For tech startups with remote teams scattered across continents, traditional cross-border payroll often feels like wrestling with quicksand: high fees erode budgets, settlement delays frustrate talent, and currency fluctuations add unnecessary risk. Enter USDC payroll, a stablecoin solution pegged at a rock-solid $1.00 that slashes those pains while keeping everything compliant and transparent. Platforms like Cross-Border Payroll make it straightforward to issue stablecoin salaries for remote teams, turning complex international payments into seamless, borderless transactions.

I’ve advised dozens of fintech startups on this shift, and the results are consistent: teams stay productive without payroll headaches. USDC, backed by reserves and running on efficient blockchains, ensures USDC payroll cross-border payments settle in minutes, not days, at fractions of bank wire costs.

Why Traditional Cross-Border Payroll Drains Startup Resources

Picture this: your lead developer in Lisbon waits 3-5 business days for salary while dealing with a 5-7% fee cocktail of SWIFT charges, intermediary banks, and FX spreads. For a 50-person remote team, that’s thousands lost monthly, plus the hidden drag of delayed cash flow on morale. Sources like Riseworks highlight how banks pile on these costs, especially for crypto payroll tech startups hiring globally.

Compliance adds another layer. Misclassifying contractors or fumbling tax withholding invites audits, as noted in Toku’s crypto payroll guide. Traditional systems demand endless paperwork, KYC checks per country, and volatile exchange rates that can swing paychecks by 10% overnight. No wonder Deel emphasizes opt-in crypto to minimize exposure without overhauling processes.

“Crypto payroll avoids banking delays, which is especially handy for cross-border teams. ” – Lano. io

Tech startups can’t afford this inefficiency when scaling fast. USDC flips the script with blockchain’s transparency: every transaction auditable on-chain, reducing disputes and building trust.

Cutting Fees by Up to 80% with USDC Global Contractor Payments

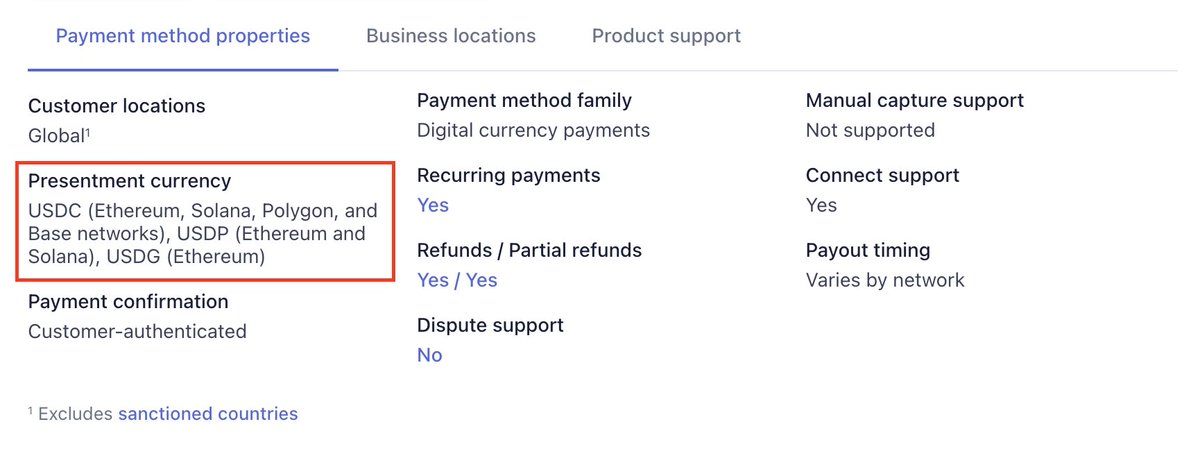

The math is compelling. A typical international wire might cost $25-50 flat plus 1-3% FX, totaling $100 and per payout for mid-sized salaries. USDC on networks like Base or Stellar? Often under $0.01 per transfer, as Bitwage demonstrates with its recent integration. Remote’s partnership with Stripe on Base blockchain now enables USDC global contractor payments to 69 countries, near-instant and compliant.

OneSafe’s analysis nails it: blockchain bypasses hefty bank fees, vital for startups where every dollar fuels growth. Cross-Border Payroll leverages this for borderless USDC salaries, integrating USDC funding across products like Rise does with Circle. Stability at $1.00 means no hedging worries; employees get dollar parity without volatility.

From my FRM lens, this isn’t hype, it’s risk-managed efficiency. Startups I’ve guided report 70-80% fee reductions, freeing capital for R and amp;D over remittances.

USD Coin (USDC) Price Prediction 2027-2032

Forecasting a stable $1.00 peg with low volatility scenarios driven by payroll adoption and regulatory stability

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2028 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2029 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2030 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2031 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2032 | $0.99 | $1.00 | $1.01 | 0.00% |

Price Prediction Summary

USDC is expected to firmly maintain its $1.00 peg throughout 2027-2032, with minimal price deviations (±1%) even in bearish or bullish scenarios. This stability is underpinned by growing adoption in tech startups’ cross-border payroll, robust reserve backing, and progressive regulatory frameworks, insulating it from broader crypto market cycles.

Key Factors Affecting USD Coin Price

- Rising adoption in USDC payroll platforms like Remote, Bitwage, and Rise for faster, low-fee global payments

- Regulatory developments ensuring compliance and reserve transparency

- Blockchain improvements (e.g., Base, Stellar) enhancing transaction speed and cost-efficiency

- Stablecoin market competition and market cap growth supporting peg maintenance

- Macroeconomic stability of USD and low risk of depegs due to audited reserves

- Potential short-term volatility from market stress, mitigated by institutional demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Settlement Speeds That Keep Remote Teams Moving

Waiting weeks for pay? Obsolete. USDC settlements clock in at seconds to minutes. Circle’s stablecoin payroll tools, as used by Rise, enable instant funding. Medium articles from Lolacoin. org echo this: instant cross-border payments via crypto redefine global teams.

LinkedIn insights from Rise on AI startups show blockchain and USDC/USDT dodging intermediaries for reliable payouts. For tech firms, this means contractors in emerging markets cash out locally without friction, boosting retention. Check out our fast setup guide for a deeper dive.

Regulations evolve favorably too. With MiCA in Europe and U. S. clarity on stablecoins, compliant platforms like ours ensure worker classification and identity verification are handled upfront, no headaches.

Platforms like Cross-Border Payroll embed these safeguards, verifying identities and classifying workers correctly from day one. This pragmatic approach lets tech startups focus on innovation, not audits.

Real-World Proof: Tech Startups Thriving on USDC Payroll

Take Remote’s fresh partnership with Stripe: US-based companies now pay contractors in 69 countries via USDC on the Base blockchain. Near-instant transactions, full compliance, no FX headaches. Bitwage ups the ante on Stellar, delivering cost-effective payouts to remote workers worldwide. These aren’t experiments; they’re production-scale wins reshaping crypto payroll tech startups.

Riseworks calls USDC payroll the best for global teams, citing faster settlements, lower fees, and dollar stability. Toku’s guide backs it: pay in USDC legally and efficiently, dodging compliance pitfalls. I’ve seen startups cut payout cycles from weeks to hours, with one AI firm reporting 80% cost drops after switching. Employees love the control; cash out to local banks or hold for upside in crypto markets.

Traditional Bank Wires vs. USDC Payroll: Key Differences

| Aspect | Traditional Bank Wires | USDC Payroll |

|---|---|---|

| Fees | $25-50 + 1-3% FX | Under $0.01 💰 |

| Settlement Time | 3-5 days ⏳ | Seconds to minutes ⚡ |

| Stability | Volatile currencies | $1.00 peg (USDC Price: $1.00) 🔒 |

| Compliance | High exposure | Built-in verification & compliant platforms (e.g., Remote, Bitwage) ✅ |

Cross-Border Payroll mirrors these successes, funding salaries with USDC across borders. No more begging banks for approvals or sweating weekends. Rise’s Circle integration proves stablecoins scale; so does our platform for stablecoin salaries remote teams.

Overcoming Hurdles: Compliance and Adoption Made Simple

Skeptics worry about volatility or regs, but USDC’s $1.00 peg, audited reserves, and blockchain trails crush those fears. MiCA greenlights stablecoins in Europe; U. S. frameworks clarify paths for employers. Deel’s opt-in model shows crypto payroll fits existing flows without disruption.

Worker buy-in? High. Lano. io notes faster global payments keep teams happy. OneSafe highlights fee cuts as the killer app for remote work. Onboarding takes minutes: upload docs, set wallets, automate runs. Our clients ramp to 100 and countries seamlessly, with tools for tax forms and reporting.

For tech founders, the choice is clear: cling to legacy systems and bleed cash, or embrace USDC for lean, global operations. Platforms like ours handle the tech and compliance, so you don’t.

Getting Started with Borderless USDC Salaries

Switching sounds bold, but it’s straightforward. Fund your account in USDC at $1.00, map employee wallets, schedule payroll. Tools auto-convert if needed, with on-chain proofs for audits. Check our step-by-step guide to launch in days.

Results? Predictable costs, happy teams, capital preserved. One startup I consulted paid a Jakarta engineer same-day, saving $200 per cycle. Scale that across dozens: game-changer. Lolacoin. org sums it: crypto payroll ushers a new era for global startups.

Tech leaders get it: USDC payroll isn’t future tech, it’s today’s edge. With fees slashed and speeds soared, remote teams thrive without friction. Cross-Border Payroll delivers this daily, empowering startups to hire the best, anywhere. Ready to cut the cord on old payroll pains?