In 2025, the way remote teams get paid across borders is being fundamentally reshaped by USDC payroll. As companies scale globally and tap into talent pools from Lagos to Lisbon, old-school bank wires and clunky SWIFT payments are losing ground to blockchain-powered alternatives. At the center of this shift is USD Coin (USDC), a stablecoin pegged 1: 1 to the U. S. dollar, offering near-instant settlement and cost efficiency that legacy systems simply can’t match.

Why USDC Payroll Is Gaining Momentum in 2025

The global cross-border payments market is surging toward $290 trillion by 2030, but traditional rails remain slow and expensive. In contrast, USDC payroll solutions are slashing friction for distributed teams. Recent collaborations highlight this momentum: in December 2024, Remote joined forces with Stripe to enable U. S. -based companies to pay contractors in 69 countries using USDC on the Base blockchain. Meanwhile, platforms like Rise and TransFi have integrated USDC payroll at scale, reporting a 40% reduction in payment costs and a majority of users opting for stablecoin withdrawals.

Top Benefits of USDC Payroll for Remote Teams

-

Lightning-Fast Payments: USDC transactions settle within minutes, compared to traditional bank transfers that can take several days. This enables remote teams to access their earnings almost instantly, regardless of their location.

-

Significantly Lower Fees: By removing intermediaries, USDC payroll reduces transaction costs and eliminates expensive currency conversion fees. Companies like Rise have reported up to 40% savings on cross-border payroll expenses.

-

Enhanced Transparency & Compliance: USDC leverages blockchain technology for real-time transaction tracking, simplifying audits and supporting compliance with international payroll regulations.

-

Stable Value & Predictability: As a stablecoin pegged to the U.S. dollar, USDC provides price stability—for example, Multichain Bridged USDC (Fantom) is currently priced at $0.0308—helping remote workers avoid the volatility associated with other cryptocurrencies.

-

Employee Empowerment: With USDC, remote workers can choose how and when to withdraw their funds, whether to a bank account or crypto wallet, increasing financial autonomy and satisfaction.

What’s driving this adoption?

- Speed: Unlike traditional bank wires that can take days or even weeks, especially over weekends or holidays, USDC transactions settle within minutes.

- Cost: Transaction fees for USDC payroll typically fall below 2%, compared to 3, 7% for wires or card-based payouts.

- No FX Surprises: Because USDC is dollar-pegged, both employers and employees sidestep currency conversion headaches and volatile exchange rates.

- Transparency: Every payment is traceable on-chain, making audits and compliance checks dramatically easier.

The Real-World Impact: Case Studies From 2025

The promise of instant, borderless salary distribution isn’t just theoretical, real companies are reaping tangible benefits today. Take Rise’s September 2025 integration with Circle: over half of their global users now choose stablecoin withdrawals via USDC. Another example comes from a fully remote tech firm leveraging TransFi; by transitioning away from slow international bank wires, they achieved faster settlements, simplified operations, and reduced costs across the board.

This shift isn’t limited to startups or crypto-native firms either. Established HR platforms like Remote are rolling out stablecoin options for contractors worldwide, directly addressing pain points like delayed payments and high remittance fees in emerging markets.

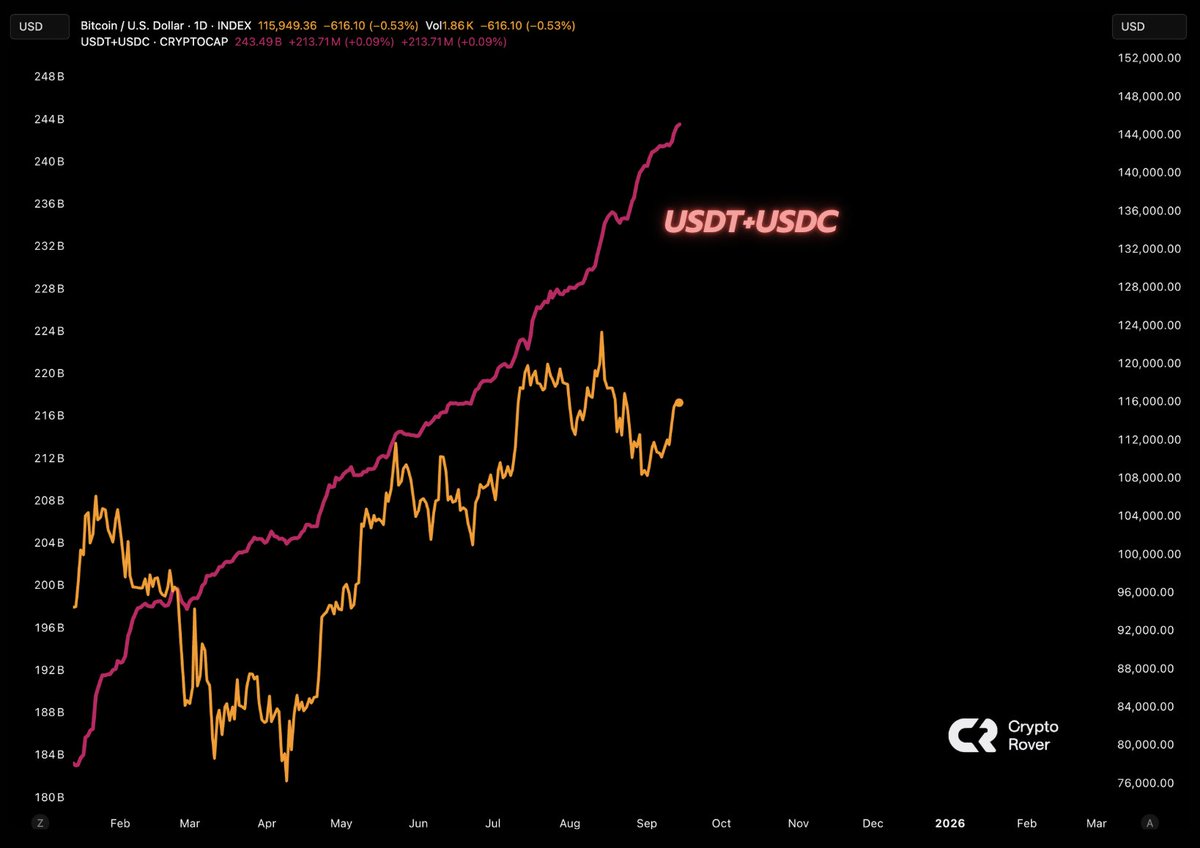

The Numbers Behind the Revolution: Current Market Data

If you’re wondering about stability or market reliability, it’s important to note that as of November 2025, Multichain Bridged USDC (Fantom) is priced at $0.0308, with a daily high of $0.0347 and low of $0.0303. While these figures reflect bridged assets on specific networks rather than mainnet USDC (which remains tightly pegged), they underscore the transparency inherent in blockchain-based payroll systems, every transaction is verifiable in real time.

This transparency not only builds trust but also simplifies compliance across jurisdictions, a frequent stumbling block for global payroll teams navigating local laws and tax regimes. For more on how stablecoins like USDC are revolutionizing cross-border payroll compliance and efficiency, check out our detailed guide on how stablecoins like USDC are revolutionizing cross-border payroll for remote teams.

Beyond the numbers, what resonates most for employers and remote professionals is the peace of mind that comes from predictable, on-time payments and a frictionless user experience. For workers in regions where banking infrastructure is unreliable or costly, USDC payroll means they can access their earnings within minutes, not days, and often at a fraction of the cost. This is especially transformative for digital nomads and freelancers who rely on steady cash flow to manage living expenses across borders.

Navigating Compliance and Security in Crypto Payroll

One of the biggest myths about crypto payroll is that it’s a compliance minefield. In reality, modern platforms are built with robust KYC/AML controls, automated tax reporting, and transparent transaction histories. USDC’s blockchain ledger provides a clear audit trail that simplifies everything from employee onboarding to year-end reconciliation.

For companies concerned about regulatory complexity, leading providers now offer APIs and dashboards tailored to local requirements. Whether you’re paying developers in Vietnam or designers in Brazil, you can maintain compliance without drowning in paperwork. If you’re considering rolling out USDC salaries for your own team, our step-by-step guide on how to pay remote teams in USDC walks through best practices for onboarding, documentation, and reporting.

What’s Next for Global Payroll?

The trajectory is clear: as stablecoin adoption accelerates and more HR platforms join the movement, we’ll see even greater interoperability between traditional finance and crypto rails. Expect features like multi-currency wallets, instant FX-free conversions, native tax withholding modules, and real-time analytics dashboards, all designed to make cross-border payroll seamless for both employers and employees.

With transaction fees for USDC payroll processing consistently dropping below 2%, compared to 3, 7% for legacy methods, the financial incentive alone is compelling. But perhaps more importantly, this technology empowers companies of any size to tap into global talent pools without being held hostage by outdated payment infrastructure.

If you’re evaluating your international payroll strategy for 2025 and beyond, consider how USDC can unlock new efficiencies, and give your team the freedom to work (and get paid) anywhere in the world. For further insights into how real-time crypto payroll is transforming global salary payments for remote teams, see our comprehensive analysis on real-time crypto payroll.