For startups and global tech companies, paying remote employees in emerging markets is no longer a logistical nightmare. Thanks to stablecoins like USD Coin (USDC), it’s now possible to deliver salaries that are fast, borderless, and immune to local currency swings. USDC payroll is rapidly gaining traction as a cross-border payroll solution, offering both employers and workers a new level of financial efficiency and security.

Why USDC Payroll Is Transforming Emerging Market Compensation

Traditional international payroll methods are plagued by delays, high fees, and unpredictable exchange rates. In contrast, USDC maintains a 1: 1 value with the US dollar, making it an attractive alternative for regions where local currencies can swing wildly within weeks. This stability is not just theoretical – it’s practical protection against inflation and devaluation for remote teams across Latin America, Africa, Southeast Asia, and beyond.

Recent adoption data underscores the momentum: platforms like Remote now enable companies to pay contractors in nearly 70 countries using USDC on the Base network. Firms leveraging B2B crypto rails have reported slashing payroll costs by up to 60% while reducing payment times from days to minutes (TransFi). This isn’t just about speed; it’s about empowering workers with reliable access to global earnings.

The Core Benefits of Paying Remote Employees with Stablecoins

Key Benefits of USDC Payroll for Global Teams

-

Stable Value Pegged to the US Dollar: USDC maintains a 1:1 value with the US dollar, protecting remote employees from local currency volatility and inflation risks in emerging markets.

-

Fast and Reliable Payments: USDC transactions are processed within minutes, enabling employers to pay remote workers quickly and efficiently, regardless of their location.

-

Lower Transaction Fees: Sending payroll via USDC typically incurs significantly lower fees compared to traditional wire transfers or international banking, reducing costs for both employers and employees.

-

Enhanced Financial Inclusion: USDC payroll empowers workers in regions with limited banking infrastructure, allowing them to receive payments directly to their digital wallets and access global financial services.

-

Transparent and Trackable Transactions: Every USDC payment is recorded on the blockchain, providing an immutable and transparent audit trail for compliance and recordkeeping.

Stability: Employees are shielded from local currency volatility thanks to USDC’s dollar peg.

Speed: Payments clear within minutes rather than days – crucial for workers relying on timely income.

Cost-effectiveness: Transaction fees are dramatically lower than SWIFT wires or remittance services.

Simplicity: No need for expensive intermediary banks or complex compliance hurdles common with fiat transfers.

Transparency: Blockchain records provide an immutable audit trail for every transaction.

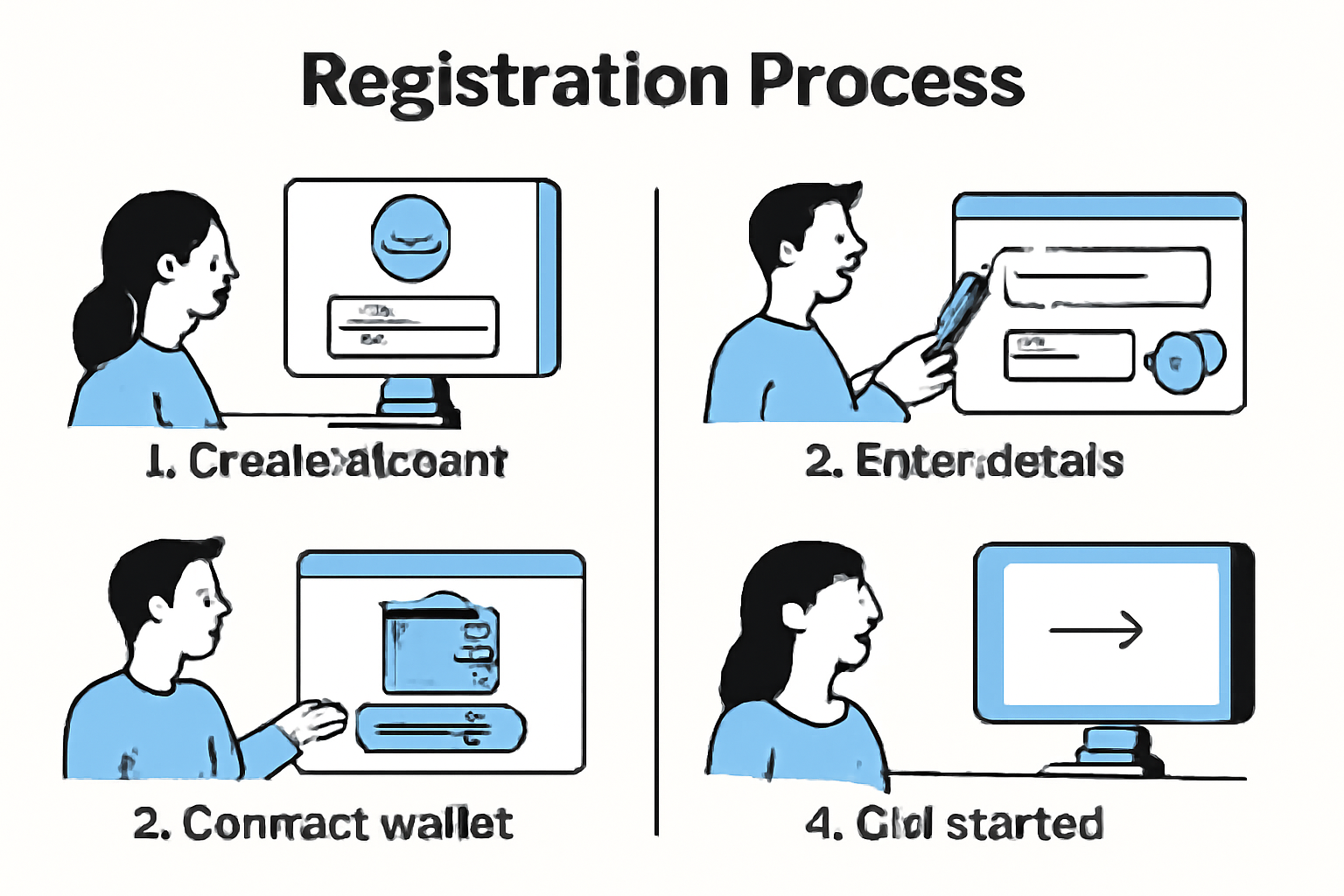

A Step-by-Step Guide: How To Set Up USDC Payroll in Emerging Markets

The process of implementing stablecoin salaries is more straightforward than most expect. Here’s how leading organizations are rolling out compliant and secure crypto payroll systems:

- Select a trusted platform: Choose a provider that supports cross-border USDC payments and operates within regulatory frameworks. Platforms like Remote (with Stripe) or Bitwage offer robust compliance features out-of-the-box.

- Create employer and employee accounts: Register your business and invite staff or contractors to onboard. Each worker needs a compatible digital wallet address to receive funds.

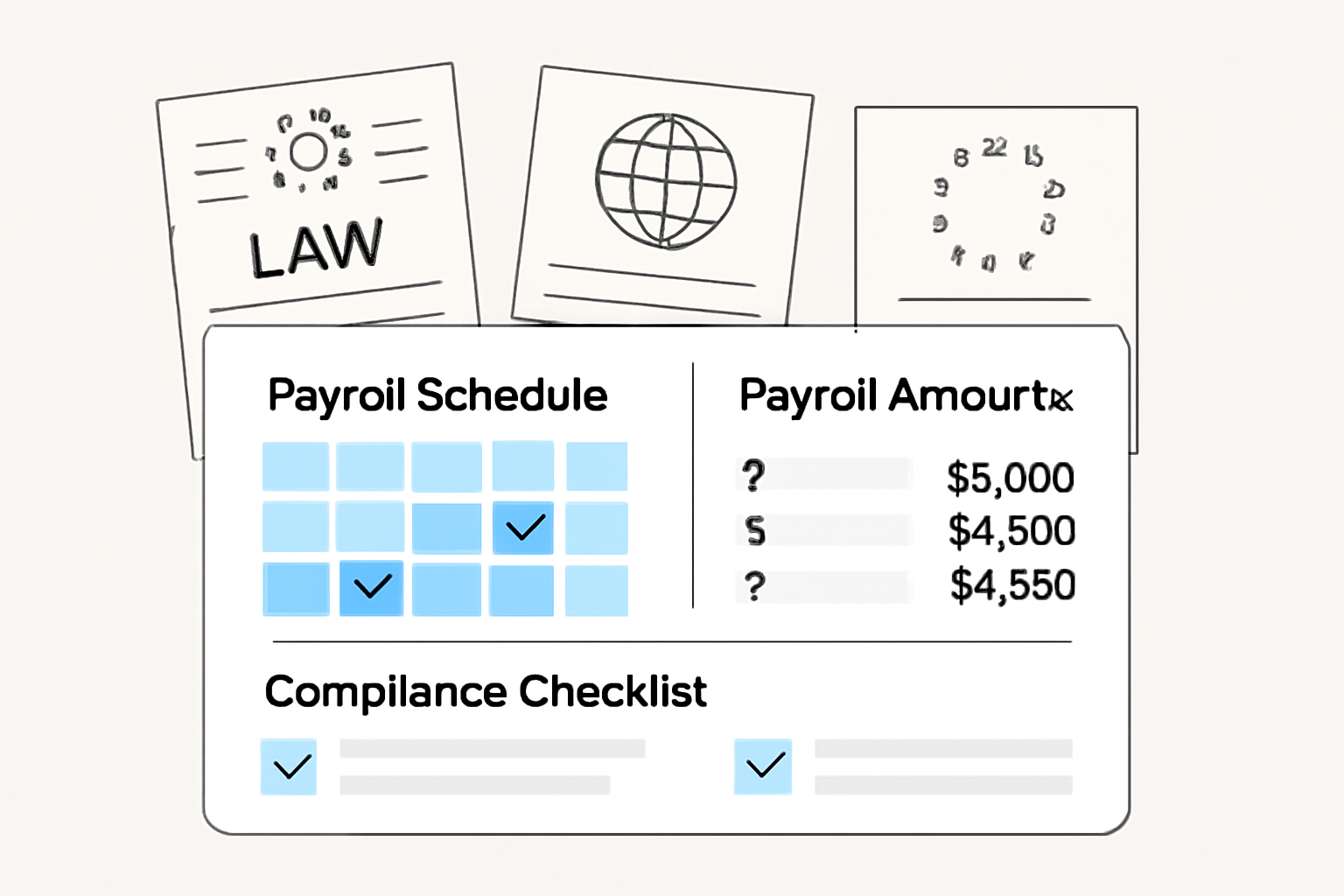

- Configure your payroll schedule: Set up payment intervals (weekly/monthly), salary amounts, and deductions – ensuring all details align with local labor laws.

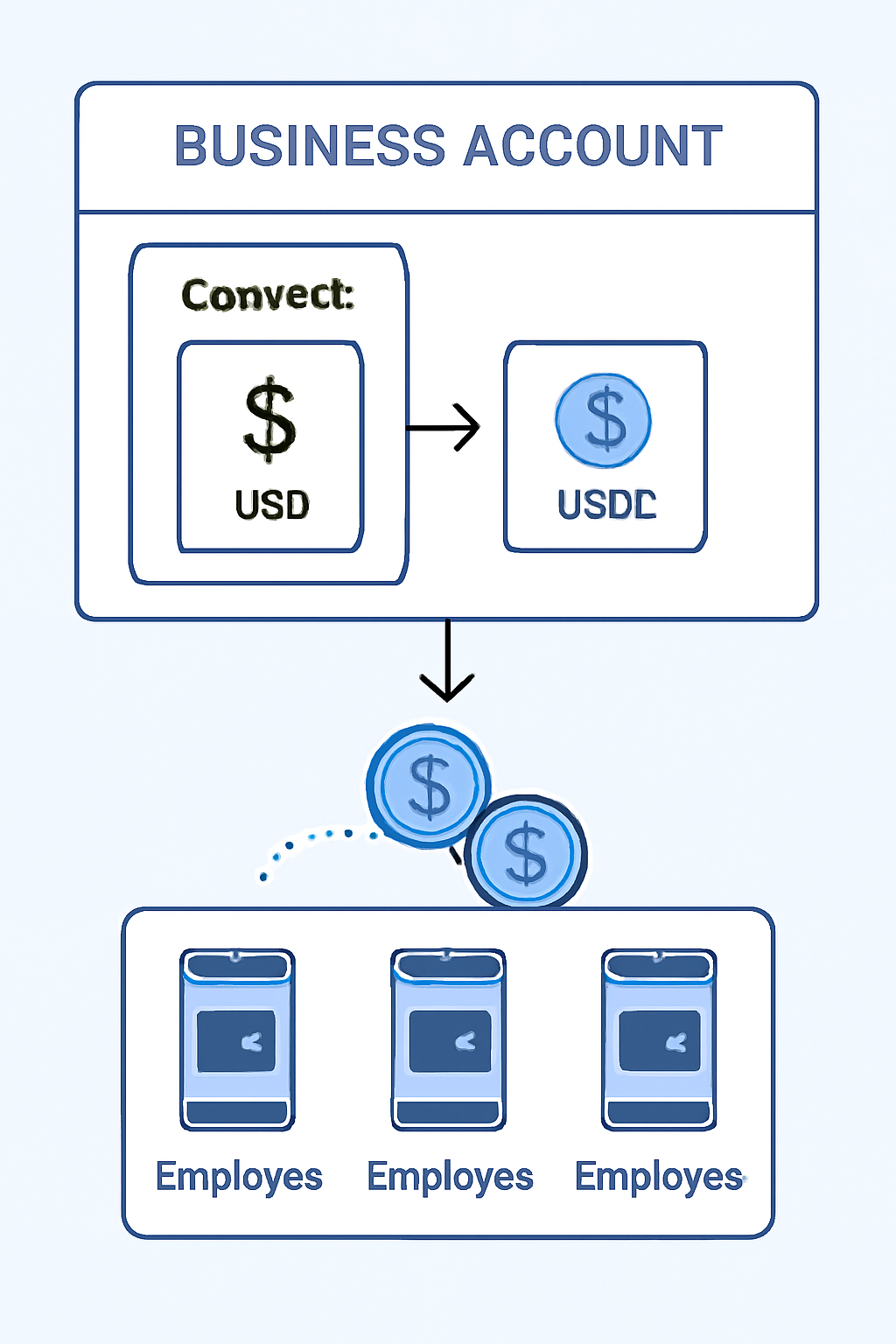

- Add funds and distribute pay: Deposit fiat or crypto into your provider account; the platform converts funds into USDC before distributing them directly to employee wallets.

- Monitor compliance and security: Regularly review processes, stay updated on regulations in each country of operation, and educate employees on wallet safety best practices.

Navigating Compliance in Crypto Payroll

The regulatory landscape remains dynamic. Employers must verify that stablecoin payouts are legal both at home and abroad. For instance, some jurisdictions require additional reporting or restrict crypto-based compensation altogether. Proactive employee education is also essential – not every team member will be familiar with managing digital assets securely right away.

Leading payroll platforms are responding to these challenges by integrating compliance modules and offering educational resources for both employers and workers. Services like Remote have set a new standard, supporting nearly 70 countries and providing built-in tools to help organizations stay ahead of regulatory shifts. This is critical for companies scaling globally, as the cost of non-compliance can be severe, ranging from fines to reputational damage.

Security is another pillar underpinning successful USDC payroll adoption. Multi-factor authentication, cold storage options, and regular wallet audits are now standard features among leading providers. Employers should also encourage staff to use hardware wallets or reputable custodial solutions to further minimize risk.

Real-World Impact: More Than Just Faster Payments

The tangible impact of USDC payroll in emerging markets extends well beyond speed or cost savings. By eliminating the friction of cross-border pay, companies empower their teams with financial autonomy and flexibility. In regions where banking infrastructure is limited or unreliable, stablecoin salaries can be a lifeline, enabling workers to save in a stable currency, access DeFi services, or instantly convert funds into local cash as needed.

Case studies from tech firms using B2B crypto rails illustrate this shift: one global team reduced payroll costs by 60% while paying contractors in minutes rather than days (TransFi). Such results are not outliers but increasingly the norm as stablecoin rails become more accessible and trusted worldwide.

What Remote Teams Should Expect Next

The adoption curve for USDC payroll in emerging markets is steepening as more businesses recognize its operational advantages and employees demand flexible compensation options. We’re witnessing a new baseline for global work, one where location is no longer a barrier to fair, fast, and reliable pay.

Still, this transition requires patience and diligence. The most successful organizations invest in ongoing education for their teams and maintain open channels with legal advisors who specialize in crypto payroll compliance. As regulations evolve, so too must company policies and processes.

Key Takeaways for Forward-Thinking Employers

- USDC payroll offers unmatched stability compared to most local currencies in emerging markets.

- Payments clear within minutes, dramatically improving cash flow for remote workers.

- Compliance is non-negotiable: Choose partners who prioritize regulatory adherence across all jurisdictions.

- Education matters: Equip employees with resources on wallet security and digital asset management.

- The future of compensation is borderless: Early adopters gain a competitive edge in talent acquisition and retention.