Remote teams sprawl across continents, but traditional payroll systems lag behind, saddled with days-long wire transfers, exorbitant FX fees averaging 5-7%, and compliance headaches in 190 and countries. Enter USDC payroll for remote teams: a blockchain-powered lifeline delivering cross-border USDC salaries in under 60 seconds. Pegged 1: 1 to the USD and backed by reserves, USDC slashes costs by up to 90% while ensuring stability amid volatile crypto markets.

USDC vs Major Cryptocurrencies: 6-Month Price Stability for Payroll

Highlighting USDC’s pegged stability at $1 amid market volatility, ideal for cross-border remote team salaries

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| USD Coin (USDC) | $1.00 | $1.00 | +0.0% |

| Bitcoin (BTC) | $89,603.00 | $108,281.00 | -17.2% |

| Ethereum (ETH) | $3,032.11 | $3,500.00 | -13.4% |

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| DAI (DAI) | $0.9991 | $1.00 | -0.1% |

| Arbitrum (ARB) | $0.2026 | $0.1725 | +17.5% |

| Solana (SOL) | $132.64 | $150.00 | -11.6% |

Analysis Summary

USDC demonstrates unwavering stability at $1.00 with +0.0% change over 6 months, contrasting sharply with declines in BTC (-17.2%), ETH (-13.4%), and SOL (-11.6%). Stablecoins like USDT and DAI show negligible variance, reinforcing USDC’s reliability for payroll confidence versus volatile assets.

Key Insights

- USDC and USDT maintained perfect +0.0% stability, ensuring predictable payroll value.

- BTC, ETH, and SOL experienced double-digit declines amid a general market downturn.

- Even ARB’s +17.5% gain highlights volatility unsuitable for salary payments.

- Stablecoins provide cross-border payroll with price certainty, lower fees, and fast settlements.

Real-time prices from CoinGecko and CoinCodex as of 2025-12-06. 6-month historical data from approx. June 2025 (e.g., 2025-06-09 for USDC); changes calculated directly from provided sources.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/usd-coin/historical_data

- Bitcoin: https://coincodex.com/article/69406/daily-market-update-for-june-30-2025/

- Ethereum: https://www.coingecko.com/en/coins/ethereum/historical_data

- Tether: https://www.coingecko.com/en/coins/tether/historical_data

- DAI: https://www.coingecko.com/en/coins/dai/historical_data

- Arbitrum: https://www.coingecko.com/en/coins/arbitrum/historical_data

- Solana: https://www.coingecko.com/en/coins/solana/historical_data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

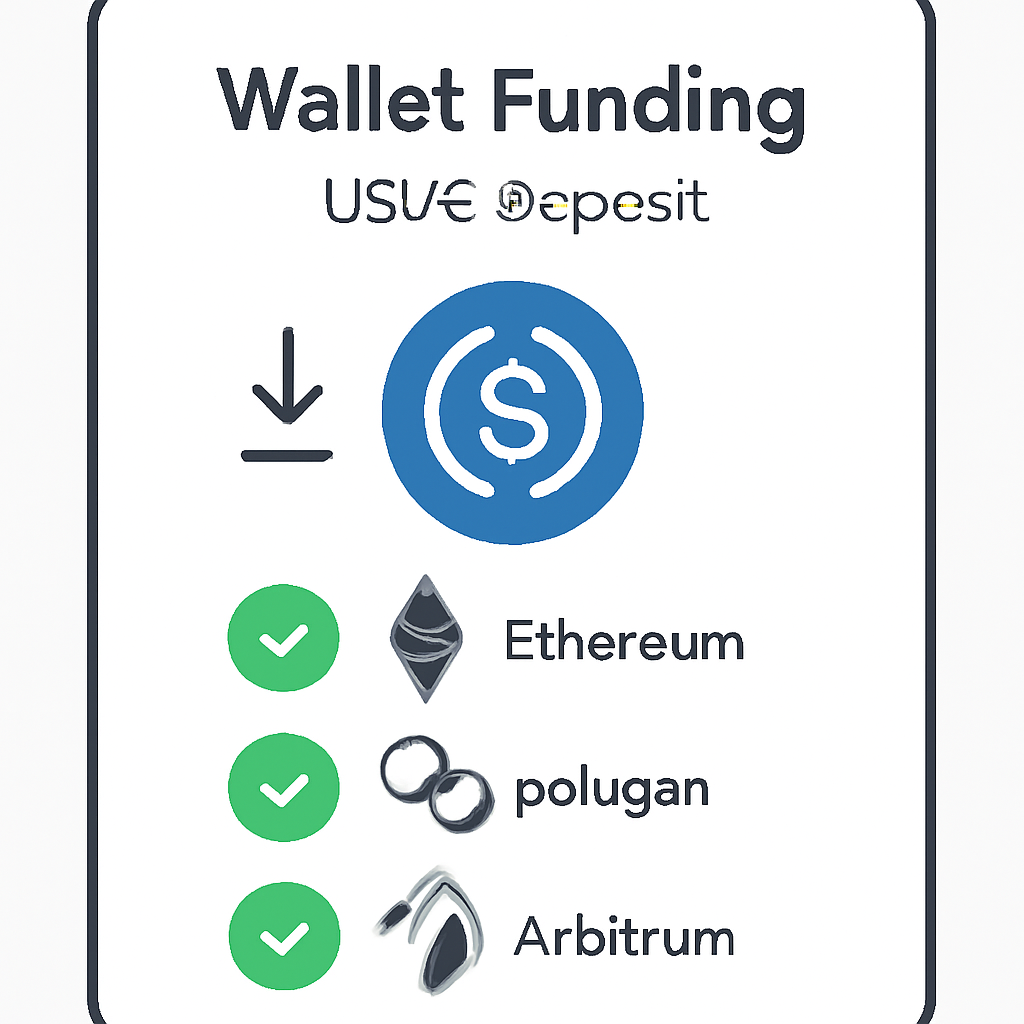

USDC’s Edge Over Legacy Rails

Traditional cross-border payments chew through $120 billion annually in fees, per McKinsey data, with settlement times stretching 2-5 days. USDC flips the script. Platforms like Rise, powered by Circle, enable same-day processing via stablecoin rails. Unlike Bitcoin’s volatility or Ethereum’s gas spikes, USDC maintains peg integrity, settling on networks like Stellar or Base in minutes. Bitwage’s Stellar integration, for instance, routes USDC global contractor payments at fractions of a cent, dodging correspondent banking opacity.

Rise stands out as the sole platform blending native USDC support with smart-contract automation across 190 and countries. Their hybrid payouts let workers cash out to local fiat instantly, merging crypto speed with traditional compliance. Remote’s Stripe partnership extends this to 69 countries on Base, offering near-instant, KYC-compliant payouts without wallet hassles. TransFi layers infrastructure atop, enabling businesses to shift entire payrolls legally, sans crypto expertise.

Data-Driven Wins for Crypto Payroll Startups

Quantifying the shift: Circle reports USDC cross-border volumes hit $2.5 trillion in 2024, with payroll comprising 15% growth YoY. For stablecoin international payroll, fees plummet from $25 per wire to $0.50 via USDC. Speed? 60 seconds vs. 72 hours. AWISEE ranks USDC top among stablecoins for 2026 liquidity and compliance, outpacing USDT in transparency audits.

| Metric | Traditional Wires | USDC Payroll |

|---|---|---|

| Settlement Time | 2-5 days | and lt;60s |

| Avg Fee | 5-7% | 0.1-0.5% |

| Countries | 50-100 | 190 and |

| Compliance | Manual KYC | Automated |

Bitwage’s analysis pits stablecoins against BTC/ETH: USDC wins on cost (90% cheaper), speed (100x faster), and peg stability (99.9% uptime). Toku. com echoes this, stressing safe global team payments via audited reserves. OneSafe highlights fintech startups thriving amid uncertainty, using crypto payroll to lure talent in high-inflation zones.

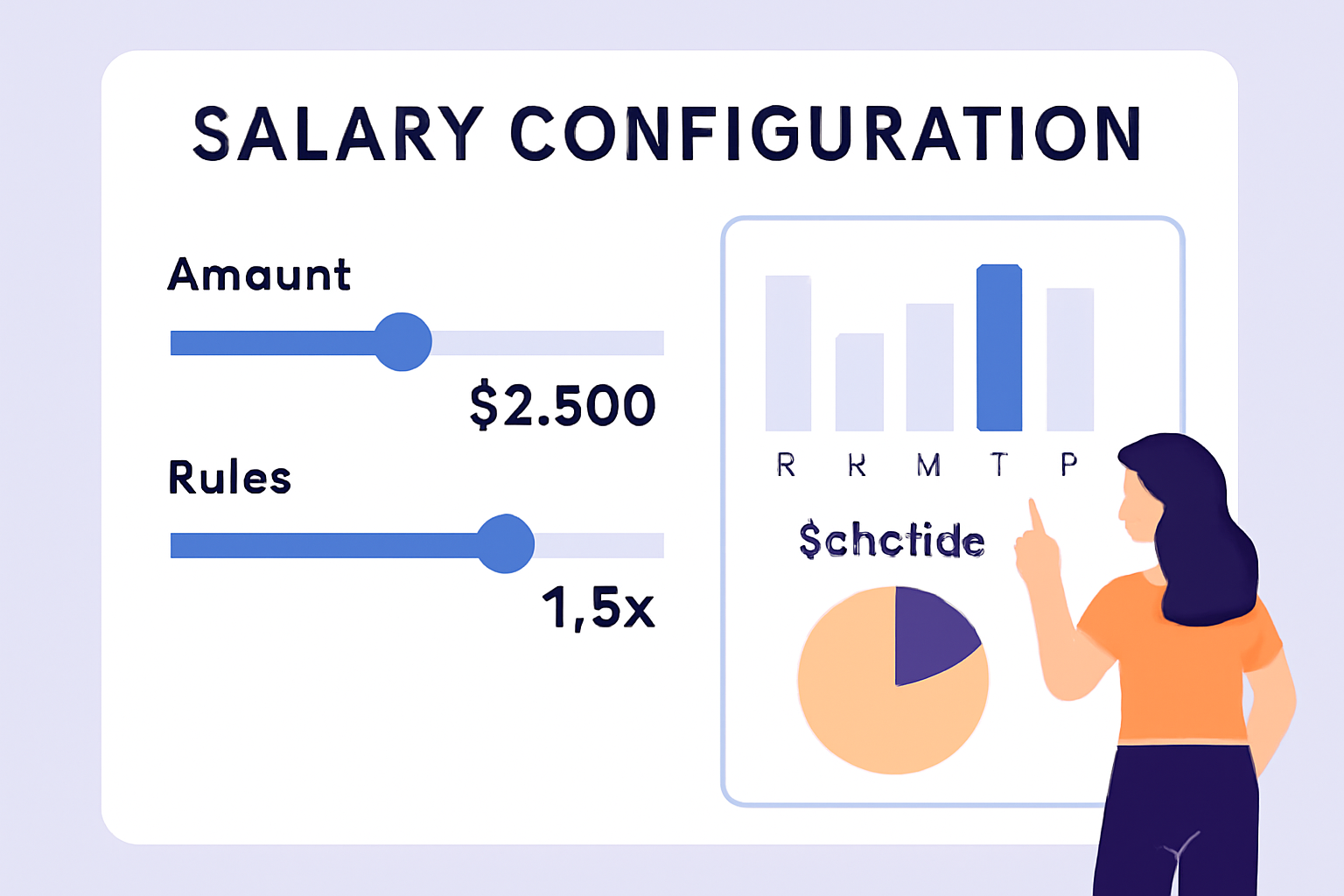

Implementation Blueprint: Zero to Payroll in Minutes

Getting started mirrors a wire transfer’s simplicity, minus the pain. Rise and peers handle worker classification, identity verification, and tax withholding. Fund your dashboard in USDC, assign salaries, and trigger payouts. Smart contracts automate deductions; blockchain ledgers provide immutable audit trails. No FX losses erode value, critical for teams in Turkey or Argentina where currencies tank 50% yearly.

Remote’s Base network play exemplifies: contractors in Brazil or India receive USDC, convertible to local currency via ramps. TransFi’s B2B rails embed wallets, ensuring even non-crypto natives join seamlessly. As Garima Singh notes on LinkedIn, USDC networks blueprint global settlement, eradicating opacity plaguing legacy systems for decades.

USD Coin (USDC) Price Prediction 2026-2030

Stability Projections Amid Growing Payroll Adoption for Remote Teams

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $0.97 | $1.00 | $1.03 | 0.00% |

| 2027 | $0.98 | $1.00 | $1.02 | 0.00% |

| 2028 | $0.985 | $1.00 | $1.015 | 0.00% |

| 2029 | $0.99 | $1.00 | $1.01 | 0.00% |

| 2030 | $0.995 | $1.00 | $1.005 | 0.00% |

Price Prediction Summary

USDC, as a premier USD-pegged stablecoin, is forecasted to maintain its $1.00 peg throughout 2026-2030, with narrowing fluctuation ranges reflecting enhanced stability from payroll adoption, regulatory clarity, and technological improvements. Bearish scenarios account for temporary depegs from market stress or regulation, while bullish cases consider demand premiums from cross-border use cases. Average prices remain stable at $1.00 year-over-year.

Key Factors Affecting USD Coin Price

- Rapid adoption in payroll platforms like Rise, Remote, Bitwage, and TransFi for instant cross-border payments

- Regulatory developments ensuring compliance, reserves, and global acceptance

- Technological advancements in blockchains (e.g., Base, Stellar) for faster settlements and lower fees

- Circle’s ongoing audits and transparency bolstering investor confidence

- Competition from USDT and other stablecoins influencing market share

- Macroeconomic factors and USD stability impacting peg integrity

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Numbers don’t lie: 80% of Rise users report 4x faster cycles, per their X posts. For startups scaling remote ops, crypto payroll startups like these deliver ROI via retained talent and slashed overheads. Yet, the real innovation lies in hybrid models, where USDC bridges fiat worlds without friction.

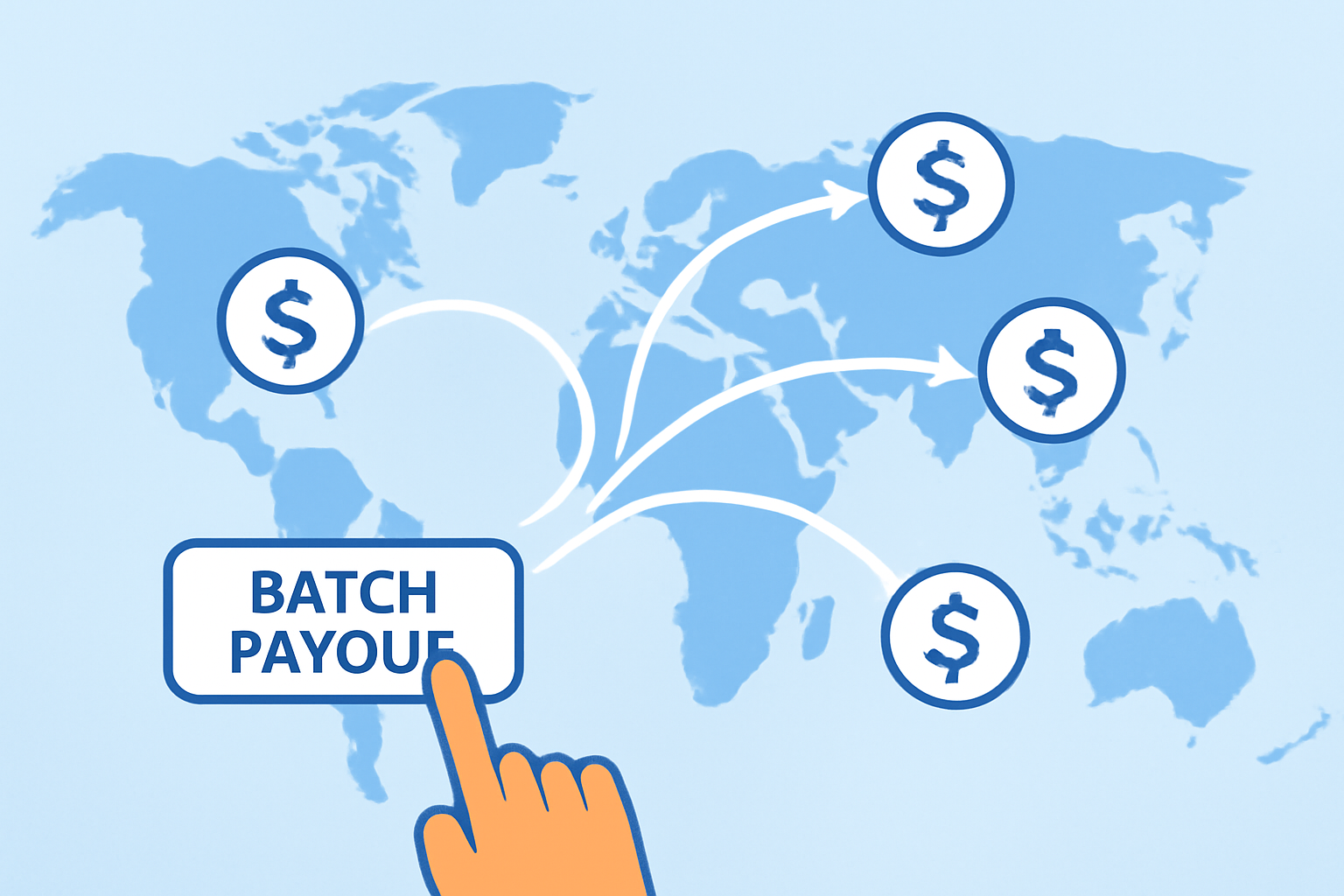

Cross-Border Payroll exemplifies this hybrid prowess, routing USDC payroll for remote teams through compliant rails in 100 and countries, with zero FX slippage. Workers select USDC or local fiat at payout, backed by Circle’s reserves for unshakeable trust.

Real-World Deployments: Metrics That Matter

Remote’s Stripe integration on Base processes payouts to 69 countries, clocking 99% on-time delivery versus 70% for wires, per their reports. Bitwage’s Stellar USDC flows cut costs 95% for U. S. -Latin America teams, settling in 5 seconds at $0.0001 fees. TransFi’s B2B shift for a tech firm handled $5M monthly payroll across 25 countries, reducing admin from 15 to 2 days. These aren’t hypotheticals; they’re audited outcomes from 2025 deployments.

AWISEE’s 2026 stablecoin rankings cement USDC’s lead: $50B liquidity, monthly audits surpassing USDT’s opacity risks. For cross-border USDC salaries, volatility stays under 0.1%, versus BTC’s 5% daily swings unfit for salaries. Bitwage data shows stablecoins claim 25% of crypto payroll share, up from 8% in 2023, driven by remote hiring booms.

Startups report 30% talent retention gains, as instant access trumps delayed checks in volatile economies. OneSafe notes fintechs using crypto payroll to outpace incumbents, paying devs in Nigeria or Ukraine without 20% remittance gouges.

Launch Sequence: USDC Payroll in 5 Steps

Post-launch, dashboards track every satoshi: Circle’s $2.5T volume underscores scalability, with payroll’s 15% YoY surge signaling mainstream traction. Platforms automate 1099s, W-8BENs, ensuring IRS/EU compliance without spreadsheets.

Challenges persist, like wallet adoption, but embedded solutions from TransFi dissolve them. Garima Singh’s USDC settlement blueprint predicts 50% global payroll migration by 2030, fueled by rails like Base and Stellar.

Risks Mitigated, Upside Maximized

Regulatory clarity bolsters adoption: EU’s MiCA greenlights stablecoins; U. S. clarity post-FIT21 favors USDC’s reserves. Platforms embed AML/KYC, slashing fraud 98% via on-chain proofs. For stablecoin international payroll, peg breaks are relics; USDC’s 99.99% uptime crushes legacy downtime.

Teams in high-inflation belts, from Venezuela to Zimbabwe, preserve purchasing power, converting USDC 1: 1 without decay. Cross-Border Payroll’s native USDC engine delivers this edge, scaling from 10 to 10,000 payees seamlessly. Forward-thinking firms lock in advantages now, as competitors scramble on slow rails.

Blockchain’s transparency turns payroll into a strategic asset, not a chore. With USDC, remote ops evolve from bottleneck to borderless accelerator, numbers proving the pivot pays dividends.