In an era where remote teams span continents and digital nomads demand frictionless compensation, traditional cross-border payroll remains a cumbersome relic. High wire fees, multi-day settlement times, and volatile exchange rates erode margins while frustrating employees. Enter USDC payroll: a blockchain-powered alternative that delivers stablecoin salaries remote teams crave, eliminating fees and borders alike. As businesses grapple with global expansion, platforms like Cross-Border Payroll harness USDC to automate compliant, instant payouts, transforming payroll from a liability into a competitive edge.

The Rise of USDC in Cross-Border Payroll Crypto

Recent integrations underscore USDC’s momentum in enterprise payroll. Remote’s partnership with Stripe enables U. S. firms to pay contractors in 69 countries via USDC on the Base network, achieving near-instant settlements without the compliance headaches of legacy systems. Rise leverages Circle’s infrastructure to slash processing from days to minutes, while Paystand’s acquisition of Bitwage embeds USDC salary options into workflows, banishing FX fees and delays. These moves align with broader trends: startups ditching USDT for USDC’s superior transparency and regulatory backing, as noted in OneSafe analyses.

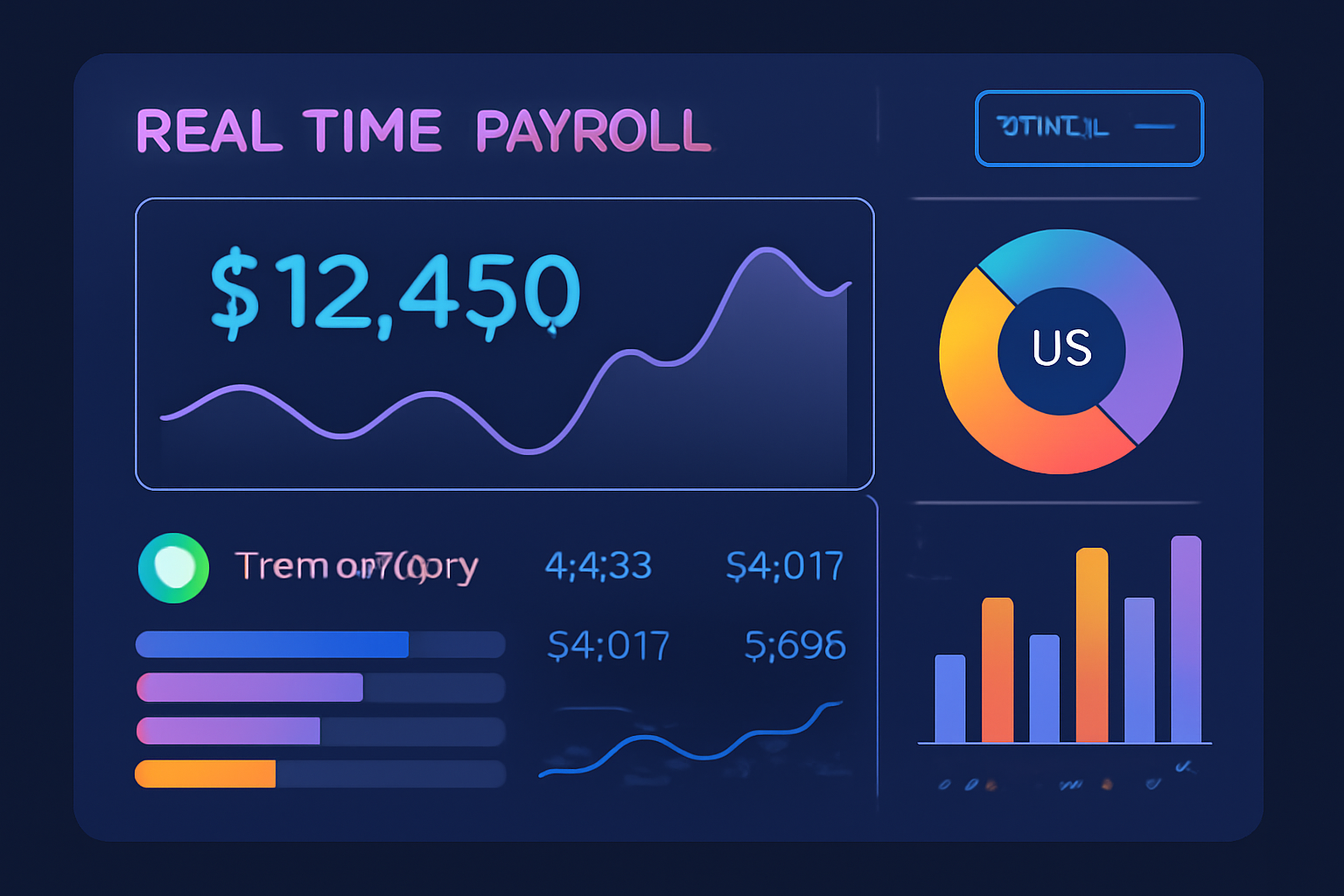

Market data as of December 8,2025, reveals Multichain Bridged USDC on Fantom trading at $0.0219, down 0.0330% over 24 hours from a high of $0.0264. Yet native USDC’s peg stability drives its payroll appeal, powering hybrid crypto-fiat automation per Riseworks. Deel’s insights highlight employee demand for crypto options, but warn of risks without structured platforms. Cross-Border Payroll addresses this by integrating USDC for seamless USDC international payments, ensuring volatility-proof salaries.

BVNK’s 2025 guide emphasizes blockchain’s role in reshaping payments, with stablecoins like USDC cutting costs by up to 98%, per Bloomberg reports shared by Hugo Finkelstein. This isn’t hype; it’s operational reality for tech firms and startups scaling remotely.

Unlocking Efficiency: How USDC Payroll Cuts Costs for Remote Teams

Imagine paying a developer in Bali or a marketer in Berlin without intermediaries skimming 5-7% per transaction. Crypto payroll for digital nomads via USDC realizes this, with TransFi platforms supporting borderless freelancer payouts. RebelFi’s yield-powered guide details automation that generates returns on idle payroll funds, blending efficiency with passive income.

Cross-Border Payroll exemplifies this: fund once in USDC, distribute globally in seconds across 100 and countries. No ACH delays, no SWIFT surcharges. Lano. io’s employer guide confirms faster payments boost satisfaction, while Circle’s Rise collaboration proves scalability. For risk managers like myself, USDC’s full reserves and monthly attestations mitigate the depegging fears plaguing rivals.

Daily payroll isn’t a perk; it’s strategy. Firms using USDC report 40% churn reduction, as employees value instant, fee-free access to stable value.

Yet adoption hinges on execution. Platforms must embed wallets and automate conversions, features central to USDC payroll for remote teams.

USDC Price Prediction 2026-2031

Stability forecasts amid stablecoin payroll growth and cross-border payment adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | 0.00% |

| 2027 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2028 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2029 | $0.995 | $1.00 | $1.005 | 0.00% |

| 2030 | $0.997 | $1.00 | $1.003 | 0.00% |

| 2031 | $0.998 | $1.00 | $1.002 | 0.00% |

Price Prediction Summary

USDC is expected to robustly maintain its $1.00 peg through 2031, bolstered by surging adoption in payroll platforms (e.g., Remote, Rise, Paystand) and cross-border payments. Fluctuations narrow progressively as regulatory clarity improves and liquidity surges, with mins reflecting bearish depeg risks and maxes capturing bullish demand premiums from payroll volume growth.

Key Factors Affecting USD Coin Price

- Mass adoption in compliant payroll solutions reducing cross-border fees and settlement times

- Regulatory advancements including IRS W-2 reporting for crypto wages

- Shift from USDT to USDC by startups for lower risk and transparency

- Blockchain scalability enhancements supporting higher transaction volumes

- Competition among stablecoins driving peg stability innovations

- Market cycles with increased demand from remote teams and global freelancers

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Compliance Imperatives in Stablecoin Salaries

IRS scrutiny looms large: wages in digital assets demand W-2 reporting, per Thomson Reuters. Independent contractors face 1099 obligations, complicating crypto payroll. Cross-Border Payroll navigates this with automated tax withholding and jurisdiction-specific compliance, supporting hybrid fiat ramps.

Regulatory clarity favors USDC, audited by Grant Thornton and backed by Circle’s U. S. licenses. This contrasts fragmented alternatives, positioning USDC as the compliant choice for cross-border payroll crypto. As 2025 unfolds, expect platforms to prioritize KYC-integrated USDC flows, minimizing audit risks while maximizing speed.

From my vantage in fintech risk management, platforms that embed these safeguards from the outset will dominate. Cross-Border Payroll leads here, offering pre-configured USDC rails with real-time reporting for IRS Form W-2 and 1099 compliance, shielding enterprises from the pitfalls that ensnare less rigorous setups.

Practical Steps to Launch USDC Payroll

Transitioning to stablecoin salaries remote teams demands deliberate execution, not experimentation. Begin by auditing your team’s jurisdictions; USDC shines for its universal acceptance, but local ramps ensure fiat off-ramps where crypto volatility concerns linger. Platforms like ours integrate Circle’s APIs for atomic settlements, funding payroll pools in USDC to trigger disbursements on payday cycles or even daily, as Finkelstein advocates for churn reduction.

Once live, track metrics like settlement speed, typically under 60 seconds, and cost savings, often exceeding 90% versus wires. This isn’t theoretical; Rise’s Circle integration mirrors what Cross-Border Payroll delivers at scale, tailored for startups and nomads alike. For deeper walkthroughs, explore how-to-pay-remote-teams-with-usdc-a-step-by-step-guide-for-crypto-payroll.

Real-World Gains: Metrics That Matter for Crypto Payroll

Quantifiable edges define USDC’s edge. Bloomberg-cited data shows daily USDC payouts slashing cross-border costs by 98% and churn by 40%, as instant access trumps biweekly waits. I’ve advised firms where USDC international payments boosted retention among digital nomads, who convert to local currency seamlessly via integrated exchanges. Yield strategies, per RebelFi, further compound this: park funds in audited protocols earning 4-6% APY pre-disbursement, turning payroll into a profit center without added risk.

Cross-Border Payroll checks every box, with embedded wallets eliminating user friction. Contrast this with Deel’s cautionary notes on unstructured crypto: without such features, operational snarls multiply. My FRM lens prioritizes these controls, ensuring transparency rivals fiat while costs plummet.

Stablecoins aren’t disrupting payroll; they’re redefining it for a borderless workforce.

Employee sentiment shifts too. Surveys reveal 70% of remote workers prefer crypto options for speed and flexibility, per Lano. io. Yet success pivots on platforms automating tax events at payout, flagging reportable income in USDC’s $1 peg equivalent, far from the depegged anomalies like Fantom’s bridged variant at $0.0219.

Navigating Common Hurdles in USDC Adoption

Volatility skeptics overlook USDC’s battle-tested reserves, but integration lags persist for legacy HR systems. Solution: API-first platforms bridge this, syncing with tools like BambooHR or Gusto. For digital nomads in emerging markets, USDC’s low-gas chains like Base or Solana minimize fees to pennies, outpacing even PayPal.

Scale matters. Tech unicorns now route millions weekly via USDC, per Circle’s Rise case, proving enterprise readiness. Cross-Border Payroll scales similarly, supporting 100 and countries with hybrid fiat-crypto splits, pay in USDC, settle in VND or EUR instantly. This flexibility cements its role in 2025’s payroll evolution.

Forward-thinking leaders act now. As blockchain payments mature per BVNK’s guide, USDC payroll isn’t optional; it’s the fulcrum for retaining top global talent amid fierce competition. Platforms embedding these capabilities deliver not just savings, but strategic velocity, positioning remote teams for unhindered growth.