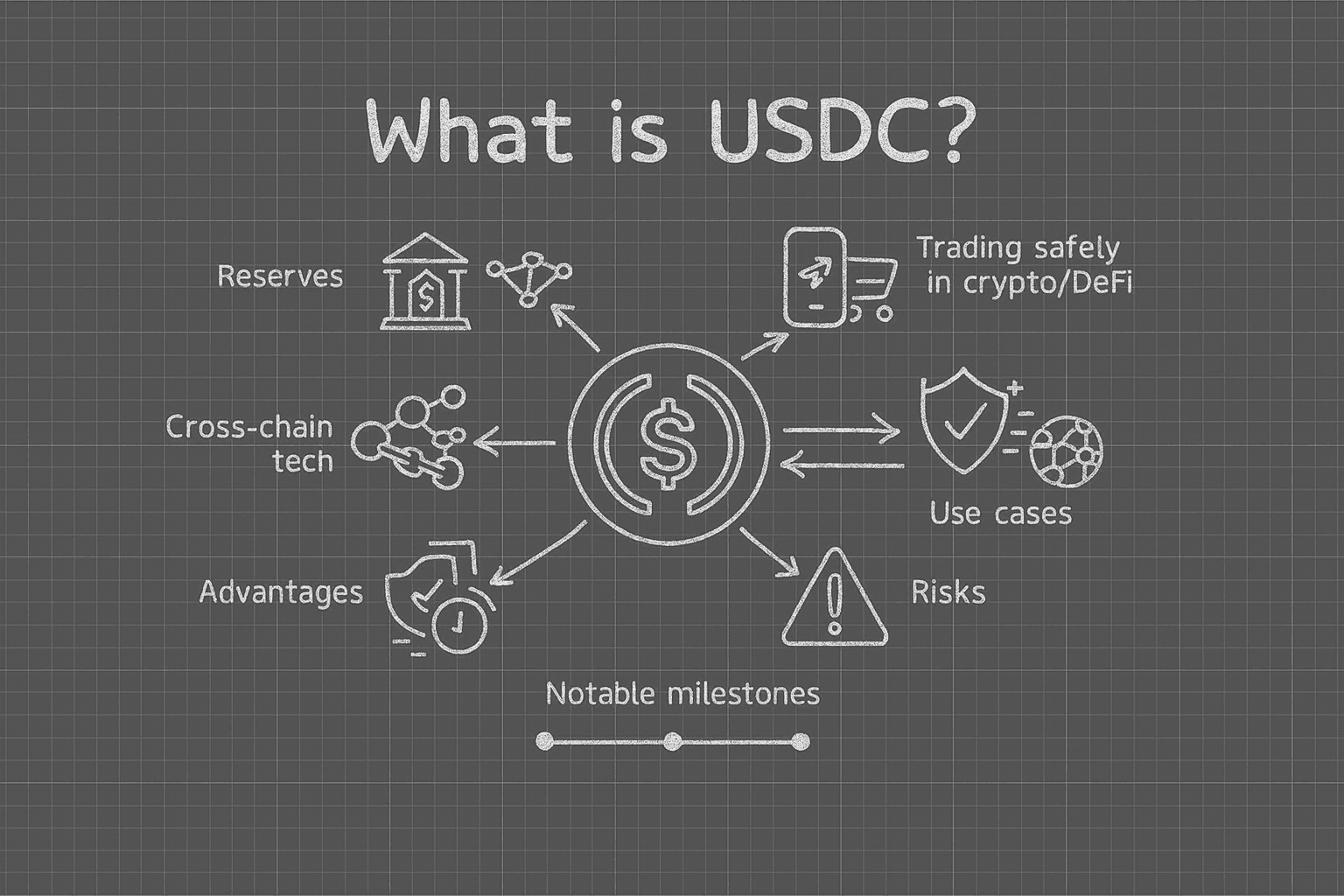

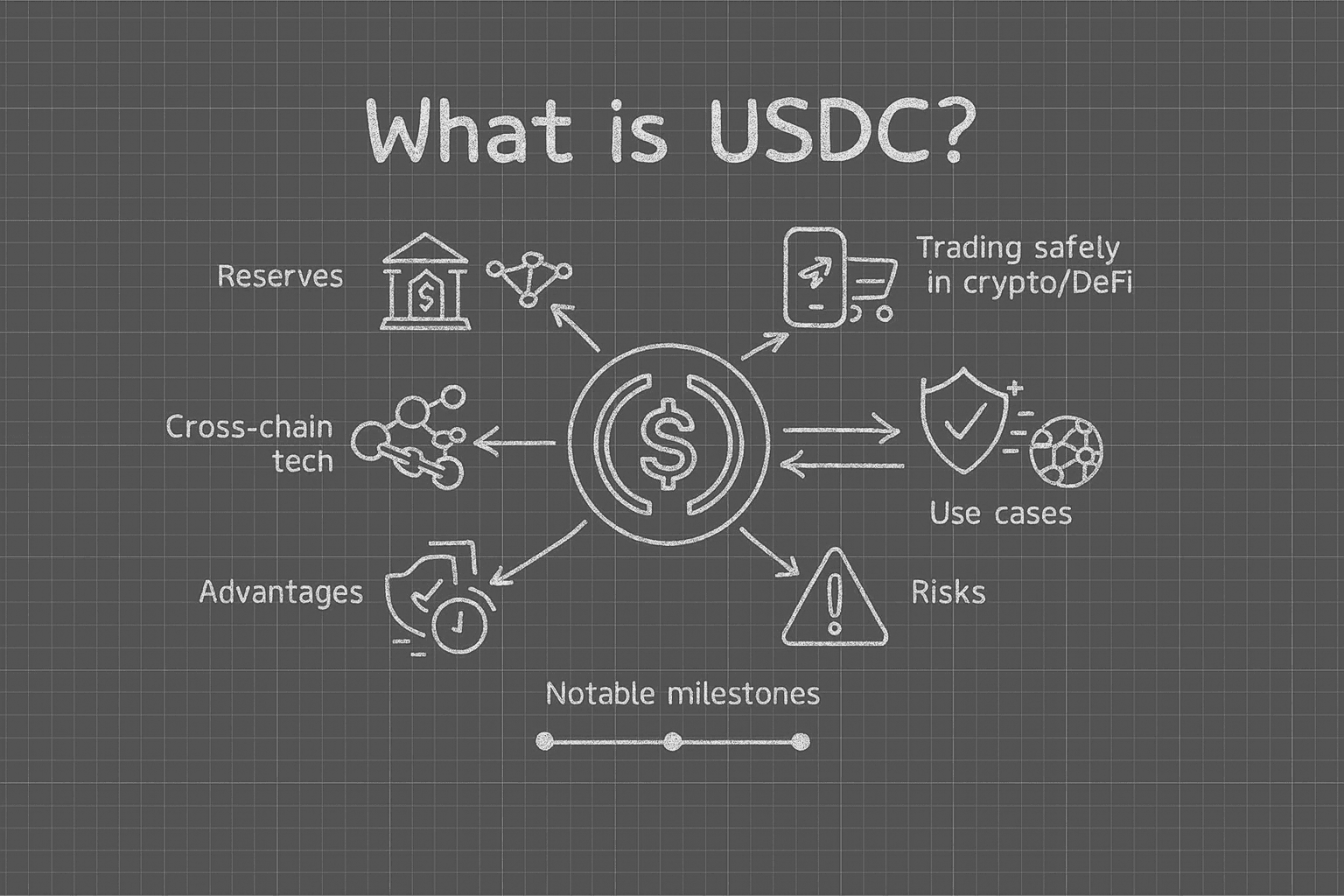

Global payroll is undergoing a dramatic transformation, as organizations expand internationally and seek faster, more cost-effective ways to compensate remote employees and contractors. The debate between USDC vs wire transfer payroll is at the center of this shift, with stablecoins like USD Coin (USDC) offering a compelling alternative to legacy banking rails. But which approach truly delivers on speed, cost, accessibility, and transparency for distributed teams?

Speed: Minutes vs Days

Traditional international wire transfers are notoriously sluggish. Depending on the countries involved and the number of intermediary banks, salary payments can take anywhere from 1 to 5 business days to reach your team members. Delays due to local banking holidays or compliance checks are common, leaving employees anxiously waiting for their funds.

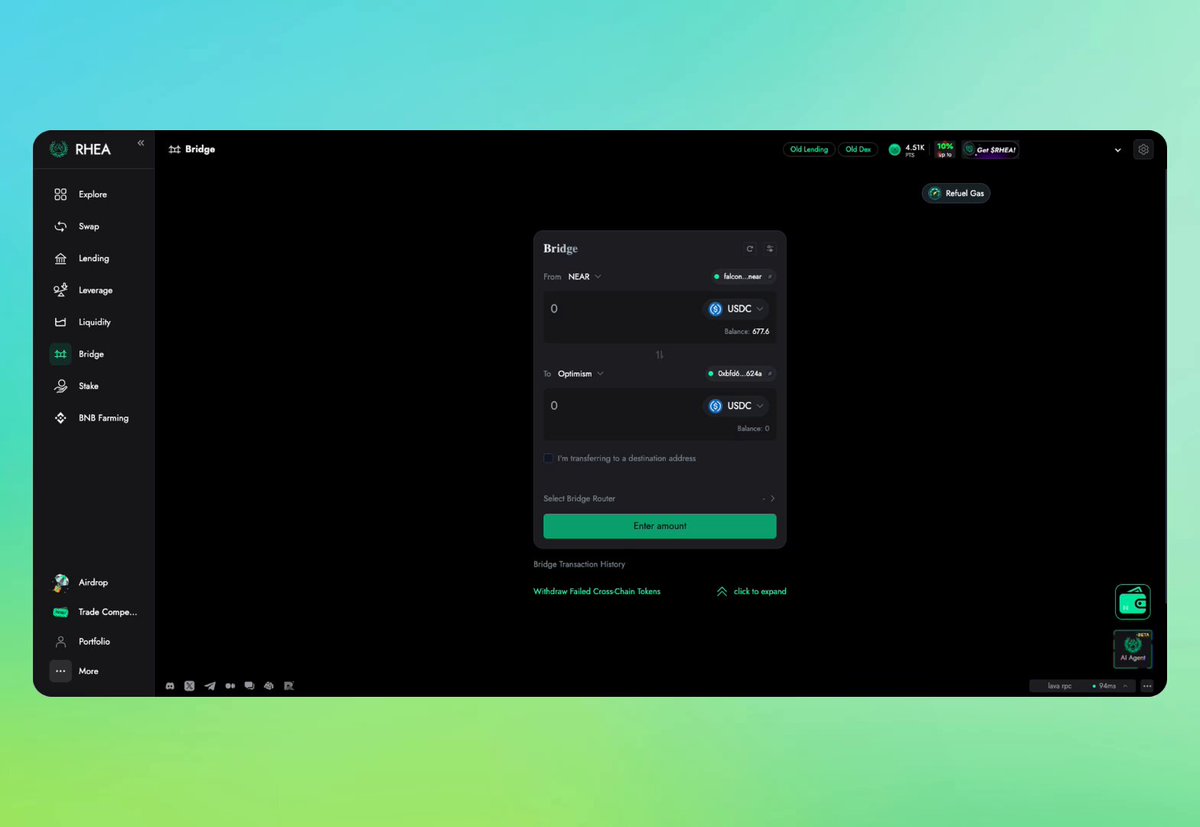

By contrast, USDC transactions typically settle within minutes, regardless of geography or local banking hours. This near-instant settlement is possible because USDC operates on public blockchains that process transactions 24/7 – no waiting on bank business hours or cross-border middlemen. For organizations with urgent payroll needs or contractors in multiple time zones, this speed can be a game-changer.

Cost Efficiency: Slashing Fees for Global Teams

The price tag attached to wire transfers is often underestimated until it hits the bottom line. Sending international wires typically incurs fees ranging from $20 to $75 per transaction, not including additional costs for currency conversion and intermediary bank charges. These fees quickly add up when paying dozens or hundreds of remote workers each month.

USDC transactions usually cost just a few cents per payment, regardless of destination or amount. The savings become even more pronounced for mass payouts – think gig platforms or tech startups scaling globally – where traditional wires would be prohibitively expensive. For companies seeking to optimize their global payroll payment methods, stablecoin payouts offer an undeniable financial edge.

Key Advantages of USDC Over Wire Transfers for Payroll

-

Significantly Lower Transaction Fees: USDC transactions typically cost just a few cents, compared to traditional wire transfer fees that range from $20 to $75 per payment. This makes USDC especially attractive for companies managing large, global teams.

-

Faster Settlement Times: While wire transfers can take several days to process—especially for cross-border payments—USDC transactions are settled on the blockchain within minutes, ensuring employees get paid promptly.

-

Global Accessibility Without Banks: USDC enables payments to anyone with a digital wallet, regardless of their location or access to traditional banking. This is a game-changer for payroll in underbanked or remote regions.

-

Enhanced Transparency and Security: Every USDC transaction is recorded on the blockchain, providing an immutable and transparent ledger. Employers and employees can track payments in real-time, reducing errors and increasing trust.

-

Elimination of Currency Conversion Hassles: USDC is pegged to the US dollar, so companies can pay employees in a stable digital dollar without worrying about currency conversion fees or fluctuating exchange rates.

-

Efficient Mass Payouts: Platforms like Bitwage and Circle Mass Payouts allow businesses to send USDC salaries to multiple recipients simultaneously, streamlining global payroll operations.

Accessibility and Inclusion: Reaching the Underbanked Workforce

The limitations of bank-based payroll become glaringly obvious in regions with limited financial infrastructure. Many talented professionals in emerging markets do not have reliable access to local banks or face steep barriers opening accounts in foreign currencies. This has historically excluded them from participating fully in the global digital economy.

With USDC-based payroll, all that’s needed is a digital wallet, no bank account required. This opens doors for remote workers and freelancers everywhere, democratizing access to timely compensation regardless of location or local banking regulations. As noted by industry observers, digital dollar payments are fueling the global freelancer boom, empowering companies and workers alike.

Transparency is another area where USDC payroll shines. Every transaction is recorded on a public blockchain, providing an immutable and auditable trail. Employers and employees can verify payment status in real time, reducing disputes and virtually eliminating the “lost wire” headaches that plague traditional systems. This level of visibility not only boosts trust but also helps businesses meet compliance requirements in jurisdictions with stringent reporting rules.

Security and Compliance: Mitigating Risks Without Sacrificing Speed

Stablecoin payroll is not without its challenges, particularly around regulatory compliance and security. Companies must ensure they’re working with platforms that adhere to KYC/AML regulations and provide robust security measures to protect digital wallets from unauthorized access. However, the programmable nature of USDC allows for automated compliance checks and instant reporting, which can reduce manual errors and streamline audit processes compared to legacy banking.

One key consideration is off-ramping: while USDC is pegged 1: 1 to the US dollar, employees may need to convert their stablecoin salary into local fiat currency for daily expenses. Depending on local crypto infrastructure, this process can introduce minor friction or fees, but as global adoption accelerates, conversion options are rapidly improving.

Making the Transition: Is Your Organization Ready?

Adopting stablecoin payroll isn’t just about technology, it’s about mindset shift. Forward-thinking organizations are already leveraging USDC vs wire transfer payroll as a recruiting advantage, offering faster payments and financial autonomy to attract top talent worldwide. Before making the leap, it’s critical to assess your workforce’s digital literacy, local crypto regulations, and preferred payout methods.

The decision between stablecoin vs bank transfer salary ultimately comes down to your business priorities: if speed, cost savings, transparency, and inclusion matter most, and you’re ready to invest in education and compliance, USDC stands out as a future-proof solution for global payroll.

Final Thoughts

The world of global payroll payment methods is evolving rapidly. As more companies embrace borderless hiring and remote workforces become the norm rather than the exception, solutions like USDC provide a tangible path toward faster, fairer compensation models. While traditional wires still have their place in certain scenarios, their limitations are increasingly hard to justify in an age of instant digital value transfer.