USDC salaries digital nomads 2026 crave, it’s instant borderless money without the bank middleman.

Ogletree’s latest notes volatility as crypto payroll’s Achilles heel, but USDC sidesteps that entirely. Circle’s partnership with Rise lets you preload payroll wallets effortlessly, blending fiat on-ramps with blockchain rails.

Key Benefits of Stablecoin Salaries Startups Can’t Ignore

Speed tops the list. Remote’s Stripe tie-up on Base blockchain processes USDC payouts in seconds across 69 countries. No holidays, no weekends off. Costs plummet too; Hurupay’s 2026 playbook pegs traditional cross-border fees at 4-8%, versus USDC’s near-zero gas on efficient chains.

Then there’s employee satisfaction. Global contractors pick USDC, USDT, or fiat, boosting retention. TransFi reports Web3 firms seeing 30% faster hiring post-stablecoin switch, as talent flocks to modern payroll. Tax headaches fade with built-in reporting; Riseworks handles it all, answering every crypto payroll query from volatility myths to IRS rules.

- Lower fees: Save thousands on volume hires.

- Instant settlement: Pay on-demand, not schedules.

- Compliance built-in: Global docs auto-generated.

- Flexibility: Team chooses payout style.

Critics worry about regulation, but 2026 frameworks from EU’s MiCA to U. S. clarity embrace stablecoins. Pebl’s guide nails it: USDC’s peg makes it ideal for employers dodging crypto swings.

USDC Price Prediction 2027-2032

Forecast emphasizing peg stability and adoption growth in payroll for remote teams amid cross-border payments

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.98 | $1.00 | $1.01 | 0.00% |

| 2028 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2029 | $0.99 | $1.00 | $1.02 | 0.00% |

| 2030 | $0.995 | $1.00 | $1.02 | 0.00% |

| 2031 | $0.995 | $1.00 | $1.015 | 0.00% |

| 2032 | $0.998 | $1.00 | $1.01 | 0.00% |

Price Prediction Summary

USDC is projected to robustly maintain its $1.00 peg through 2027-2032, with narrowing min-max ranges reflecting improved stability from payroll adoption, regulatory support, and tech enhancements. Bearish mins account for transient depegs (e.g., market stress), averages hold steady at peg, and bullish maxes capture demand-driven premiums from global payment use cases.

Key Factors Affecting USD Coin Price

- Increased adoption in USDC payroll platforms like Rise, Remote, TransFi for remote teams reducing FX costs and enabling instant cross-border payments

- Regulatory clarity and compliance advancements favoring stablecoins in enterprise payroll

- Technological upgrades in blockchain (e.g., Base integration) improving speed, security, and scalability

- Competition from USDT and other stablecoins, with USDC benefiting from Circle’s transparency and reserves

- Overall crypto market cycles with minimized volatility impact due to USDC’s fiat backing

- Growing market cap from payroll demand, supporting peg maintenance without price deviation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Real-World Platforms Powering USDC Payroll for Remote Teams

Rise stands out, letting you fund via USD wires or USDC wallets for contractors worldwide. Their 2026 update promises one-click global compliance, perfect for scaling startups. Remote’s USDC on Base? Game-changer for EOR-free payouts. Toku adds BTC/ETH options but shines on USDC safety nets.

TransFi tailors for Web3, with digital dollar payroll yielding faster, cheaper runs. Even Deel nods to crypto trends, though USDC specialists like these lead. Founders in the Remote Work Playbook rave about blending stablecoins into ops without tech overhauls.

Getting your startup on USDC payroll doesn’t require a blockchain PhD. It’s as straightforward as swapping your old provider for one that gets crypto. Take Rise: upload your team roster, fund with USDC from Circle, and hit pay. Contractors get notified instantly, choosing USDC hold or fiat conversion via integrated ramps. No more Excel sheets or manual wires.

Step-by-Step to Launching USDC Payroll for Your Remote Crew

Start by picking a vetted platform. Rise or Remote handle the heavy lifting, integrating Circle for seamless USDC inflows. Verify identities once, then automate everything. I recommend testing with a small batch; pay five contractors first to iron out kinks. Costs? Expect under $0.50 per payout on Base or Solana layers, versus Deel’s multi-dollar cuts.

For cross-border payroll USDC, timing matters. Pre-fund weekly to dodge gas spikes, and educate your team on wallet setup. Tools like TransFi even embed wallets, so non-crypto natives onboard in minutes. One founder told me their Manila devs cheered when salaries hit wallets at 2 a. m. local time, no bank holiday delays.

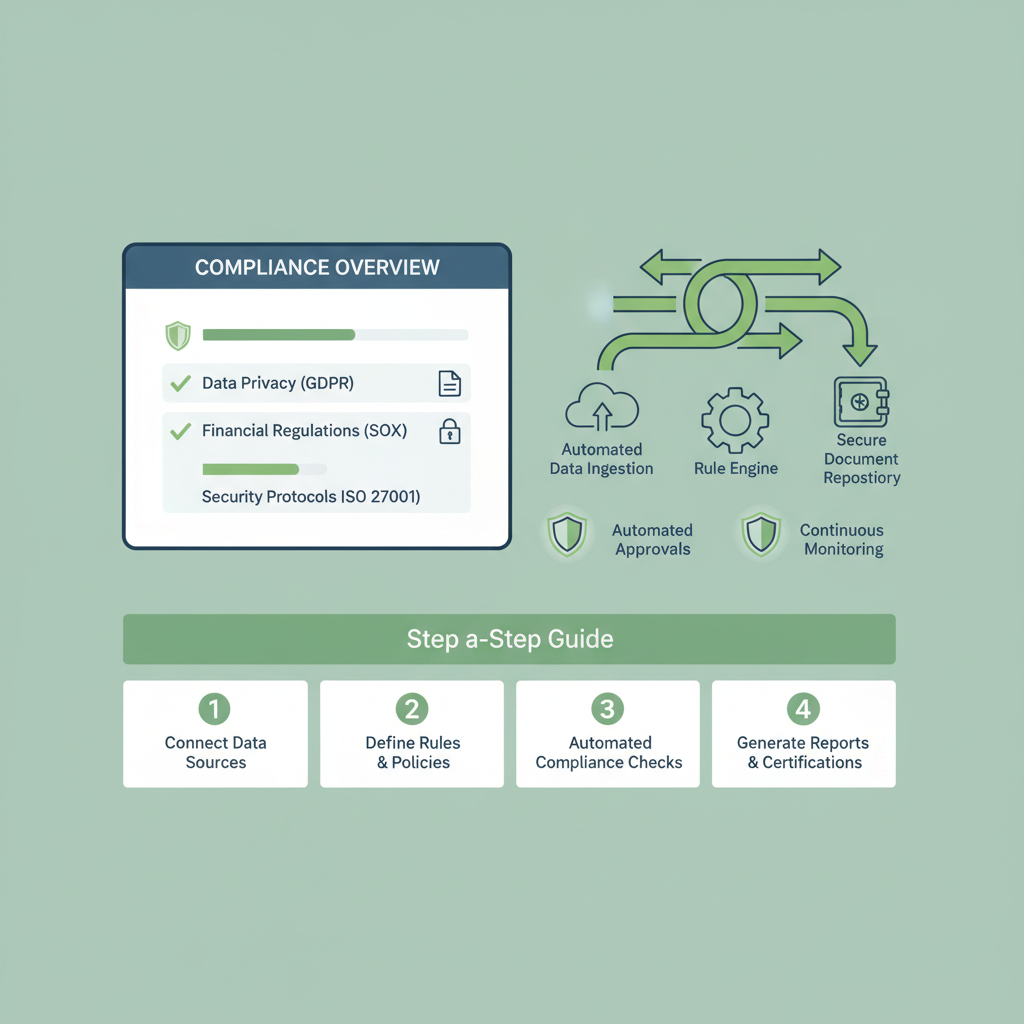

Compliance seals the deal. Platforms auto-generate 1099s, W-8s, even EU VAT slips. Riseworks’ 2026 update covers IRS crypto rules, confirming USDC counts as property but with stablecoin exemptions simplifying reporting. Ogletree warns on volatility, yet USDC’s peg holds firm, backed by Circle’s reserves.

Overcoming Hurdles in Stablecoin Salaries for Startups

Not everything’s smooth. Wallet adoption trips some teams; not everyone’s comfy with MetaMask. Solution? Platforms offer custodial options or QR-code fiat swaps. Regulation evolves fast; MiCA greenlights USDC in Europe, while U. S. bills eye stablecoin sandboxes. Stay ahead by choosing compliant providers like Toku, who layer legal wrappers around blockchain.

Another gripe: on-ramps. Converting fiat to USDC can sting at 1-2%. Batch buys via Rise mitigate that, pooling employer funds for bulk rates. Pebl’s employer guide stresses education; run workshops so your global contractors grasp tax implications of holding USDC. Retention jumps when teams feel empowered, not lectured.

Case in point: a SaaS startup I followed switched mid-2026. Their 40-person remote squad spanned Brazil to Bali. Old system: $15k monthly fees, two-week delays. USDC via Remote: $800 total, same-day pays. Headcount grew 25% as word spread among digital nomads chasing USDC salaries digital nomads 2026 promise.

Hurupay’s playbook echoes this, urging ops leads to blend stablecoins into remote playbooks. No tech stack rewrite needed; APIs plug into QuickBooks or Xero seamlessly.

Why 2026 Marks the Tipping Point for Crypto Payroll Global Contractors

Adoption snowballs. Circle’s Rise collab scales USDC funding effortlessly, while Base’s low fees lure Stripe-powered Remote. TransFi’s Web3 focus proves even niche teams thrive. Expect 50% of startups testing stablecoins by year-end, per industry chatter. For lean ops, it’s table stakes: compete for top talent without payroll drag.

Cross-Border Payroll takes it further, specializing in USDC for borderless teams. Our platform cuts through noise, delivering compliant, instant salaries that let you focus on growth. Remote teams paid, founders freed. That’s the 2026 reality.

| Platform | Key Feature | Cost Savings | Countries |

|---|---|---|---|

| Rise | USDC Funding | 90% | 100 and |

| Remote | Base Blockchain | 85% | 69 |

| TransFi | Web3 Payroll | 80% | Global |