In 2025, the landscape of remote team payments is almost unrecognizable compared to just a few years ago. The catalyst? Stablecoin payroll solutions. As businesses expand globally and remote work becomes the default for high-performing teams, the need for fast, cost-effective, and compliant cross-border payments has never been more urgent. Stablecoins like USDC are quickly emerging as the backbone of modern payroll systems, bridging digital innovation with real-world utility.

![]()

Why Stablecoin Payroll Is Taking Over in 2025

The traditional approach to international payroll is riddled with friction: slow bank transfers, expensive intermediary fees, currency conversion headaches, and compliance risks that keep HR teams up at night. Enter stablecoin payroll. By leveraging blockchain technology and dollar-pegged assets like USDC, companies can now pay remote employees and contractors anywhere in the world instantly, often saving between $2,000 and $5,000 per month on transaction costs for a 50-person team (according to recent reports).

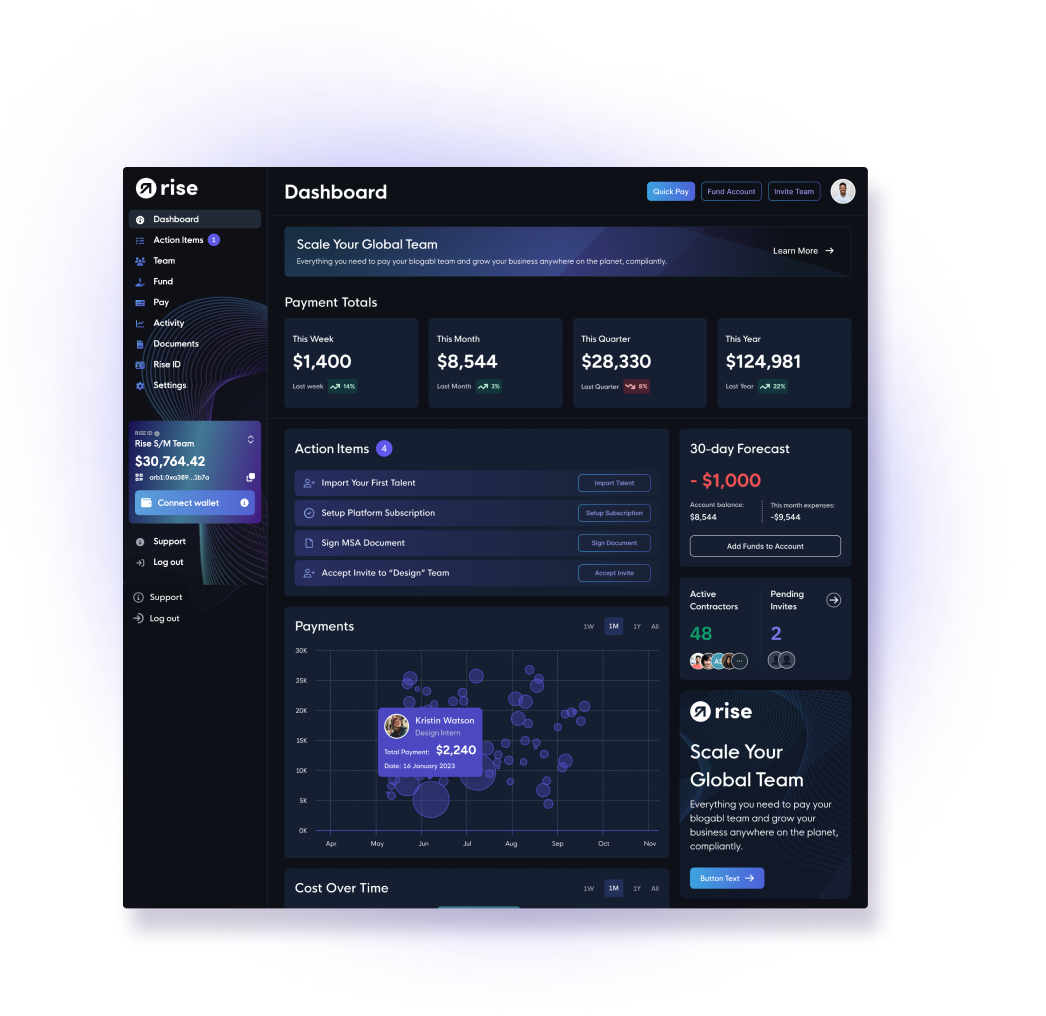

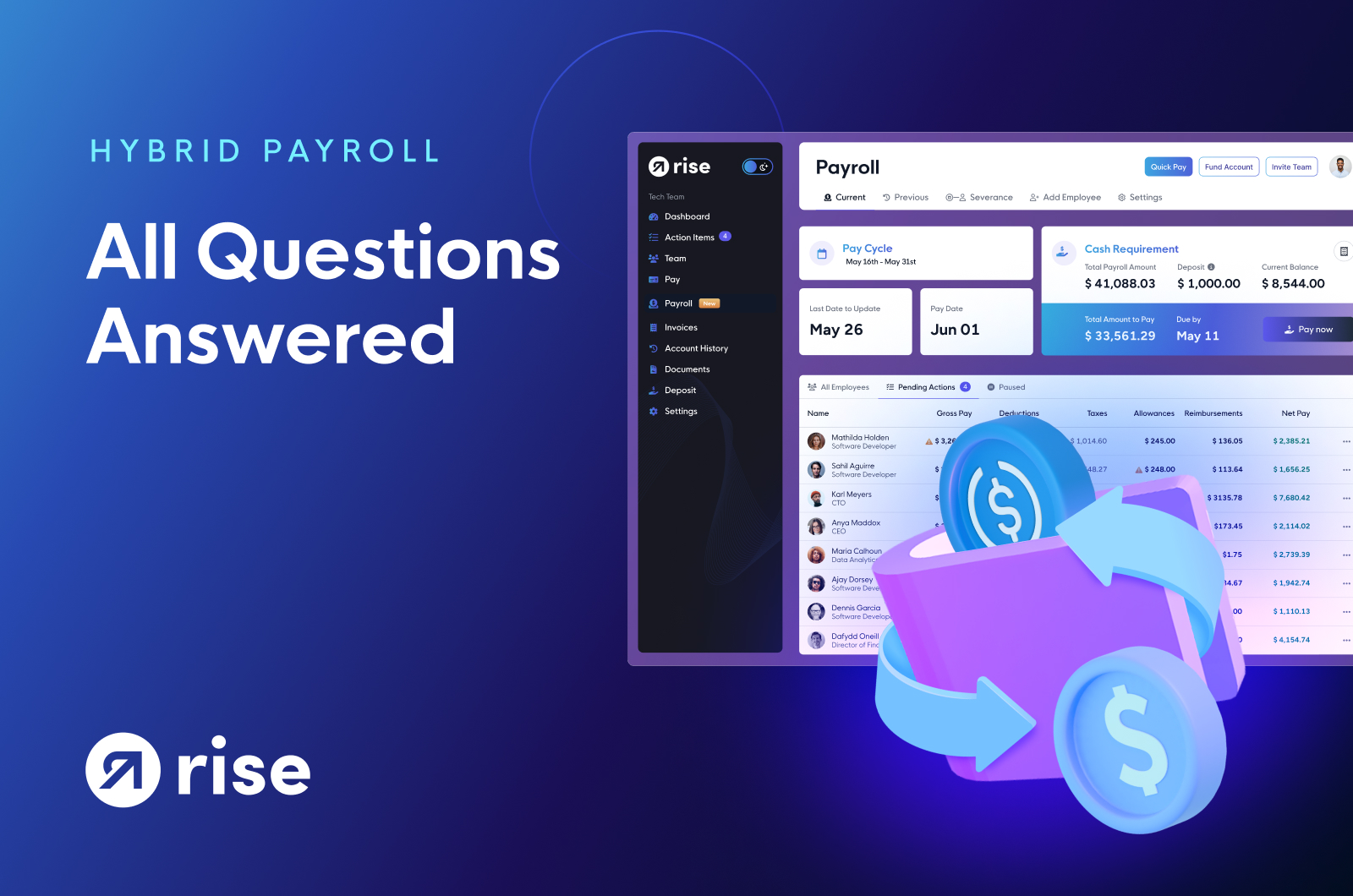

This isn’t hype, it’s a seismic shift in how value moves across borders. Companies like Remote have partnered with fintech giants such as Stripe to enable seamless stablecoin payouts in over 100 countries. Platforms like Rise now offer unified dashboards where businesses can execute large-scale payroll runs in both fiat and digital currencies while ensuring compliance with local tax regulations. The result? No more waiting days for funds to clear or worrying about surprise fees eating into salaries.

The Real-World Impact: Speed, Savings and Global Reach

The numbers speak volumes about stablecoin adoption. As of August 2025, the total market capitalization of stablecoins has soared to nearly $270 billion. This explosive growth signals not just speculation but genuine use cases, none more compelling than global payroll.

For remote-first companies and digital nomads alike, stablecoin salaries mean:

- Lightning-fast settlements: Payments arrive within minutes, not days, regardless of borders or banking hours.

- Radical cost reduction: Blockchain rails eliminate costly intermediaries; what used to cost $50 and per international transfer now costs a fraction of a cent.

- Financial inclusion: Workers in emerging markets gain access to dollar-denominated income without needing traditional bank accounts.

If you want a deeper dive into how these systems eliminate delays and high fees for remote teams, check out our detailed guide at How Stablecoin Payroll Solutions Eliminate Delays and High Fees for Remote Teams.

Compliance and Confidence: Navigating Regulations With Ease

A common misconception is that crypto payroll means regulatory headaches, but that’s no longer true for stablecoins in 2025. Thanks to robust KYC/AML frameworks built into leading platforms (think Rise or Bitwage), businesses can satisfy local labor laws while enjoying all the benefits of borderless payments. Recent partnerships between major HR platforms and payment processors ensure that every transaction is traceable, transparent, and fully auditable on-chain, a win-win for both employers and regulators.

This new era isn’t just about moving money faster; it’s about building trust through transparency. Every USDC salary paid is verifiable on the blockchain, a feature that’s winning over finance teams wary of shadowy transactions or hidden fees. For organizations looking to future-proof their operations while attracting top talent worldwide, embracing stablecoin payroll isn’t just smart, it’s essential.

And let’s not forget the talent advantage. In a hyper-competitive hiring landscape, offering stablecoin salaries is a magnet for global talent, especially digital nomads and tech professionals who want to be paid in a currency that’s stable, borderless, and instantly accessible. This flexibility empowers teams to hire the best people, anywhere, without being constrained by local banking limitations or volatile exchange rates.

As more companies embrace stablecoin payrolls for global remote teams, we’re seeing a virtuous cycle: greater adoption leads to more robust infrastructure, which in turn lowers costs and increases reliability for everyone involved. The days of waiting anxiously for cross-border wire transfers are fading fast. Now, a developer in Lagos or a designer in Buenos Aires can receive their USDC salary within minutes of payroll processing, no matter where their employer is based.

What Makes Stablecoin Payroll Different?Programmability and Real-Time Insights

One of the most underrated advantages of crypto payroll systems is programmability. Unlike legacy payment rails, stablecoin-based systems allow for automated, customizable payouts, think milestone-triggered bonuses or real-time invoicing for freelancers. Finance leaders can set up recurring payments or instantly pay out project-based work with just a few clicks.

And the data visibility? Game-changing. With blockchain-backed payroll, both employers and employees gain real-time insights into payment status, transaction history, and even compliance documentation, all at their fingertips. This transparency reduces disputes and builds trust across time zones.

Top Benefits of Paying Remote Teams in USDC

-

Instant Global Payments: USDC salaries enable remote teams to receive funds within minutes, anywhere in the world, eliminating the delays of traditional banking systems.

-

Significant Cost Savings: Companies using USDC payroll solutions report monthly savings of $2,000 to $5,000 for a 50-person team, thanks to lower transaction fees and no currency conversion costs.

-

Borderless Access & Financial Inclusion: USDC allows remote workers in over 190 countries to access stable, dollar-pegged salaries—even in regions with limited banking infrastructure.

-

Protection from Local Currency Volatility: Receiving salaries in USDC shields remote employees from unstable local currencies, ensuring predictable income and financial stability.

Looking Ahead: The Future Is Borderless

The rise of stablecoin payroll is more than just a technical shift, it’s a cultural one. As market capitalization surges past $270 billion, it’s clear that digital assets are no longer fringe tools but foundational elements of modern business infrastructure.

If you’re ready to explore how real-time stablecoin payroll can transform your team’s payments, and give you an edge in hiring and retention, don’t miss our comprehensive resource on real-time stablecoin wage payments in 2025.

The future isn’t waiting. Global teams are already embracing borderless payrolls powered by USDC and other leading stablecoins. The only question left: Will your organization lead, or get left behind?