The modern startup landscape is borderless, and so are the challenges of paying remote teams. As stablecoins like USD Coin (USDC) gain traction, more companies are turning to crypto payroll to streamline cross-border payments and reduce friction. With USDC currently trading at $0.0486 as of September 19,2025, startups can leverage its stability and speed for global salary disbursement. But how do you set up a seamless, compliant USDC payroll system? This guide walks you through the exact steps every founder should follow to pay remote teams with USDC efficiently and securely.

Why Startups Are Choosing USDC Payroll

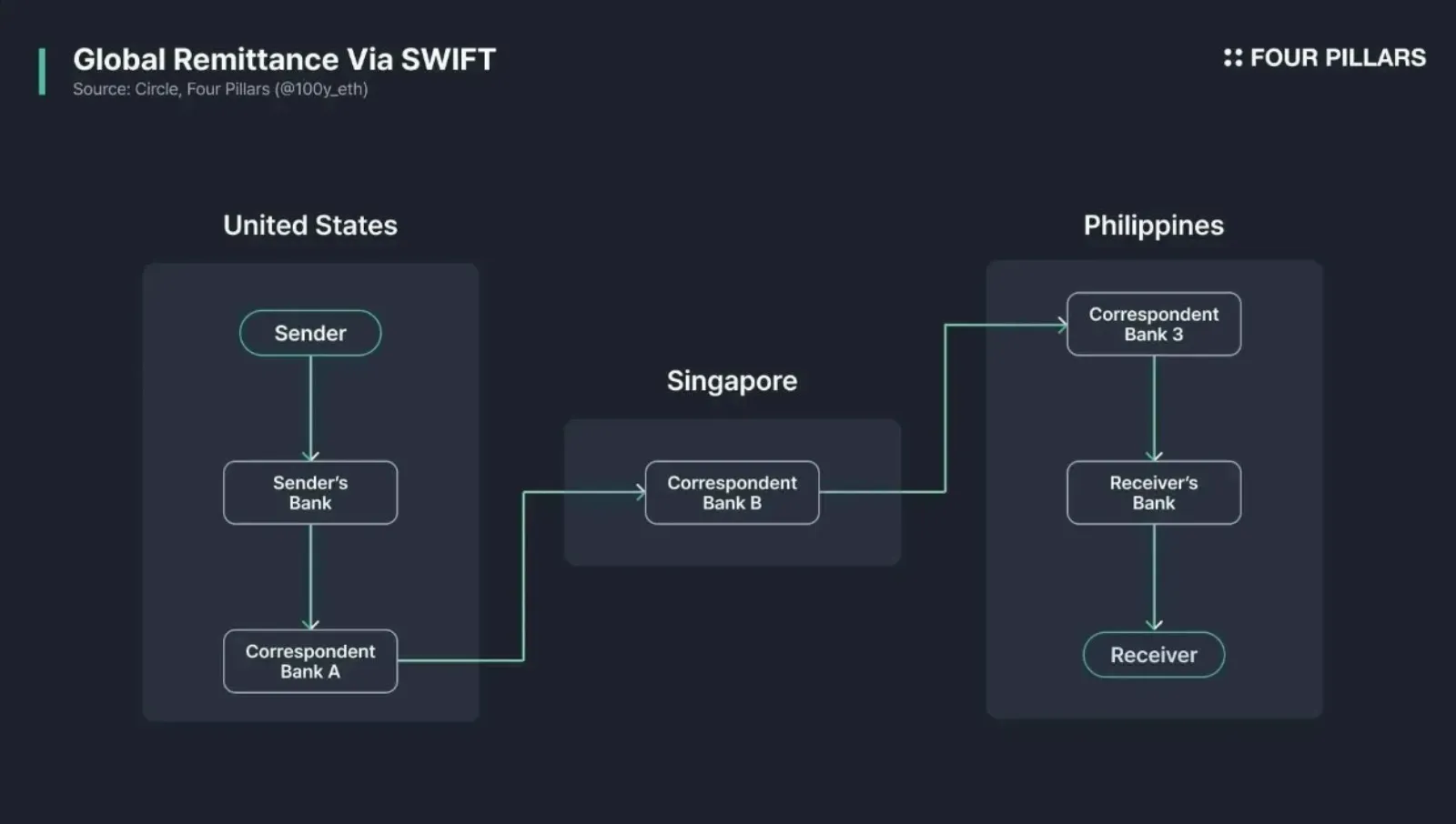

Stablecoin salary payment is no longer just a trend – it’s quickly becoming a strategic necessity for globally distributed teams. Platforms like Remote and Fipto now enable companies to pay contractors in nearly 70 countries with stablecoins such as USDC, dramatically reducing transaction costs and processing times compared to traditional banking rails. The transparency and programmability of blockchain further enhance compliance, while employees enjoy instant access to funds without waiting days for international wires.

Yet the real magic lies in execution. To ensure compliance, security, and operational efficiency, it’s critical to follow a proven process. Here’s the step-by-step blueprint that leading startups use to pay remote teams in USDC:

Step 1: Register and Verify a Business Account on a Reputable Crypto Payroll Platform

Your journey begins by choosing a robust platform purpose-built for crypto payroll management. Solutions such as Remote (in partnership with Stripe) allow startups to register business accounts tailored for stablecoin disbursements. During onboarding, you’ll need to provide essential company documentation and complete verification checks that align with international anti-money laundering (AML) standards.

This foundational step ensures your organization meets both local and global compliance requirements from day one – critical when handling digital assets across borders.

Step 2: Onboard Remote Employees and Contractors with KYC and Compliance Checks

After your business account is active, invite your remote employees or contractors onto the platform. Each team member will be prompted to complete Know Your Customer (KYC) verification – typically requiring government-issued ID uploads and sometimes proof of address.

This process not only satisfies regulatory obligations but also secures your payroll pipeline against fraud or identity theft. For contractors receiving USDC, onboarding usually involves:

- Creating a compatible crypto wallet, such as MetaMask configured for the Base Network

- Adding their public wallet address within the payroll platform

- Selecting preferred withdrawal options, which may include holding USDC or converting it into local fiat currency via partner exchanges

If you’re new to this workflow or want hands-on guidance, platforms like Remote offer detailed support articles on how contractors receive stablecoin payouts.

Step 3: Fund Your Payroll Wallet with USDC via Bank Transfer or Crypto Exchange

The next step is ensuring your payroll wallet is adequately funded before salary day arrives. Most reputable platforms allow you to top up your business wallet by either:

- Transferring funds from a linked bank account, where USD is automatically converted into USDC at prevailing rates (currently $0.0486 per USDC on Fantom network)

- Sending existing crypto assets from an external exchange or wallet directly into your payroll account in USDC format

This flexibility empowers finance teams to optimize conversion timing based on market movements while maintaining full control over treasury operations.

5 Essential Steps to Pay Remote Teams in USDC

-

Register and Verify a Business Account on a Reputable Crypto Payroll PlatformStart by choosing a trusted platform such as Remote, Fipto, or Request Finance. Complete all required business verification and compliance steps to ensure secure and compliant transactions.

-

Onboard Remote Employees and Contractors with KYC and Compliance ChecksInvite your team to join the platform. Each member must complete Know Your Customer (KYC) procedures and provide necessary documentation, ensuring global compliance and secure onboarding.

-

Configure Payroll Schedules, Salary Amounts, and Tax Documentation in the PlatformSet up recurring payroll schedules, define salary or invoice amounts in USDC, and upload or generate required tax documentation for each contractor or employee within your chosen platform.

-

Initiate USDC Payments and Provide Real-Time Payment Tracking to RecipientsApprove and send USDC payments directly to recipients’ wallets. Most platforms offer real-time tracking so your team can monitor payment status instantly, enhancing transparency and trust.

Step 4: Configure Payroll Schedules, Salary Amounts, and Tax Documentation in the Platform

With your wallet funded and your team fully onboarded, it’s time to automate the core of your payroll process. Modern crypto payroll platforms provide intuitive dashboards where you can:

- Set recurring payroll schedules (weekly, biweekly, or monthly) to match your company’s cadence and cash flow needs

- Specify salary amounts in USDC for each employee or contractor, ensuring clarity and predictability regardless of local currency fluctuations

- Attach invoices and generate tax documentation that aligns with both local regulations and international reporting standards

This step is crucial for startups aiming to scale efficiently. By leveraging built-in compliance tools and automated recordkeeping, you minimize manual errors and prepare your business for audits or due diligence requests. For global teams, the ability to centralize documentation also streamlines communication with accountants or legal advisors across jurisdictions.

Step 5: Initiate USDC Payments and Provide Real-Time Payment Tracking to Recipients

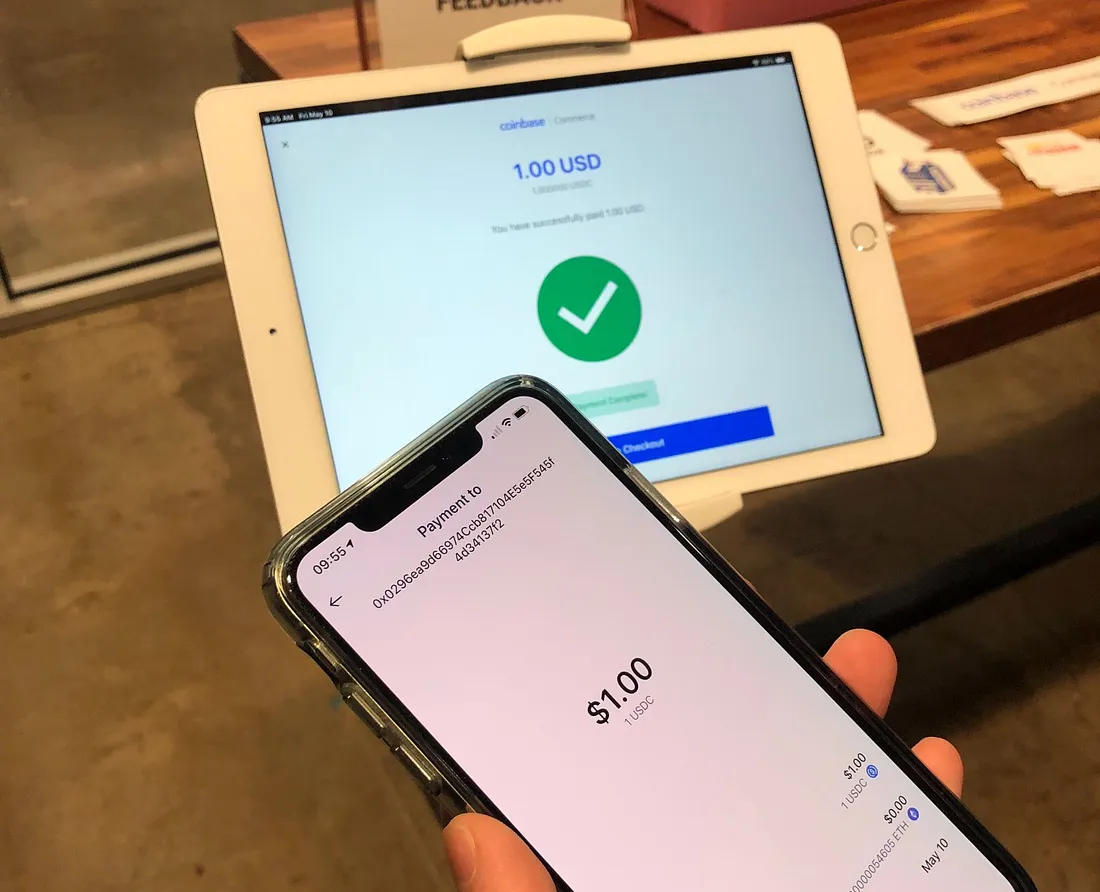

The final step is where blockchain truly shines. Once payroll details are configured, initiate bulk USDC payments directly from the platform. Each transaction is executed on-chain, meaning your team receives funds in their wallets within minutes, not days.

Recipients can monitor payment status in real-time thanks to blockchain transparency. Most platforms offer automated notifications via email or app alerts once a payout is processed. For finance teams, this means less time spent chasing confirmations and more time focusing on strategic growth.

Why This Process Future-Proofs Your Startup’s Payroll Strategy

Following these five steps, registering a business account on a compliant platform, onboarding remote talent with KYC checks, funding your wallet at the current rate of $0.0486 per USDC (Fantom), configuring schedules with tax compliance in mind, and providing instant payments with live tracking, gives startups an operational edge. Not only do you reduce transaction fees compared to legacy rails but you also empower employees worldwide with fast access to stable-value compensation.

This approach also positions your organization as forward-thinking, an attractive quality for top global talent who increasingly expect flexible payment options.

The Road Ahead: Building Trust Through Transparent Crypto Payroll

The adoption curve for stablecoin salaries is steepening as regulatory clarity improves and platforms mature. Startups willing to embrace this technology signal openness to innovation while maintaining strong compliance standards. Remember that ongoing education, both for finance teams and remote workers, is key; staying informed about market prices (like the current $0.0486 per USDC on Fantom network) helps optimize treasury decisions over time.

If you’re ready to pay remote teams with USDC or want deeper insights into crypto payroll best practices, explore resources from trusted providers such as Remote’s stablecoin payout solution. The future of borderless work demands frictionless compensation, and now you have a proven blueprint to deliver it securely at scale.